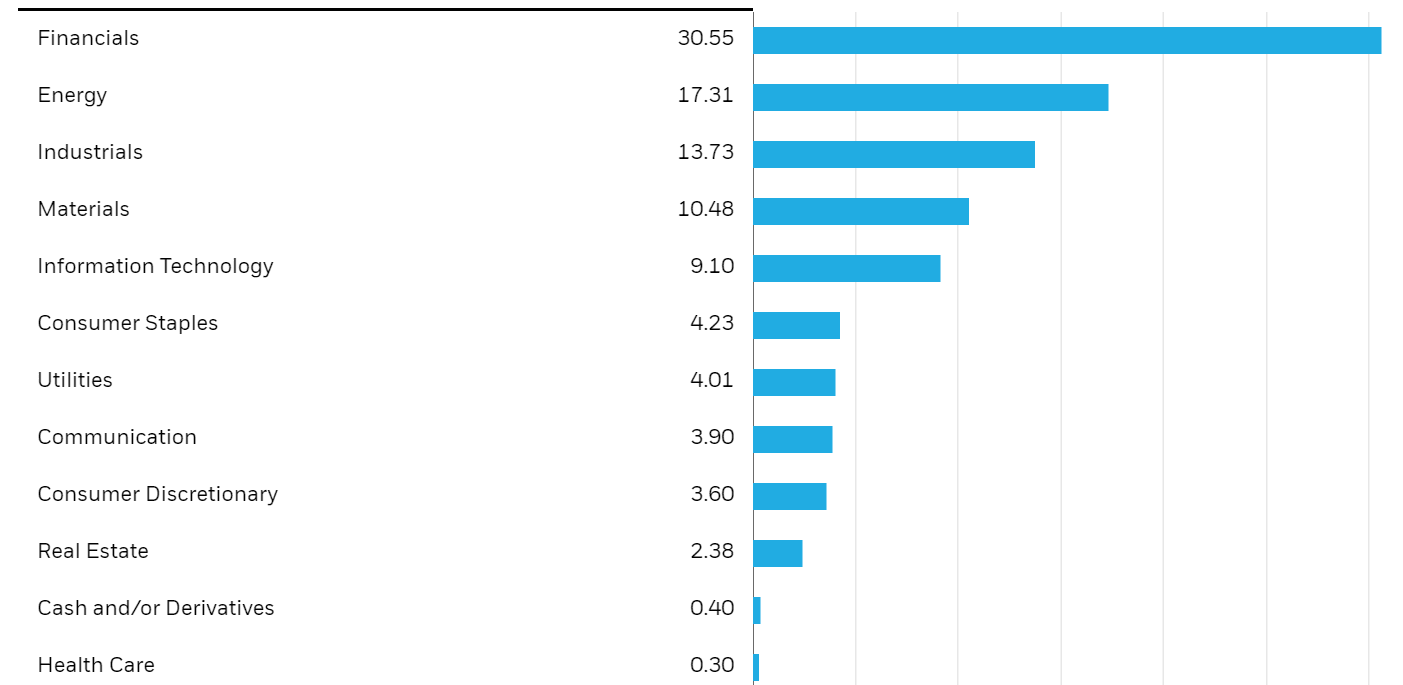

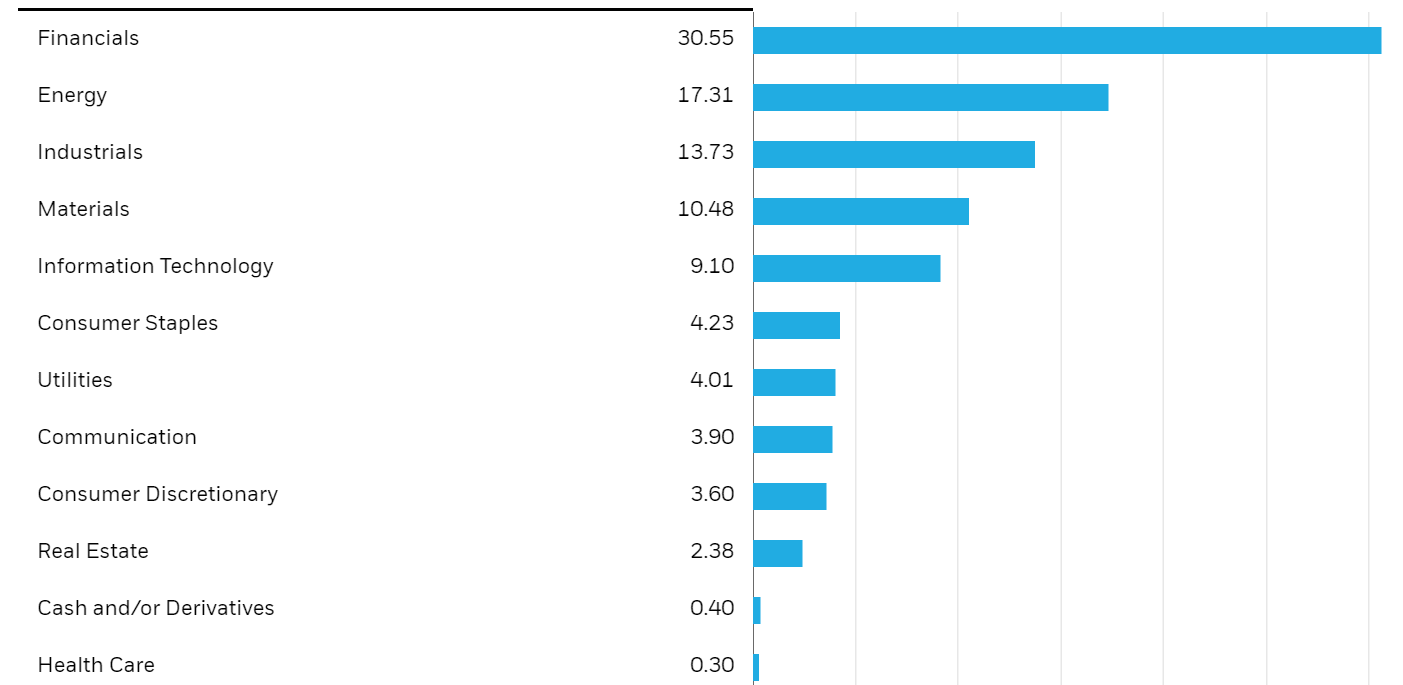

It’s no secret that the Canadian inventory market isn’t very effectively diversified by sector. Canada is essentially monetary, power and supplies, with all of that different stuff in between. By investing in Canadian retail shares, traders can add some much-needed diversification.

Canadian retail shares also can assist traders revenue throughout occasions of financial power and sure varieties of retail shares can supply a pleasant hedge in opposition to durations of gradual progress or recessions.

A sure phase of Canadian retail shares also can assist the inflation combat – assume Canadian grocers or comfort shops which have profited handsomely during the last two years.

Our favorite Canadian retail inventory is Alimentation Couche-Tard (ATB). As all the time, Mike from Dividend Shares Rock sums up our investor thesis:

Whereas the concentrated Canadian inventory market is perhaps an obstacle for many who personal a inventory market ETF or mutual fund, it’d current a possibility for traders who create their very own inventory portfolio. Once we construct our personal inventory portfolio we definitely don’t must observe the index weighting. We are able to construct a extra balanced portfolio.

Right here’s the present sector breakdown for the Canadian market. The chart for the TSX Composite, ticker XIC, is courtesy of BlackRock Canada.

And once we construct our portfolio we Canadians will largely shore up these sector holes by investing in US dividend progress shares or maybe a US dividend ETF or market ETF.

The Canadian retail shares are principally economically delicate. Canadians must be employed and with free money move to spend at these retail shops. They typically rely on a wholesome economic system and financial progress.

Retail shares will fall into two classes. First off there are client staples or defensives. As per the identify they’re staple objects that we merely want in our every day lives. After which there are client discretionary corporations. These are objects that aren’t requirements however are a alternative of the way to personally allocate cash for private wants and desires.

Early in 2023 many analysts and economists had been getting ready for an earnings recession. In a report BMO provided solely Client Discretionary, Client Staples, Industrials, and Utilities noticed internet optimistic earnings projections for the primary two quarters of 2023. It turned out to be a strong yr for retail shares. The index (XSP) was up 6.2% in 2023.

As I shared within the house, BMO’s high Canadian retail inventory picks had been Alimentation Couche-Tard, Dollarama Inc., and Metro. That basket enormously outperformed the market and the patron staples index in 2023.

Dividend Investing for Canadian Retail Inventory Pickers

As we all know the Canadian Dividend Investor will typically put money into Canadian banks and different financials because the bedrock of the portfolio. We would then flip our consideration to Canadian power shares and investing in Canadian REITs is a superb supply of earnings and portfolio diversification.

You’ll discover extra concepts in the very best Canadian dividend shares for 2024.

Some Broad Moat Retail Shares in Canada

I’m a giant fan of investing in broad moat or moat shares that endure from little or no competitors. They could even be in an oligopoly state of affairs such because the banks.

We additionally talked about these moats when investing in Canadian railway shares.

There’s nothing like a moat to assist defend our earnings, free money move and dividend progress.

In relation to investing in Canadian retail shares we would construct across the grocers. The house is dominated by a couple of gamers, a lot in order that it’s oligopoly-like. Canadians principally wish to store at a full service grocer. As an additional benefit and layer of diversification, a couple of of the grocers additionally personal the foremost pharmacy chains in Canada.

On that entrance we’ll begin with Loblaws (L) that acquired Consumers Drug Mart a number of years in the past.

Metro (MRU) Metro is a number one meals and pharmaceutical firm that covers Quebec and Ontario. The model names areMetro, Metro Plus, Tremendous C, Meals Fundamentals, Adonis, and Premiere Moisson, in addition to the pharmacies underneath the Jean Coutu, Brunet, Metro Pharmacy, and Meals Fundamentals Pharmacy names.

Empire (EMP.A) is a meals conglomerate that operates Sobeys. Different manufacturers and retailers embody Safeway, IGA, Foodland, Farm Boy, FreshCo, Thrifty Meals and Lawtons Drug.

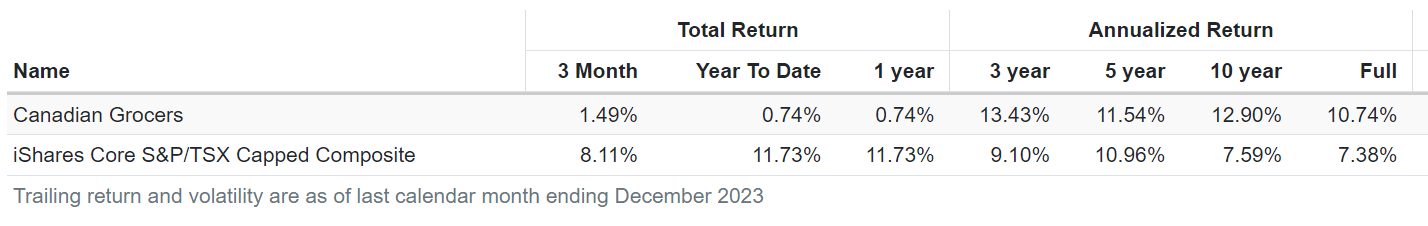

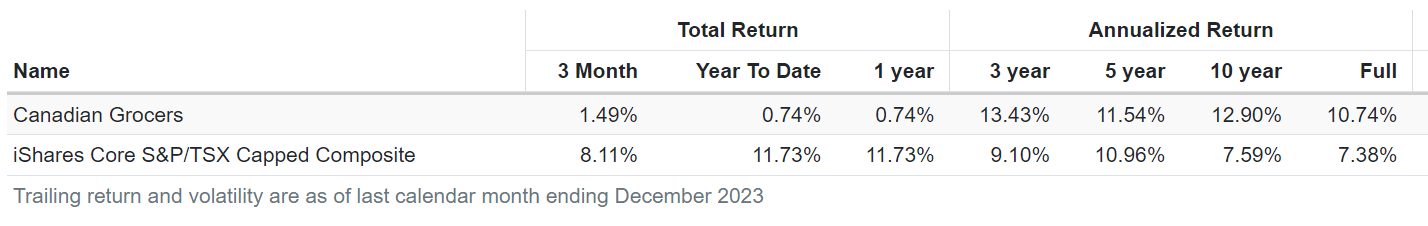

We see there’s sizable and constant outperformance.

The grocers have been great Canadian retail shares. They’re much less economically delicate and are in truth pure client staples – we have to eat. It may be a good suggestion to chubby these shares for defensive functions, and once more as a part of the devoted inflation safety. In actual fact they’ve been so worthwhile they confronted accusations of value gouging. The accusations had been proven to be unfounded. Grocery gross sales elevated as a consequence of inflation and client alternative. Larger earnings naturally went alongside for the trip. That stated, margins had been proven to have elevated within the pharmacy operations.

One other attention-grabbing add on on this house is The Northwest Firm (NWC). The North West Firm caters to the wants of underserved and rural communities in Northern Canada, Western Canada, rural Alaska, the South Pacific islands, and the Caribbean. You’ll achieve some worldwide

diversification. It generates 75% of its income from meals gross sales and the rest from basic merchandise and varied choices. This inventory has been one other great performer. It has averaged 9.07% annual during the last ten years, beating the market by 1.4%. The inventory delivered a formidable 11.23% annualized during the last 3 years. During the last 5 years, Northwest has delivered 9.33% annual. Northwest has been a beautiful inflation inventory.

Gasoline up with Alimentation Couche-Tard

Alimentation Couche-Tard (ATD.B) is an unbelievable Canadian success story. It is without doubt one of the most worldwide of the favored Canadian dividends shares. From Couche-Tard:

Couche-Tard is a worldwide chief in comfort and gasoline retail, working in 29 international locations and territories, with greater than 16,700 shops, of which roughly 10,800 supply street transportation gasoline. With its well-known Couche-Tard and Circle Okay banners, it’s the largest unbiased comfort retailer operator when it comes to the variety of company-operated shops in america and it’s a chief within the comfort retailer trade and street transportation gasoline retail in Canada.

Couche-Tard is a worldwide chief in comfort and gasoline retail, working in 29 international locations and territories, with greater than 16,700 shops, of which roughly 10,800 supply street transportation gasoline.

With its well-known Couche-Tard and Circle Okay banners, it’s the largest unbiased comfort retailer operator when it comes to the variety of company-operated shops in america and it’s a chief within the comfort retailer trade and street transportation gasoline retail in Canada.

In addition they have important presence in different areas across the globe. Couche-Tard are liveable acquirers that know the way to bolt on acquisitions and feed that earnings and dividend stream. Right here’s Mike at DSR with a fast video:

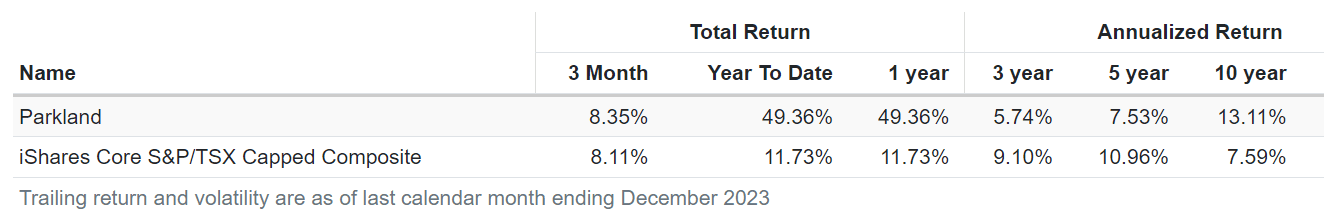

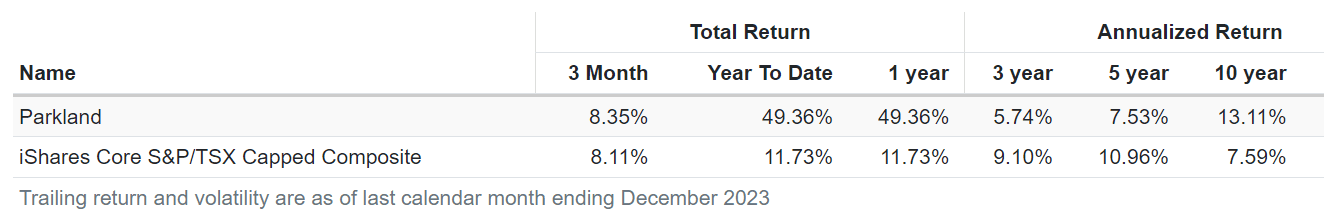

In the identical house you may additionally look to Parkland Fuels (PKI) Parkland is a Canadian unbiased gasoline retailing firm based mostly in Calgary, Alberta. Its subsidiaries embody a number of gasoline station chains, together with Pioneer, Fas Fuel Plus and Ultramar.

Parkland has crushed the market during the last 10 years, although it has been an underperformer during the last 5 years.

Seize a Tims Whereas You’re on the Street

Tim Hortons (QSR) is without doubt one of the most iconic manufacturers and establishments in Canada. They cowl each avenue nook throughout a lot of the nation and so they even have a major presence within the U.S. northeast. They’ve international enlargement plans within the works, together with China. In actual fact, they wish to open 1700 Popeyes in China over the following decade.

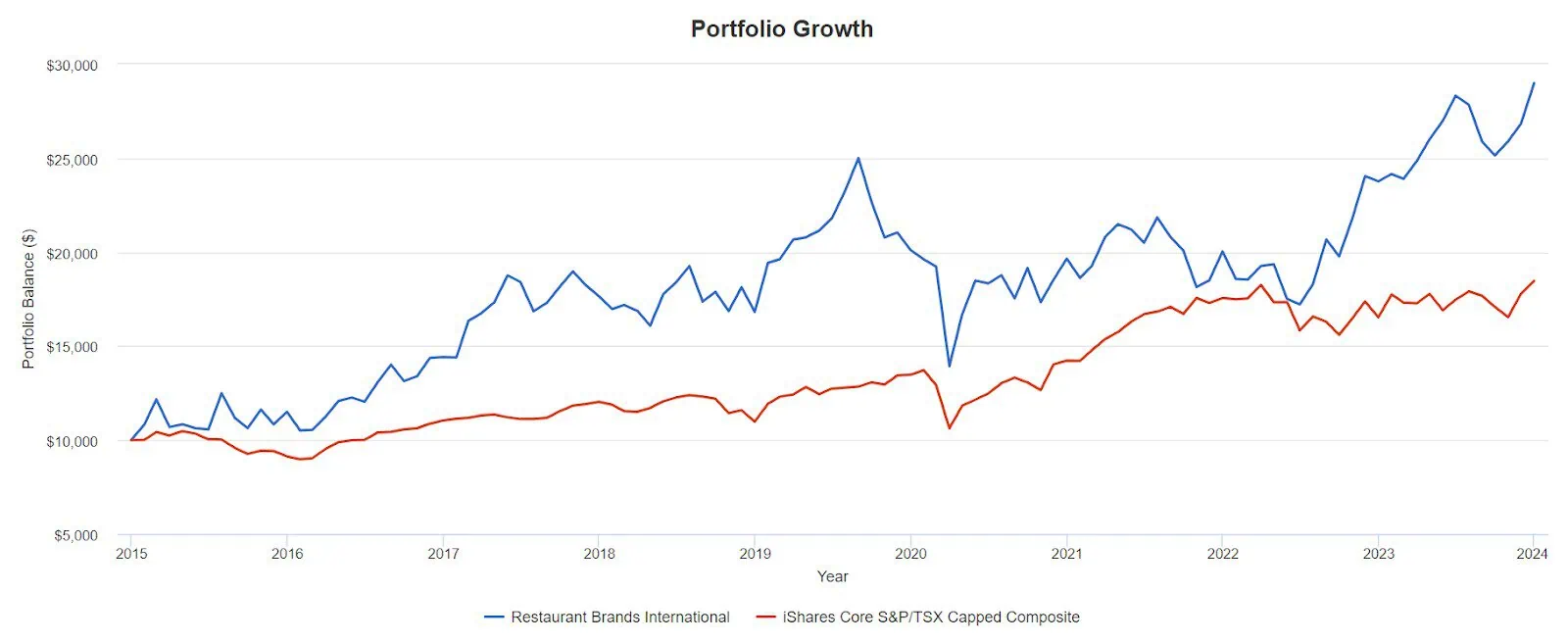

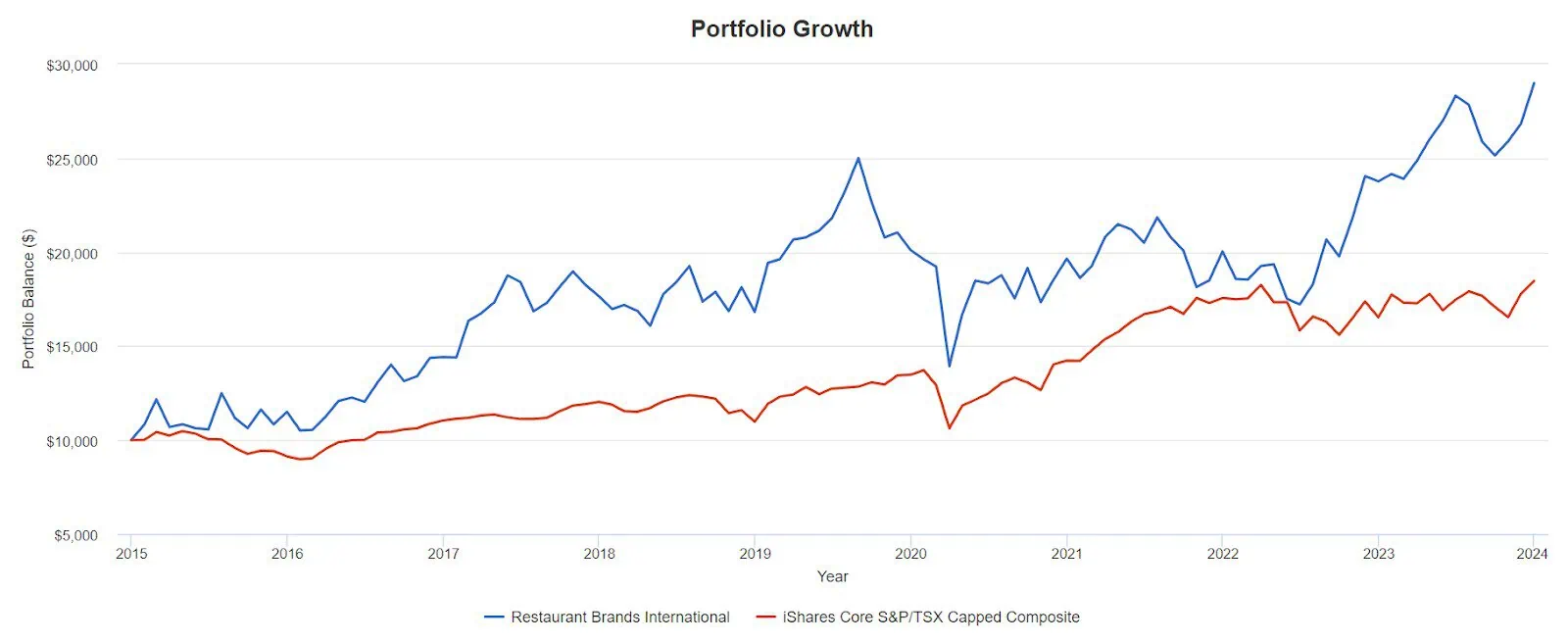

Tim Hortons is a part of Restaurant Manufacturers Worldwide. The inventory affords an attention-grabbing alternative as it’s listed in Canada on the Toronto Inventory Alternate, however it’s extra of a US targeted firm in comparison with Canadian. QSR (the ticker stands for Fast Serve Restaurant) additionally contains the very profitable Popeyes and Burger King. In addition they lately acquired Firehouse Subs.

QSR has began to pour it on lately. Popeyes and Burger King have been serving up the expansion. Firehouse Subs has been ringing up the gross sales as effectively. That was an excellent pick-up for QSR. Firehouse is soooooo good.

From inception in 2015 QSR has delivered 12.55% annual vs 7.06% for the TSX Composite.

Listed here are a couple of highlights from the November quarterly report.

- Income of $1.84B up 6.4% yr over yr

- Consolidated system-wide gross sales progress of 10.9% yr over yr, up $1.1 billion

- Adjusted EBITDA of $698 million elevated 9.3% organically versus the prior yr

Restaurant Manufacturers Worldwide has been a beautiful performer. And the expansion prospects look very encouraging.

Extra Iconic Canadian Manufacturers

Most Canadians have a spot of their coronary heart for Canadian Tire (CTC.A). It’s a splendidly run enterprise with a really sturdy model. The corporate and inventory has been surprisingly resilient over time, they’ve been capable of fend off competitors from US and international gamers. It operates within the automotive, {hardware}, sports activities, leisure and housewares sectors. Its Canadian operations embody: Canadian Tire, Mark’s, FGL Sports activities, PartSource, and the Canadian operations of Occasion Metropolis.

The corporate has delivered spectacular dividend progress over time. CTI delivered complete returns of 20.6% in 2020, 67.8% in 2021 after which fell 25.5% in 2022, after which added 3.67% in 2023. The inventory was in outperformance mode but it surely has not recovered from the slip in 2022.

The value decline allowed a beneficiant dividend in 2023, and now at 4.8% in early 2024. That stated, gross sales have turned smooth. Within the November quarterly report Canadian tire gross sales had been down 0.6%, Mark’s gross sales had been down 0.2% and SporkCheck gross sales had been down 7.4%. Earnings had been down 11.4%. The Canadian client is reevaluating their spending plans. Discretionary shares are coming underneath stress.

You may also sit with Leons Furnishings (LNF). The corporate has places in each Province throughout Canada. This firm has been a long-time (and stunning) Canadian success story. This firm is off the radar for a lot of Canadian dividend traders, however has been a market-beater over the long term. It’s presently at superb valuations, and it affords a strong dividend. And it’s recognized to throw the occasional particular dividend at you.

Sleep Tight with ZZZ

You may also take into account the long-lasting Sleep Nation (ZZZ), nice ticker by the way in which. Sleep Nation Canada Holdings Inc. is a Canadian mattress retailer, with over 260 shops working in British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, Quebec, New Brunswick, Prince Edward Island and Nova Scotia.

The identical story hit ZZZ. After a robust 2020 and 2021 the inventory went to sleep in 2022. It bounced again in 2023 with a 15.7% return.

These Loonies Can Add Up

Canada has its personal low finances greenback retailer by means of Dollarama (DOL). They’ll feed your portfolio one loonie at a time.

Dollarama is a Canadian greenback retailer retail chain headquartered in Montreal. Since 2009, it’s now Canada’s largest retailer of things for 4 {dollars} or much less. Dollarama has over 1000 shops and has a presence in each province of Canada.

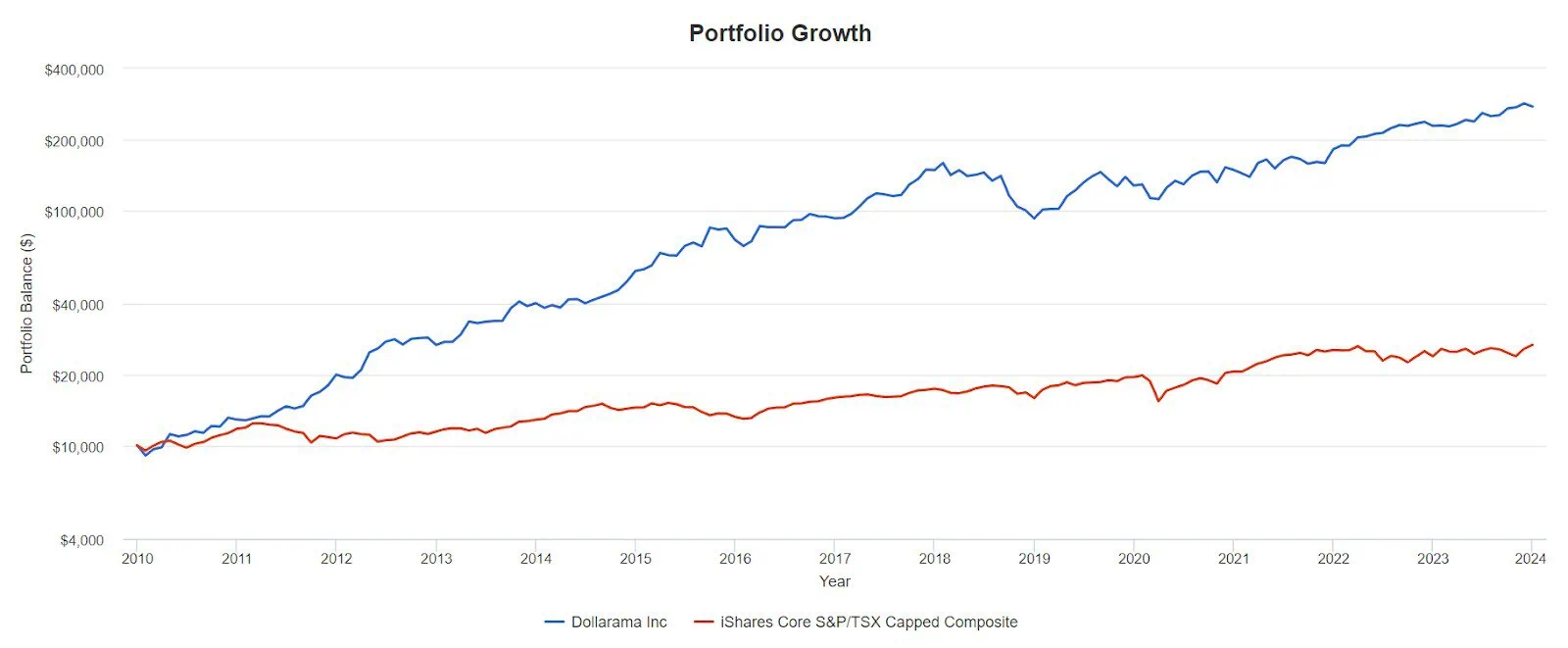

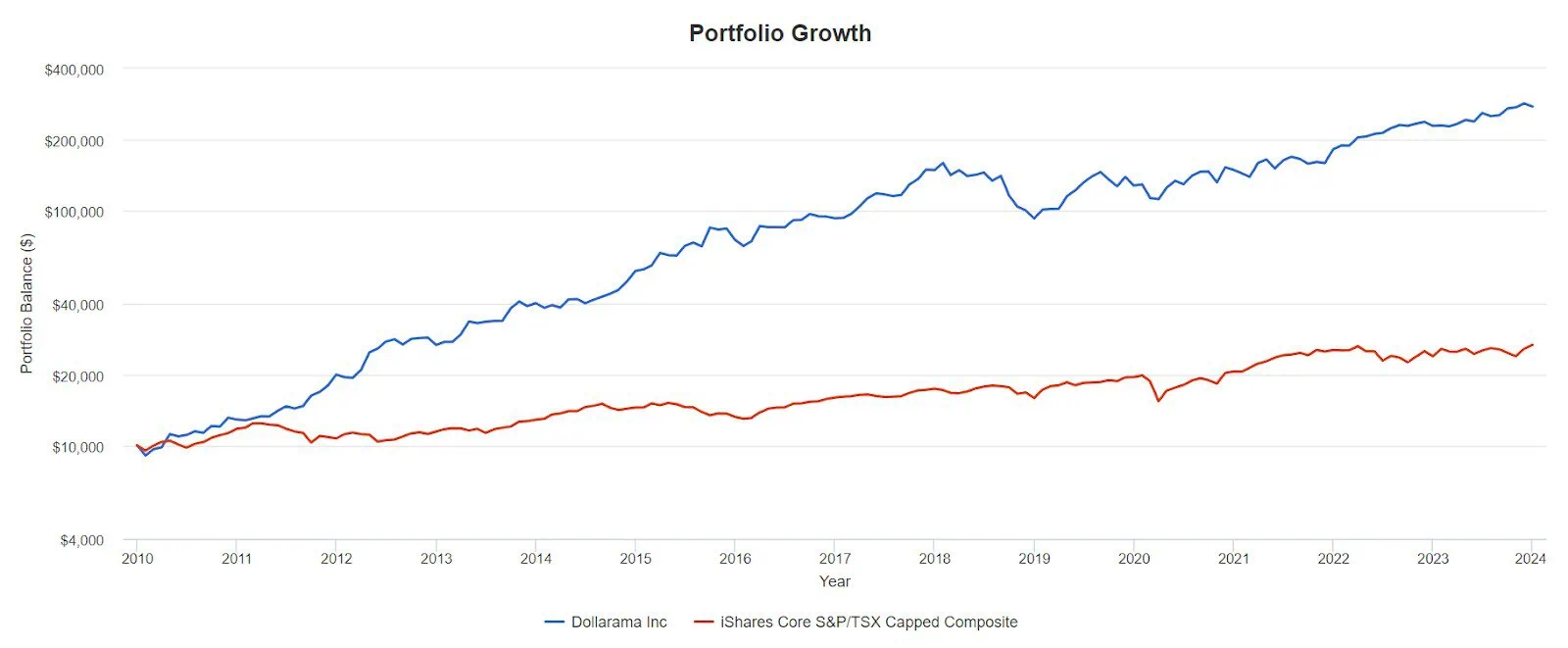

Whereas Dollarama has been on the costly facet (satirically), it has completely destroyed the TSX during the last decade and extra.

Canadian Retail Shares For Your Portfolio

You may also take into account the success story generally known as Canada Goose (GOOS) and Lululemon (LULU) within the specialty clothes model class.

This submit would possibly enable you to understand that whereas Canadian retail shares don’t all the time get a variety of press, it’s really a really sturdy sector that has served traders effectively. They might pair properly with our favourites equivalent to financial institution shares, telco shares, utilities, power and pipeline shares.

Your portfolio might possible profit by investing in Canadian retail shares. It provides some great layers and diversification. There’s embedded inflation safety in lots of of those corporations. And you’ll have added some outperformance from the time we put these on the desk at Million Greenback Journey.

You too can look to U.S. client staples, a lot of them being multinationals with international attain. In our accounts (for me and my spouse) we maintain Walmart (WMT), Pepsi (PEP) and Colgate Palmolive (CL). U.S. client discretionary shares can add much more progress potential.

As all the time, look past Canada for higher diversification.