As Canadians head into the canine days of August, the hunt to supply the highest promo amongst Canada’s greatest on-line brokerages is de facto heating up.

My newest on-line brokers comparability measures prime rivals comparable to Qtrade, Questrade, Wealthsimple, RBC, TD, BMO, Scotiabank, and CIBC. I’ve researched the most recent relating to brokerage charges, account choices, person expertise (desktop and cellular), customer support, and the most recent promo supply codes (see under for promotional particulars).

As a result of I’ve been a longtime person of a number of of Canada’s buying and selling platforms (with token accounts used to see the most recent from the entire different brokers), I can sincerely say that DIY investing choices are considerably extra inexpensive and handy than ever earlier than.

Our High On-line Brokers in Canada: Fast Comparability

ETF Comissions

FREE shopping for and promoting of 100+ ETFs

Buying and selling Charges

$8.75 ($6.95 elite accounts)

Canada’s Greatest Total Dealer – Purchase & Promote ETFs for Free, Greatest On-line Platform, Low Value, Very good Service, Rated #1 by The Globe and Mail & Surviscor

ETF Comissions

Free BUY of ETFs (full buying and selling costs apply to ETF gross sales)

Runner Up Greatest Dealer – Greatest Choices Buying and selling, Superior Knowledge Streams, Buyer Service Missing

ETF Comissions

FREE shopping for and promoting of 80+ ETFs

Buying and selling Charges

$9.95 ($7.95 elite accounts)

Greatest Huge Financial institution Brokerage – 80+ Free ETF Trades, Huge Financial institution Comfort, Excessive Charges.

ETF Comissions

$9.95 per ETF commerce

Buying and selling Charges

$9.95 ($6.95 elite accounts)

Canada’s Greatest Financial institution, Good Cell Platform, Excessive Charges

ETF Comissions

$9.95 per ETF commerce

Buying and selling Charges

$9.99 ($7 for Lively Merchants)

Serviceable Platform, Good Comfort, Excessive Charges

ETF Comissions

$9.95 per ETF commerce

Medium Value, Excessive ETF Charges, Good Comfort, Built-in Financial savings Account

ETF Comissions

Free to purchase and promote

$0 Trades, Poor and Buggy Platform / App, Horrible Account Choices, Is dependent upon high-fee crypto buying and selling to generate income

What Are The Greatest Canadian Buying and selling Platforms?

When individuals speak about one of the best Canadian buying and selling platforms, they’re in all probability referring to on-line brokerages. These are the businesses that produce the web sites and apps that will let you login and commerce all the things from primary index ETFs to shares, choices, and extra unique securities.

You may additionally see these buying and selling platforms known as “low cost brokerages. That title comes from the low cost these brokerage accounts offered to shoppers versus the $30-per-trade charges that had been regular for over-the-phone inventory buying and selling again within the day. So after I speak about “on-line brokers,” “on-line brokerages,” or “Canadian low cost brokers” these phrases are all referring to the identical sort of Canadian buying and selling platform. They don’t embody the totally automated type of investing that has been popularized by Canada’s robo advisors.

Our 2024 Inventory Dealer Decisions

Selecting one of the best on-line brokerage account on your particular person wants and tastes isn’t an actual course of. There are simply too many variables concerned to positively say. “That is the Greatest Canadian Dealer for each single particular person.” Therefore, we go into nice depth with our Canadian buying and selling platform evaluations, and designate every dealer for the kind of buyer that would profit most from utilizing it.

With that being mentioned, we’ve 4 rating pillars that we use to find out the standard of every of Canada’s low cost brokerages:

- Inventory and ETF buying and selling Charges

- Brokerage Accounts Charges

- High quality of Buyer Service

- Promotions and Bonuses

Qtrade Direct Investing – MDJ’s High Canadian Dealer

In any case of that anecdotal and quantitative analysis, we predict that Qtrade is prone to be one of the best on-line dealer in Canada, a minimum of for most individuals in 2024. That mentioned, as all the time, we’ll be listening to our remark boards and inboxes as a way to implement any real-time suggestions we get from the Million Greenback Journey group.

Don’t take our phrase for it… longtime Canadian private finance veteran, Rob Carrick of the Globe and Mail says that:

No different dealer is sweet in so many various areas and no different dealer makes such constant year-by-year enhancements.

Qtrade’s dedication to innovating extra worth to their platform – whereas holding the location extremely user-friendly for each new traders and veterans – signifies that Qtrade has really expanded its lead over the previous few years. That they’ve been capable of constantly ship such an elite product – whereas chopping charges to amongst the bottom in Canada – has allowed the dealer to proceed to set that worth bar larger and better.

The one actual competitor to Qtrade relating to providing well-rounded dealer options for rock-bottom costs is Questrade. Learn on to seek out out why we’ve Questrade at #2, and what forms of traders would possibly profit extra from the opposite buying and selling platforms we overview.

| Million Greenback Journey’s Total Score: | 4.9 / 5 |

| Consumer Expertise | Wonderful |

| Buyer Service | World Class |

| Free ETF Buying and selling | Sure – Purchase & Promote Extra Than 100 ETFs For Free |

| Buying and selling Charges | $6.95 – $8.75 |

| Minimal Steadiness | $1 |

| Present Promotion | $100 Free + $2,000 Cashback |

| Full Assessment | Qtrade Assessment |

Qtrade Direct Investing Professionals:

- FREE shopping for and promoting of 100+ ETFs

- Constantly rated #1 over the previous decade

- Wonderful Buyer Service

- Among the finest apps in the marketplace

- Elite investor instruments

- Extremely-easy account opening

- Greatest Canadian On-line Brokerage for 2023 Surviscor + “A” Grade by the Globe and Mail

- $100 – $2,100 Welcome Bonus

Qtrade Direct Investing Cons:

- Pesky inactivity charges (will be simply prevented)

- Not the most cost effective buying and selling charges in Canada for all devices

For Extra details about Qtrade’s implausible promo go to our Qtrade promo web page.

Runner Up Canadian Buying and selling Platform – Questrade

Questrade is a truly-usable low cost brokerage that has amongst the bottom prices in Canada. Questrade costs a penny-per-share-traded (purchased or bought) – however with a minimal of $4.95, and a most of $9.95. Personally, I’ve by no means purchased greater than 495 shares of a inventory or unit of an ETF earlier than – however I’d prefer to have an account sufficiently big to strive it a while.

There aren’t any annual charges (irrespective of the scale of your account, although there’s an account minimal of $1,000) and no charges charged once you purchase ETFs.

It’s not like the remainder of the Questrade bundle is missing one thing main, it’s merely a tribute to how far a few of the different brokerages have come, that we not rank them #1. The Questrade app and web site have seen great upgrades within the final couple of years, and the overwhelming majority of those that we’ve beneficial Questrade to through the years have been fairly proud of them.

That mentioned, there isn’t any doubt that customer support emerged as a weak spot for the quickly-growing firm throughout the pandemic. A number of of the writers on this web site noticed wait instances of over 4 hours for each the net chat and call-in choices. Emails went over per week between response instances at varied factors.

After all, if you happen to’re not the “customer support” sort, and easily need entry to an incredible platform on the lowest worth – then Questrade makes a ton of sense for you.

| Million Greenback Journey’s Total Score: | 4.4 / 5 |

| Consumer Expertise | Wonderful |

| Buyer Service | Missing within the final 2 years |

| Free ETF Buying and selling | Free shopping for of ETFs (full buying and selling costs apply to ETF gross sales) |

| Buying and selling Charges | $4.95-$9.95 |

| Minimal Steadiness | $1,000 |

| Present Promotion | $50 in Free Trades |

| Full Assessment | Questrade Assessment |

Questrade Professionals:

- No Charges To Construct an ETF Portfolio!

- Very Low Commerce Prices (very best for constructing a dividend-heavy portfolio)

- $0 Annual Account Charges

- 24-Hour Paperless Account Opening

- Globe and Mail “A” Score + Greatest DIY Brokerage Web site

- Good Promo Provide

- Stable USD Buying and selling Choices

- $50 in free trades for brand spanking new accounts

Questrade Cons:

- Higher choices on-line for these excited by doing in-depth evaluation analysis on shares prior to buy

- Customer support score took an actual hit the final couple of years – the primary motive we now rank Qtrade forward of Questrade.

- Solely 2.9/5 app score on Google Play – evaluations talked about delay in pricing on app vs desktop

BMO InvestorLine – Stable If Unspectacular

Very similar to their fellow massive financial institution cousins, BMO InvestorLine is a wonderfully serviceable brokerage choice – it’s simply not your greatest guess. The $9.95 per commerce charges, in addition to varied account charges simply make it too dear to take the highest spot.

That mentioned, if comfort is your foremost purpose and also you need to preserve your entire banking and investing providers beneath one roof, then BMO’s dealer can do all the things that you just want it to. If in case you have a big portfolio to speculate, BMO may even reduce the account charges that you just’ll should pay.

One place BMO InvestorLine stands out amongst the massive banks is that they do have 80 ETFs that they permit to be purchased and bought without spending a dime. They’re distinctive on this regard. Qtrade permits 100+ ETFs to be traded without spending a dime, and Questade permits all ETFs to be bought without spending a dime (however not bought without spending a dime) – however BMO is the one massive financial institution brokerage with this characteristic.

In case you’re searching for a brokerage that excels at customer support and person expertise although, you in all probability need to look in one other path. BMO ranked #13 on the most recent Surviscor Canadian brokerage rankings.

| Million Greenback Journey’s Total Score: | 4 / 5 |

| Consumer Expertise | Stable – may use a refresh |

| Buyer Service | Higher than common |

| Free ETF Buying and selling | $9.95 per ETF commerce (except for 80 free ETFs) |

| Buying and selling Charges | $9.95 ($7.95 for elite accounts) |

| Minimal Steadiness | $0 |

| Present Promotion | None |

| Full Assessment | BMO InvestorLine Assessment |

BMO InvestorLine Professionals:

- Greatest bank-owned dealer

- Handy choice for a lot of Canadians who financial institution with BMO

- Consists of all main account choices

- 80 ETFs that may be traded without spending a dime

- Well-known and trusted firm

BMO InvestorLine Cons:

- Charges are a lot larger than different brokers

- 3.6/5 for his or her cellular app

- Lacking the most recent data and person experiences benefits that the main Canadian brokerages have made over the past three years.

Lowest Charges Canadian Dealer – Nationwide Financial institution Direct Brokerage

Nationwide Financial institution Direct Brokerage shook up the world in August of 2021 once they introduced that they’d be the primary of Canada’s “Huge Banks” to roll out commission-free purchases of not solely ETFs, but additionally shares of Canadian shares as properly. This was a artful transfer by NBDB, as the net dealer has struggled to make any headway up to now, and this has garnered the a singular worth proposition.

If per-trade charges are the be-all and end-all relating to what you want out of your dealer account, then Nationwide Financial institution Direct Brokerage is certainly value a glance. That mentioned, there are a number of explanation why the dealer perennially receives one of many lowest grades in Canada from most of the private finance authorities.

NBDB doesn’t have a cellular app of any form but, and its on-line platform leaves a lot to be desired when in comparison with the well-oiled machines that our prime selections convey to the desk. Lastly, there aren’t any actual portfolio evaluation instruments or investor data sources accessible at NBDB, so it truly is the “no frills” choice relating to the Huge Financial institution brokerages.

In case you’re questioning how NBDB goes to generate income in the event that they don’t cost any charges, it’s vital to level out that they may cost you a $100 account charge if you happen to’re account is beneath $20,000, and that they may generate income off foreign money alternate once you purchase inventory in US {Dollars}, and/or once you “purchase on the margin” (borrow cash from Nationwide Financial institution as a way to make investments). So don’t fear about poor outdated Nationwide Financial institution – they’ll nonetheless do exactly high-quality!

| Million Greenback Journey’s Total Score: | 2.8 / 5 |

| Consumer Expertise | Missing – Dangerous platform and no cellular app |

| Buyer Service | Mediocre at greatest |

| Free ETF Buying and selling | Free shopping for and promoting of ETFs |

| Buying and selling Charges | $0 for Canadian or US inventory trades |

| Minimal Steadiness | $0 |

| Present Promotion | None |

| Full Assessment | Nationwide Financial institution Direct Brokerage Assessment |

NBDB Professionals:

- No Payment Trades

- Good bricks-and-mortar presence if you happen to reside in Quebec

NBDB Cons:

- No Cell App

- No Portfolio Evaluation Instruments

- $100 Account Payment

- No Signal Up Promotions

- Poor Total Platform Score

- Onboarding Course of is Labour Intensive

Different Canadian On-line Brokers

Despite the fact that Qtrade and Questrade are virtually neck and neck for the title of one of the best on-line dealer, and BMO represents one of the best compromise choice relating to utilizing a reduction dealer that Canadians are aware of, that doesn’t imply they’re the one viable selections. Fortunately, we Canucks have loads of good choices accessible if you wish to see if there’s a higher match.

Learn on to seek out out a little bit extra about “one of the best of the remainder”, together with what we like and dislike about every of the opposite buying and selling platform choices in Canada. We even have detailed evaluations for all of these firms which shall be linked from the related a part of textual content – so if you wish to be taught extra a couple of particular one you may merely click on the overview hyperlink and get all of the added data you want.

RBC Direct Investing – 2nd Greatest Cell App (After Qtrade)

As talked about above, the entire massive banks buying and selling platforms are fairly comparable and will all be categorised as ‘elite merchandise’. The largest upside is after all the truth that if you happen to already financial institution with them, opening a brokerage account with a particular financial institution turns into simpler and far more handy. In that regard, RBC is not any completely different.

RBC Direct Investing affords you an identical trade-off as different massive banks do – you pay larger charges and in return take pleasure in a superb platform and a variety of account choices to select from. In RBC’s case, their largest benefit is their cellular app, which has one of the best rankings out of all of the choices listed on this web page.

| Million Greenback Journey’s Total Score: | 3.9 / 5 |

| Consumer Expertise | Wonderful |

| Buyer Service | Good |

| Free ETF Buying and selling | $9.95 per ETF commerce |

| Buying and selling Charges | $9.95 ($6.95 elite accounts) |

| Minimal Steadiness | $0 |

| Present Promotion | None |

| Full Assessment | RBC Direct Investing Assessment |

RBC Direst Investing Professionals:

- Consumer pleasant, superior platform

- Incredible cellular app

- Straightforward to arrange if you happen to financial institution with RBC

- Secure and reliable firm

RBC Direct Investing Cons:

- A lot larger charges in comparison with different on-line brokers

TD Direct Investing – Nice Platform

If it weren’t for the actual fact they neither have an ongoing promotion, nor supply free ETF buying and selling, TD Direct would possibly properly have been positioned larger on our checklist. With the TD Webbroker, they’ve arguably one of the best buying and selling platform in Canada – a minimum of for desktop customers. Whereas their cellular app isn’t one of the best, it is usually an excellent product and general person evaluations are very constructive.

In case you already financial institution with TD, or if you recognize you’re going to make a variety of use of their glorious buying and selling platform, then signing up with TD Direct Investing can’t be a foul resolution ever. That mentioned, although their software program is perhaps a little bit bit higher – they merely can’t compete with the worth one would possibly get from Qtrade’s low charges.

TD’s massive information in 2022 has been the rollout of their new cellular app, TD Straightforward Commerce. It ought to be famous that this app is just not linked to TD Direct Investing, and as a substitute is an replace of the TD GoalAssist platform that got here out in 2020. It’s extra like a competitor to Wealthsimple Commerce than a real on-line buying and selling platform.

| Million Greenback Journey’s Total Score: | 3.8 / 5 |

| Consumer Expertise | Wonderful |

| Buyer Service | Very Good |

| Free ETF Buying and selling | $9.95 per ETF commerce |

| Buying and selling Charges | $9.99 ($7 for Lively Merchants) |

| Minimal Steadiness | None – However charges apply to accounts holding lower than 15K |

| Present Promotion | None |

| Full Assessment | TD Direct Investing Assessment |

TD Direct Investing Professionals:

- Certainly one of Canada’s most trusted monetary firms

- Straightforward and handy if you happen to already financial institution with TD

- Fashionable, straightforward to make use of platform

- Good quantity of account choices to select from

TD Direct Investing Cons:

- Larger buying and selling charges, ETFs particularly

- Very excessive account charges until you keep a $15K stability

Previously often called Digital Brokers, CI Direct Investing is a superb brokerage choice for Canadian expats who are actually residing abroad. The overwhelming majority of Canada’s on-line brokers is not going to settle for expat shoppers, so CI’s dealer actually distinguishes itself on this regard.

It’s additionally value noting that CI is without doubt one of the largest monetary firms in Canada and the brokerage has been within the enterprise since 2009 – so it’s not a small newcomer to the scene.

Whereas CI has continued Digital Dealer’s custom of getting low charges, it has but to essentially catch as much as our market leaders relating to the buying and selling platform’s person expertise, in addition to general customer support.

The cellular app particularly has been a lot criticized. The shortage of a beautiful promotional supply makes it much more tough to suggest this Canadian dealer to anybody aside from expats.

| Million Greenback Journey’s Total Score: | 3.7 / 5 |

| Consumer Expertise | Dangerous |

| Buyer Service | Good |

| Free ETF Buying and selling | $1.99 To Purchase and $7.99 to Promote |

| Buying and selling Charges | $1.99 – $7.99 |

| Minimal Steadiness | $25,000 – Solely applies to non-residents |

| Present Promotion | None |

| Full Assessment | CI Direct Buying and selling Assessment |

CI Direct Professionals:

- Very aggressive charges, much like trade leaders

- Greatest answer for Canadian expats

- Reliable and protected with a protracted constructive monitor document

- Nice charges and platform for very lively merchants

CI Direct Cons:

- Not one of the best product for passive traders

- Platform is general not very person pleasant or good

- Fairly primary cellular app

- No promo affords for brand spanking new signups

Scotia iTrade – Wonderful for Merchants Who Like Scotiabank

Like many of the massive banks, Scotia’s buying and selling product is an elite one. The platform is trendy and integrates very simply with all different Scotia merchandise so that you get an excellent ‘multi function’ answer on your monetary wants.

Scotia iTrade is especially engaging for individuals who need to deposit giant quantities of cash and be very lively with their accounts. In case you do this, then it considerably mitigates the upper charges and the general comfort and ease of use actually shines by means of.

Scotia’s buying and selling charges are larger than the highest brokers on this checklist, however are on par with all the opposite massive banks. The one actual main draw back is their cellular inventory buying and selling app – it obtained abysmal evaluations and hasn’t been up to date in a protracted whereas.

| Million Greenback Journey’s Total Score: | 3.7 / 5 |

| Consumer Expertise | Good, apart from the cellular app |

| Buyer Service | Good |

| Free ETF Buying and selling | $9.95 per ETF commerce |

| Buying and selling Charges | $9.95 |

| Minimal Steadiness | None |

| Present Promotion | None |

| Full Assessment | Scotia iTrade Assessment |

Scotia iTrade Professionals:

- Nice all-in-one answer

- Excellent for day merchants

- Wonderful desktop platform

- Well-known and trusted firm

Scotia iTrade Cons:

- Charges are a lot larger than different brokers

- Dangerous evaluations for his or her cellular app

Editor’s Be aware: Nonetheless searching for extra brokers? Learn our evaluations of HSBC, Interactive Brokers or Desjardins. All 3 are completely high-quality selections, however we didn’t establish any subject the place they shine above the remainder, and our person’s evaluations weren’t stellar to say the least.

CIBC Investor’s Edge – Not Canada’s Greatest On-line Dealer

Look, not each on-line dealer will be “among the best in Canada.” By definition, somebody needs to be on the surface wanting in.

In the meanwhile, that “somebody” is CIBC’s brokerage account. You’ll be able to learn our CIBC Investor’s Edge Assessment for all the small print on the platform, however suffice it to say that the mediocre person expertise doesn’t actually justify the excessive account charges.

If in case you have the remainder of your accounts at CIBC, it’s not the top of the world to even have a CIBC Investor’s Edge account. You would possibly even be capable of use that account to barter a barely higher mortgage fee, or get some financial savings account charges eliminated.

That mentioned, there’s simply no denying that whereas IE’s per-trade charges are aggressive, these annual account upkeep charges can actually chew up your returns once you’re getting began with investing. The shortage of any kind of free ETF buying and selling can be a giant detrimental for my part.

Lastly, there’s simply no denying the substantial quantity of detrimental suggestions that we’ve acquired within the remark part of our overview through the years. It’s actually doable that an organization with the assets that CIBC has (I imply… the corporate made $5 billion final yr) may take an incredible leap ahead at any time – however for now, Investor’s Edge ranks close to the again of the low cost brokerage pack.

| Million Greenback Journey’s Total Score: | 3.5 / 5 |

| Consumer Expertise | Common |

| Buyer Service | Beneath Common |

| Free ETF Buying and selling | $6.95 per ETF commerce |

| Buying and selling Charges | $6.95 |

| Minimal Steadiness | None |

| Present Promotion | None |

| Full Assessment | CIBC Investor’s Edge Assessment |

CIBC Investor’s Edge Professionals:

- Wonderful money again affords

- Decrease charges than different massive banks

- Attainable to buy fractional shares

CIBC Investor’s Edge Cons:

- Excessive charges on ETF buying and selling

- $100 per yr account upkeep charge

- Most negatively talked about customer support of all MDJ brokerage evaluations

Are These Canadian Inventory Brokers Secure?

The primary query that the majority risk-averse Canadians have with regard to opening a reduction brokerage account is: Are Canadian on-line brokers protected?

Briefly: YES!

Look, in a day and age when the USA’s prime secret recordsdata can get hacked, it might be dishonest to say something is 100% protected from prying eyes. That mentioned, Canada’s on-line brokers have nearly as good a security document as any monetary establishment on the planet relating to stopping information breaches, malware, and different forms of fraud.

All that to say – your cash and investments are precisely as protected with an internet brokerage account as they’d be with another sort of investing or banking in Canada.

You’ll be able to relaxation straightforward figuring out that if these brokerages ever had an web safety challenge, they’d most assuredly be out of enterprise fairly rapidly. They’ve extremely robust incentives to be sure that they’ve one of the best expertise on this planet working exhausting to maintain your data protected.

Frequent on-line dealer safety measures embody the next:

- SSL encryption

- Extremely-secure servers

- Two-step authentication course of when logging in

- Computerized logout

- Common system monitoring

After all, it’s not simply as much as the net dealer. It’s essential be cautious as properly. If you’re investing on-line (or sharing any private data on-line, actually), it is best to take the next steps to higher defend your self on-line.

Really helpful Steps

- Set up anti-virus and anti-spyware packages in your pc

- Use robust passwords which can be exhausting to guess

- Reap the benefits of two-factor authentication when supplied

- All the time be conscious of who’s round if you find yourself coming into your account data. As a lot as doable, this ought to be executed if you find yourself alone at dwelling. If it’s essential step away from the pc, be certain to log off first.

On the finish of the day, sure, investing on-line does have dangers, it’s not usually seen as a dangerous exercise. As talked about above, there are many safety measures in place and procedures try to be following as properly. It’s actually nearly being sensible and cautious along with your private data.

Are Qtrade and Questrade as protected as BMO, RBC, TD, CIBC, and Scotia?

I feel most Canadians perceive intrinsically that the Huge Banks are protected. In any case, the huge banks have been round for over 200 years, and are a few of the largest companies in Canada. Folks assume that their cash shall be protected.

Fewer Canadians make the identical assumption about our different prime low cost brokers.

The underside line is that Qtrade and Questrade have the entire web security measures which can be described above, however moreover, they’ve the identical CIPF-insurance backed accounts that the massive banks take pleasure in.

What’s the CIPF you would possibly ask?

The Canadian Investor Safety Fund is mainly an insurance coverage protection the the Canadian Authorities created as a way to defend Canadian traders in case a brokerage went bankrupt or turned bancrupt.

This insurance coverage covers every funding account to $1 Million. That’s $1 Million every on your RRSP, TFSA, non-registered, and so on.

So even when the corporate was in bother (which it isn’t – since Qtrade for instance is owned by Canadian monetary conglomerate Avisio Wealth), your private belongings would nonetheless be protected – similar to BMO, TD, RBC, Questrade, and another on-line dealer in Canada.

Now, it shouldn’t want stating, however I’m going to say it right here anyway: No dealer account or monetary advisor can defend you towards primary funding danger!

The Canadian on-line dealer can preserve your data protected from being hacked, there are steps that may be taken to attenuate vulnerability to fraud, and the CIPF will defend your belongings from an organization that’s in bother – however there aren’t any ensures once you put money into shares, bonds, ETFs, or commodities. Once more, this is perhaps apparent to you – however you wouldn’t imagine the questions that find yourself in our inbox generally!

Why did we resolve to rank Qtrade above its major rival, Questrade?

- Through the years, the inbox and remark boards at MDJ have constantly had considerably extra complaints about Questrade’s customer support requirements vs Qtrade’s customer support.

- Whereas Questrade has improved its cellphone and line chat wait instances over the past couple of years, my private expertise (in addition to a number of Third-party reviewers comparable to Surviscor) confirms that Qtrade remains to be considerably forward relating to each person expertise and customer support.

- Qtrade’s free ETFs symbolize a pleasant little improve on Questrades “free to purchase – however to not promote” ETFs.

- -The present promotional supply from Qtrade is simply leaps and bounds forward of the rest on the market. It’s like they took one of the best free trades bonus, one of the best money again bonus, and one of the best immediate cash in your account bonus – and stacked them on prime of one another!

- Lastly, I simply assume that Qtrade’s general investor schooling bundle, mixed with the app and desktop platforms are a big benefit. Each brokerages are good choices, and I even have accounts with each (I saved my outdated Questrade one for analysis functions), however Qtrade has merely managed to out-innovate their major rival at Questrade for a number of years now.

Qtrade isn’t the unchallenged chief in each single class – however they haven’t any obtrusive weaknesses, and completely shine relating to free ETFs, elite customer support, and unparalleled entry to data and schooling instruments. See our in-depth Qtrade Assessment for extra data, or this Questrade vs Qtrade comparability.

The latest version of the Globe and Mail (with the assistance of Dalbar Canada) 2024 low cost brokerage rankings simply got here out and as soon as once more ranked Qtrade forward of Qtrade, incomes an A grade.

Globe and Mail authors said that, “Qtrade has lived on the prime ranges of this rating for ages as a result of it’s all the time making massive and small enhancements.”

“Any dealer can fill an order to purchase shares, exchange-traded funds, mutual funds, bonds and extra. Qtrade helps you construct a well-constructed portfolio after which monitor it to make sure it continues to give you the results you want.” and, “They would be the king of regular year-by-year enchancment.”

I ought to take a second to notice that between 2009 and 2016 I used to be a really pleased Questrade person. I nonetheless assume they’re a stable step above the massive financial institution on-line brokers. It’s simply the case that Qtrade at the moment affords extra benefits (plus a considerably higher promo supply) than Questrade. Until you’re a giant choices dealer, or making 50+ trades each month (with out promoting any ETFs), then Qtrade ought to be the selection.

I’ll say that there’s one different space I’ve to rank Questrade #1: Humorous Commercials. “You’re not nonetheless utilizing your dad’s cash man are you?!” nonetheless will get me as a rule. Kudos to Questrade for really injecting some actual math right into a 30-second spot as a way to present Canadians simply how a lot cash MER charges are going to value them once they put money into mutual funds as a substitute of low-fee investing choices.

Evaluating Canadian Inventory Dealer Buying and selling Charges for ETFs and Shares

Everyone seems to be searching for low investing charges in Canada, and there’s little question that on-line low cost brokers supply one of the best charges relative to mutual funds and even robo advisors. However, simply how a lot better off are you with a reduction dealer? Let’s have a look:

In terms of ETFs we have to keep in mind that although a number of of the net brokers talked about on this article supply free ETFs to purchase, you typically must pay a charge to promote. That is one space that permits Qtrade, BMO, and NBDB to essentially shine.

One other charge that it would be best to have in mind are ECN charges. So, what precisely is an ECN charge? ECN stands for Digital Communication Community and these charges are basically service costs that you’ll pay in your trades, though they’ll generally be prevented.

You’ll be able to see from the chart above what the common worth of an ECN charge is for every dealer. In case you’re shopping for and promoting comparatively small quantities of shares, the charge received’t add as much as a lot. Nonetheless, if you happen to’re making giant Market Orders (versus restrict orders) and “eradicating liquidity from the market” – you then would possibly find yourself paying one thing like $2-$5 per commerce on a 500 share buy or sale.

I feel it’s additionally value mentioning that Canada has a few of the highest funding charges on this planet. A Morningstar 2017 international examine in contrast the funding charges and bills in 25 completely different international locations around the globe. So, the place did Canada fall on the size?

On the backside.

We paid the best funding charges out of all the opposite developed international locations on this checklist. While you learn or hear stats like that, it’s actually no marvel that increasingly more Canadians have gotten excited by taking the proverbial bull by the horns and entering into DIY investing themselves relatively than paying others to do it for them. In any case, the top purpose is to generate income – not flush it away on pointless bills comparable to shopping for yachts for mega-wealthy yacht house owners..

Backside Line: In case you’re a passive investor or want to diversify by means of ETFs, you actually can’t beat Qtrade’s free ETF coverage. In case you’re extra into margin buying and selling, or need to concentrate on buying and selling choices, then Questrade is value a powerful consideration as properly.

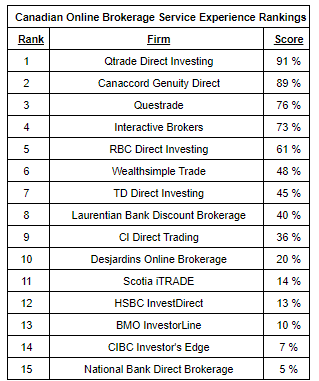

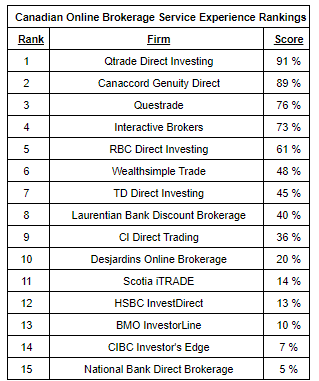

2023 Surviscor Canadian On-line Dealer Rankings

The brand new 2023 Surviscor rankings popping out for Canadian on-line brokers had been lately launched, and as anticipated, my most well-liked brokerage proceed to take the highest spot.

Surviscor raved about one of the best dealer in Canada saying: “Qtrade Direct Investing offers one of the best customer support expertise amongst Canadian On-line Brokerage companies as measured by the 2023 Surviscor On-line Brokerage Service Stage Expertise overview.”

Glenn LaCoste, the Preside of Surviscor Group said, “Congratulations to Qtrade Direct Investing for its continued service response excellence and its breadth of service interplay selections for every type of digital traders.”

Christine Zalzal, the Head of On-line Brokerage and Digital Wealth over at Qtrade was pleased to just accept the award stating:

“What makes an incredible on-line brokerage agency for traders is just not solely an incredible on-line buying and selling expertise but additionally being supported by an incredible service staff. At Qtrade, we’re all the time listening to our prospects. A powerful customer-focused tradition is embedded into our DNA. As extra Canadians discover the world of self-directed investing, we’re persevering with to put money into our individuals and our platform to assist construct their confidence to construct their wealth.”

Given the experience that Surviscor has 18 years of expertise in reviewing Canada’s on-line brokers, they’ve substantial credibility with the house. The info is the end result of roughly 2,200 particular person service interactions all through the earlier yr.

Qtrade continued with its Surviscor Canadian on-line dealer rating dominance by taking the #1 spot within the 2024 DIY investing desktop comparability.

These rankings had been launched proper on the finish of 2023, and Surviscor confirmed my private opinion that Qtrade’s on-line desktop platform is just one of the best relating to person expertise and investor schooling. My most well-liked brokerage continues to impress with new innovation every year.

2023 Globe and Mail Carrick Canadian On-line Dealer Scores

Every year The Globe and Mail’s Rob Carrick releases the 2nd greatest (*wink*) dialogue of Canada’s on-line brokerages. Whereas Rob doesn’t replace his brokerage rankings all year long like we do, he has been writing about private finance since nearly the daybreak of the low cost brokerage platform in Canada, so his experience is well-known.

Right here’s what he needed to say about Qtrade in 2023:

Grade: A

For commissions at a flat $8.75, this constantly top-ranked dealer provides you one of many higher web sites and apps for taking care of your investments.

Greater than many others, Qtrade has created a mini-me app that displays the excessive degree of utility within the web site, together with a quickie chart that reveals portfolio outcomes over the previous yr. On-line, there’s a Portfolio Rating device that slices and dices your holdings to supply insights on returns, charges, draw back danger, revenue and environmental, social and governance (ESG) elements. In contrast to some brokers, Qtrade by no means coasts.

Whereas a lot of Canada’s prime on-line brokers undergo ups and downs, Qtrade’s consistency is what units them aside. To show my level, right here’s what Carrick needed to say final yr:

“As has typically been the case on this rating through the years, Qtrade Direct Investing is the dealer that does it greatest. Different brokers beat Qtrade in particular areas like fee prices, however Qtrade’s general goodness turns into obvious as quickly as you log in and discover a neat little dashboard to get you up to the mark in your investments.

Qtrade’s constantly robust displaying on this rating speaks to a different of its virtues, fixed enchancment. Different brokers get higher in suits and begins, whereas Qtrade strikes ever ahead.”

The Greatest Brokers Cell App in Canada

As a result of I’ve a viewer-friendly twin monitor setup – and I spend an excessive amount of time at my keyboard – I don’t use my on-line brokerage cellular app all that always. That mentioned, I preserve updated with the most recent app updates from Canada’s brokers as a result of it’s clearly vital to a variety of readers.

A observe of warning relating to investing apps: these apps usually are set as much as make you commerce extra. These trades are the one approach that free buying and selling apps generate income (as a result of they’re promoting your “order circulation” as information to different firms). Consequently, they’re incentivized to get you to commerce as a lot as doable. That’s clearly not very best from a long-term wealth administration perspective.

Qtrade doesn’t promote your order data to others, and the explanation I proceed to rank it #1 as one of the best Canadian brokerage app (in addition to the one I personally use probably the most) is that it’s by far probably the most person pleasant. Your display screen isn’t crowded with “suggestions” and “options” which can be mainly ineffective (as you’re when utilizing different investing apps). Qtrade’s app continues to have one of the best app retailer rankings because of their easy class and constant stability.

Learn our full inventory dealer app comparability.

2024 Greatest Canadian Brokerage Promo Gives

More often than not, Canadian brokerage promo affords prime out round RRSP season as the massive banks attempt to achieve your corporation once you’re most paying consideration.

The actually attention-grabbing factor is that as of August 2024, Qtrade has determined to show this logic on its head.

Simply click on right here and the promo code of SUMMERBONUS2024 shall be mechanically entered for you.

The rationale I’m such a fan of this summer time and fall brokerage supply is that it stacks 4 glorious worthwhile bonuses:

1) You’re going to get a minimum of $100 money again only for opening an account and placing a thousand bucks in. That’s 10% money again!

2) Along with the $100, when you hit some larger ranges, you’re going to get 1% money again.

3) You get Limitless FREE Trades in 2024!

4) Qtrade goes to pay your switch charge if you wish to come over from one other brokerage.

You can simply be taking a look at $2,500 in bonuses once you make the most of this supply. It’s additionally an unimaginable deal for folk simply beginning to construct their nest eggs as their bonus is disproportionately giant! Right here’s a fast abstract:

| New Funds / Property Transferred | Cashback Bonus |

| $1,000 – $4,999 | None, Simply the $100 bonus |

| $5,000 – $24,999 | $250 + $100 |

| $25,000+ | 1% money again, capped at $2,000 + $100 |

Questrade is at the moment providing $50 in free trades, and Wealthsimple, in addition to TD have a 1% money again supply happening. However no brokerage comes near Qtrade’s newest providing.

Who Ought to Use an On-line Buying and selling Platform?

In terms of investing there are two classes that DIY traders must seperate all new data into.

Class 1: Issues you may management.

Class 2: Belongings you can not management.

It is perhaps stunning to most starting traders to seek out out that the majority traders spend the overwhelming majority of their time worrying about Class 2 than they do Class 1.

Class 2 contains issues like how the market is doing on a day-to-day foundation, whether or not a recession is coming quickly, or how inflation worries will have an effect on commodity costs. There’s simply no mathematical argument that it is possible for you to to foretell these occurrences with any degree of consistency.

What you can management alternatively is chopping down on the charges you pay as a way to put your cash to give you the results you want. There’s a motive why the individuals concerned with investing cash are wealthy – it’s as a result of they’re taking your funding {dollars} dwelling with them!

The very best low cost brokerages in Canada will let you lower out the entire center males and get your nest egg rising for a couple of bucks a month. Gone are the times of paying $30 per commerce, plus 2%+ of your whole account as a way to get entry to the inventory market.

Our prime Canadian low cost brokerages received’t cost you any annual charges, enable you commerce ETFs without spending a dime, and have very minimal per commerce commissions of $5-$8.

So, what kind of tradeoffs do you need to make in time and power in return for chopping all these charges (which add as much as a whole lot of 1000’s of {dollars} for a lot of Canadians over their investing lifetime)?

Actually, the training course of is now very mild. Right here’s a fast primer on how you can purchase shares in Canada that reveals you precisely what is required in a step-by-step style.

In case you’re prepared to spend an hour or so to setup the preliminary paperwork and browse our how-to information – in alternate for saving a whole lot of 1000’s of {dollars} in investing charges – then utilizing an internet brokerage account is the appropriate path for you.

Greatest On-line Brokers for Buying and selling and Consumer Expertise (Rating)

With a view to decide one of the best on-line brokers for buying and selling and person expertise I relied upon my very own private expertise (I at the moment preserve 6 brokerage accounts open, with one being my foremost account, and the opposite 5 for analysis functions) in addition to the experiences of different authors at MDJ. Between us, we’ve lively or inactive accounts at the entire main on-line brokers in Canada.

I additionally took into consideration the handfuls of feedback we get on our articles, in addition to the emails we obtain with regard to person experiences. Very similar to the Surviscor rankings really.

In any case that analysis, and searching into the prices and ease of buying and selling, as properly the as high quality of person expertise (with customer support factored in) our rating of greatest on-line brokers for buying and selling and person expertise is (Click on the hyperlinks for detailed overview of every):

- Qtrade

- Questrade

- TD Direct Investing

- RBC Direct Investing

- BMO Investorline

- Scotia iTrade

- Nationwide Financial institution Direct Brokerage

- DI Direct Investing

- CIBC Investor’s Edge

- Wealthsimple Commerce

Various to On-line Brokers in Canada: Robo Advisors

I ought to take a second to level out that if you happen to really need the final word in low-maintenance hands-off investing (like a lot of my mates do) then the Wealthsimple robo advisor platform has actually distinguished itself from the remainder of the pack relating to immediate portfolio options, and is rated our greatest robo advisor in Canada.

You’ll pay extra in charges than you’ll with a reduction brokers account, however it’s nonetheless lower than 25% of what you’d be paying with a typical Canadian mutual fund. They’ll even offer you $50 money once you open an account!

Canadian On-line Dealer Continuously Requested Questions

What’s The Greatest On-line Dealer in Canada?

Qtrade is our general choose for one of the best on-line dealer in Canada. Their mixture of low costs, elite customer support, and fixed innovation is just one of the best in school.

That mentioned, one of the best on-line brokerage account for YOU is the one that you’re most definitely to make use of. So if low prices are your precedence, then Questrade or Wealthsimple Commerce is perhaps a greater guess.

If holding issues easy and handy by utilizing a giant financial institution is your most well-liked banking technique, then we suggest BMO InvestorLine, with RBC and TD coming in 2nd and Third respectively. See our above comparability for extra detailed data.

Are On-line Brokers and Shopping for Shares On-line Secure in Canada?

Sure. In case you learn the part above on the entire methods on-line brokers preserve your investments protected, then you’re probably reassured that you’ll not be susceptible to shedding cash to a dealer’s fraud or the brokerage going bankrupt. There are very strict Canadian rules on all of these items, and being a member of the IIROC, all of the Canadian low cost brokerages adhere to excessive security requirements.

After all, we’re discussing security from non-investment danger elements right here. Please remember that there nothing any funding platform can do to guard you from inherent funding danger. Your investments can clearly go down in worth, and this has nothing to do with which brokerage you select.

What’s The Greatest Free On-line Dealer in Canada?

There isn’t a actual free on-line dealer in Canada. You’re both paying account charges, buying and selling charges, or the brokerage is promoting your data to different firms in alternate for a $0 upfront charge. The closest ones to being free are NBDB and Wealthsimple Commerce. You’ll be able to learn my information on the free inventory buying and selling in Canada for extra data.

How Do I Open a Dealer Account in Canada?

Whereas it used to contain emailing signed paperwork backwards and forwards to open a brokerage account in Canada, the previous few years have seen increasingly more brokerages undertake on-line signatures as a way to pace the account opening course of.

It’s now simpler than ever to enroll with a Canadian on-line dealer and start shopping for and promoting shares on-line.

You merely must enter your primary private data (together with your SIN), select your account (RRSP, TFSA, Non-registered, margin, and so on.) after which use the digital join the platform. Processing instances can differ relying on the brokerage and the time of yr.

Learn our information on how you can purchase shares in Canada for an entire, step-by-step information for opening your brokerage account.

How A lot Does an On-line Brokerage Value?

How a lot an internet dealer prices goes to depend upon what sort of investing you need to do and what degree of knowledge you need to pay for. On-line brokerages usually depend upon annual account charges and buying and selling commissions as their foremost charges to customers.

Some brokers even have inactivity charges. You’ll see in our 2023 Canadian brokerage comparability that we reveal what every dealer prices relating to account charges, buying and selling commissions, and ETF commissions.

What Canadian On-line Dealer Has The Greatest Buyer Service?

Qtrade constantly ranks as one of the best dealer for customer support, adopted by the massive financial institution brokers at BMO, TD, RBC and Scotia.

After all, it’s not straightforward to quantify precisely what “nice customer support” appears like, however we really feel assured in stating Qtrade is on the prime of the Canadian brokerage rankings because of the giant variety of emails and feedback we get at MDJ, plus our fixed evaluations of each Moneysense journal’s, and the Globe and Mail’s new dealer comparisons every year.

By no means has customer support been extra vital to shoppers as in 2021 as we’ve seen many on-line brokerages actually battle with 4 hours+ delays in responding to on-line and cellphone inquiries. This is without doubt one of the key causes we determined to rank Qtade above Questrade as our general #1 Canadian low cost brokerage this yr. Learn our detailed Qtrade vs Questrade article for a full comparability of the 2.

Which Financial institution is The Greatest For Inventory Buying and selling in Canada?

Whereas Qtrade is our greatest inventory buying and selling brokerage in Canada for 2023, if you happen to really feel the necessity to preserve your monetary life easy, and follow one of many massive banks, then we suggest the BMO Investorline brokerages over its rivals choices at TD, BMO, RBC, and particularly CIBC.

What Portfolio Ought to I Construct With an On-line Dealer?

If you wish to prioritize simplicity, we suggest an all-in-one ETF, whereas if you wish to prioritize cashflow we’re massive followers of dividend investing. Try our article on the greatest dividend shares in Canada for 2023 for extra data.

Can You Purchase Shares on a Cell App?

Sure, shopping for shares on cellular apps has by no means been simpler or extra handy. Whereas I personally nonetheless want to make use of my desktop, the brokerages have been steadily enhancing their apps over the past decade.

Our #1 ranked cellular app for Canadian low cost brokerages is Qtrade, however the main banks (TD particularly) have additionally poured important assets into enhancing their usability over the previous few years.

For extra data on cellular buying and selling, learn our comparability of one of the best inventory buying and selling apps in Canada or this checklist of one of the best Robinhood options in Canada.

What’s a Low cost Dealer Margin Account?

A margin account is just an everyday non-registered buying and selling account with one particular characteristic: It permits you to borrow cash to speculate.

Whereas some individuals are in a position to make use of a margin account to make giant positive factors (with the dealer’s cash) in a shorter time period, we usually don’t advise individuals to strive one of these investing.

Statistically, you’re way more prone to lose cash than achieve cash if you happen to’re “buying and selling on the margin” because of charges and primary human lack of ability to select shares within the quick time period.

What’s The Greatest Canadian Buying and selling Platform for Newcomers?

Qtrade. While you’re simply beginning out as a Canadian DIY investor you desire a easy intuitive platform, low charges, entry to investor schooling assets, and nice buyer help in case you make a logistical error. Qtrade merely excels in precisely these areas.

What’s The Greatest Canadian Dealer For Choices Buying and selling?

Questrade or IBKR are in all probability one of the best selections for choices buying and selling in Canada, however to be sincere, choices aren’t actually our factor.

How Do On-line Brokers Make Cash?

In Canada, on-line brokers nonetheless make most of their cash by means of per-trade commissions. These have been coming down lately (and there are even a number of brokerages which have nearly eradicated them totally).

Along with these easy-to-understand charges although, brokerages additionally generate income by charging account charges, documentation charges, and most of all, by means of the foreign exchange charges that they cost if you happen to purchase shares exterior of Canada in one other foreign money. Lastly, if you happen to preserve money balances in your account, brokerages can lend that cash out like a financial institution does.

Day Buying and selling Platforms in Canada

We’re not massive followers of day buying and selling at MDJ. The uncooked information towards considering you may outsmart the market sufficient to cowl the elevated buying and selling prices simply doesn’t exist.

That mentioned, if you wish to strive your hand at rapidly shifting out and in of funding positions, then understanding what to search for in a Canadian day buying and selling platform may make a fairly large distinction to your backside line.

You need to search for an internet dealer platform that emphasizes:

- Low per-trade charges (making use of “elite tier” pricing for individuals who make 50+ trades per 30 days).

- The simple capability to make use of leverage – together with a comparatively low rate of interest on mentioned leverage.

- The power to commerce non-conventional funding merchandise like foreign exchange, CDRs, and cryptocurrencies.

There aren’t really that many Canadian day buying and selling platforms that meet these standards. Avatrade might be the one most geared towards hardcore merchants who what to make use of CDRs to put every day (hourly?) leveraged bets on market outcomes. Try our Avatrade overview for extra particulars.

We nonetheless assume the Qtrade vs Questrade resolution is the best way to go if you happen to’re a dividend investor or index investor who needs to dabble with a “core and discover portfolio”. Qtrade’s customer support can assist easy out any surprising errors, whereas Questrade’s barely decrease non-ETF price-per-trade needs to be extra closely weighted once you’re making a number of trades every day.

Once more, value reiterating right here that we’re extra about utilizing on-line dealer platforms to speculate for the long run and lower charges to the bone, to not use them as day buying and selling platforms meant to squeeze out small buying and selling positive factors a number of instances per day.

Last Phrases of Knowledge About Canada’s On-line Brokers in 2024

As we get probably the most out of summer time and look forward to the beginning of a brand new college yr, it’s not solely the thermometers which can be heating up!

The competitors between Canadian on-line brokers continues to learn the patron. (Us!)

Qtrade’s present promo instance of 1% money again + $100 bucks + Free Trades + Fee of your switch charges – is a good illustration of how competitors is driving brokerages to up their recreation. I by no means noticed offers wherever near this three years in the past!

Given how less expensive DIY funding merchandise are than mutual funds, in addition to how good on-line brokers have turn into, I feel it’s solely a matter of time earlier than the complete conventional wealth administration mannequin adjustments in Canada.

If you wish to join new prospects immediately, you higher supply an FHSA account, have low charges, glorious customer support, and a user-friendly app/web site combo.

Selecting one of the best Canadian on-line dealer for you ought to contain having a look at what you actually worth when it comes time to speculate your personal cash. Quite a few research have proven that an investor’s consolation degree with their brokerage account can considerably impression the amount of cash that they make investments over the long run.

It is smart that if an individual feels intimidated or simply type of “detrimental” about the entire investing expertise, then they’re much less prone to put extra money to work for them. That hesitation can add as much as a a lot smaller nest egg because the many years cross by!

Over my 18 years of serving to Canadians make investments, I’ve seen that eradicating behavioral limitations and making the method so simple as doable is essential to constructing long-term success.

Low charges are a giant deal, and allow you to preserve extra of your hard-earned cash the place it belongs – in your funding account. BUT, you additionally must really feel snug with no matter your closing selection of DIY buying and selling platform is.

Let me know what your current expertise with Canada’s on-line brokers have been, as I all the time take current feedback and emails into consideration after I replace the 2024 brokerage rankings!