The Authorities of India rolled out the Nationwide Pension Scheme (NPS) for all of the residents of India manner again on 1st Could 2009, and for company sector from December 2011. Since then, NPS has turn into one of the vital widespread funding and tax saving choices in India.

The numbers communicate for themselves – The Complete property below administration (AUM) with NPS is now at Rs. 8.82 Lakh crore with Y-o-Y development of 23.45%. The variety of subscribers below varied schemes below the Nationwide Pension System (NPS) rose to 624.81 lakh as at March 4th 2023 from 508.47 Lakh in March 2022 exhibiting a year- on- 12 months (Y-o-Y) enhance of twenty-two.88%.

The pension scheme provides its buyers a alternative to pick the funds mechanically or manually. Whereas the energetic alternative will help you decide the plan and share of your funds you want to spend money on, the auto alternative will allocate your investments primarily based on the chance evaluation and your profile.

On this submit let’s perceive – What are the several types of funds or asset lessons below NPS? What number of fund managers are presently managing the NPS schemes? That are the highest performing NPS Schemes 2023? That are one of the best NPS Schemes to spend money on 2024 & past? Which NPS Scheme has given the very best return? Who’re one of the best NPS Fund managers in India?

Forms of NPS Funds, Scheme Preferences & Fund Managers

Nationwide Pension System (NPS) gives two sorts of accounts – Tier I and Tier II.

| NPS Tier – I Account | NPS Tier – II Account |

|---|---|

| Particular person Pension Account | Non-compulsory Account and requires an energetic Tier-I Account |

| Withdrawal as per Exit & Withdrawal guidelines and rules | Unrestricted withdrawals |

| Minimal contribution to open is Rs.500/- | Min. Contribution to open is Rs.250/- |

| Min. Contribution per 12 months is Rs.1000/- | There’s no restriction on min. Contribution per 12 months |

| AMC fees relevant | No separate AMC fees relevant |

| Switching to Tier-II is restricted topic to Exit & Withdrawal rules | Anytime switching to Tier-I allowed |

Earnings Tax advantages can be found on Tier-1 deposits solely. The returns in your NPS investments whether or not in Tier 1 or Tier 2, are primarily depending on the kind of Fund(s) and Pension Fund supervisor that who’ve chosen to speculate. So, you want to know and perceive the several types of NPS Funds.

Under talked about 4 fund classes / Funding choices (also referred to as asset lessons) can be found below Nationwide Pension System:

- Fairness Fund (E)

- Authorities Securities Fund (G)

- Company Fastened Earnings Devices aside from Govt. Securities (C)

- Various Investments (obtainable solely in Tier-1)

The cash invested in NPS is managed by PFRDA-registered Pension Fund Managers. At the second, there are ten NPS pension fund managers:

- Aditya Birla Solar Life Pension Administration Ltd.

- Axis Pension Fund Administration Restricted

- HDFC Pension Administration Co. Ltd.

- ICICI Pru. Pension Fund Mgmt Co. Ltd.

- Kotak Mahindra Pension Fund Ltd.

- LIC Pension Fund Ltd.

- Max Life Pension Fund Administration Restricted

- SBI Pension Funds Pvt. Ltd

- Tata Pension Administration Ltd. &

- UTI Retirement Options Ltd.

The govt. workers’ NPS accounts and contributions are presently managed equally by three fund managers specifically – LIC Pension Fund, SBI Pension Fund and UTI. Beneath this class, do word that as much as 50% of corpus solely will be invested in Fairness fund. The remainder of the corpus is allotted to Company Bonds and Govt securities.

The pvt (company) sector workers and different people may spend money on NPS. The Fairness fund threshold restrict is ready at 75%. These people can choose any of the 2 funding choices to pick scheme preferences.

- Energetic alternative – Beneath this feature, subscriber selects the allocation sample amongst the three funds E, C and G. The Most allocation to Fairness will be 75% and 100% in Company or Govt securities. (Nonetheless, there’s a clause of tapering of the fairness allocation after the age of 60 years.)

| Asset Class / Fund Selection | Most allocation of funding within the asset class |

|---|---|

| E (Fairness Fund) | As much as 75% until Age 60 As much as 50% Age 60 & above |

| C (Company Fastened Earnings) | As much as 100% |

| G (Govt Securities) | As much as 100% |

| A (Alternate Investments) | As much as 5% . (Accessible just for NPS Tier 1 account) |

- Auto Selection : Beneath this feature, subscriber funds are mechanically allotted amongst three funds E, C and G in a pre-defined portfolio sample prescribed by PFRDA. When a subscriber chooses this feature, it adopts a lifecycle-based strategy, by which the allocation to completely different asset lessons modifications step by step because the particular person’s age will increase.

- Beneath Auto alternative, you can be given three sorts of funds to select from –

- Reasonable Life Cycle Fund (default possibility) – The “Reasonable Life Cycle Fund” possibility supplies you with the choice of a Life Cycle fund with an affordable threat profile, the place the utmost fairness allocation is saved at 50% as much as the age of 35 years.

- Aggressive Life Cycle Fund – For “Aggressive Life Cycle Fund” most fairness allocation is saved at 75% as much as the age of 35 years.

- Conservative Life Cycle Fund – for “Conservative Life Cycle Fund” most fairness allocation is saved at 25% as much as the age of 35 years.

NPS permits you to change your fund supervisor yearly and your scheme of funding 4 instances a 12 months. The shift is allowed for investments in NPS Tier I (non-government subscribers solely) and NPS Tier II accounts.

High Performing NPS Schemes 2023 – Greatest NPS Funds 2024 – Greatest NPS Fund Returns

Under are one of the best NPS Funds to spend money on 2024 & past;

Greatest NPS Fund Returns – Central Govt Scheme

| Pension Fund | Inception Date |

AUM (Rs Crs) |

Returns 1 12 months |

Returns 3 Years |

Returns 5 Years |

Returns 7 Years |

Returns 10 Years |

Returns Inception |

|---|---|---|---|---|---|---|---|---|

| LIC Pension Fund Ltd. | 1-Apr-08 | 90,303.54 | 9.64% | 7.87% | 9.38% | 8.04% | 9.81% | 9.35% |

| SBI Pension Funds Pvt. Ltd | 1-Apr-08 | 96,230.00 | 9.45% | 7.44% | 9.35% | 8.04% | 9.79% | 9.54% |

| UTI Retirement Options Ltd. | 1-Apr-08 | 89,951.50 | 9.38% | 7.69% | 9.32% | 8.07% | 9.77% | 9.31% |

- The contributions to NPS Accounts by Central govt workers are presently equally managed by the three pension fund managers.

- Beneath Central Govt Scheme, the fairness publicity sometimes ranges from 8% to fifteen% of a fund’s portfolio.

- The perfect NPS Fund supervisor primarily based on the returns generated within the final 10 years is LIC Pension Fund. This fund has generated returns of round 9.81%.

- When it comes to Belongings below administration, SBI Pension Fund is the largest one with Belongings of round Rs 96,200 cr.

Greatest NPS Fund Supervisor 2023 – State Govt Scheme

| Pension Fund | Inception Date |

AUM (Rs Crs) |

Returns 1 12 months |

Returns 3 Years |

Returns 5 Years |

Returns 7 Years |

Returns 10 Years |

Returns Inception |

|---|---|---|---|---|---|---|---|---|

| LIC Pension Fund Ltd. | 25-Jun-09 | 167,825.58 | 9.54% | 7.77% | 9.33% | 7.96% | 9.78% | 9.30% |

| SBI Pension Funds Pvt. Ltd | 25-Jun-09 | 172,412.62 | 9.35% | 7.32% | 9.33% | 7.97% | 9.85% | 9.22% |

| UTI Retirement Options Ltd. | 25-Jun-09 | 163,040.19 | 9.37% | 7.66% | 9.31% | 8.00% | 9.75% | 9.25% |

- The perfect NPS Fund supervisor primarily based on the returns generated within the final 10 years is SBI Pension Fund. This fund has generated returns of round 9.85%.

- When it comes to Belongings below administration, SBI Pension Fund is the largest one with Belongings of round Rs 1,70,000 cr.

High Performing NPS Tier-I Fairness Fund Supervisor 2023

| Pension Fund | Inception Date |

AUM (Rs Crs) |

Subscribers | Returns 1 12 months |

Returns 3 Years |

Returns 5 Years |

Returns 7 Years |

Returns 10 Years |

Returns Inception |

|---|---|---|---|---|---|---|---|---|---|

| Aditya Birla Solar Life | 9-Could-17 | 414.65 | 43,436 | 18.85% | 20.92% | 13.09% | NA | NA | 12.78% |

| Axis Pension Fund | 21-Oct-22 | 241.91 | 27,562 | NA | NA | NA | NA | NA | 10.38% |

| HDFC Pension | 1-Aug-13 | 26,189.86 | 1,713,869 | 17.76% | 21.98% | 13.83% | 13.73% | 14.40% | 14.60% |

| ICICI Pru. Pension Fund | 18-Could-09 | 8,306.01 | 641,839 | 20.25% | 23.03% | 13.68% | 13.25% | 14.12% | 12.41% |

| Kotak Mahindra | 15-Could-09 | 1,462.89 | 99,055 | 19.92% | 22.65% | 14.13% | 12.98% | 14.12% | 11.82% |

| LIC Pension Fund | 23-Jul-13 | 4,066.88 | 384,140 | 18.73% | 23.28% | 13.06% | 12.32% | 12.96% | 12.78% |

| Max Life Pension | 12-Sep-22 | 124.75 | 7,772 | 18.19% | NA | NA | NA | NA | 8.18% |

| SBI Pension Funds | 15-Could-09 | 13,373.32 | 1,484,740 | 18.89% | 21.60% | 12.77% | 12.59% | 13.59% | 10.89% |

| Tata Pension Administration | 19-Aug-22 | 86.42 | 15,025 | 16.92% | NA | NA | NA | NA | 12.78% |

| UTI Retirement Options | 21-Could-09 | 1,762.92 | 116,988 | 17.94% | 22.27% | 13.04% | 12.82% | 13.97% | 12.17% |

| Benchmark Return as on 28.09.2023 | 15.24% | 22.51% | 14.00% | 13.81% | 14.55% | ||||

- The perfect performing NPS Pension Fund supervisor below NPS Tier-1 Fairness Plan is HDFC Pension Fund. This scheme has generated returns of round 14.4% and within the final 10 years.

- The HDFC Pension fund – Fairness plan has picked Financials as the highest sector. The highest 5 holdings of this fund are HDFC Financial institution, ICICI Financial institution, Reliance Industries, Infosys and Axis Financial institution.

- The HDFC Pension Fund – Fairness Plan has been faring nicely primarily based on the parameters of Returns, Draw back threat and Consistency.

- The Fairness plan provided by the HDFC Pension Fund has the very best AUM and subscribers.

- The benchmark used for Fairness plans is CNX Nifty 50 Index.

Greatest NPS Fund Tier-1 below Scheme-G Class (Govt Securities / Bonds)

| Pension Fund | Inception Date | AUM (Rs Crs) |

Subscribers | Returns 1 12 months |

Returns 3 Years |

Returns 5 Years |

Returns 7 Years |

Returns 10 Years |

Returns Inception |

|---|---|---|---|---|---|---|---|---|---|

| Aditya Birla Solar Life | 9-Could-17 | 355.41 | 42,705 | 8.26% | 5.20% | 9.01% | NA | NA | 7.66% |

| Axis Pension Fund | 21-Oct-22 | 237.48 | 27,332 | NA | NA | NA | NA | NA | 7.08% |

| HDFC Pension | 1-Aug-13 | 18816.27 | 1,681,340 | 8.09% | 4.92% | 9.06% | 7.21% | 9.26% | 8.95% |

| ICICI Pru. | 18-Could-09 | 7018.84 | 631,891 | 8.18% | 4.95% | 8.81% | 7.08% | 9.36% | 8.42% |

| Kotak Mahindra | 15-Could-09 | 1085.54 | 96,528 | 8.17% | 5.12% | 9.03% | 7.14% | 9.36% | 8.41% |

| LIC | 23-Jul-13 | 4349.77 | 391,670 | 8.15% | 5.15% | 9.52% | 7.98% | 9.79% | 9.75% |

| Max Life | 12-Sep-22 | 197.98 | 11,485 | 8.10% | NA | NA | NA | NA | 8.23% |

| SBI Pension | 15-Could-09 | 14473.25 | 1,484,698 | 8.33% | 4.95% | 8.89% | 7.19% | 9.40% | 9.00% |

| Tata Pension | 19-Aug-22 | 69.31 | 15,029 | 8.16% | NA | NA | NA | NA | 7.43% |

| UTI | 21-Could-09 | 1500.1 | 113,030 | 8.42% | 5.00% | 8.74% | 6.91% | 9.14% | 8.17% |

| Benchmark Return as on 28.09.2023 | 8.70% | 4.54% | 8.52% | 6.69% | 8.86% | ||||

- The Authorities Bond Plan provided by LIC Pension fund has clocked returns of round 9.79% over the last 5 years. The common benchmark return for a similar interval is 8.86%.

- SBI Pension fund Scheme G Plan has additionally been performing nicely.

High Performing NPS Fund Supervisor – NPS Tier 1 Funds – Company Debt Plans (Scheme C)

| Pension Fund | Inception Date | AUM (Rs Crs) |

Subscribers | Returns 1 12 months |

Returns 3 Years |

Returns 5 Years |

Returns 7 Years |

Returns 10 Years |

Returns Inception |

|---|---|---|---|---|---|---|---|---|---|

| Aditya Birla | 9-Could-17 | 210.43 | 43,028 | 7.88% | 5.85% | 8.83% | NA | NA | 8.29% |

| Axis | 21-Oct-22 | 136.53 | 27,287 | NA | NA | NA | NA | NA | 6.73% |

| HDFC | 1-Aug-13 | 11267.83 | 1,687,290 | 7.88% | 6.23% | 9.05% | 7.86% | 9.29% | 9.32% |

| ICICI Pru. | 18-Could-09 | 4179.03 | 635,867 | 7.97% | 5.94% | 8.54% | 7.59% | 9.28% | 9.61% |

| Kotak Mahindra | 15-Could-09 | 636.03 | 97,062 | 7.71% | 5.76% | 7.94% | 6.99% | 8.80% | 9.29% |

| LIC | 23-Jul-13 | 2379.31 | 383,096 | 7.74% | 5.75% | 8.71% | 7.46% | 8.98% | 9.06% |

| Max Life | 12-Sep-22 | 85.23 | 7,757 | 6.89% | NA | NA | NA | NA | 6.67% |

| SBI | 15-Could-09 | 7081.69 | 1,474,714 | 7.72% | 5.86% | 8.61% | 7.58% | 9.10% | 9.63% |

| Tata | 19-Aug-22 | 39.68 | 14,820 | 6.18% | NA | NA | NA | NA | 5.81% |

| UTI | 21-Could-09 | 824.92 | 115,604 | 8.04% | 5.61% | 8.32% | 7.24% | 8.82% | 8.72% |

| Benchmark Return as on 28.09.2023 | 7.77% | 6.37% | 9.29% | 7.77% | 9.46% | ||||

- The very best returns generated within the final 10 years by NPS Funds below Company Fastened Earnings Plans are managed by ICICI Prudential & HDFC Fund Managers.

- The HDFC Pension Fund – Company Debt Scheme has additionally been performing nicely, primarily based on the parameters of Returns, (higher) Draw back threat and Consistency.

- HDFC Pension Fund has the very best AUM of round Rs 11,000 cr.

Greatest NPS Pension Fund Returns – Tier II Account – Fairness Plan (E)

| Pension Fund | Inception Date | AUM (Rs Crs) |

Subscribers | Returns 1 12 months |

Returns 3 Years |

Returns 5 Years |

Returns 7 Years |

Returns 10 Years |

Returns Inception |

|---|---|---|---|---|---|---|---|---|---|

| Aditya Birla | 9-Could-17 | 27.36 | 12,192 | 18.92% | 21.12% | 13.13% | NA | NA | 12.76% |

| Axis | 21-Oct-22 | 3.42 | 2,842 | NA | NA | NA | NA | NA | 10.64% |

| HDFC | 1-Aug-13 | 932.06 | 226,624 | 17.89% | 21.97% | 13.84% | 13.72% | 13.01% | 12.96% |

| ICICI Pru. | 21-Dec-09 | 318.84 | 81,721 | 20.94% | 23.24% | 13.88% | 13.40% | 14.21% | 11.12% |

| Kotak Mahindra | 14-Dec-09 | 94.48 | 22,986 | 20.03% | 22.50% | 13.97% | 12.89% | 13.98% | 11.31% |

| LIC | 12-Aug-13 | 130.24 | 63,031 | 18.30% | 23.40% | 13.12% | 12.21% | 10.97% | 10.88% |

| Max Life | 12-Sep-22 | 0.63 | 680 | 18.79% | NA | NA | NA | NA | 14.86% |

| SBI | 14-Dec-09 | 438.32 | 197,017 | 18.84% | 21.74% | 12.82% | 12.63% | 13.66% | 10.75% |

| Tata | 19-Aug-22 | 6.43 | 4,223 | 17.75% | NA | NA | NA | NA | 12.68% |

| UTI | 14-Dec-09 | 78.11 | 24,066 | 18.08% | 22.36% | 13.07% | 13.13% | 14.25% | 11.06% |

| Benchmark Return as on 28.09.2023 | 15.24% | 22.51% | 14.00% | 13.81% | 14.55% | ||||

- The Fairness Scheme provided by UTI Retirement has generated returns of round 14.25% over the last 10 years. The fund’s portfolio has ‘financials’ sector with highest publicity, adopted by the Vitality & Know-how sectors. The highest 5 holdings of this fund are Hdfc Financial institution, Icici Financial institution, Reliance Industries, Infosys Tech & Larsen & Tourbo.

- Not one of the funds have been in a position to beat their benchmark index return during the last 5-to-10-year intervals.

- HDFC Pension Fund has the very best AUM of round Rs 900 cr.

Greatest NPS Pension Fund Returns – Tier II Account – Govt Bond Plans (G)

| Pension Fund | Inception Date |

AUM (Rs Crs) |

Subscribers | Returns 1 12 months |

Returns 3 Years |

Returns 5 Years |

Returns 7 Years |

Returns 10 Years |

Returns Inception |

|---|---|---|---|---|---|---|---|---|---|

| Aditya Birla | 9-Could-17 | 22.63 | 11,914 | 8.17% | 5.20% | 8.94% | NA | NA | 7.00% |

| Axis | 21-Oct-22 | 1.94 | 2,715 | NA | NA | NA | NA | NA | 5.80% |

| HDFC | 1-Aug-13 | 574.43 | 218,674 | 8.00% | 4.88% | 8.86% | 7.06% | 9.14% | 9.07% |

| ICICI Pru. | 30-Dec-09 | 245.15 | 79,342 | 8.24% | 5.07% | 8.81% | 7.09% | 9.36% | 8.49% |

| Kotak Mahindra | 14-Dec-09 | 63.48 | 22,230 | 7.96% | 5.05% | 8.67% | 6.97% | 9.19% | 8.16% |

| LIC | 12-Aug-13 | 179.26 | 64,792 | 8.23% | 5.27% | 9.77% | 8.20% | 10.03% | 9.99% |

| Max Life | 12-Sep-22 | 0.32 | 645 | 6.96% | NA | NA | NA | NA | 6.83% |

| SBI | 14-Dec-09 | 428.46 | 196,104 | 8.24% | 4.89% | 8.70% | 7.05% | 9.32% | 8.97% |

| Tata | 19-Aug-22 | 4.45 | 4,109 | 8.55% | NA | NA | NA | NA | 8.09% |

| UTI | 14-Dec-09 | 61.24 | 23,649 | 8.31% | 5.00% | 8.77% | 6.95% | 9.22% | 8.73% |

| Benchmark Return as on 28.09.2023 | 8.70% | 4.54% | 8.52% | 6.69% | 8.86% | ||||

- The Tier-II Authorities Bond Plan provided by LIC Pension fund has clocked returns of round 10% over the last 10 years. The fund is ready to beat its benchmark return over the 3-to-10-year interval.

- HDFC Pension Fund has the very best AUM of round Rs 570 cr.

Greatest NPS Tier-II Funds Returns 2020 – High Performing NPS Fund Supervisor Company Debt Plans (Scheme C)

| Pension Fund | Inception Date | AUM (Rs Crs) |

Subscribers | Returns 1 12 months |

Returns 3 Years |

Returns 5 Years |

Returns 7 Years |

Returns 10 Years |

Returns Inception |

| Aditya Birla | 9-Could-17 | 12.23 | 12,067 | 7.76% | 5.94% | 8.55% | NA | NA | 7.68% |

| Axis | 21-Oct-22 | 1.33 | 2,731 | NA | NA | NA | NA | NA | 5.36% |

| HDFC | 1-Aug-13 | 390.63 | 220,825 | 7.86% | 5.92% | 8.80% | 7.75% | 8.57% | 8.59% |

| ICICI Pru. | 21-Dec-09 | 168.22 | 81,099 | 7.92% | 5.85% | 8.44% | 7.49% | 9.17% | 9.43% |

| Kotak Mahindra | 14-Dec-09 | 37.8 | 22,531 | 7.62% | 5.51% | 8.22% | 7.23% | 8.81% | 8.62% |

| LIC | 12-Aug-13 | 72.39 | 63,023 | 7.73% | 6.87% | 9.06% | 7.55% | 8.61% | 8.55% |

| Max Life | 12-Sep-22 | 0.16 | 643 | 6.51% | NA | NA | NA | NA | 6.44% |

| SBI | 14-Dec-09 | 222.86 | 195,816 | 7.49% | 5.35% | 8.13% | 7.23% | 8.85% | 9.17% |

| Tata | 19-Aug-22 | 2.04 | 4,108 | 6.97% | NA | NA | NA | NA | 6.66% |

| UTI | 14-Dec-09 | 32.88 | 23,858 | 7.81% | 5.52% | 8.26% | 7.25% | 8.82% | 8.74% |

| Benchmark Return as on 28.09.2023 | 7.77% | 6.37% | 9.29% | 7.77% | 9.46% | ||||

- The very best returns generated by NPS Funds (Tier -II) below Company Fastened Earnings Plans are managed by ICICI Prudential & HDFC Pension Funds.

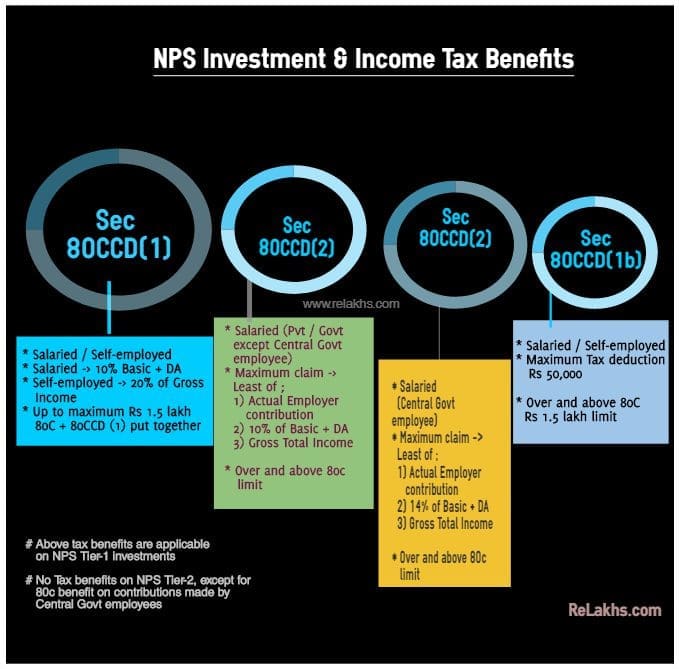

Newest NPS Earnings Tax Advantages FY 2023-24 / AY 2024-25 below Previous & New Tax Regimes

Under are the assorted Earnings Tax Sections below which an NPS investor can declare Earnings Tax Deductions for FY 2023-24 / AY 2024-25 .

- Part 80C

- Part 80CCD (1)

- U/S 80CCD (1b)

- Part 80CCD (2)

Beneath the brand new tax regime, the primary three deductions usually are not obtainable, however the fourth one continues to be obtainable.

Associated article : NPS Earnings Tax Advantages FY 2023-24 | Beneath Previous & New Tax Regimes

My perspective on NPS:

Sadly, majority of the subscribers usually are not conscious of ‘how NPS scheme works’ and spend money on it simply to avoid wasting taxes. Observe that NPS doesn’t offer you Pension. The subscriber has to re-invest the NPS Withdrawal corpus in an annuity insurance coverage product.

Earlier than you spend money on NPS (if planning to speculate), kindly perceive the options of NPS, tax implications, withdrawal guidelines & necessary clause to purchase annuity product on maturity after which take a clever choice. If in case you have already invested in NPS, it’s possible you’ll overview your funding choice.

I imagine that a lot of the buyers go for the NPS for 2 principal causes – i) for tax saving goal & ii) No different alternative than to speculate as contribution to NPS has been made necessary for the Govt workers.

Given a alternative between NPS and Mutual Funds, I would like investing in Mutual Funds to NPS.

Kindly share your views on NPS as an funding alternative? Have you ever invested in NPS? Is NPS your most popular alternative for tax saving? Which one do you like, NPS or MFs on your long-term retirement planning? Share your views, cheers!

Proceed studying associated articles :

(Put up first printed on : 03-Oct-2023)