Affordability plummets amid rising charges and costs

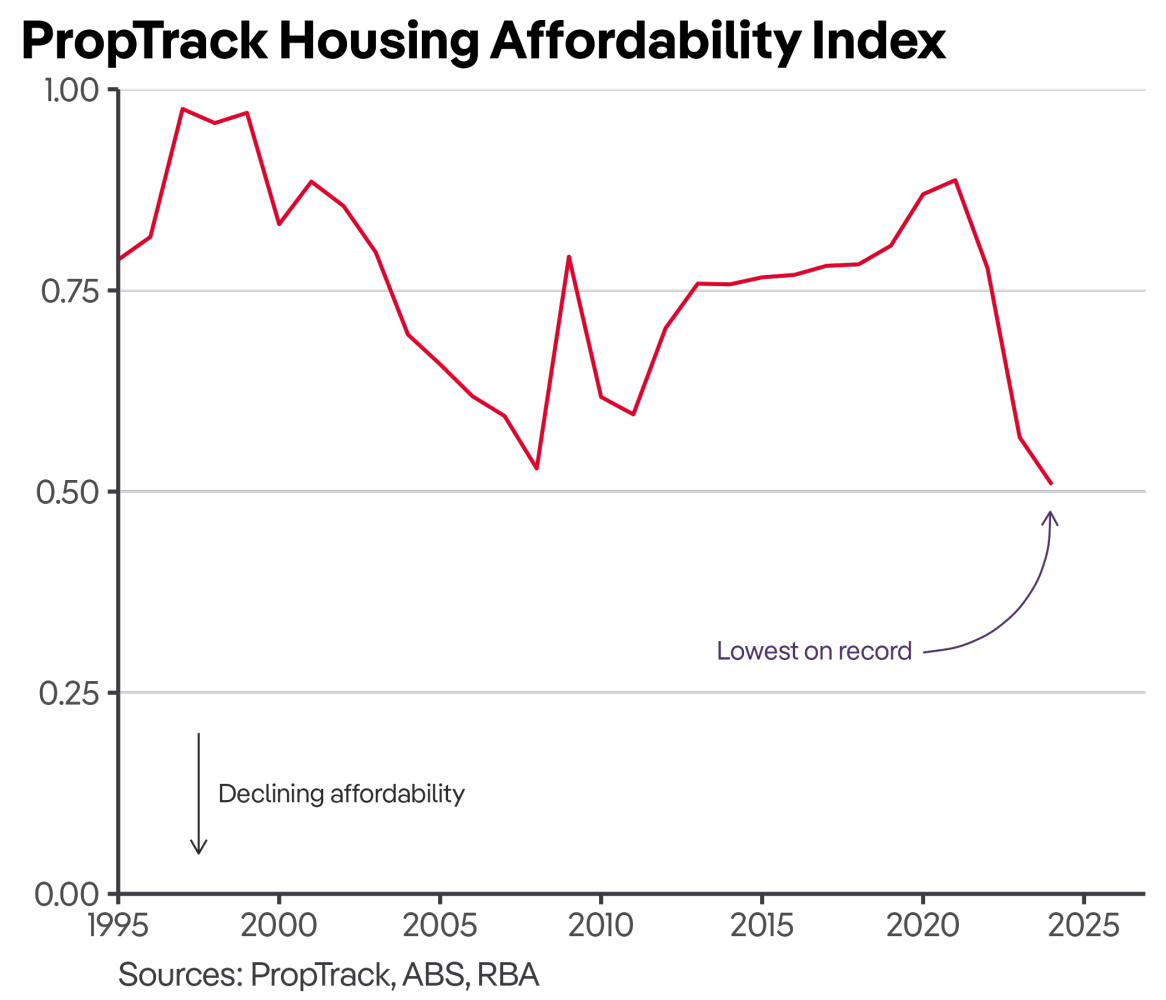

Housing affordability in Australia has reached its lowest degree on report, based on the newest PropTrack housing affordability index.

A mix of excessive mortgage charges – at ranges not seen since 2011 – and fast residence worth will increase has severely restricted the power of households to buy property.

Over the previous 12 months, the nationwide median residence worth has surged by roughly $50,000, leaving households capable of afford solely the smallest share of properties since data started.

Median-income households battle to enter market

The decline in affordability has been stark.

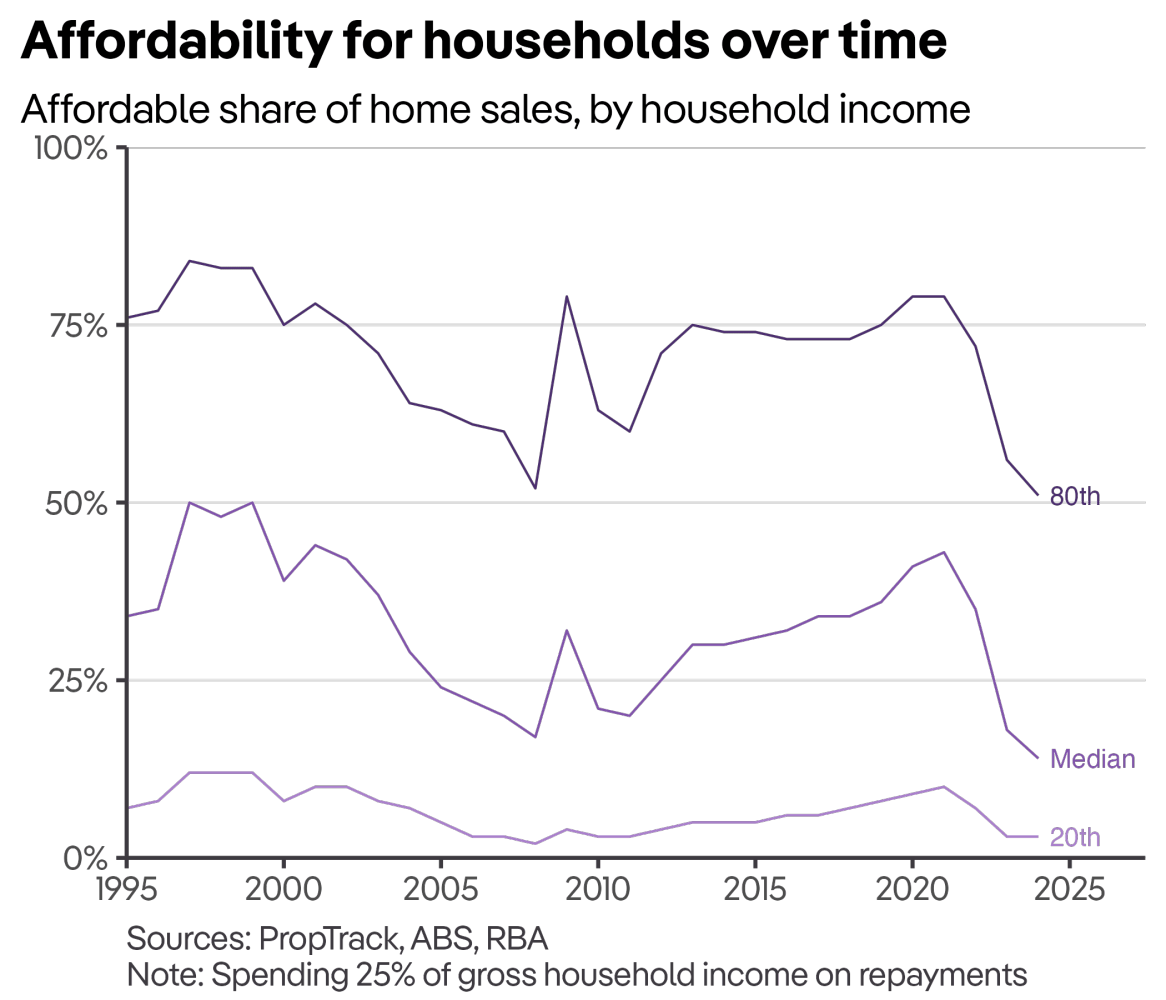

“A median revenue family – incomes simply over $112,000 a 12 months – can afford to buy simply 14% of properties bought throughout the nation,” mentioned Paul Ryan (pictured above), PropTrack’s senior economist.

This represents a dramatic drop from 2020-21, when a median-income family may afford 43% of properties. Right now, solely high-income earners, with annual earnings of $213,000, can afford to buy half of the properties in the marketplace.

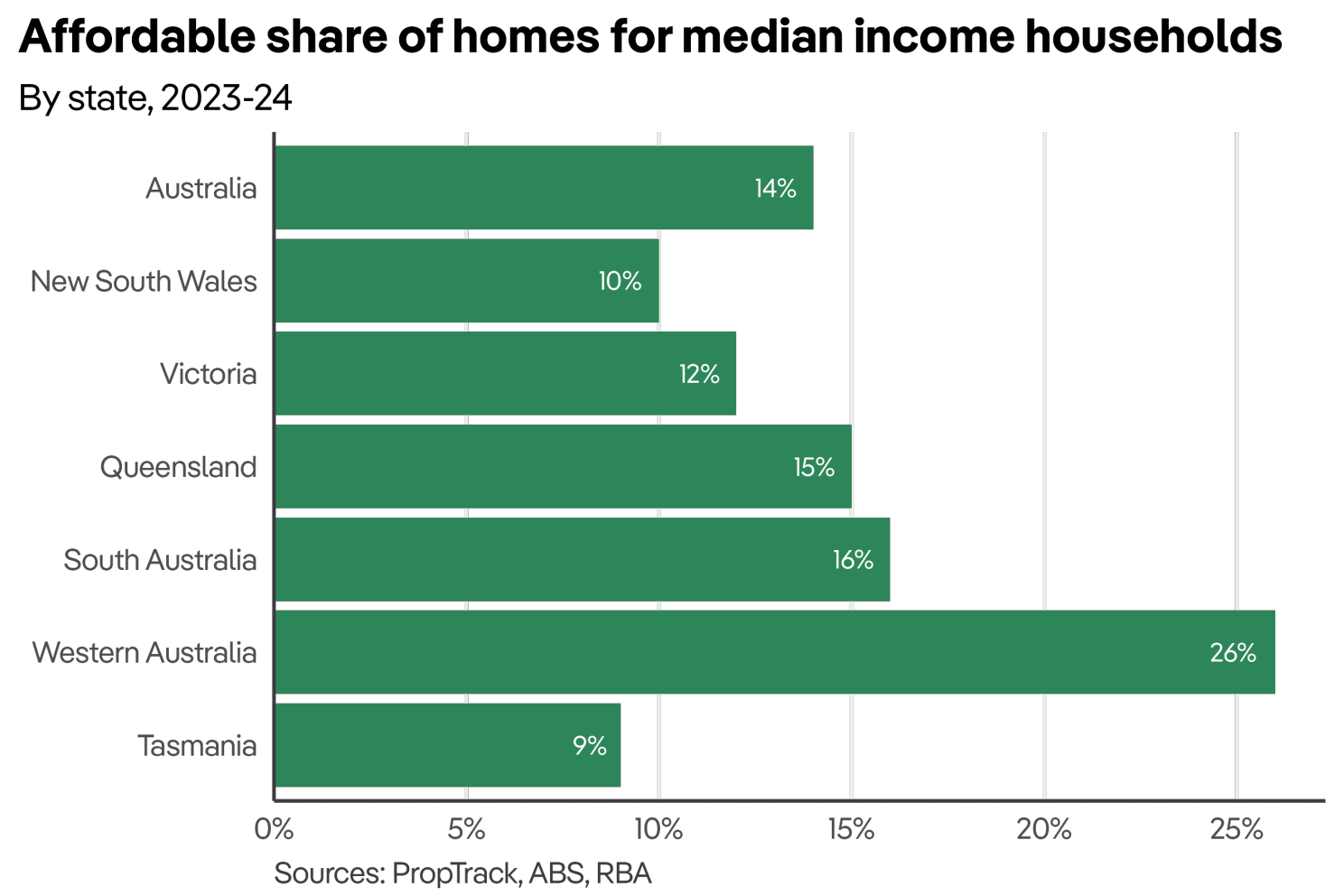

Affordability disaster hits hardest in NSW, Tasmania, and Victoria

New South Wales, Tasmania, and Victoria are experiencing probably the most extreme affordability challenges.

In Sydney, the place the median residence worth is now $1.5 million, homeownership is essentially out of attain for many.

Tasmania ranks because the second least reasonably priced state, with lower than 10% of properties inside attain for a median-income family.

South Australia noticed the biggest year-over-year decline in affordability, whereas Western Australia stays probably the most reasonably priced state, attracting many interstate movers.

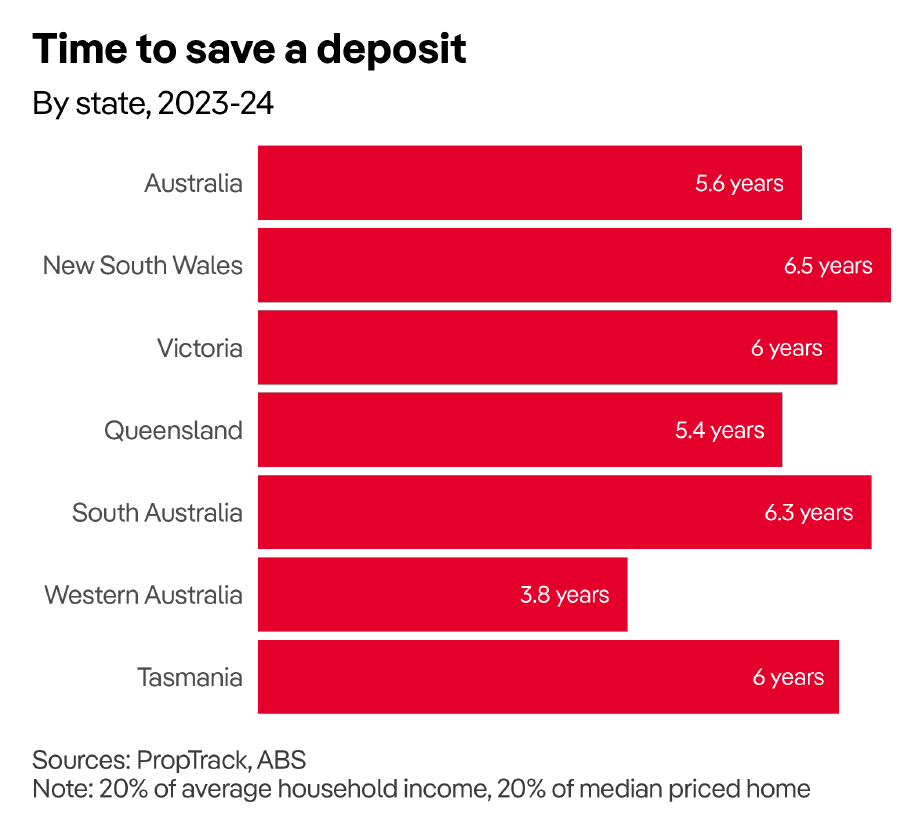

A median family should save 20% of their revenue for over 5 and a half years to assemble a 20% deposit on a median-priced residence, making homeownership an elusive aim for a lot of.

Structural modifications wanted

Whereas a possible discount in rates of interest later this 12 months may supply some aid, specialists argue that substantial, long-term enhancements in affordability require broader modifications to the housing market.

“Decrease rates of interest will ease housing affordability considerably, and this aid might come as quickly as late this 12 months,” Ryan mentioned. “However significant, long-term enchancment would require structural modifications to the housing market to make extra properties accessible.”

The Nationwide Cupboard’s aim of constructing 1.2 million well-located properties is seen as a constructive step, however coordinated efforts will probably be important to handle the broader housing disaster and maintain homeownership inside attain for future generations.

Get the most popular and freshest mortgage information delivered proper into your inbox. Subscribe now to our FREE every day e-newsletter

Associated Tales

Sustain with the newest information and occasions

Be part of our mailing checklist, it’s free!