Whereas the price of elder care in the US, whether or not paid for by Medicare, Medicaid or out-of-pocket, is substantial, most care is offered by relations for no compensation. But the burden on these relations may also be large when it comes to forgoing paid employment or work alternatives, time with household and buddies, and common exhaustion.

An challenge temporary not too long ago printed by the Heart for Retirement Analysis at Boston Faculty examines these prices, insurance policies that may assist household caregivers, and their preferences as expressed in focus teams. Listed below are a few of its findings:

In 2021, there have been about 38 million household caregivers in the US who’re estimated to have offered 36 billion hours of help to their relations.

Racial Disparities

White caregivers usually tend to be spouses and are older than Black or Hispanic caregivers, who usually tend to be the youngsters or grandchildren of the individuals for whom they’re caring. Whereas 56 p.c of White caregivers are ages 62+, solely 37 p.c of Black and 30 p.c of Hispanic caregivers are this age. Only a fifth of White caregivers are underneath age 50 as in comparison with a 3rd of Black caregivers and simply over 40 p.c of Hispanic caregivers. Non-White caregivers are additionally extra possible to offer extra hours of care per week.

Not surprisingly, the youthful age and better hours of caregiving for non-White caregivers have a better influence on their capacity to keep up their employment, which has ripple results on their present and future funds as they earn much less and contribute much less to Social Safety when working.

Restricted Help

When it comes to current monetary assist, household caregivers can declare a Youngster and Dependent Care Tax Credit score for out-of-pocket bills of as much as $3,000 for one dependent and $6,000 for 2 or extra dependents. This tax break has restricted utility for a number of causes: the member of the family should qualify as a dependent; the credit score is just for out-of-pocket bills reasonably than compensation for the effort and time of care; and it’s non-refundable, that means it’s not obtainable to lower-income caregivers who don’t have any federal revenue tax obligation.

The Household and Medical Depart Act (FMLA) gives as much as 12 weeks of unpaid depart to staff who have to take time without work to offer care. The shortage of cost undermines the utility of this profit for many staff. Fourteen states supply some type of paid household depart with the phrases various from state to state.

What Caregivers Need

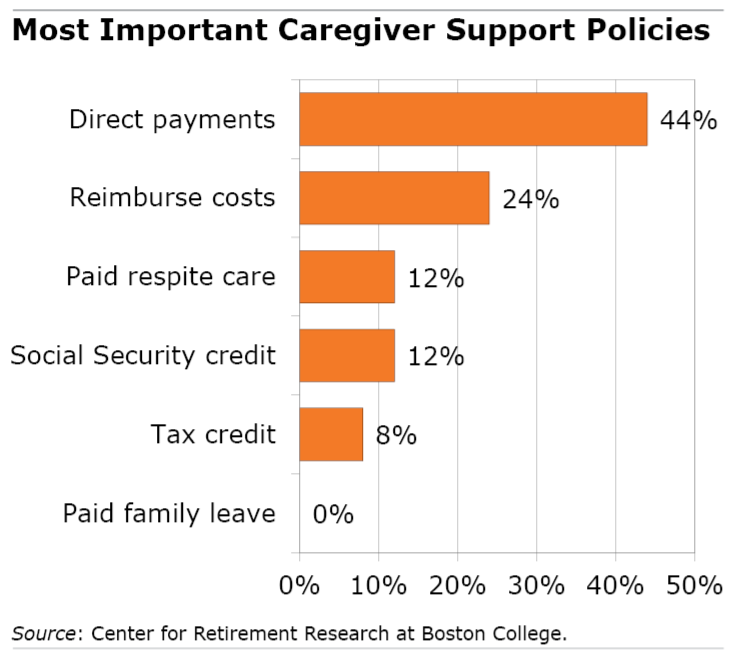

Researchers on the Heart for Retirement Analysis at Boston Faculty and the College of Massachusetts Boston performed focus teams of household caregivers to study what public insurance policies would most assist them. In keeping with their report, the individuals expressed nice curiosity in being paid for caregiving and fewer for paid depart from work or tax credit. Lots of them weren’t working, so wouldn’t profit from paid depart, and proposals for less than 12 weeks of paid depart had been seen as too quick to be of a lot utility.

Few of the caregivers had been inquisitive about solutions to present them credit towards their future Social Safety as a result of this coverage thought focuses on the longer term reasonably than their instant monetary wants. Some had been inquisitive about proposals for paid respite care to offer a much-needed break however they expressed concern concerning the high quality of care that may be offered by these stepping in.

After direct funds, the best favorable response was for reimbursement for prices that the caregivers incur associated to the assist they supply their relations.

Whereas these preferences had been constant amongst all individuals, non-Whites favored direct funds and value reimbursement to a good better diploma than White caregivers. This discrepancy little doubt displays the better influence on their employment resulting from their common youthful age as cited above.

The flexibility of relations to offer needed care to each older and youthful disabled adults relieves strain on the overburdened and fractured care community of nursing properties, assisted dwelling amenities and residential care suppliers, in addition to public budgets, particularly Medicaid. The strain on this method will develop as the necessity for elder care doubles between 2030 and 2050 when the child boomers attain their later years.

It will make sense to do what we will to raised assist household caregivers. This research makes it clear that the easiest way to take action is to offer monetary help to relations, each when it comes to compensation for his or her caregiving work and reimbursement for out-of-pocket prices.

For extra from Harry Margolis, try his Risking Previous Age in America weblog and podcast. He additionally solutions client property planning questions at AskHarry.information. To remain present on the Squared Away weblog, be part of our free e-mail checklist. You’ll obtain only one e-mail every week.