The transient’s key findings are:

- Life expectancy is a key consideration for retirement planning.

- The uncertainty round this expectation, nonetheless, is what makes lifetime revenue sources like Social Safety and annuities so helpful.

- The evaluation explores how the variance round common longevity has modified over time by race, schooling, and gender.

- Most teams noticed a modest enhance within the variance, apart from low-education Black males who noticed a decline attributable to a drop in deaths at youthful ages.

- Importantly, Blacks and people with much less schooling constantly present larger variance in lifespans, making lifetime revenue notably helpful for them.

Introduction

Life expectancy and its swings over time obtain important consideration from each lecturers and the general public. A lot much less consideration, nonetheless, is paid to the variation in lifespan round its common – the variance of longevity. Nonetheless, it’s exactly this unpredictability of age of dying that makes lifetime revenue supplied by Social Safety and annuities so helpful.

In reality, the better the variance in longevity, the extra helpful is assured lifetime revenue. And, latest research have proven that the variance of longevity varies by race and schooling, with Black and lower-education people having better dispersion than their counterparts. What has not been nicely documented is how this variance round life expectancy – and thus the worth of assured lifetime revenue – has modified over time.

This transient, which is predicated on a latest examine, examines adjustments within the variance of longevity at older ages for the inhabitants as a complete, for various race/schooling subgroups, and for many who truly purchase annuities.1 To evaluate the financial implications of adjustments within the variance, the evaluation calculates its impression on the insurance coverage worth of honest life annuities.

The dialogue proceeds as follows. The primary part describes the variance of longevity and its implications. The second part discusses the methodology for setting up the life tables, calculating the variance of longevity, and estimating the impression of any change on the worth of annuities. The third part presents the outcomes for all times expectancy and the variation round it, and the fourth part presents the welfare evaluation to quantify the impression of adjustments within the variance of longevity. The ultimate part concludes that longevity variance has trended modestly up over the previous 20 years for nearly all of the demographic teams explored, resulting in a small enhance within the worth of assured lifetime revenue.

Why Lifespan Variation Issues

The variation of longevity gives helpful details about mortality past life expectancy. It’s exactly this uncertainty across the common lifespan that provides rise to “longevity danger” – the potential of dwelling an unusually very long time and outliving one’s property. Insuring towards longevity danger via assured lifetime revenue has develop into an essential coverage subject.

Conceptually, on the particular person degree, the variation in longevity has two parts: the probability of untimely dying at youthful ages and that of survival to older ages.2 Enhancements in financial and medical circumstances that cut back general mortality charges contribute to longer life expectancy, however their impacts on the variance of longevity is ambiguous. Whereas lowering mortality at youthful ages lowers lifespan variation by compressing the distribution of the age-at-death towards the common, lowering mortality at larger ages will increase lifespan variation by stretching the age-at-death distribution away from the common. Therefore, the impression of financial and medical enhancements is dependent upon how the mortality reductions are distributed throughout ages.3

Other than financial and technological developments affecting the total inhabitants, lifespan variation additionally differs by traits resembling race and schooling.4 For instance, Black and lower-education people, who usually have decrease life expectations, face better variability in lifespan in comparison with their White and higher-education counterparts. This sample displays unequal entry to financial and health-related assets. Specifically, the upper lifespan variation amongst lower-educated people largely outcomes from an extra of untimely deaths from illnesses and exterior causes, lots of that are preventable.5

Along with documenting the variation in longevity throughout inhabitants teams and over time, understanding the financial implications of those developments is essential for researchers and policymakers. Research based mostly on lifecycle fashions recommend {that a} extra dispersed age-at-death distribution, all else being equal, is much less fascinating.6 Furthermore, as lifespan uncertainty is exactly the motivation for purchasing annuities, altering values of annuities can function a measure of the financial worth of adjusting lifespan variation.7

Constructing on prior analysis, this examine paperwork and compares the variation in longevity at older ages for the overall inhabitants, numerous race/schooling teams, and annuitants. To quantify the magnitudes in relatable, dollar-value phrases, the evaluation additionally estimates the welfare implications of any adjustments in lifespan variations by calculating their impact on the worth of annuities.

Information and Methodology

When accessible, this examine depends on present life tables and analyzes the variance of longevity they suggest. For population-level life expectancy and variance of longevity, the examine makes use of life tables from the Social Safety Administration (SSA).8 For calculations by racial teams (non-Hispanic Black and non-Hispanic White) and academic attainment (high and low), the tables come from earlier work by the authors. The life tables for annuitants are constructed utilizing knowledge from the Society of Actuaries.9

The life tables present the likelihood of dying at every future age, which yields the anticipated age of dying and the usual deviation of doable ages of dying round that imply age.

Then, the duty is to find out whether or not a one-unit change in the usual deviation of longevity is massive or small. To provide a greenback worth to those adjustments, the evaluation takes a wealth equivalence method. Particularly, it makes use of a simplified lifecycle mannequin to calculate the longevity insurance coverage worth of annuities, which will increase with the variance of longevity.10 This worth is measured by the wealth equivalence of getting an actuarially honest fast annuity contract – that’s, the quantity of further wealth a person with an annuity would should be persuaded to offer it up. It is very important observe that the aim right here is to not consider annuities per se, however to make use of the change within the worth of honest annuities as a measure of the magnitude of variations in lifespan uncertainty.

Within the full examine, the variance of remaining longevity is calculated at various key ages: 50, 62, 67, and 70. These are ages at which people could make meaningfully totally different choices about their work and retirement plans, corresponding, respectively, to the age at which they’ll start to make catch-up contributions to 401(ok)s and IRAs; the earliest claiming age for Social Safety; the total Social Safety retirement age; and the utmost Social Safety claiming age. For ease of exposition, this transient focuses on individuals at age 50, however the outcomes for older ages are fairly related.

Outcomes

The outcomes embody estimates of life expectancy and the usual deviation of lifespan over time.

Life Expectancy

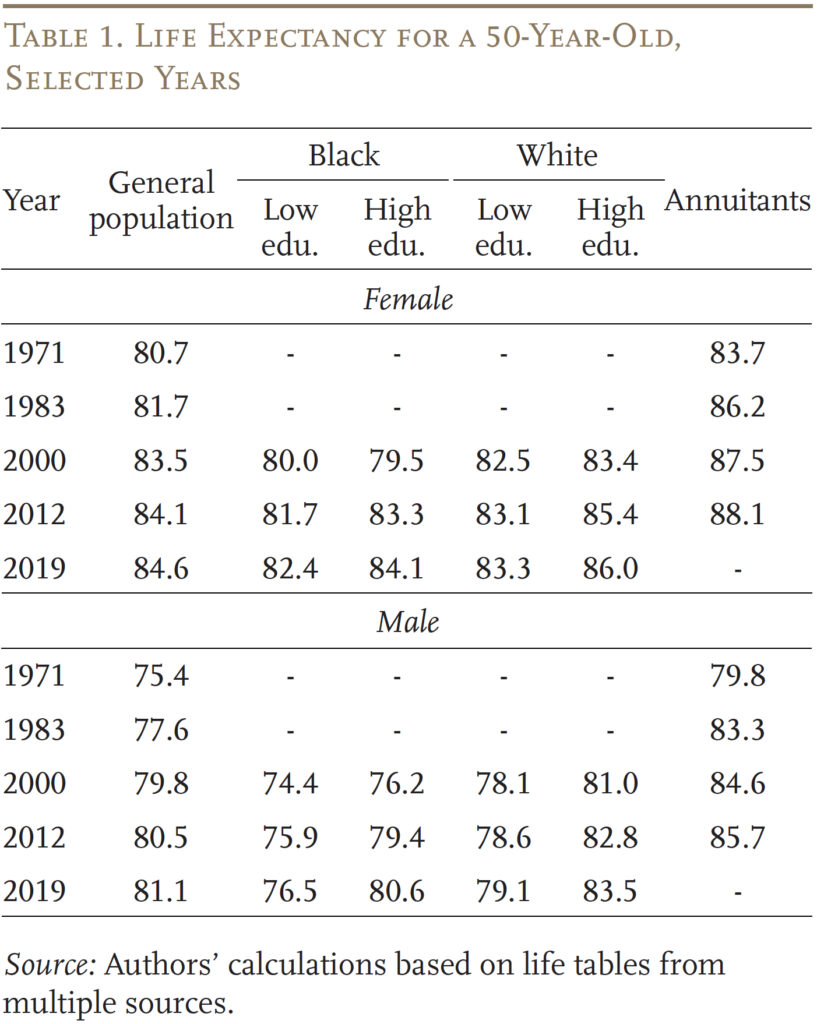

Earlier than trying into the variance of longevity, it’s useful to begin with the patterns of life expectancy produced by the underlying knowledge. Desk 1 reveals life expectancy at age 50 in chosen years for females and males within the basic inhabitants, in numerous race/schooling teams, and amongst annuitants.

When it comes to the extent of life expectancy, the sample is acquainted: girls, Whites, and higher-education people are inclined to reside longer than their counterparts.11 And annuitants, who’re usually wealthier and more healthy than the overall inhabitants,12 have considerably larger life expectations in all years.

Additionally, as nicely documented, the life expectancy for the overall inhabitants rose considerably from 1971 to 2019. Black people usually noticed better enchancment in comparison with their White counterparts, and inside racial teams, people within the larger schooling teams loved better enchancment than these with much less schooling. These developments are in step with latest work displaying declining racial gaps and growing socioeconomic gaps in life expectancy.13 Annuitants not solely have larger life expectations but in addition noticed better enhancements in anticipated lifespans than the inhabitants as a complete.

Observe that the comparability between the life expectations of race/schooling teams and the overall inhabitants needs to be carried out with warning. The final inhabitants consists of all demographic teams, whereas solely Blacks and Whites are examined individually on this examine. Hispanics and Asians are inclined to have a better life expectancy than Whites, which raises the life expectancy for the inhabitants as a complete.14 As well as, variations within the underlying knowledge sources can lead to discrepancies in life expectancy estimates.15

Variance of Longevity

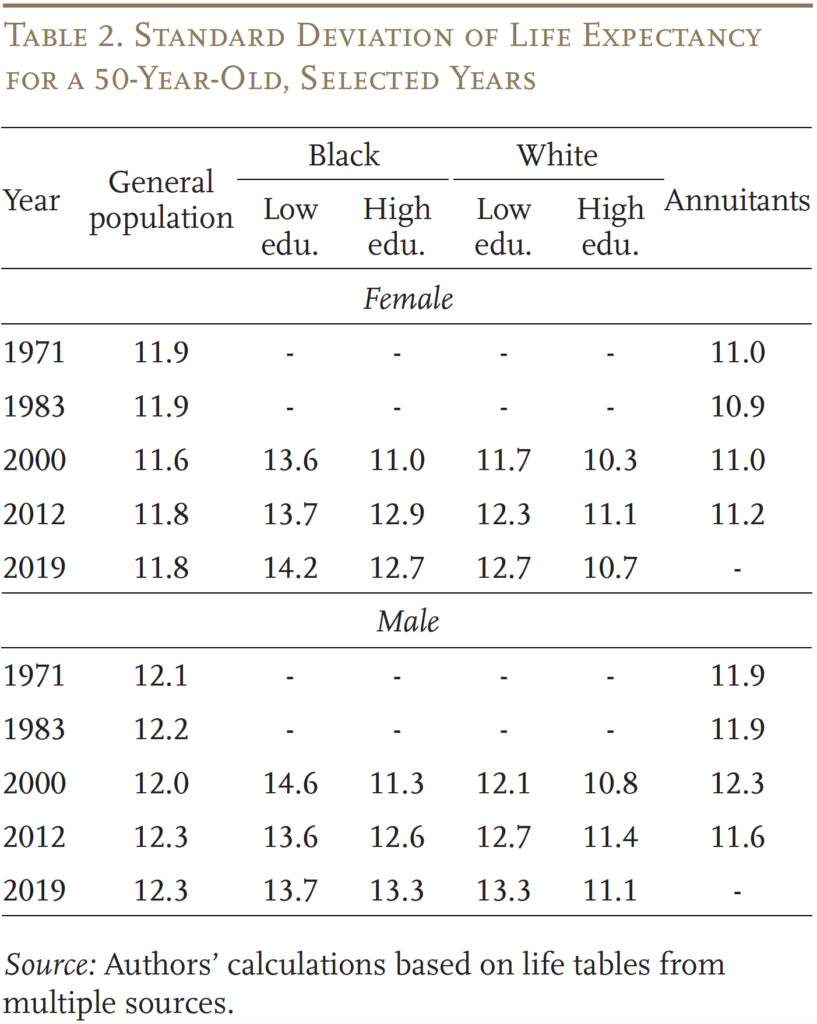

Shifting from common life expectancy to variances across the common, the outcomes present that for the overall inhabitants the variance – i.e., the usual deviation across the anticipated age at dying for 50-year-olds – has been remarkably secure (see Desk 2).16 Nonetheless, the measure has decreased barely for females and elevated barely for males.

The sample of lifespan variation on the inhabitants degree masks significant variations throughout teams.17 In all years, lifespan dispersion is far better for Blacks than for Whites. Equally, inside racial teams, people with much less schooling face bigger lifespan variation than these with extra. These outcomes are in step with earlier research.18

With respect to time developments, over the interval 2000-2019 the usual deviation elevated in virtually all gender-race-education teams (particularly high-education Black and low-education White people). The notable exception was low-education Black males, the place the usual deviation of longevity declined from 14.6 years in 2000 to 13.7 years in 2019.

The consequence for annuitants is what one would anticipate – they’ve a smaller variance of longevity than the overall inhabitants. In 2012, when the newest mortality tables for annuitants can be found, the usual deviation of life expectancy for annuitants was 0.6 to 0.7 years decrease than these for the overall inhabitants and near the usual deviation values for high-education Whites. The values for annuitants had been comparatively secure over the interval from 1971 to 2012.

Whereas the earlier dialogue has quantified the magnitude of the adjustments within the variance of longevity, it’s nearly unattainable to gauge the significance of those adjustments over time. Thankfully, the variance in longevity is instantly linked to the worth of annuities, as a result of insuring towards longevity danger is the very motivation to buy annuities. Exploiting this relationship can present some financial measure of the impression of adjustments in customary deviations.

Welfare Implications of Adjustments in Lifespan Variation

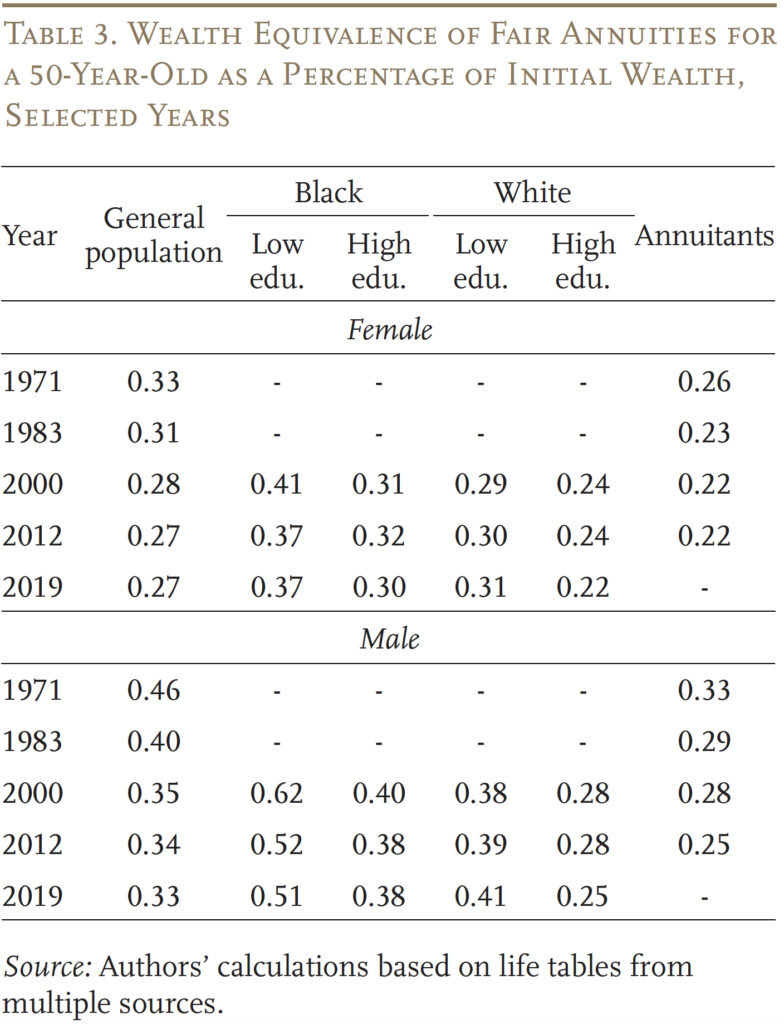

For a extra intuitive sense of the dimensions of the change in lifespan variation, we flip to a welfare evaluation of annuities. Particularly, we calculate the wealth equivalence of a good annuity bought at age 50, as a share of beginning wealth. This measure implies, for instance, that if an annuity has a wealth equivalence of 0.2 for a 50-year-old, that particular person holding a good annuity would should be compensated by 20 % of their wealth at age 50 to offer it up.

Desk 3 presents the wealth equivalence values by gender, race, and schooling over the 1971-2019 interval. Total, the magnitude of the longevity insurance coverage worth of honest annuities is substantial. For the overall inhabitants, the worth of honest annuities equals about 25-50 % of a typical particular person’s preliminary wealth at age 50.

Wanting throughout gender-race-education teams, the sample of the wealth equivalence of annuities is in step with that of the usual deviation of lifespan. That’s, the wealth equivalence values are larger for males, Blacks, and people with much less schooling who are inclined to have extra dispersed lifespans in comparison with these of their counterpart teams. Annuitants, the group that truly purchases annuities, derive much less longevity insurance coverage worth from honest annuities than the overall inhabitants, due partly to their comparatively low lifespan variation.19

That mentioned, the overall decline in wealth equivalence is a shocking consequence given the secure or barely growing sample of the usual deviation of age at dying documented within the earlier part. Such elevated dispersion ought to, in concept, lead to a secure or growing longevity insurance coverage worth of annuities. This battle might be reconciled by noting that the speculation assumes that life expectancy holds regular. In reality, life expectancy rose over the interval, which in a lifecycle mannequin reduces the worth of honest annuities.20

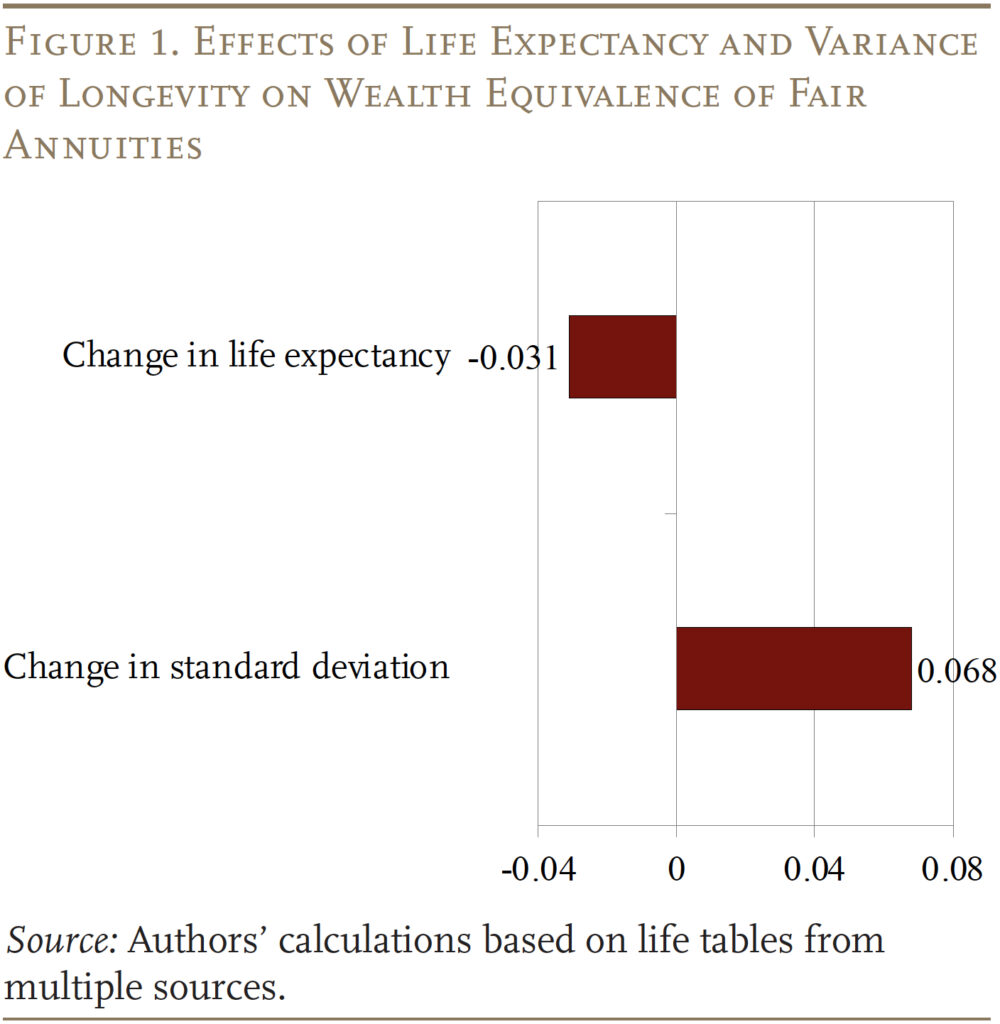

To disentangle the consequences of life expectancy and the variance of longevity on the wealth equivalence of annuities, we estimate a regression that relates (for every subgroup at every beginning age) the adjustments in wealth equivalence to the adjustments in life expectancy and the usual deviation of longevity. The regression outcomes (see Determine 1) affirm that wealth equivalence of a good annuity will increase with the dispersion of lifespan and reduces with rising life expectancy. The estimated coefficients recommend that, on common, a one-year enhance in the usual deviation of longevity is related to a rise in wealth equivalence of 6.8 % of preliminary wealth, holding life expectancy fixed, whereas a one-year enhance in life expectancy is related to a lower in wealth equivalence price 3.1 % of preliminary wealth. Whereas the coefficient for the change in life expectancy is smaller for every one-year enhance, life expectancy rose by extra years than did the usual deviation of longevity – so the online impact is to cut back the wealth equivalence of annuities.

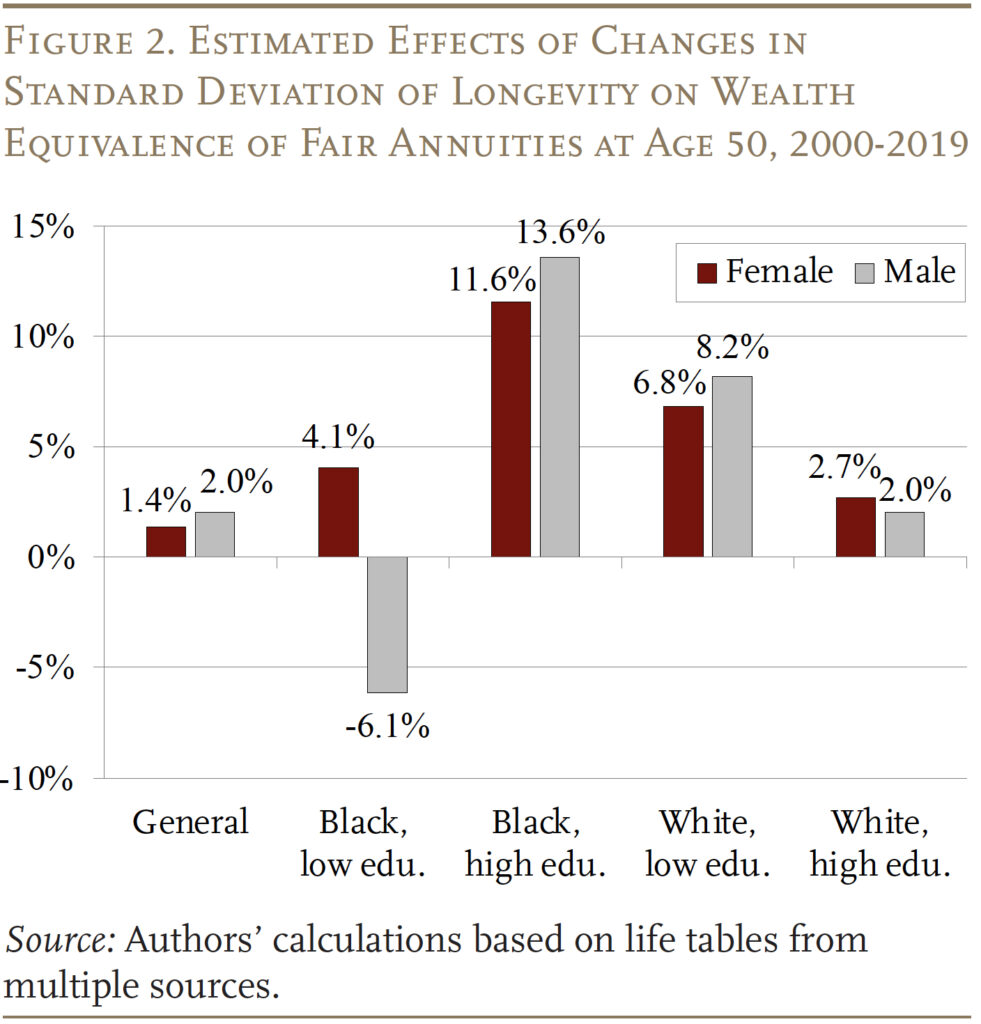

The train above permits us to reply our essential query: how massive has the change in lifespan variation – by itself – been over the previous a long time? To take action, we first calculate the adjustments in the usual deviation of longevity from 2000-2019 for every inhabitants group (apart from annuitants, for whom the newest knowledge are 2012), then multiply them by the coefficient for adjustments in the usual deviation of longevity (6.8 % for a one-year change) in Determine 1. The calculations yield the overall impression of the adjustments in lifespan variation over this era on the wealth equivalence of annuities, assuming life expectancy had remained unchanged.

Determine 2 reveals the results of this calculation for people at age 50 by inhabitants group. The secure time sample of lifespan variation for the overall inhabitants yields a small enhance in wealth equivalence of lower than 2 %. Throughout gender-race-education teams, the biggest will increase in wealth equivalence attributable to adjustments in lifespan variation are concentrated in high-education Black people (11.6 % for females and 13.6 % for males) and low-education White people (6.8 % for females and eight.2 % for males). Excessive-education White people and low-education Black females have additionally seen a rise in wealth equivalence attributable to variance-of-longevity adjustments, although the magnitudes are modest (2 to 4 %). The lower in the usual deviation of longevity amongst low-education Black males, which is exclusive throughout gender-race-education teams, is related to a 6.1-percent lower within the worth of longevity insurance coverage for this group.

Conclusion

The variation of lifespan is a vital part of mortality patterns and has essential welfare and financial implications. Lifespan variation represents the uncertainty relating to age at dying confronted by people and is exactly why sources of lifetime revenue, resembling annuities, are helpful. Furthermore, the variations in lifespan variation by gender, race, and schooling mirror an essential dimension of inequality.

This transient paperwork how the variance of longevity has modified over time for the overall inhabitants, gender-race-education teams, and annuitants. The outcomes present that the population-level variance of longevity has usually stayed secure over the previous 5 a long time, though the sample diversified throughout teams.

Quantifying the welfare implications of change within the variance of longevity utilizing the wealth equivalence of honest annuities reveals that the rise in worth for the overall inhabitants is modest – roughly 2 % – though the positive aspects for some teams had been considerably extra. Total, this examine gives additional proof that those that don’t usually purchase annuities truly stand to achieve considerably from them and these positive aspects have been persistent over time.

References

Arapakis, Karolos, Gal Wettstein, and Yimeng Yin. 2023. “What Is the Insurance coverage Worth of Social Safety by Race and Socioeconomic Standing?” Working Paper 2023-14. Chestnut Hill, MA: Middle for Retirement Analysis at Boston School.

Barbieri, Magali. 2018. “Investigating the Distinction in Mortality Estimates Between the Social Safety Administration Trustees’ Report and the Human Mortality Database.” Working Paper No. 2018-394. Ann Arbor, MI: Michigan Retirement Analysis Middle.

Brown, Dustin C., Mark D., Hayward, Jennifer Karas Montez, Robert A. Humme, Chi-Tsun Chiu, C, and Mira M. Hidajat. 2012. “The Significance of Training for Mortality Compression in the US.” Demography 49(3): 819-840.

Brown, Jeffrey R. 2002. “Differential Mortality and the Worth of Particular person Account Retirement Annuities.” In The Distributional Elements of Social Safety and Social Safety Reform, edited by Martin Feldstein and Jeffrey B. Liebman, 401-446. Chicago, IL: College of Chicago Press.

Chetty, Raj, Will Dobbie, Benjamin Goldman, Sonya Porter, Crystal Yang. 2024. “Altering Alternative: Sociological Mechanisms Underlying Rising Class Gaps and Shrinking Race Gaps in Financial Mobility.” Working Paper 32697. Cambridge, MA: Nationwide Bureau of Financial Analysis.

Edwards, Ryan D. 2013. “The Value of Unsure Life Span.” Journal of Inhabitants Economics 26(4): 1485-1522.

Gillespie, Duncan O. S., Meredith V. Trotter, and Shripad D. Tuljapurkar. 2014. “Divergence in Age Patterns of Mortality Change Drives Worldwide Divergence in Lifespan Inequality.” Demography 51(3): 1003-1017.

Hill, Latoya and Samantha Artiga. 2023. “What’s Driving Widening Racial Disparities in Life Expectancy?” Difficulty Transient. San Francisco, CA: KFF.

Johnson, Catherine O., Alexandra S. Boon-Dooley, Nicole Ok. DeCleene, et al. 2022. “Life Expectancy for White, Black, and Hispanic Race/Ethnicity within the U.S. States: Traits and Disparities, 1990 to 2019.” Annals of Inside Medication 175(8): 1057-1067.

Milevsky, Moshe A. 2020. “Swimming with Rich Sharks: Longevity, Volatility and the Worth of Danger Pooling.” Journal of Pension Economics & Finance 19(2): 217-246.

Nuss, Ken. 2020. “Retirees with a Assured Earnings Are Happier, Reside Longer.” (December 24). Washington, DC: Kiplinger.

Sasson, Isaac. 2016. “Traits in Life Expectancy and Lifespan Variation by Academic Attainment: United States 1990-2010.” Demography 53(2): 269-293.

U.S. Social Safety Administration. 2024. “Cohort Life Tables.” Washington, DC.

van Raalte, Alyson A., Anton E. Kunst, Olle Lundberg, Mall Leinsalu, Pekka Martikainen, Barbara Artnik, Patrick Deboosere, Irina Stirbu, Bogdan Wojtyniak, and Johan P. Mackenbach. 2012. “The Contribution of Academic Inequalities to Lifespan Variation.” Inhabitants Well being Metrics 10(3): 1-10.

Wettstein, Gal, Alicia H. Munnell, Wenliang Hou, and Nilufer Gok. 2021. “The Worth of Annuities.” Working Paper 2021-5. Chestnut Hill, MA: Middle for Retirement Analysis at Boston School.

Wettstein, Gal and Yimeng Yin. 2025. “How Has the Variance of Longevity Modified Over Time?” Working Paper 2025-1. Chestnut Hill, MA: Middle for Retirement Analysis at Boston School

Yaari, Menahem E. 1965. “Unsure Lifetime, Life Insurance coverage, and the Principle of the Shopper.” Overview of Financial Research 32(2): 137-150.

Zhang, Zhen and James W. Vaupel. 2009. “The Age Separating Early Deaths from Late Deaths.” Demographic Analysis 20(29): 721-730.