HSBC India has been actively increasing its presence by launching new bank cards, refreshing current ones, and opening new branches nationwide. In keeping with this momentum, HSBC has launched the HSBC TravelOne Credit score Card, a travel-focused providing designed for frequent vacationers.

The HSBC TravelOne Credit score Card permits cardholders to seamlessly switch reward factors to numerous resort and airline loyalty packages immediately. Right here’s all the things it’s worthwhile to know in regards to the newly launched HSBC TravelOne Credit score Card.

Overview

| Sort | Journey Credit score Card |

| Reward Fee | 2% to 7.2% |

| Foreign exchange Markup Charge | 3.5%+GST |

| Greatest for | OTA Journey Spends |

| USP | Factors Switch Companions |

HSBC TravelOne Credit score Card is greatest fitted to travellers with give attention to airmiles and resort loyalty packages.

Charges

| Becoming a member of Charge | 4,999+GST |

| Welcome Profit | 3,000 Factors (after spending 1L in 90 days) |

| Renewal / Annual Charge | 4,999+GST |

| Renewal Profit | – |

| Renewal Charge waiver | 8L INR annual spend |

The welcome advantage of 3K factors doesn’t cowl the becoming a member of price until you redeem it for Accor, which is kind of unfair!

Nonetheless, should you’re fascinated with downloading the HSBC cell app and spend 10K INR in first 30 days of opening bank card, one may get under:

- 1,000 INR cashback

- 3,000 INR postcard voucher

- 3 months Eazydiner Prime Membership

Notice that this isn’t a normal providing however an “introductory provide”. Aside from the first rate cash-back, relaxation are irrelevant for the cardboard and solely makes it look pointless.

Design

Whereas the worldwide design of HSBC TravelOne Credit score Card seems simply effective, the modern reduce design on the backside appears like an pointless innovation.

Rewards

| SPEND TYPE | Reward Factors | REWARD RATE (POINTS TRANSFER) | REWARD RATE (Accor) | MAX. CAP (PER MONTH) |

|---|---|---|---|---|

| Common Spends | 2 / 100 INR | ~2% | ~3.6% | – |

| Airways, Journey aggregators & Foreign exchange Spends | 4 / 100 INR | ~4% | ~7.2% | 50K Factors (12.5L spend) |

One of many key differentiator between Axis Atlas and HSBC TravelOne card is that the HSBC provides factors on spends with Journey Aggregators like MMT, Cleartrip and many others as properly. That is helpful particularly for resort spends at occasions, as one can double dip with different presents.

Excluded spends for rewards:

- Utilities (4900), insurance coverage (6300, 5960), jewelry (5944, 5094)

- Training and authorities (9399, 8299, 8220, 8211, 8241, 8244, 8249, 9222, 9402, 9211, 9405), tax funds (9311), actual property agent and managers (6513), bail and bond funds (9223)

- Monetary establishments (6010-6012), non-financial establishments (6051), cash transfers (4829), e-wallets (6540)

- Gas (5541, 5983, 5172, 5542, 5552)

The exclusions are much more in comparison with Axis Financial institution’s record and excluding Utilities/insurance coverage/jewelry is kind of unfair.

I want banks put a cap on these classes as a substitute of simply ignoring them altogether, talking of which, it’s executed fantastically on ICICI Emeralde Personal Credit score Card. It will likely be good if extra banks observe this, in order that non-abusers are unaffected.

Milestone Profit

| SPEND REQUIREMENT | MILESTONE BENEFIT | Reward Fee |

|---|---|---|

| 12 Lakhs | 10,000 Factors | 0.8% |

Milestone profit will increase the bottom reward price of the cardboard from 2% to 2.8% (or 5% for Accor) and that’s good certainly.

However I want they’d a number of milestones, like an additional 6L milestone would have seemed higher. Having a single milestone appears like flying to Europe and visiting 1 nation in a visit. Hmm!

Redemption

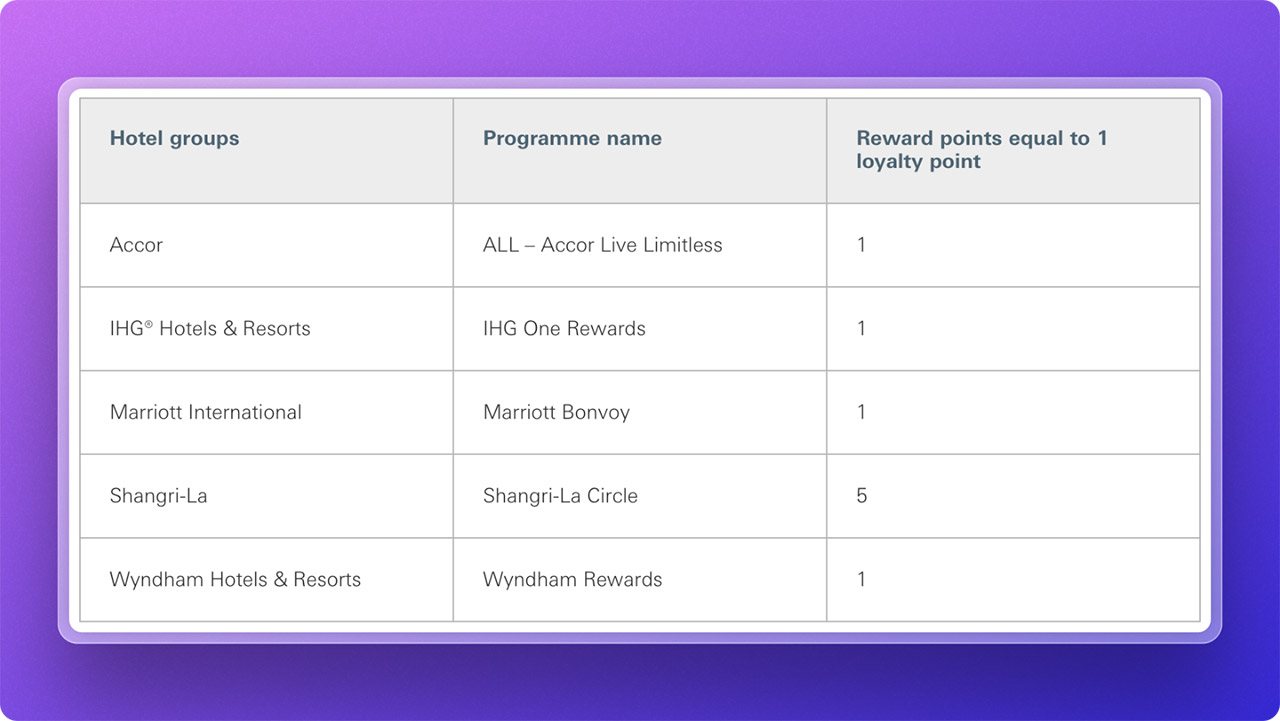

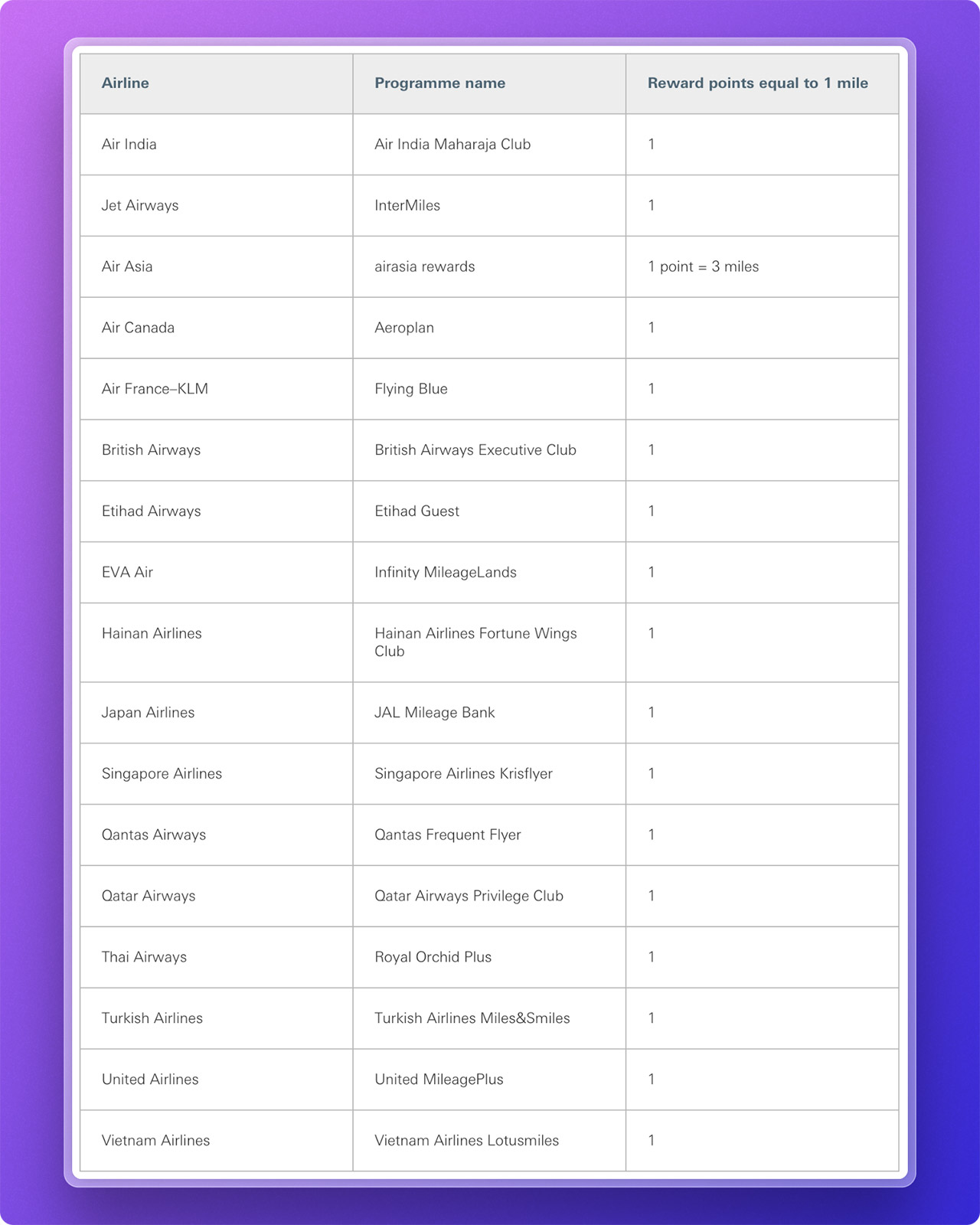

- Switch factors to airline/resort companions (most at 1:1)

- Companions record: Airline & Resort companions (under)

- Factors switch period: On the spot or 1 day for many companions

It’s good to see lengthy record of companions. That mentioned, as you may know, Accor is the one companion that right away provides good worth.

Whereas there are not any cap on redemptions in the mean time, likelihood is it’d present up anytime.

It seems like HSBC has provide you with a superior factors switch system for HSBC TravelOne Credit score Card not like the present age-old type filling system which takes over every week to course of.

I want that the financial institution brings this facility to HSBC Premier Credit score Card as properly, maybe they’d, as a result of they had been saying that HSBC Premier has “20+ companions” publish the HSBC card re-fresh, which isn’t true in actuality to this point.

Lounge Entry

| ACCESS TYPE | VIA | LIMIT |

|---|---|---|

| Home | Mastercard | 6 / 12 months |

| Worldwide | Lounge Key | 4 / 12 months |

Whereas it doesn’t include visitor entry, the great factor is that there isn’t a spend requirement for the lounge entry, which is sensible for a 5K price card.

Foreign exchange Markup Charge

- Overseas Forex Markup Charge: 3.5%+GST = ~4.13%

- Internet Return: Rewards – Markup Charge = 4% – 4.13% = – 0.13%

Whereas foreign exchange spends presents larger reward price, the web return is in destructive due to the upper foreign exchange markup price.

For a journey card, it could been higher if the markup price was decrease, within the vary of two% which might make sense with the accelerated rewards.

Options & Advantages

- 15% off at Yatra, Cleartrip, EaseMyTrip & Paytm

- 10% off on Zomato

- Purchase 1 Get 1 on films (200 INR off) on District App.

- 20% off on duty-free by way of the AdaniOne app or web site

- Golf profit by way of Mastercard Golf Program

- USD 20,000 buy safety yearly.

Do you have to get it?

Effectively, it relies on a few components.

- In case your spends are underneath 15 Lakhs, likelihood is Axis Atlas Credit score Card is a more sensible choice with 50% extra rewards as that of HSBC TravelOne Card.

- In case your spends are larger than 15 Lakhs and don’t want to get a number of Axis Atlas or Axis Magnus in household, then maybe HSBC TravelOne Credit score Card is an efficient possibility.

- If you want to not transcend HSBC, spends are larger and don’t want to get into costly playing cards or maybe not eligible for them, then HSBC TravelOne card is an honest possibility.

So should you have a look at the above, it’s apparent that the goal phase is tremendous small so long as the potential cardholder is conscious of Axis Atlas Credit score Card & AMEX Platinum Journey Credit score Card, as each provide superior return on spend in comparison with HSBC TravelOne Credit score Card.

Nonetheless, do notice that Axis may Axe the Atlas into half, anyday. So HSBC TravelOne may shine by then, however not now.

Bottomline

HSBC TravelOne Credit score Card in India is a decently rewarding card within the phase however it’s aggressive competitors doesn’t make it really feel like one.

It seems like the cardboard has been rigorously designed with Axis Atlas in thoughts however that doesn’t assist as a result of it couldn’t higher the Atlas.

A greater welcome profit, an extra milestone, a greater foreign exchange markup and higher dealing with of exclusions/particular classes would have made the cardboard an excellent hit. However as that didn’t occur, let’s hope HDFC Financial institution brings considered one of that sort.

What’s your ideas on the newly launched HSBC TravelOne Credit score Card? Be at liberty to share your ideas within the feedback under.