For the primary time within the historical past of ICICI Financial institution Credit score Playing cards, the financial institution has launched a rewarding tremendous premium bank card named Emeralde Non-public Metallic Credit score Card. Basically, ICICI Financial institution has taken suggestions on the beforehand launched common Emeralde Credit score Card and addressed these shortcomings, such because the reward price, by making a number of modifications and launching a brand new product.

Right here’s an in depth assessment of the newly launched ICICI Emeralde Non-public Metallic Credit score Card, which is at the moment being supplied on an invite-only foundation.

Overview

| Kind | Tremendous Premium Credit score Card |

| Reward Fee | 3% |

| Annual Charge | 12,499 INR + GST |

| Greatest for | Welcome Advantages |

| USP | Taj Epicure Membership with 1 Night time Keep |

ICICI Financial institution Emeralde Credit score Card is an excellent bank card not just for it’s welcome advantages but additionally for it’s engaging reward price.

Becoming a member of Charges

| Becoming a member of / Annual Charge | Rs.12,499+GST |

| Welcome Profit | – 12,500 Factors (12,500 INR worth) – Taj Epicure Membership with 1 Night time Keep |

| Renewal Charge | Rs.12,499+GST |

| Renewal Profit | 12,500 Factors (12,500 INR worth) |

| Renewal Charge Waiver | Spend Rs.10L within the card anniversary yr |

As you possibly can see, impulsively ICICI Financial institution has develop into fairly beneficiant. I’ve by no means seen another Credit score Card Issuer being this beneficiant on the welcome profit. It’s virtually 2X the worth of what we pay.

Taj Epicure is closely loaded as you would possibly know and when you use all these advantages you would possibly even get 3X of what you’ve paid.

And luckily there’s additionally a renewal price waiver situation of 10 Lakhs p.a. which may be very a lot possible for many on this phase.

Observe: I didn’t obtain the welcome factors mechanically regardless of receiving an electronic mail alert. Nevertheless, elevating a request with wealth assist obtained the factors added the identical day.

Design

The design is gorgeous identical to the common Emeralde Credit score Card and it’s being issued solely on Mastercard community as of now.

Whereas the design appears to be like elegant, I want they enhance the brightness of Mastercard emblem a bit because it appears to be like boring now, as you possibly can see above.

It’s a steel card and so don’t neglect that the cardboard comes with a 3,500 INR card substitute price simply incase you missed it.

Reward Factors

| SPEND TYPE | REWARDS | REWARD RATE (FLIGHTS/HOTELS) |

Max. Cap ( Per Stmt Cycle) |

|---|---|---|---|

| Common Spends | 6 RP / 200 INR | 3% | Nil |

| Grocery | 6 RP / 200 INR | 3% | 1000 RP (Max: 33K INR spend) |

| Utilities | 6 RP / 200 INR | 3% | 1000 RP (Max: 33K INR spend) |

| Schooling | 6 RP / 200 INR | 3% | 1000 RP (Max: 33K INR spend) |

| Insurance coverage Spends | 6 RP / 200 INR | 3% | 5000 RP (Max: 1.67L spend) |

- Redemption Charge: Nil

- Tax, Gas & Hire funds are excluded for Reward Factors

- 1% price on Hire Funds

- All Capping are set as per Assertion Cycle

You get to take pleasure in 3% reward price on a lot of the spends and those who have limits are fairly wise. Observe that Grocery, Utilities & Schooling Spends can have SEPARATE 1000 RP cap for EACH class.

We’ll need to thank the one who designed this reward system limits as a result of that is most likely one of many few playing cards within the business that follows the frequent sense on max caps. Although, I really feel Schooling might have had higher limits.

It’s sheer stupidity of some banks to only carry on including MCC’s each different quarter to exclusion checklist, as a substitute, setting such first rate caps is an effective transfer as most common spenders wont be affected this manner. Nicely carried out ICICI Financial institution!

Redemption

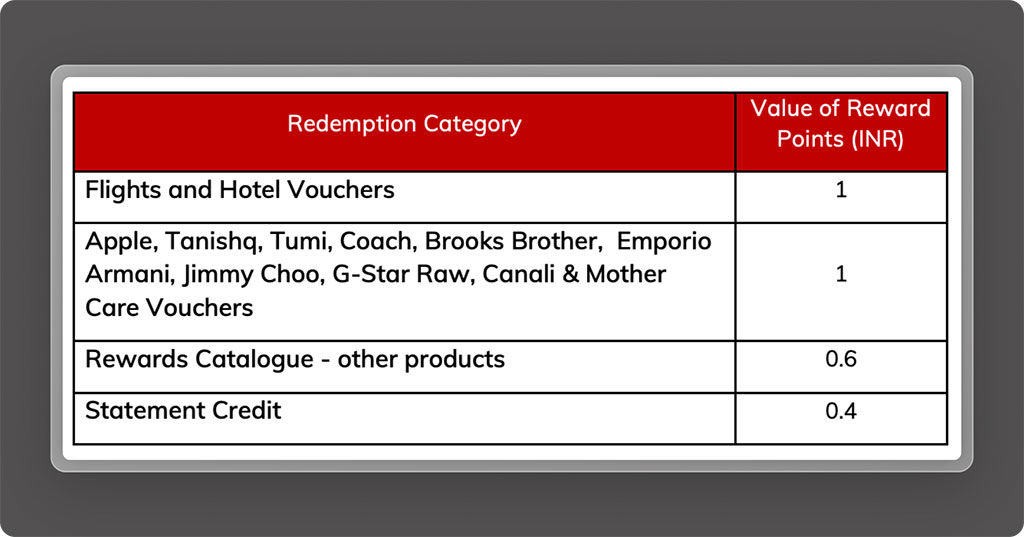

Similar to most different tremendous premium bank cards, ICICI Emeralde Non-public Credit score Card can be targeted on Flight & Resort redemptions to extract greater worth of 1RP = 1 INR.

So when you’re not concerned about journey redemptions, your reward price will go for a toss. Although, it’s to be famous that some branded vouchers like US Polo, Allen Solly, and so on are nonetheless at 1:1 if redeemed for the next quantity like 10K INR.

Milestone Rewards

| SPEND REQUIREMENT | MILESTONE BENEFIT (EaseMYTrip Voucher) |

REWARD RATE (AS POINTS) |

|---|---|---|

| 4 Lakhs | 3,000 INR | 0.75% |

| 8 Lakhs | 3,000 INR | 0.75% |

- EaseMYTrip Voucher can be utilized for Flights Solely as per t&c

The milestone profit is well-designed to offer an extra enhance to the reward price. When mixed with common rewards, it quantities to a powerful 3.75%, which is unparalleled in ICICI Financial institution’s Proprietary Credit score Playing cards portfolio.

The Milestone Voucher was triggered for my account inside a couple of week of finishing the transaction. So the milestone fulfillments are fairly fast too.

Factors Switch Companions

ICICI Financial institution has began arising with an choice to switch your factors to Air India. You could find the choice on the house web page of rewards portal.

That is excellent news, and I hope it results in partnerships with many different worldwide companions sooner or later. Nevertheless, the switch ratio will not be thrilling for Air India, as I hardly ever worth Air India Miles at 1 Rs/mile.

Airport Lounge Entry

| ACCESS TYPE | VIA | LIMIT | GUEST ACCESS |

|---|---|---|---|

| Home Lounge Entry | MasterCard | Limitless | – |

| Worldwide Lounge Entry | Precedence Move | Limitless | – |

The Home & Worldwide airport Lounge entry profit will not be just for the first cardholder but additionally extends to all Add-on cardmembers as properly. Upto 3 Add-on Playing cards are complimentary with ICICI Financial institution Emeralde Non-public Credit score Card.

Golf Profit

- Complimentary Video games/Classes: Limitless

- Protection: 20 Home Golf Programs & 90 Worldwide Golf Programs

It’s uncommon to search out Credit score Playing cards with entry to worldwide golf programs, so it’s good to see that with a protection of 90 Worldwide Golf Programs.

Nevertheless, do not forget that just one reserving will be held at any cut-off date. So, virtually it’s not limitless, that’s high quality although.

Foreign exchange Markup Charge

- International Foreign money Markup Charge: 2%+GST = 2.36%

- Rewards: 3% (3.7% when you hit milestone)

- Internet Achieve: 3% – 2.36% = 0.4% (minimal acquire)

Much like most different super-premium bank cards, the ICICI Emeralde Non-public Metallic Credit score Card additionally gives a reduced foreign exchange markup price of two%, leading to a web acquire of near 0.5%, leaving a variety of room for enchancment.

Different advantages

- Money Advance Charge: Nil

- Late cost Charge: Nil

- Over-limit Charge: Nil

- Bookmyshow: Purchase one ticket and rise up to 750 off on the second ticket on motion pictures/sport occasions/theatre/live performance tickets, twice per 30 days

- EazyDiner Prime Membership

My Expertise

I requested my new ICICI Wealth RM to tell me concerning the steps to improve as quickly as the cardboard goes stay. As soon as it went stay, the RM patiently adopted up with me virtually each week for over a month, which was a bit shocking from ICICI RM’s.

At some point, I made a decision to go for it.

The RM related me to the consultant who handles bank cards on the department. She took the request for an improve from my lately issued ICICI Sapphiro Credit score Card, which beforehand changed my Intermiles Sapphiro card.

The service request was accredited inside 3 days and I used to be capable of see the cardboard on my app. I obtained the bodily card within the subsequent few days. All of this occurred inside per week, and it was tremendous clean.

Tip: For individuals who’re caught with an improve, all you want is to search out the one who can take the request. Surprisingly it may as properly be carried out by the cellphone banking officers however possibly not all understand it.

I did use the identical route to use for an improve for a few of my shoppers and most of them went via efficiently, aside from one, which we’ll focus on under.

Eligibility

- For Contemporary Purposes: Invite Solely as per Financial institution

- For Improve, Credit score Restrict on Present ICICI Financial institution Credit score Card: ~10 Lakhs

Ideally, such invite-only playing cards are issued to present clients with a great relationship with the financial institution. Nevertheless, the financial institution could change its necessities once in a while.

For contemporary functions, ICICI Financial institution could not concern the cardboard simply. Nevertheless, in case you have different financial institution playing cards with a credit score restrict of over 10 lakhs, it’s possible you’ll give it a strive.

For present ICICI Financial institution bank card clients, the anticipated credit score restrict on the prevailing card for an improve is within the vary of 10 lakhs. Nevertheless, one would possibly want to carry premium playing cards like Rubyx/Sapphiro to extend the likelihood of an improve, as I’ve seen 1 case getting declined with a 15 lakh restrict on the Coral Card.

If you have already got the Emeralde Card, you would possibly as properly see the improve possibility on the app.

For those who couldn’t get the cardboard for any cause, it’s best to first attempt to get the common ICICI Emeralde Credit score Card after which go for the improve, which shall be lot simpler.

Devaluation Meter

- Devaluation meter studying: Low

Apart from the profitable welcome profit, all different advantages are properly capped, so I’m not anticipating any main devaluation. Nevertheless, since they’re new to a high-rewards card, they could hold optimizing the redemption worth for vouchers.

Additionally, as of now, the financial institution isn’t issuing the cardboard simply for everybody, which is an effective signal. If that continues, it could take properly over 2-3 years for any main devaluation to occur.

Backside line

With the Emeralde Non-public Credit score Card, ICICI Financial institution has lastly launched a rewarding tremendous premium bank card for many who have been ready for it. A part of the rationale for this achievement is probably going as a result of ICICI Financial institution has exited Payback Rewards and launched its personal rewards program.

With fairly good rewards and great becoming a member of advantages, it’s actually one of many finest bank card in India for 2024.

Whereas this can be a good begin, I hope the financial institution quickly brings in additional airline/lodge switch companions and an accelerated reward system like HDFC Smartbuy’s 5X/10X rewards sooner or later to compete properly with the King of Tremendous Premium Credit score Playing cards.