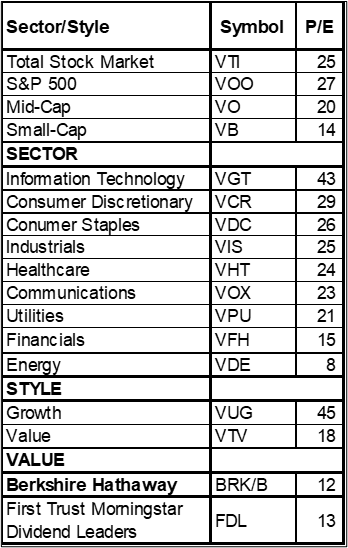

My largest holding by far is an actively managed, complete inventory market fund of funds with a tilt towards large-cap development shares. In accordance with multpl.com, the Value-to-earnings ratio of the S&P 500 is 28.5 which is 50% greater than the common of 19.8 since 1970 and better than 80% of the years since 1970. Desk #1 reveals the price-to-earnings ratio of Vanguard sectors and magnificence exchange-traded funds. Whereas most sectors are traditionally excessive, the P/E of the Data Expertise sector is especially regarding at 50% greater than the S&P500. Warren Buffet is the CEO of Berkshire Hathaway, a extremely diversified value-oriented firm (P/E 12 TTM), which I’m contemplating shopping for to tilt a portion of my portfolio towards worth.

Desk #1: Fairness Lipper Class Momentum

On this article, I check out financial development and valuations and evaluate the Berkshire Hathaway inventory to value-oriented mutual and exchange-traded funds. This text is split into the next sections:

COMPARING BERKSHIRE HATHAWAY PERFORMANCE TO FUNDS

This text was impressed by conversations with Monetary Advisors to maneuver a portion of my portfolio into particular person shares. First, I don’t need to be actively buying and selling shares. Secondly, I need to preserve issues easy and never replicate some massive index. Third, I need to tilt a portion of my portfolio towards worth. And at last, I need to preserve odd earnings from dividends low for tax effectivity.

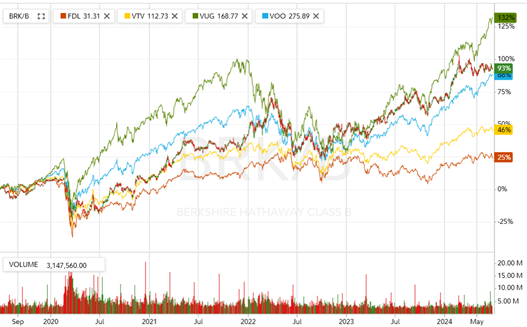

Progress funds have risen sooner throughout the good occasions akin to now, and have fallen more durable throughout the dangerous occasions. Determine #1 reveals the five-year efficiency of the S&P 500 (blue line), Vanguard Progress (inexperienced line) and Worth Fund (orange line) and Berkshire Hathaway (BRK.B, crimson and inexperienced bars), together with the First Belief Morningstar Dividend Leaders Index Fund (FDL, crimson line). My choice is to begin locking within the beneficial properties by tilting away from development towards worth. Berkshire Hathaway has fared higher than the worth funds over the previous 5 years.

Determine #1: Costs of Berkshire Hathaway, S&P 500, Progress, and Worth Funds

Desk #2: Metrics of Berkshire Hathaway, S&P 500, Progress, and Worth Funds

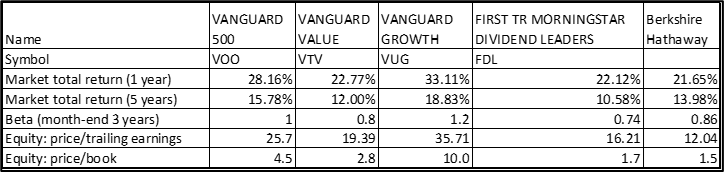

I extracted the mutual and exchange-traded funds with below-average valuations, average volatility, and excessive returns as proven in Determine #2.

Determine #2: Prime Performing Funds with Under Common Valuations

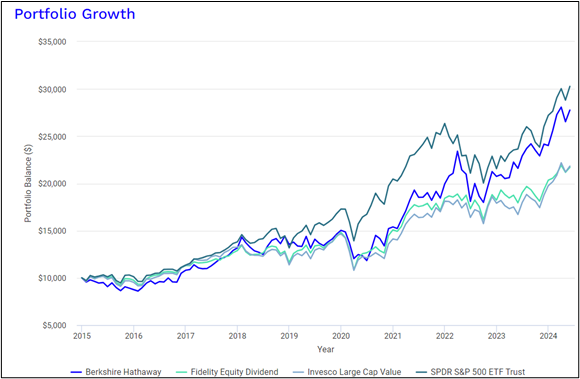

I then in contrast two of one of the best ETFs to the Berkshire Hathaway inventory for the previous ten years. Over the previous ten years, Berkshire Hathaway has had returns near the S&P 500 and above the worth funds.

Determine #3: Berkshire Hathaway, Constancy Fairness Earnings, Invesco Massive Cap Worth Returns

ECONOMIC WATCH – SAHM’S RULE

Key Level: The economic system continues to sluggish within the late stage of the enterprise cycle with the danger of a recession nonetheless on the horizon.

Gentle landings following excessive inflation and main fee hikes haven’t been achieved in trendy historical past within the US. They’re uncommon even in milder situations. An article by Jeff Cox at CNBC describes Sahm’s Rule which Chief Economist Claudia Sahm at New Century Advisors developed for predicting recessions. The premise is that when the unemployment fee’s three-month common is half a share level greater than its 12-month low, the economic system is in recession. My baseline shouldn’t be recession,” Sahm mentioned. “Nevertheless it’s an actual danger, and I don’t perceive why the Fed is pushing that danger. I’m undecided what they’re ready for.”

On the labor entrance, the 4-Week Transferring Common of Preliminary Claims has began creeping up this 12 months, the Unemployment Fee has risen to 4%, Hours Labored for All Employees (Enterprise Sector) have stagnated since final 12 months. Short-term Assist Companies (All Staff) has been dropping exhibiting that companies are getting ready for a slowing economic system.

Actual GDP grew 2.5% in 2023 and the Second Quarter 2024 Survey of Skilled Forecasters by The Federal Reserve Financial institution of Philadelphia reveals estimated Actual GDP Progress falling from 2.5% in 2024 to 1.9% in 2025 and 2026. The Federal Reserve Financial institution of New York makes use of the distinction between 10-year and 3-month Treasury charges to estimate that the chance of a recession by way of 2024 and to Could 2025 principally stays above 50%.

The economic system has remained surprisingly resilient with excessive rates of interest due largely to pandemic-era spending which is ending and financial savings which have been partly depleted. There are warning indicators on the horizon akin to Delinquency Fee on Credit score Card Loans which has risen to three.2% – simply in need of the three.7% common since 1991. Actual Retail and Meals Companies Gross sales, Complete Enterprise Gross sales, Industrial Manufacturing, Capability Utilization, Industrial and Industrial Loans, and Actual Disposable Private Earnings have been stagnant and even declining since January 2023 or longer.

The Shopper Value Index for All City Customers (All Objects in U.S. Metropolis Common) declined to three.3% in Could and the Private Consumption Expenditures (Chain-type Value Index) declined to three.3% in Could. In accordance with Christopher Rugaber on the Affiliate Press, “Federal Reserve officers mentioned Wednesday that inflation has fallen additional towards their goal degree in latest months however signaled that they anticipate to chop their benchmark rate of interest simply as soon as this 12 months… The policymakers’ forecast for one fee reduce was down from their earlier projection of three cuts, as a result of inflation, regardless of having cooled up to now two months, stays persistently above their goal degree.”

LOOKING UNDER THE HOOD OF EQUITY FUNDS

Final month, I wrote Fund Household Efficiency for Fairness ETFs for the Mutual Fund Observer e-newsletter which recognized ten Fund Households that had a excessive share of their fairness funds that outperformed their friends for the previous three years. This month, I extracted fifty-eight of these funds which have outperformed from these households to see what shares they maintain within the high ten holdings. The Prime Ten Holdings comprise 84 shares of which 41 have a minimum of 5% of the full allocation inside the high ten. 13 of the funds personal shares of Berkshire Hathaway.

Sixty % is allotted to the Software program, “Semiconductors & Semiconductor Gear”, “Interactive Media & Companies”, and “Expertise {Hardware}, Storage & Peripherals Industries” sectors. The common Value to Earnings Ratio of all the shares is 29 whereas the common Value to Earnings Ratio within the previous 4 industries is 39.

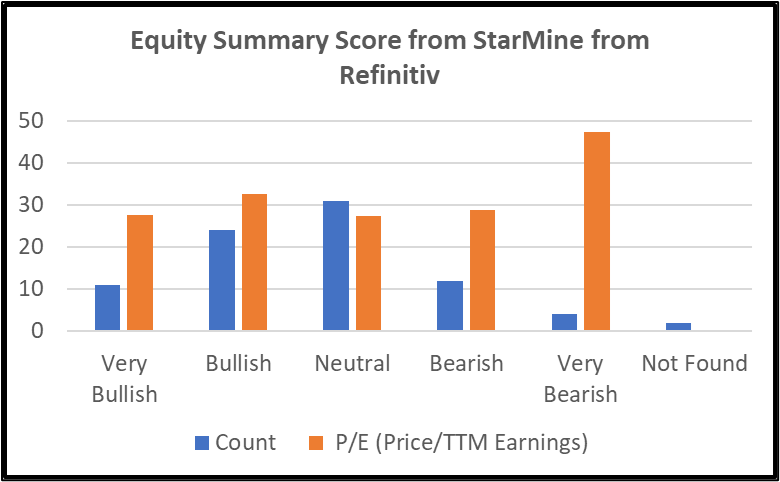

I experimented with the Constancy Inventory Screening Software and one of many choices to make use of is the Fairness Abstract Rating from StarMine from Refinitiv:

StarMine from Refinitiv’s subtle scoring system facilitates a good comparability of agency suggestion efficiency throughout extensively disparate industries and market situations. StarMine from Refinitiv makes use of suggestions from analysis suppliers and the previous efficiency of their suggestions on the sector degree to create a quantitative metric, the StarMine from Refinitiv Relative Accuracy Rating, for a given inventory.

Determine #4 reveals the Fairness Rating from StarMine from Refinitiv for the 84 shares within the Prime Ten Holdings of the outperforming funds. It seems that momentum is driving valuations even greater. My choice is to search for a subset with low valuations.

Determine #4: Fairness Rating from StarMine from Refinitiv for Shares in Prime 10 Holdings

Berkshire Hathaway

Berkshire Hathaway is the one massive firm within the Multi-Sector Holdings Sub-Trade of the Monetary Companies Trade. Berkshire Hathaway has a market capitalization of $535 billion. To grasp Berkshire Hathaway, let’s check out its investments, administration philosophy often known as the “Proprietor’s Plan”, and succession plan.

“Listing of property owned by Berkshire Hathaway” at Wikipedia describes seventy-one firms for which Berkshire Hathaway owns wholly or controls a majority of voting shares, and fifty U.S.-listed public firm and ETF holdings. “As of March 31, 2024, Berkshire Hathaway had $28.9 billion in money and money equivalents and $153.4 billion in short-term investments in U.S. treasury payments.”

In accordance with Wayne Duggan in “Largest holdings within the Warren Buffett portfolio” at USA At present, “Among the many 47 shares Berkshire Hathaway holds, the highest 10 signify about 84% of the corporate’s holdings.” The highest 10 are Apple (AAPL), Financial institution of America (BAC), American Specific Co. (AXP), Coca-Cola Co. (KO), Chevron (CVX), Occidental Petroleum (OXY), Kraft Heinz (KHC), and Moody’s Corp. (MCO).

Mr. Buffett laid out his “Proprietor’s Handbook” for Berkshire Hathaway in 1999 which I summarize:

- Though our kind is company, our perspective is partnership…

- Consistent with Berkshire’s owner-orientation, most of our administrators have a significant portion of their internet price invested within the firm. We eat our personal cooking.

- Our long-term financial objective (topic to some {qualifications} talked about later) is to maximise Berkshire’s common annual fee of acquire in intrinsic enterprise worth on a per-share foundation…

- Our choice could be to achieve our objective by immediately proudly owning a diversified group of companies that generate money and persistently earn above-average returns on capital…

- Due to our two-pronged strategy to enterprise possession and due to the restrictions of standard accounting, consolidated reported earnings could reveal comparatively little about our true financial efficiency…

- Accounting penalties don’t affect our working or capital-allocation choices…

- We use debt sparingly and, after we do borrow, we try to construction our loans on a long-term fixed-rate foundation…

- A managerial “want listing” is not going to be stuffed at shareholder expense…

- We really feel noble intentions needs to be checked periodically in opposition to outcomes…

- We’ll concern frequent inventory solely after we obtain as a lot in enterprise worth as we give…

- …No matter value, now we have no curiosity in any respect in promoting any good companies that Berkshire owns…

- We might be candid in our reporting to you, emphasizing the pluses and minuses necessary in appraising enterprise worth…

- Regardless of our coverage of candor, we’ll focus on our actions in marketable securities solely to the extent legally required…

Troy Segal describes Warren Buffett’s deliberate successor in “Greg Abel: Warren Buffett’s Successor’s Life, Wage, and Accomplishments” at Investopedia. Mr. Buffett’s function will in all probability be divided into a number of components with Gregory Abel changing into the CEO of Berkshire, and Buffett’s son Howard prone to be named Berkshire Chair of the Board. Canadian-born Gregory Abel (62) joined Berkshire Hathway in 2000. Mr. Abel was appointed to the Berkshire Hathaway board of administrators in 2018. He “oversees all of Berkshire’s railroad, auto utilities, manufacturing, and retail subsidiaries—over 90 firms in all.”

In abstract, Berkshire Hathaway invests for the long run utilizing a price technique. It’s diversified with an excellent long-term monitor file. It has the money accessible to make acquisitions at decrease costs if a recession turns into extra probably.

Closing

The subsequent six months will present clarification on the economic system, inflation, and rates of interest. I’ve one other assembly with Monetary Advisors to debate presumably utilizing personalised portfolios in managed accounts. Of the accounts that I handle, I’m fascinated with being extra value-oriented in a tax-efficient method. I’ve a number of shares and worth funds on my quick listing, and at this level, I’m leaning towards Berkshire Hathaway.