It appears fairly clear that the housing market has cooled, and is now extra of a purchaser’s market than a vendor’s market.

Whereas this does and can at all times range by metro, it’s turning into more and more widespread to see greater days on market (DOM), worth cuts, and rising stock.

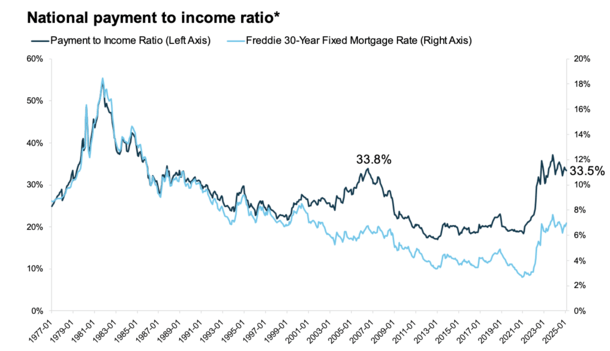

This all has to do with report low affordability, which has made it troublesome for a potential dwelling purchaser to make a deal pencil.

The stubbornly excessive mortgage charges aren’t serving to issues both, calling into query if it’s a superb time to purchase a house. Or if it’s higher to only maintain renting.

However in case you do undergo with a house buy in the present day, anticipate to maintain the property for a few years to return.

Residence Value Features Have Cooled and May Even Go Damaging This Yr

Whereas economists at CoreLogic nonetheless forecast dwelling costs to rise 3.6% from January 2025 to January 2026, it appears as if the features are quickly slowing.

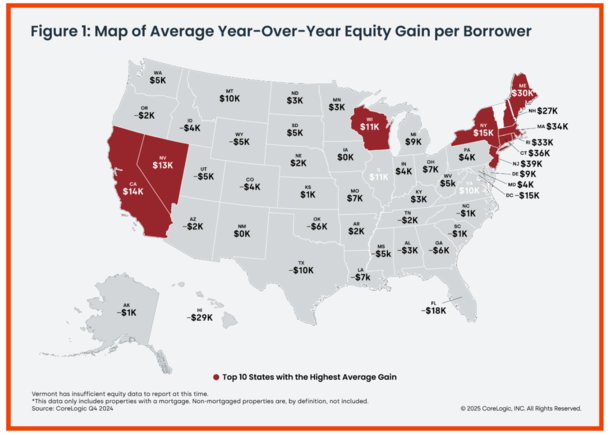

And in some markets, notably Florida and Texas, dwelling costs have already turned detrimental and have begun falling year-over-year.

For instance, dwelling costs have been off 3.9% YoY in Fort Myers, FL, 1% in Fort Value, TX, and 1.1% in San Francisco.

I anticipate extra markets to show detrimental as 2025 progresses, particularly with extra properties coming to market and sitting available on the market as DOM goes up.

It’s a easy matter of provide and demand, with fewer eligible (or ) consumers, and extra properties to select from.

There are a lot of culprits, however it’s principally an affordability drawback, with the nationwide fee to revenue ratio nonetheless round GFC bubble highs, per ICE.

This explains why dwelling buy purposes are nonetheless fairly flat regardless of some current mortgage price enchancment.

Sprinkle in rising householders insurance coverage and property taxes, and on a regular basis prices of residing and it’s turning into much more troublesome to purchase a house in the present day.

Whereas it could be excellent news for a potential purchaser who has a strong job and belongings within the financial institution, for the standard American it most likely means renting is the one recreation on the town.

If this persists, I anticipate extra downward stress on dwelling costs, although mortgage charges can fall in tandem as nicely.

Nonetheless, I wouldn’t anticipate any spectacular features after a house buy in the present day in most eventualities.

Appreciation is predicted to be fairly flat in most markets at finest for the foreseeable future.

This imply the one solution to make a dent is by way of common principal funds (one in every of 4 key parts to PITI).

Your Mortgage Is Being Paid Down Extra Slowly When Charges Are Increased

| $400,000 mortgage quantity | 2.75% mortgage price | 6.75% mortgage price |

| Month-to-month fee | $1,632.96 | $2,594.39 |

| Curiosity paid in 3 years | $31,938.47 | $79,698.01 |

| Principal in 3 years | $26,848.09 | $13,700.03 |

| Remaining steadiness | $373,151.91 | $386,299.97 |

The issue is mortgage charges in the present day are nearer to six.75%. On a $400,000 mortgage quantity, which means simply $345 of the primary fee goes towards principal.

The remaining $2,250 goes towards curiosity. Sure, you learn that proper!

Consequently, your mortgage is being paid down much more slowly in the present day in case you take out a house mortgage at prevailing charges.

Distinction this to the oldsters who took out 2-3% mortgage charges, who’ve smaller mortgage quantities and far quicker principal reimbursement.

On the identical $400,000 mortgage quantity at 2.75%, $716 goes towards principal and simply $917 goes towards curiosity.

The impact is these householders are gaining fairness a lot quicker, and making a wider buffer between what they owe and what their house is price.

To return to our 6.75% mortgage price borrower, they’d nonetheless owe $386,000 after three years of possession.

A Low-Down Fee Makes It More durable to Promote Your Residence

Now let’s faux the 6.75% mortgage price proprietor put simply 3% down on their dwelling buy.

That is the minimal for Fannie Mae and Freddie Mac, the commonest sort of mortgage (conforming mortgage) on the market.

The acquisition worth could be roughly $412,000 on this state of affairs, which means simply $12,000 down fee.

It’s nice that the down fee is low I suppose, however it additionally means you’ve little or no fairness.

And as proven, you’ll pay little or no down over the primary 36 months of homeownership.

In three years, the steadiness would drop to only over $386,000, which is a cushion of roughly $26,000.

Throughout regular instances, we may anticipate dwelling costs to rise round 4.5% yearly, placing the house’s worth at say $470,000.

This may give our hypothetical house owner about $84,000 in dwelling fairness, between appreciation and principal pay down.

That works out to roughly $58,000 in appreciation, $14,000 in principal, and $12,000 down.

Now let’s assume you wish to promote since you don’t like the home for no matter motive, or want a distinct one, or just can’t afford it anymore.

There Are A lot of Transactional Prices Concerned with Promoting a Residence

| $412,000 dwelling buy | 1% achieve yearly | 4.5% achieve yearly |

| Worth after 3 years | $424,500 | $470,000 |

| Stability after 3 years | $386,000 | $386,000 |

| Residence promoting prices | $42,500 | $47,000 |

| Gross sales proceeds | -$4,000 | $37,000 |

Promoting a house isn’t free. It comes with quite a lot of transactional prices, whether or not it’s switch taxes, escrow charges, title insurance coverage, actual property agent commissions, transferring bills, and so forth.

Whereas these charges range by locale, one may anticipate to half with 10% of the gross sales worth in whole closing prices.

So let’s faux the house is ready to promote for $470,000 after three years. Prices to promote are roughly $47,000.

This implies the efficient gross sales worth is a decrease $423,000. You stroll away with $37,000 in your pocket, the distinction between that and the $386,000 mortgage steadiness.

Keep in mind you parted with $12,000 to purchase the place too, so your “revenue” is $25,000. Even much less when you think about you simply paid again your mortgage.

Now think about the house doesn’t respect in worth by that 4.5% per yr, and as a substitute appreciates at say 1% per yr.

It’s solely price $424,500 after three years and also you wish to promote it. The identical 10% in promoting prices apply, decreasing the proceeds to $382,050.

However you owe $386,000 on the mortgage. Though you didn’t have an underwater mortgage, the place the steadiness exceeds the house worth, as soon as promoting prices are factored in, it’s detrimental.

You would need to convey cash to the desk with a view to promote the property.

Because of this, you have to take into consideration an extended time horizon when shopping for a property in the present day.

This isn’t to say dwelling costs gained’t go up over the following three years, however you possibly can see how simply a state of affairs like this might unfold.

In recent times, dwelling costs have been going up by double-digits every year, with cumulative features of fifty% in simply three or 4 years in some instances.

On the identical time, these householders have been paying down their mortgage balances a lot quicker because of a 2-3% mortgage price.

This made it a lot, a lot simpler and quicker to rapidly flip round and promote in the event that they needed to. Or needed to.

Now you’re seemingly going to should maintain a property for a few years if you wish to promote for a revenue. So make the choice correctly.