Key Highlights

1. ‘Coverage continuity’ with no main populist announcement regardless of election end result

2. Continued give attention to fiscal consolidation

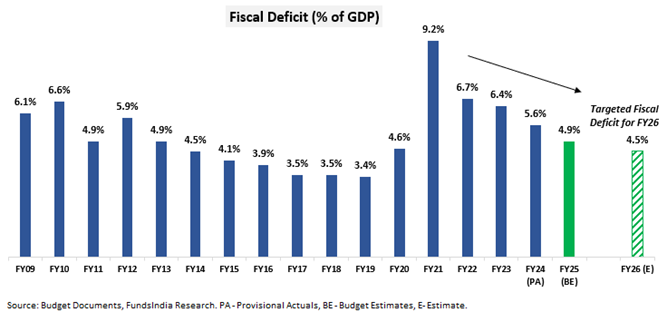

- Additional discount in fiscal deficit goal to 4.9% of GDP for FY 25 (vs 5.1% introduced in interim price range) – sustaining fiscal consolidation glide path to scale back fiscal deficit to 4.5% of GDP by FY26.

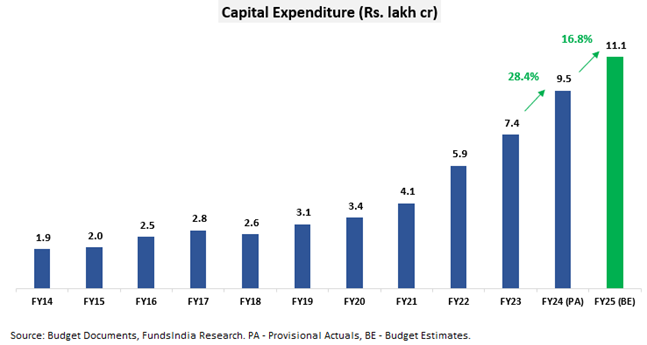

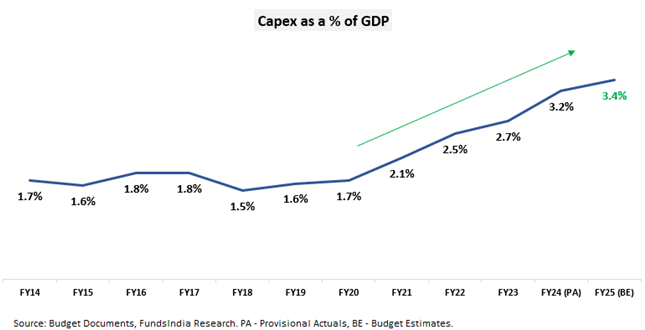

3. Maintains earlier steering on Capital Expenditure

- Capital Expenditure to extend by 17% to Rs 11.1 lakh cr in FY25 (i.e 3.4% of GDP) from Rs 9.5 lakh cr in FY24 (i.e 3.2% of GDP)

- Main focus is on: Roads & Bridges, Railways & Defence

4. Change in Capital Good points Taxation

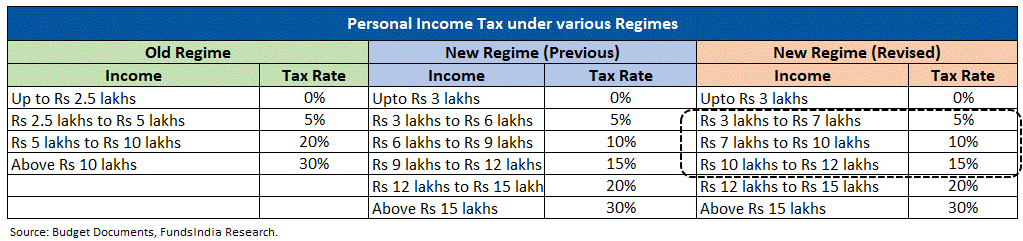

5. Nudge in direction of New Revenue Tax Regime with revisions in tax slab and normal deduction

Price range in Visuals

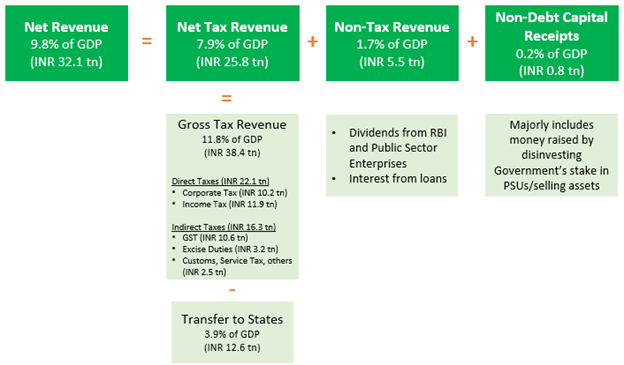

Nominal GDP for FY 25 = INR 326 lakh crores (10.5% progress over INR 295 lakh crores in FY24)

The place does the cash come from?

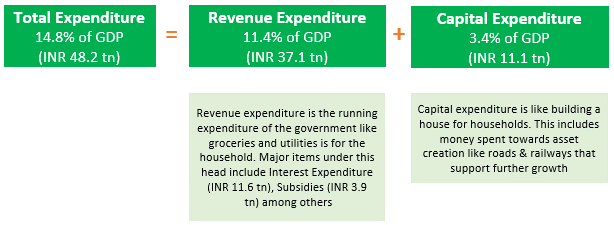

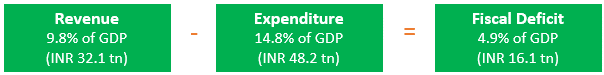

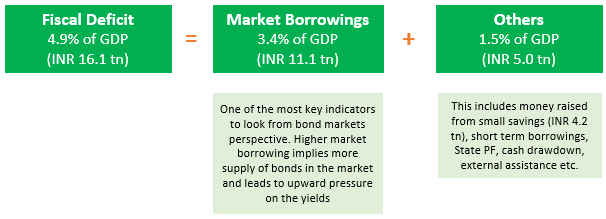

The place does the cash get spent?

How a lot is the deficit between spending and incomes?

How is the deficit financed?

Fiscal Consolidation On Observe..

Tax Receipts as a % of GDP stays steady..

Thrust on Capex Continues..

With a give attention to Defence, Roads and Railways..

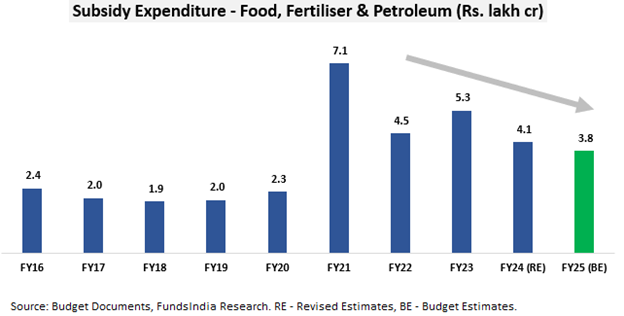

No dilution in high quality of spending -> Subsidies at 5 yr low

The federal government’s subsidy invoice (Meals, Fertiliser, Petroleum and so forth) is estimated to ease additional to 1.3% of GDP in FY25 BE from 1.5% of GDP estimated in FY24 RE, largely led by decrease fertilizer and meals subsidy invoice.

What’s in it for you?

1. Nudge in direction of New Revenue Tax Regime

- Outdated earnings tax slabs stay unchanged.

- Revision within the new regime earnings tax slabs:

- Customary deduction elevated from Rs 50,000 to Rs 75,000

Customary deduction is a flat deduction in your taxable earnings (i.e your taxable earnings comes down by that extent). Obtainable to salaried people and pensioners.

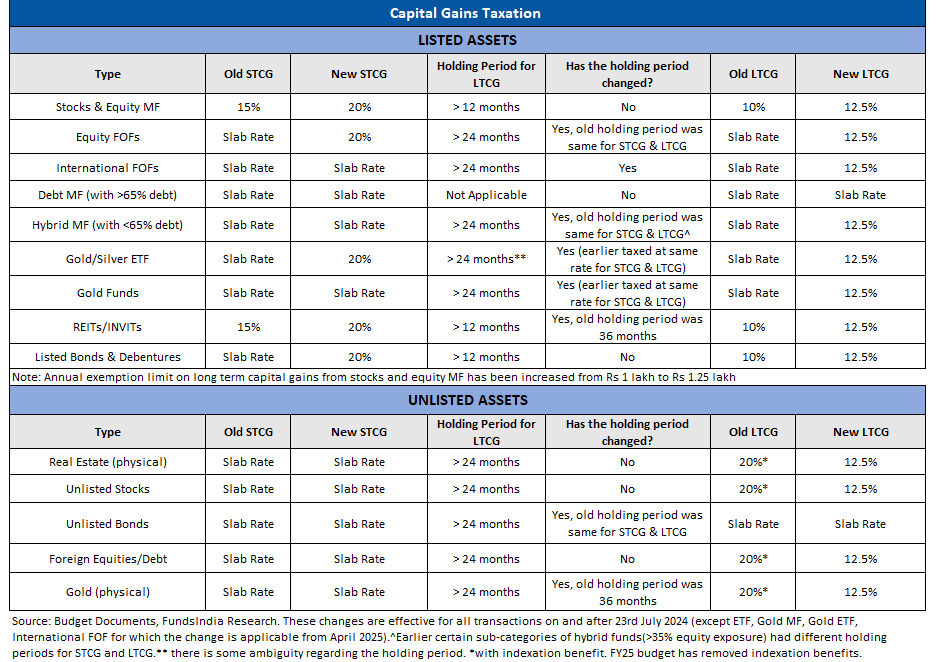

2. Change in Capital Good points Taxation

- Equities

- Capital Good points Tax elevated for Equities

- Lengthy Time period Capital Good points Tax elevated to 12.5% from 10%

- Brief Time period Capital Good points Tax elevated to twenty% from 15%

- Long run capital positive factors tax exemption restrict elevated from Rs 1 lakh to Rs 1.25 lakh.

- Capital Good points Tax elevated for Equities

- Debt Mutual Funds – No change in taxation

- Worldwide FOFs, Gold Index/ETFs – Lengthy Time period Capital Good points diminished to 12.5% if they’re held for greater than 24 months (earlier taxed at slab charges)

- Actual Property

- Indexation Profit on property eliminated – Lengthy Time period Capital positive factors from the sale of real-estate will now be taxed at 12.5% with out indexation profit (this was earlier taxed at 20% with indexation profit)

- Change in holding interval

- Earlier, there have been 3 thresholds to find out long-term – 12 months, 24 months and 36 months. Now, solely 12 months and 24 months.

- Threshold to assert LTCG tax:

- 12 months: Listed monetary devices

- 24 months: Unlisted monetary devices + All non-financial belongings

Please discover under the abstract of tax adjustments throughout completely different belongings

3. What will get low cost and expensive

Different Necessary Bulletins

- Schemes launched for employment linked incentives – 3 new schemes have been launched for employment linked incentives that profit first timers, job creation in manufacturing sector and help to employers.

- STT on F&O transactions elevated – On Futures from 0.01% to 0.02% and on Choices from 0.06% to 0.1%

FI Fairness View: Coverage Continuity – No dilution in high quality of spending with give attention to fiscal consolidation & capex

The Union Price range FY25 continues with its give attention to fiscal consolidation and capex spending reiterating coverage continuity. This additionally addresses the considerations on the opportunity of populist bulletins submit election outcomes. Nevertheless, the rise in long run capital positive factors tax for fairness traders got here as a minor unfavourable shock.

Total, we preserve our POSITIVE outlook on Equities over a 5-7 yr horizon, anticipating robust earnings progress within the coming years. We imagine we’re presently within the center levels of a multi-year bull market.

Our Fairness view is derived based mostly on our 3 sign framework pushed by

- Earnings Cycle

- Valuation

- Sentiment

As per our present analysis we’re at

MID PHASE OF EARNINGS CYCLE + EXPENSIVE VALUATIONS + MIXED SENTIMENTS

- MID PHASE OF EARNINGS CYCLE

We count on an affordable earnings progress atmosphere over the following 3-5 years. This expectation is led by Manufacturing Revival, Banks – Bettering Asset High quality & pickup in mortgage progress, Revival in Actual Property, Authorities’s give attention to Infra spending (which continues in FY25 Price range), Early indicators of Company Capex, Structural Demand for Tech providers, Structural Home Consumption Story, Consolidation of Market Share for Market Leaders, Robust Company Stability Sheets (led by Deleveraging) and Govt Reforms (Decrease company tax, Labour Reforms, PLI) and so forth. - EXPENSIVE VALUATIONS

FundsIndia Valuemeter based mostly on MCAP/GDP, Value to Earnings Ratio, Value To E book ratio and Bond Yield to Earnings Yield has diminished from 85 final month to 79 (as on 30-June-2024) – moved to ‘Costly’ Zone - MIXED SENTIMENTS

It is a contrarian indicator and we develop into constructive when sentiments are pessimistic and vice versa - DII flows proceed to be robust on a 12-month foundation. DII Flows have a structural tailwind within the type of

- Financial savings transferring from Bodily to Monetary belongings

- Rising ‘SIP’ funding tradition

- EPFO Fairness investments

- FII flows have remained muted for the final 2.5 years – FII Flows since Oct-21 at Rs. ~ 14,000 Crs. vs DII Flows at Rs. ~7,16,000 Crs. That is additionally mirrored within the FII possession of NSE Listed Universe which is presently at its 10 yr low of 17.9% (peak possession at ~22.4%). This means important scope for greater FII inflows. FII flows can enhance in CY24 led by 1. Peaking USD and rates of interest and a couple of. Rising significance of India in world markets.

- Durations of weak FII flows have traditionally been adopted by robust fairness returns over the following 2-3 years (as FII flows ultimately come again within the subsequent intervals).

- IPOs – Sentiments has slowly began to revive with most up-to-date IPOs getting oversubscribed. However no indicators of euphoria aside from the SME phase.

- Previous 5Y Annual Return is at 17% (Nifty 50 TRI) – in step with earnings progress and nowhere near what traders skilled within the 2003-07 bull market (45% CAGR)

- Total the emotions are blended and we see no indicators of ‘Euphoria’

FI Mounted Revenue View: Fiscal Consolidation continues + No change in Market Borrowing -> Constructive for Debt Markets

Price range is constructive for Debt Markets. Anticipate rates of interest to step by step come down over the following 12-18 months on the again of sustained FPI flows in debt submit index inclusion of Indian G-Secs, fiscal consolidation, inflation underneath management, anticipated fed price cuts and the latest S&P sovereign outlook improve.

Fiscal Consolidation continues:

The Fiscal Deficit for FY25 at 4.9% of GDP adheres to the fiscal glide path. The finance minister reiterated the federal government’s dedication to convey it right down to 4.5% of GDP by FY26.

Decrease Market Borrowing in comparison with earlier yr:

Internet Market Borrowing in FY25 is decrease at INR 11.1 lakh crores vs 12.7 lakh crores in FY24. No main change from what was introduced through the interim price range.

Why will we count on rates of interest to return down?

- Inflation underneath management: India’s Could-24 CPI inflation at 4.7% is inside RBI’s tolerance band (2-6%). Core CPI (excl Meals & Vitality) stays snug at 3.1%. RBI forecasts FY25 inflation to be a lot decrease at 4.5% led by world progress slowdown and broad-based moderation within the home core inflation basket.

- Curiosity Charges effectively above anticipated inflation: Repo Charge at 6.50% is comfortably above the RBI’s anticipated inflation (4.5% for FY25) – leaves the constructive actual coverage charges at an elevated 200 bps giving sufficient room for RBI to scale back rates of interest by ~50-75 bps over time.

- FED anticipated to chop rates of interest: US Fed has already hinted at a number of price cuts this yr led by considerations of world progress slowdown & early indicators of decrease US inflation.

- Favorable Demand-Provide Equation:

- Increased Demand -> Increased FII inflows as Indian Authorities Bonds have been included in JP Morgan’s world bond market index with anticipated influx of ~USD 20-25 bn in FY25 and in Bloomberg’s Rising Market Index from FY25 + risk of inclusion in FTSE indices.

- Decrease Provide -> Gross Market Borrowing in FY25 is decrease at INR 14.1 lakh crores vs 15.4 lakh crores in FY24.

- S&P sovereign outlook improve:

On Could 29, 2024, S&P World Scores revised its India outlook to constructive from steady, led by strong progress and rising high quality of presidency spending .

Find out how to make investments?

3-5 yr bond yields (GSec/AAA) proceed to stay engaging.

We favor debt funds with

- Excessive Credit score High quality (>80% AAA publicity)

- Brief Length or Goal Maturity Funds (3-5 years)

Contemplate tactically investing in debt funds with an extended length (>7 years) and excessive credit score high quality (>90% AAA) you probably have the next danger urge for food to profit from the anticipated decline in yields over the following 12-18 months.

Different articles you could like