Included in 1902 and headquartered in Mumbai, The Indian Lodges Firm Ltd. (IHCL) is a part of the Taj Group. It owns, operates, and manages lodges, palaces, and resorts beneath manufacturers like Taj, Vivanta, SeleQtions, and Ginger. IHCL’s portfolio consists of 310 lodges (218 operational and 92 within the pipeline) as of March 31, 2024. The corporate additionally provides various F&B, wellness, and life-style providers by manufacturers like amã Stays & Trails, Taj SATS Air Catering, and Qmin.

Merchandise and Companies

- Luxurious, Upscale, and Midscale Lodges: IHCL operates lodges beneath Taj (luxurious), Vivanta/SeleQtions (upscale), and Ginger (midscale).

- F&B and Wellness: Gives air catering, salons, spas, and meals supply providers.

- Boutiques and Trails: Contains amã Stays & Trails and enterprise golf equipment.

Subsidiaries: As of FY23, IHCL has 29 subsidiaries, 5 associates, and 6 joint ventures.

Development Methods

- New Companies and Initiatives: New verticals grew by 35%, producing Rs. 1,600 crore (12% of turnover). TajSATS and Ginger reported revenues of Rs. 900 crore and Rs. 486 crore, respectively.

- Portfolio Enlargement: Signed 53 and opened 34 lodges in FY24, together with 15 re-imagined Gateway lodges.

- Strategic Alliances: Partnered with Ambuja Neotia Group’s Tree of Life Resorts, portfolio of 14 resorts.

- Model Enlargement: Beneath Taj, signed 12 and opened 5 lodges; beneath SeleQtions, signed 10 and opened 6 lodges; beneath Vivanta, signed 11 and opened 3 lodges; beneath Ginger/Tree of Life, signed 6 and opened 14 lodges.

Monetary Highlights

Q4FY24 Efficiency

- Income: Rs. 1,951 crore (18% YoY development)

- Working Revenue: Rs. 706 crore (25% YoY development)

- Internet Revenue: Rs. 418 crore (40% YoY development)

- Room Revenues: Rs. 600 crore (20% YoY development)

- F&B Revenues: Rs. 471 crore (13% YoY development)

- Administration Charges: Rs. 153 crore (24% YoY development)

- Occupancy: 79.1% (440 bps YoY enchancment)

- ARR: Rs. 17,546 (3.7% YoY development)

- RevPAR: Rs. 13,885 (10% YoY development)

FY24 Efficiency

- Income: Rs. 6,769 crore (17% YoY development)

- Working Revenue: Rs. 2,340 crore (20% YoY development)

- Internet Revenue: Rs. 1,259 crore (26% YoY development)

Monetary efficiency

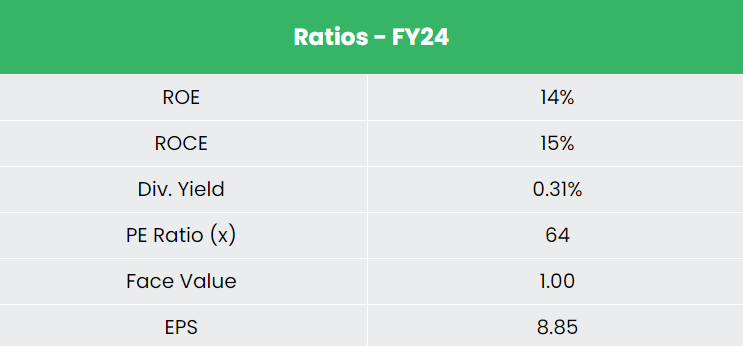

- Income CAGR (FY21-24): 63%

- PAT CAGR (FY21-24): 50%

- Common ROE & ROCE (FY21-24): 9% and 10%

- Debt-to-Fairness Ratio: 0.29

- Money Reserve: Rs. 2,200 crore

Trade Outlook

- Tourism and Hospitality contribute considerably to India’s GDP, projected to achieve US$ 250 billion by 2030.

- The sector will generate employment for 137 million people.

- The growth of the e-Visa scheme is predicted to double vacationer influx.

- India’s various geography and cultural experiences make it a high vacation spot for worldwide tourism.

- The business is a vital a part of the Make in India initiative, driving job creation and financial development.

Development Drivers

- The Indian journey market is projected to achieve US$ 125 billion by FY27, up from US$ 75 billion in FY20.

- 100% FDI allowed within the tourism business beneath the automated route.

- The Union Price range 2023-24 allotted US$ 290.64 million to the Ministry of Tourism, a 44% enhance from the earlier 12 months.

Aggressive Benefit

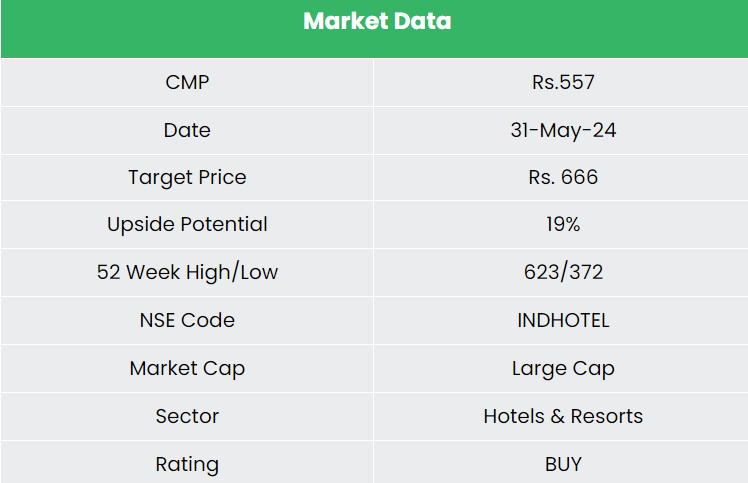

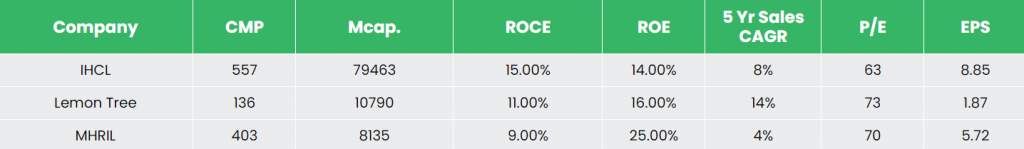

In comparison with rivals like Lemon Tree Lodges Ltd. and Mahindra Holidays & Resorts India Ltd., IHCL is undervalued with strong returns on capital and robust gross sales development.

Outlook

- IHCL expects double-digit topline development, pushed by sturdy demand.

- New companies projected to develop by 25-30%.

- Capex plans of Rs. 2,500 crore for renovations, new properties, and expertise upgrades.

- Sturdy pricing energy in key markets, with a 65% RevPAR premium over rivals.

- Diversified presence in 100 lodges throughout the highest 7 cities.

- Positioned to seize religious tourism demand with 50+ village/religious locations.

- 60/40 mixture of capital mild and capital heavy belongings, enhancing profitability and stability sheet energy.

Valuation

Trade demand is predicted to develop at over 10% yearly for the subsequent 3-4 years. IHCL is projected to ship constant topline development with sustained margins and portfolio growth. We suggest a BUY ranking with a goal value of Rs. 666, 49x FY26E EPS.

Dangers

- Macro-economic Components: Financial slowdowns could influence journey demand and firm turnover.

- Launch of New Lodges: Delays in launching new lodges/rooms can have an effect on profitability.

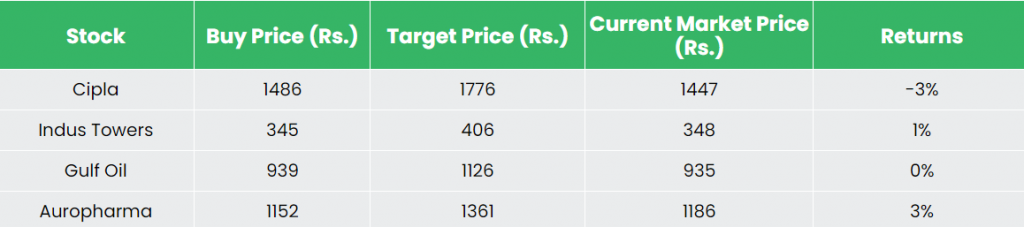

Recap of our earlier suggestions (As on 31 Could 2024)

Different articles chances are you’ll like

Submit Views:

1,432