Rising demand in regional property markets

Investor dwelling loans in Australia are on the rise, as first-time consumers goal lesser-known cities for reasonably priced property investments, in accordance with Ruggable Australia.

With capital cities changing into much less accessible, many are choosing smaller cities, renovating properties to extend worth.

Ruggable Australia’s evaluation confirmed that cities like Level Nepean paved the way, spending 20 occasions the nationwide common on dwelling renovations.

“Level Nepean’s residents have considerably surpassed the common, rising it by 1901.51%, practically 20 occasions greater,” the report stated.

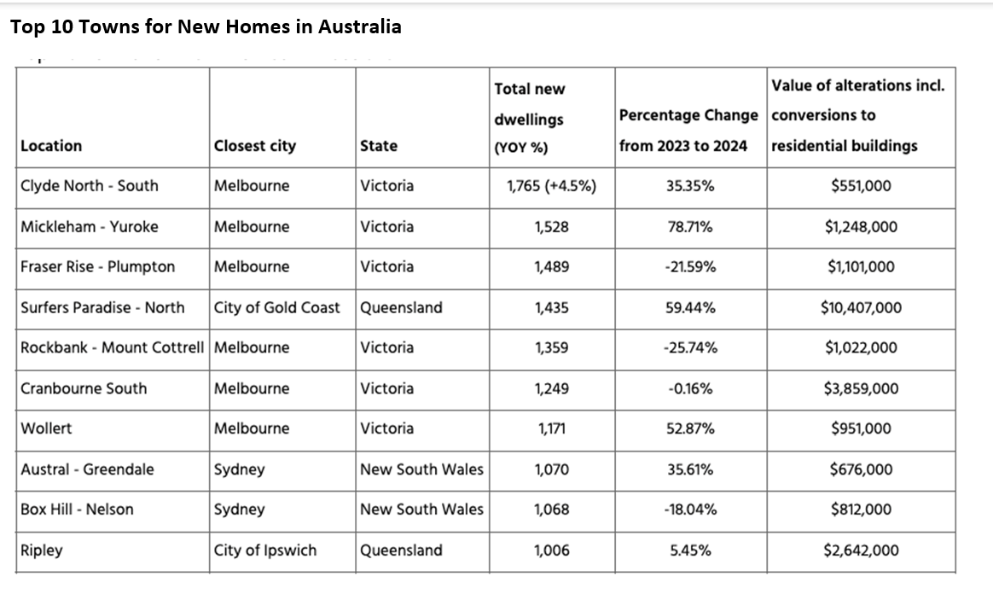

Melbourne suburbs prime new dwelling approvals

Ruggable’s knowledge additionally revealed that Clyde North (South) in Melbourne ranks first in new residential developments, with 1,765 new homes constructed over the previous 12 months.

Mickleham-Yuroke follows carefully, experiencing a 78.71% year-over-year enhance in new dwellings.

This highlighted the rising reputation of Melbourne’s suburbs for brand spanking new housing developments, as consumers search extra worth for his or her cash.

Victoria tops alteration investments

Victoria is main the way in which in dwelling alterations and additions, with a median funding of $3.59 million, adopted by New South Wales at $3.57m.

This development is pushed by traders searching for to flip homes and maximise returns exterior of costly capital cities, Ruggable Australia reported.

Investor exercise reshaping housing market

The rise in investor dwelling loans, paired with a increase in renovations and new dwelling approvals in smaller cities, underscores a shift in Australia’s housing market.

As consumers transfer away from capital cities, these regional areas have gotten hotspots for property funding and growth.

Get the most well liked and freshest mortgage information delivered proper into your inbox. Subscribe now to our FREE each day e-newsletter.

Associated Tales

Sustain with the most recent information and occasions

Be part of our mailing checklist, it’s free!