Rising prices push landlords to promote

A major shift is underway in Australia’s rental market as extra buyers pull out of property leases, pushed by rising prices and regulatory pressures.

In accordance with the most recent Property Funding Professionals Australia (PIPA) survey, 14% of buyers offered their rental properties up to now yr, surpassing final yr’s price.

Buyers deterred by excessive prices and purple tape

PIPA chair Nicola McDougall (pictured above) highlighted the frustration amongst buyers.

“Buyers have had sufficient of being the golden gooses to financially fluff up state authorities backside traces, however in addition they are reacting to the myriad rental reforms and property taxes,” McDougall mentioned.

The added burden of new laws, compliance prices, and better property taxes has pushed many to promote, decreasing the rental inventory.

Householders take over leases

PIPA knowledge revealed that 65% of offered rental properties have been bought by owner-occupiers, additional diminishing out there rental choices for tenants.

This development, mixed with different rising prices, means fewer houses can be found to hire.

Monetary strain on buyers

The survey additionally discovered that just about 43% of buyers face tight money stream, with some even dipping into financial savings to cowl bills.

Mortgage repayments have spiked by $10,000 to $60,000 yearly because the pandemic, and rising prices are pushing many to rethink their investments.

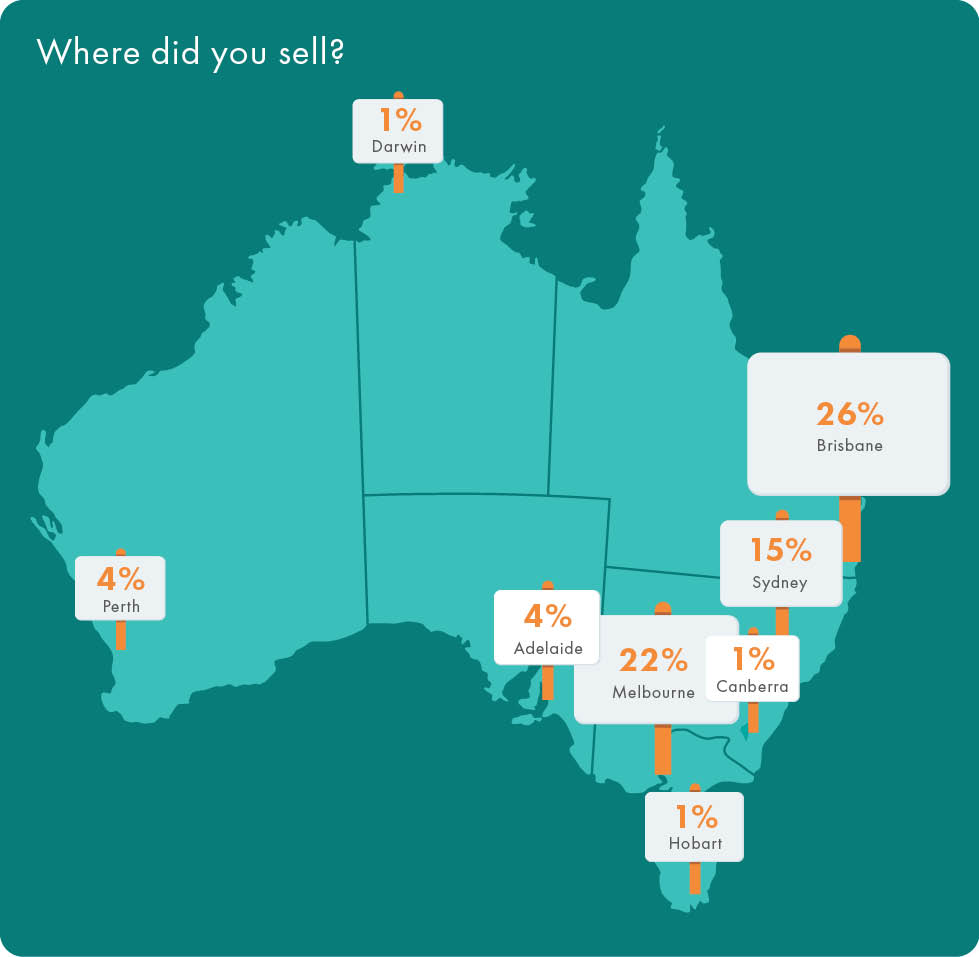

Regional tendencies in investor sell-offs

Brisbane led the sell-off with 26% of buyers offloading properties, adopted by Melbourne at 21.7%, and Sydney at practically 15%.

Buyers in Queensland, Victoria, and New South Wales accounted for almost all of gross sales, whereas Western Australia emerged as essentially the most favorable state for property funding.

Savvy buyers nonetheless eyeing alternatives

Regardless of the challenges, some buyers see alternatives in Melbourne, which is taken into account ripe for future capital progress regardless of a presently depressed market. Perth and Brisbane additionally stay widespread funding decisions.

Rising investor issues throughout Australia

Victoria has been rated the least favorable state for property buyers, with the ACT and New South Wales following carefully behind attributable to their anti-investor insurance policies. Nevertheless, Western Australia and the Northern Territory have emerged as extra investor-friendly markets.

Altering panorama for property buyers

The present local weather exhibits a rising divide between states by way of investor sentiment, with prices and laws enjoying a pivotal position in the place buyers select to place their cash. Whereas some are pulling out, others are discovering new alternatives in beforehand ignored markets, PIPA reported.

Get the most popular and freshest mortgage information delivered proper into your inbox. Subscribe now to our FREE each day publication

Associated Tales

Sustain with the most recent information and occasions

Be a part of our mailing record, it’s free!