I wrote in a earlier publish Our Expertise in Constructing a House Over Shopping for an Current House that I constructed a brand new dwelling. By coincidence, the ultimate all-in price of this new dwelling got here to about the identical as the online proceeds from promoting my earlier dwelling in California 4 years in the past. That earlier house is price much more now. If I take a mean of the estimated worth from Zillow and Redfin, it’s price 50% greater than my new dwelling.

As a home although, the earlier dwelling has nothing to check to the brand new dwelling. It was a tract home constructed within the Sixties with 1/3 of the dwelling house of my new dwelling. Successive homeowners up to date it right here and there over 60 years however the construction was nonetheless the unique.

How come a 60-year-old house is price 50% greater than a brand-new dwelling 3 times its dimension? The worth is clearly within the land. The land underneath that earlier house is price a minimum of 5 instances the land underneath my new dwelling though the 2 items of land are of comparable dimension.

When folks speak about low-cost-of-living (LCOL) areas, high-cost-of-living (HCOL) areas, and very-high-cost-of-living (VHCOL) areas, the distinction in price of dwelling is usually pushed by the price of housing. In any case, costs are the identical whenever you order stuff from Amazon. Groceries and gasoline could price a little bit extra in some locations however they don’t make up a big a part of spending. Why is housing a lot dearer in some locations than others?

We get some clues by taking a look at the place dwelling costs are costliest within the nation.

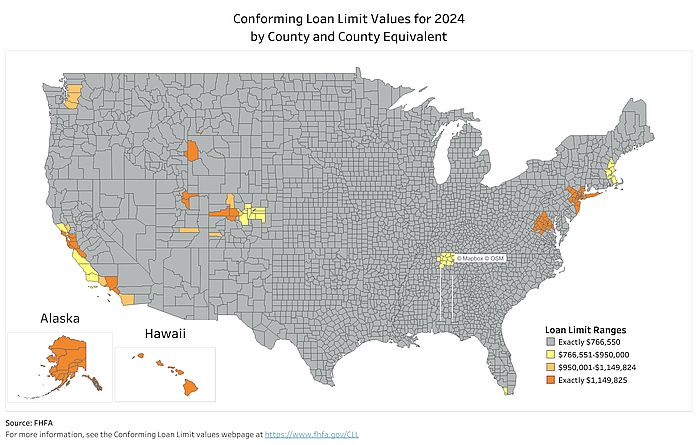

Conforming Mortgage Restrict Map

The Federal Housing Finance Company (FHFA) units a greenback restrict on “conforming loans.” Mortgages underneath the conforming mortgage restrict may be bought to Fannie Mae and Freddie Mac. The mortgage restrict is similar in most locations throughout the nation. It’s 50% increased in some pockets with excessive dwelling costs. The conforming mortgage restrict map reveals the place these high-cost areas are.

Supply: Conforming Mortgage Restrict Map, Federal Housing Finance Company

This map goes by counties. The darkish orange counties on the map have the best conforming mortgage restrict within the nation, which is an indication of the best dwelling costs.

- Alaska

- Hawaii

- Northern California close to San Francisco

- Southern California close to Los Angeles

- Two counties in Wyoming and Idaho close to Jackson, WY

- Two counties in Utah close to Park Metropolis, UT

- Three counties in Colorado close to Aspen, CO

- Washington D.C. and close by areas in Maryland, Virginia, and West Virginia

- New York Metropolis and close by areas in New York, New Jersey, and Pennsylvania

- Two counties in Massachusetts close to Martha’s Winery

We see two themes from this checklist: main financial facilities and trip spots.

Houses are dearer in main financial facilities however so are incomes. I couldn’t have made it this far if I didn’t dwell in a VHCOL space with plentiful good-paying jobs.

Houses are dearer in trip spots as a result of folks purchase second properties there for his or her holidays and to hire to vacationers.

In the event you’re working, is it price transferring to a VHCOL space for a better wage? In the event you’re retired, is it higher to maneuver away from a VHCOL space when jobs are not an element?

Value of Possession

Though I stated a buy-or-rent calculator needs to be the final step you are taking whenever you discover whether or not you should purchase or hire, it’s a great tool to check the price of proudly owning a house somewhere else as a result of the calculator converts the assorted prices of proudly owning a house to a single rent-equivalent quantity. If proudly owning a house in a single place is equal to $4,000/month in hire and proudly owning a house in a unique place is equal to $3,000/month in hire, we all know that housing within the first space prices $1,000/month extra.

I ran the New York Instances buy-or-rent calculator with these assumptions for 3 properties somewhere else costing $500k, $1 million, and $2 million:

- Plan to remain in dwelling: 20 years

- Down fee: 100% (no mortgage)

- House worth development charge: 3%

- Hire development charge: 3%

- Funding return charge: 7%

- Inflation charge: 3%

- Property tax charge: 1% of dwelling worth

- Marginal tax charge: 25% (federal and state)

- Closing price to purchase: 0%

- Closing price to promote: 6%

- Upkeep: $5,000 a 12 months

- Home-owner’s insurance coverage: $2,000 a 12 months

- Utility coated by landlord if renting: $0

- Month-to-month widespread charges: $0

- Widespread charges deduction: 0%

- Safety deposit if renting: 1 month

- Dealer’s payment if renting: $0

- Renter’s insurance coverage if renting: $150/12 months

I set the upkeep price and house owner’s insurance coverage to a hard and fast quantity as a result of the distinction within the dwelling values somewhere else is primarily within the land. An costly dwelling in a VHCOL space doesn’t essentially price extra to take care of or insure.

These are the rent-equivalent numbers for properties in three totally different locations underneath my assumptions above. Please re-run the numbers when you favor a unique set of assumptions.

| $500k House | $1 million House | $2 million House | |

|---|---|---|---|

| Value of Possession | $2,215/month | $3,939/month | $7,439/month |

The very first thing that jumps out from this train is that the price of proudly owning a house free and clear isn’t solely the property tax and upkeep. The biggest price of proudly owning a house and not using a mortgage is the chance price of the cash tied right down to the house. Proudly owning a $2 million dwelling in a VHCOL space prices a number of instances greater than proudly owning a $500k dwelling in a unique space. See extra about this in Paying Off Mortgage Did Not Decrease My Housing Value.

Beneath the assumptions above, a job seeker transferring from an space the place a house prices $500k to an space the place a house prices $1 million might want to make $1,700/month or $20k per 12 months extra after taxes to cowl the upper price of housing. A retiree transferring from the place a house prices $2 million to the place a house prices $1 million will save $3,500/month or $42k per 12 months from the decrease price of housing.

The distinction in housing prices is delicate to the assumed dwelling worth development charge. If dwelling costs in a VHCOL space develop sooner as a result of the realm is a serious financial middle or a well-liked trip spot, it lowers the hole in prices of possession. Listed here are the prices of possession with totally different dwelling worth development charges:

| $500k House | $1 million House | $2 million House | |

|---|---|---|---|

| House Value Progress | 3%/12 months | 4%/12 months | 4%/12 months |

| Value of Possession | $2,215/month | $3,476/month | $6,492/month |

If dwelling costs in a VHCOL space develop just one%/12 months sooner, a $2 million dwelling within the VHCOL space continues to be dearer to personal than a $500k dwelling within the LCOL space, nevertheless it’s solely 2.9 instances as costly, not 4 instances. A 1% sooner development charge reduces the hole in prices of possession between a $1 million dwelling and a $2 million dwelling from $42k a 12 months to $31k a 12 months. 1% sooner development lowers the hole between a $500k dwelling and a $1 million dwelling from $20k a 12 months to $15k a 12 months. A 2% sooner development will shrink the hole by but extra.

Once you’re working, it’s price transferring to a VHCOL space when increased incomes and higher profession alternatives cowl the upper price of housing. That’s why housing prices extra in these locations.

For retirees, whether or not to maneuver out of a VHCOL space is finally a way of life alternative. Sure, it could price $30k or $40k extra per 12 months however you probably have household there and you’ll afford it, it could be price it so that you can keep put. Dwelling in a spot you need to dwell in is a vital a part of retirement. Alternatively, when you aren’t too hooked up to a VHCOL space and also you had been there just for jobs, transferring to a unique place could liberate $30k or $40k per 12 months on different issues which can be extra essential to you.

I nonetheless like this tweet on the place to dwell in retirement from Christine Benz, Director of Private Finance at Morningstar:

You hear lots in regards to the distinction in state taxes however I feel the tax facet is method overblown. We saved lower than $1,000/12 months in state revenue tax after we moved from high-tax California to no-tax Nevada. It’s not price transferring to save lots of solely $1,000 a 12 months. The distinction in the price of housing is extra substantial. Operating the numbers helps you quantify it. Chances are you’ll select to remain put or transfer to a spot nearer to household, mates, actions, or a spot with the climate you like. Quantifying the distinction in housing prices helps you make an knowledgeable resolution.

In our case, we didn’t save a lot cash by transferring however we improved our way of life. We may’ve chosen a unique place with a decrease price of dwelling however we prefer it right here. That makes it price it. Way of life comes first when you possibly can afford it.

Say No To Administration Charges

If you’re paying an advisor a proportion of your property, you’re paying 5-10x an excessive amount of. Learn to discover an unbiased advisor, pay for recommendation, and solely the recommendation.