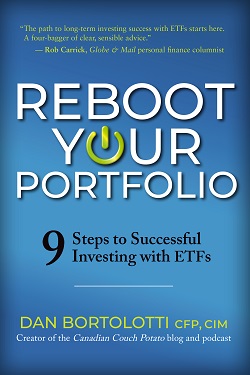

It’s been some time for the reason that final new article appeared on the Canadian Sofa Potato weblog, and over two years for the reason that final podcast. So I’m happy to share the explanation for the lengthy silence: I’ve been busy on a brand new e-book referred to as Reboot Your Portfolio: 9 Steps to Profitable Investing with ETFs.

It’s been some time for the reason that final new article appeared on the Canadian Sofa Potato weblog, and over two years for the reason that final podcast. So I’m happy to share the explanation for the lengthy silence: I’ve been busy on a brand new e-book referred to as Reboot Your Portfolio: 9 Steps to Profitable Investing with ETFs.

The official publication date is November 1, however the e-book is already accessible for pre-order on Amazon and Indigo, and can quickly be on cabinets at higher bookstores throughout Canada.

I ended recording the podcast in the summertime of 2019 as a result of I wanted to take a break and take into consideration how I might make my work extra helpful in a world of knowledge overload. I didn’t need to simply crank out content material on a deadline: I needed to create one thing that might have an enduring affect on readers and listeners. What was wanted, I acknowledged, was a step-by-step information to designing, constructing, and sustaining a portfolio of ETFs over the long-term.

The brand new e-book is one thing of a reboot in its personal proper. Once I was a columnist and editor at MoneySense journal, I wrote a modest e-book referred to as the MoneySense Information to the Good Portfolio, which laid out a plan for constructing a Sofa Potato portfolio with ETFs and index mutual funds. That e-book offered out three editions, but it surely has been out of print since 2013. I nonetheless get emails from readers searching for copies, however there are none, and even when there have been, the e-book is profoundly old-fashioned now. {The marketplace} has modified dramatically: on-line brokerages are higher and cheaper, wonderful new ETFs have appeared, and roboadvisors have develop into a viable choice for DIY traders who desire a extra hands-off method.

As 2020 dawned, I had a transparent thought of what my subsequent venture could be. Now I simply wanted to search out the time to do it. Then alongside got here the COVID pandemic, which meant much more time for all of us.

All of those roads led me to put in writing Reboot Your Portfolio. The e-book is an entire information to turning into a do-it-yourself investor utilizing low-cost index ETFs. It attracts closely from the writing I’ve achieved through the years, since a lot of the recommendation hasn’t modified. However all the pieces has been totally up to date, and huge sections are model new, reflecting the adjustments within the investing panorama. Furthermore, my very own method has advanced over the last decade as I made the transition from monetary journalist to portfolio supervisor: the extra carefully you’re employed with human beings, the extra you notice that simplicity at all times trumps complexity.

In case you’re a hardcore DIY investor who’s been utilizing ETFs for years, and also you’re searching for recommendation about optimizing your portfolio to shave a number of foundation factors in prices or taxes, you received’t discover that within the e-book. The identical goes in the event you’re solely considering mannequin portfolios or particular ETF suggestions.

My aim with the e-book is that will help you get away from the concept profitable investing is about selecting merchandise and obsessing over tiny tweaks that may take you from an A to an A+. As I’ve labored with a whole lot of traders through the years, I’ve come to know that I may help extra folks simply by getting them to an A. The small particulars don’t matter very a lot after that—and certainly, stressing over them can simply sidetrack you from what’s actually essential.

I hope you benefit from the e-book, and that it’ll make it easier to get began on a path to investing success.

Feedback are closed.