The final 12 months normally and the previous couple of months, particularly, have been unbelievable for the inventory markets.

Let the info do the speaking.

Beneath is the big cap – Bluechips – index represented by Nifty 50 and its progress during the last 1 12 months. It has delivered a 21.56% value return on the finish of Jan 5, 2024.

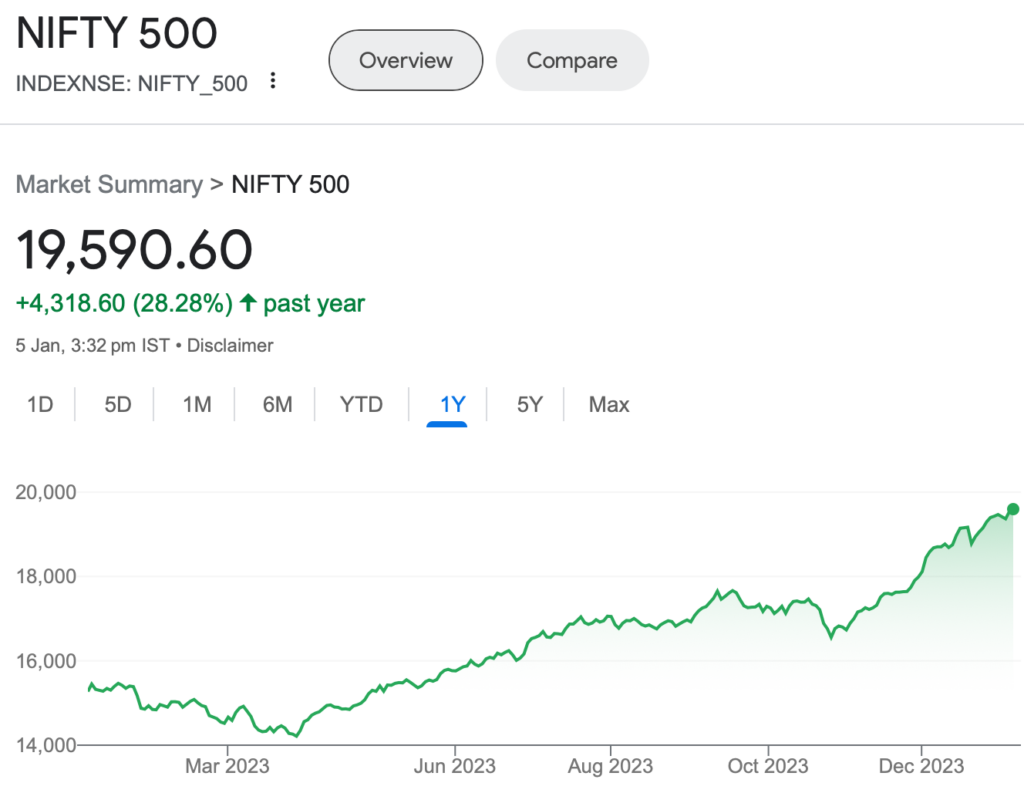

The broader market represented by Nifty 500 has an even bigger run during the last 12 months. Over the interval, the Nifty 500 has delivered a value return of 28.28% return on the finish of Jan 5, 2024.

See picture beneath.

This means that the mid and small cap segments have gone up rather more than the big cap one.

The Nifty Small Cap 250 Index has delivered over 50% return in final 1 12 months. Loopy!

Not simply that. In case you take a look at diversified portfolios with a wholesome dose of mounted revenue/ bonds, they boast an annualised returns (since inception) nearer to twenty% – far more than anticipated of such a portfolio design.

All of this begs the query.

As an investor, what must you do now?

Do you have to make investments extra, maintain or exit?

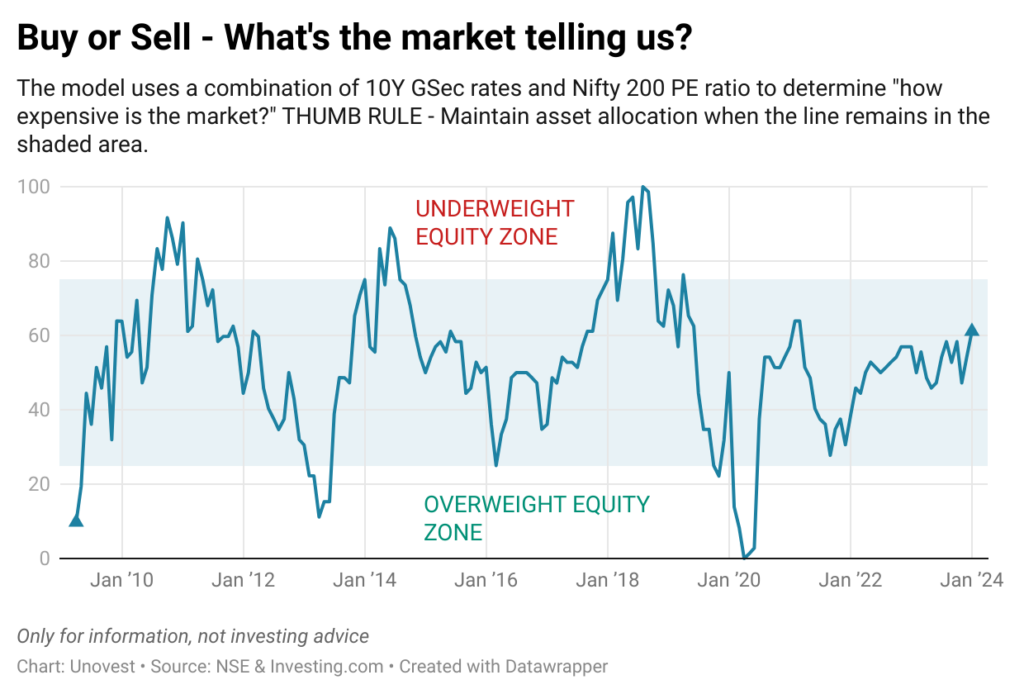

As at all times, we depend on our asset allocation mannequin.

Some easy actions to contemplate:

#1 The indicator remains to be within the zone to maintain your asset allocation going. Which means, that in case you are working a portfolio with a 50:50 in shares and bonds, however the present market momentum has pushed the fairness allocation to 70%, then it’s time to take that further 20% out and push it into bonds. Easy, proper!

#2 The opposite level is the sub allocations. In case you had determined to have 10% in small caps and that stands at 20%, then it perhaps time to cease placing any additional cash or take out that further and reallocate to the place the ratios have gone down.

These actions assist us handle our dangers and be sure that market ups and downs don’t make us really feel the identical means. You additionally guide partial income and hold the positive aspects secure.

Sure, there shall be taxes and transaction prices however they’re definitely worth the peace of thoughts.

What about investing extra? Aren’t the markets too excessive?

First issues first. A market index at 20,000 or 40,000 doesn’t actually imply a lot. As firms develop their revenues and income, the index numbers are certain to develop.

What you do should be cautious about is that if the businesses, the constituents of the index, are overvalued or not. After I say overvalue, I imply their market value is excess of what they’re really price.

In case you can decide that your self, honest. Else, you’re taking assist of knowledgeable by a fund supervisor or an funding adviser.

A comparatively easy means is to maintain doing all your common investments over time in easy merchandise and be sure that you handle your danger proper. Markets will go up and down and common investments will enable you to seize the completely different costs.

In case you really feel uncomfortable with fairness, bonds are an important possibility within the present situation. Why? As a result of rates of interest are near peak now. You will have Financial institution FDs shut to eight% for a years deposit and a few NBFCs going to 9%+ for a 3 to five 12 months lock in.

What ever you do, don’t get too grasping now. That won’t play out nicely.

The present markets are the right time for the looks of snake oil salespeople.

Blissful investing in 2024.

![[Jan 2024] What is the market telling us now? [Jan 2024] What is the market telling us now?](https://i1.wp.com/unovest.co/wp-content/uploads/2024/01/Screenshot-2024-01-06-at-8.32.34-AM.png?w=696&resize=696,0&ssl=1)