Why Justwealth?

As I’ve up to date my Justwealth evaluate through the years, they’ve risen from a solid-but-not-elite choice to the very best robo advisor in Canada.

How did they do it?

By specializing in what issues.

Frankly, whereas Justwealth has made nice strides in the way in which their web site appears to be like, they nonetheless aren’t probably the most aesthetically-appealing possibility on the market. They aren’t taking your cash and paying a large workforce of coders to make and replace some lovely app or intelligent TV advertising and marketing marketing campaign.

As a substitute, the place Justwealth excels is within the nuts and bolts of strong monetary administration:

1) Nice recommendation out of your very personal neutral monetary advisor (assigned to you while you begin at Justwealth).

2) By far the most important collection of robo advisor portfolios obtainable in Canada.

3) Elite portfolio administration from professionals with long-term monitor information inside the trade – which has led to elevated returns over time.

4) The one Canadian robo advisor to supply target-date RESP accounts.

By way of specializing in the issues which might be vital to Canadians – like higher funding returns, extra assist, and far more choices – Justwealth simply affords a superb option to develop your portfolio in an excellent easy and handy method. They don’t waste effort and time on making issues fancy for the sake of being fancy.

Justwealth Welcome Bonus

Justwealth at present affords this promo provide to MDJ’s readers. Anybody who indicators up utilizing our hyperlinks, can take pleasure in the next money bonus when opening a brand new account:

- $50 for a deposit between $5,000 and $24,999

- $100 for a deposit between $25,000 and $49,999

- $225 for a deposit between $50,000 and $99,999

- $500 for a deposit of $100,000 or extra

Justwealth Funding Efficiency (Finest Returns)

If you wish to know extra about how robo advisors work and why I believe they’ve a well-deserved place amongst Canadian platforms, take a look at my article about the very best robo advisors in Canada.

Lengthy story quick, robo advisors are the quickest and most handy option to take part of your paycheque and switch it into an instantly-diversified funding portfolio. The charges are WAY decrease than conventional mutual funds and the fundamental index investing strategy utilizing index ETFs is a superb technique for the common individual to take a position.

That worth proposition is constant throughout principally the entire robo advisors (save for probably Questrade’s Questwealth robo advisor which makes use of extra energetic administration methods.

Right here’s the factor although, even inside broad indexing funding methods there are some key variations in how the robo advisors make investments your cash. The large issues are fairly near the identical. For instance, all of robo advisors:

1) Use ETFs that are passively managed. Nobody inside these ETFs is shopping for and promoting particular person shares or bonds “attempting to get an edge.”

2) The ETFs which might be used are less expensive to put money into than Canada’s mutual funds – which leads to a a lot, a lot larger chance that your investments will develop over time.

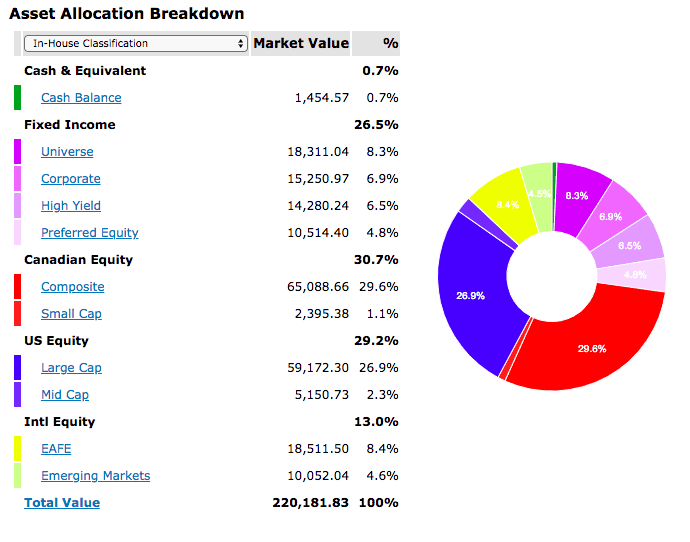

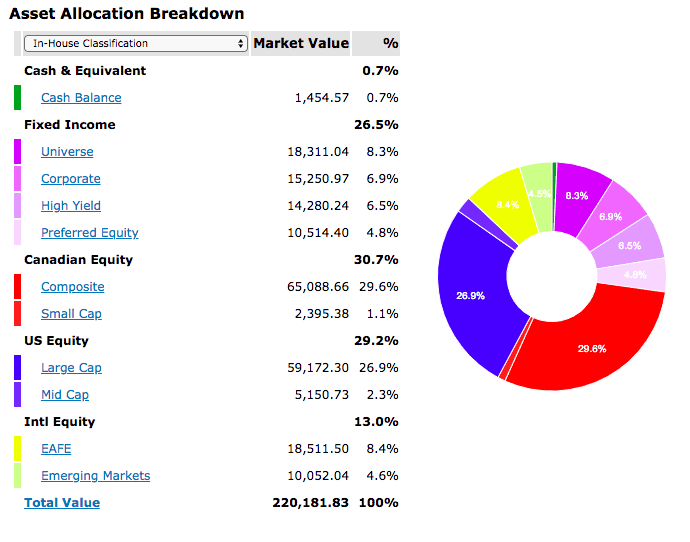

3) Use one ETF to take a position your cash into every sort of asset. So maybe there’s one ETF for Canadian shares, one ETF for American shares, one ETF for rising markets, one ETF for shares in developed markets that aren’t Canada and the USA, and possibly one or two ETFs for bonds.

That fundamental construction doesn’t change in terms of Justwealth. However – and that is key – what’s totally different is the precise ETFs that Justwealth selects, in addition to the quantity of every ETF that they maintain in your particular portfolio.

Justwealth has stated from Day 1 that they’re “extra FIN than TECH” in terms of being a fintech firm. They’ve confirmed that that is true by having a sturdy aggressive benefit in terms of portfolio composition.

Most robo advisors are both owned by a giant guardian firm, or have a aspect take care of a big ETF firm. These offers and possession buildings imply that their robo advisors use solely the ETFs put out by the guardian firm or associate firm – even when there’s a higher ETF obtainable that covers the identical asset class.

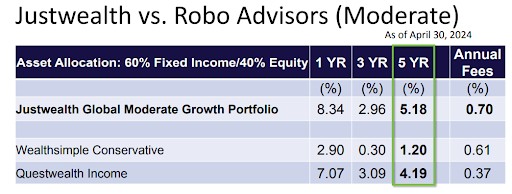

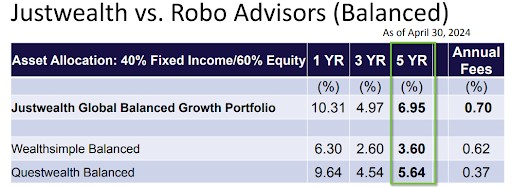

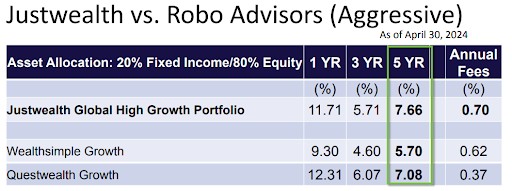

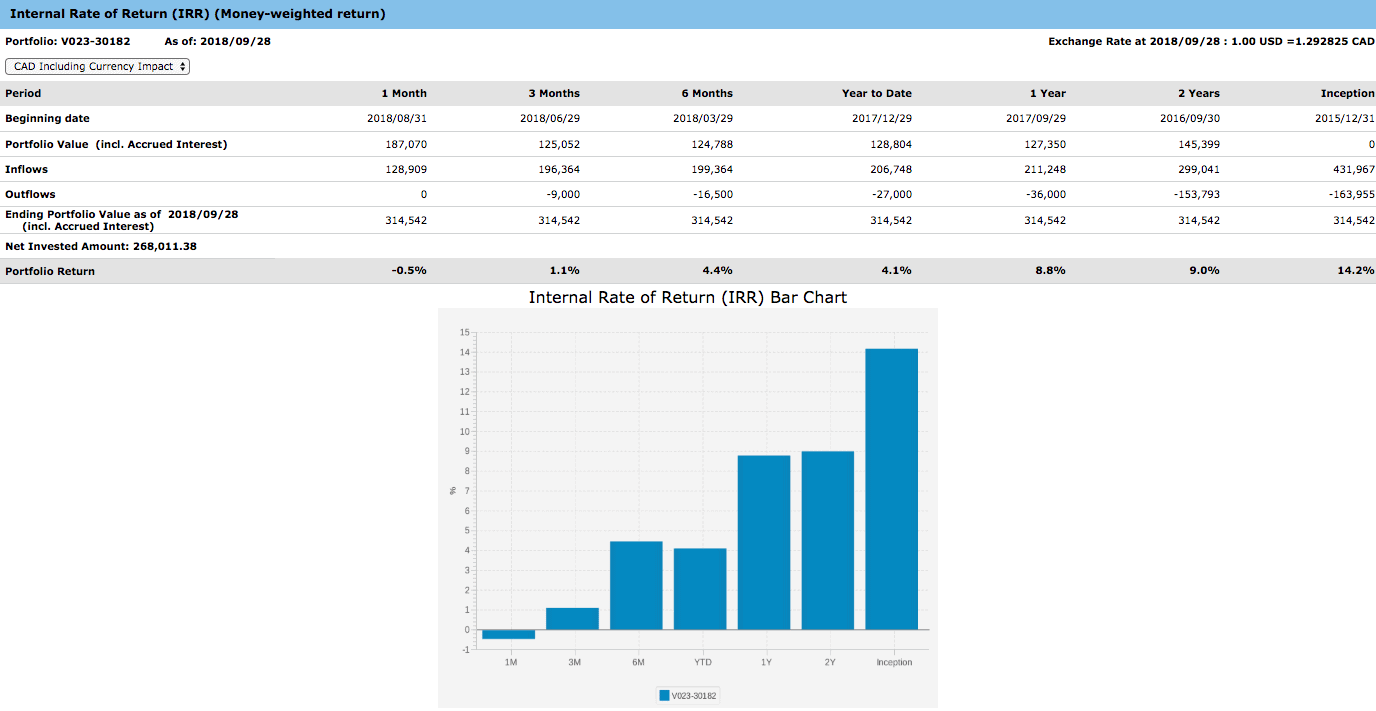

Justwealth is a completely impartial agency, and consequently can select the very best ETF obtainable in every asset class it doesn’t matter what firm has created the ETF. These small benefits – together with superior threat administration – has allowed Justwealth to realize the very best after-fee returns of any of Canada’s robo advisors (as you’ll be able to see under and as reported within the Globe and Mail.

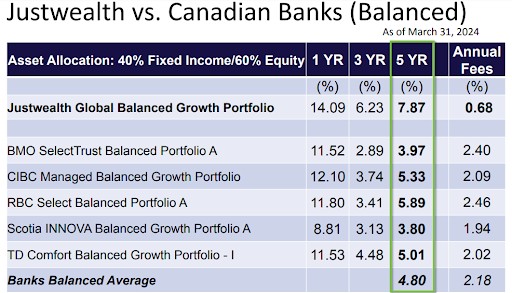

The very first thing to notice right here is simply how terrible the efficiency has been amongst these actively managed financial institution portfolios in comparison with the robo advisors. This isn’t an accident! The dual problems with horrible energetic administration mixed with loopy excessive charges are going to result in financial institution mutual funds ALWAYS shedding over a protracted sufficient time interval.

In relation to Justwealth’s outperformance vs Wealthsimple (Canada’s hottest robo advisor) Rob Carrick wrote with regard to Wealthsimple that the “Efficiency of its robo advisor portfolios doesn’t impress.”

The reality is that Wealthsimple has modified their portfolio allocation a number of occasions, making fairly ridiculous errors when it got here to bond allocation methods and including in gold publicity (amongst different errors). They’re now specializing in cross-selling dangerous crypto property and doing every kind of different ineffective promotion of their concentrate on the underside line.

Ben Felix as additionally written within the Globe and Mail in regards to the errors that Wealthsimple has made over the past 5 years, and particulars all of the tinkering that the corporate has performed (thus indicating that they don’t think about their preliminary “set-it-and-leave-it-alone” investing philosophy).

These returns don’t embody the added tax benefits that Justwealth brings to the ready within the type of tax-loss harvesting and the truth that they perceive the variations through which optimum property to carry in a registered account (like an RRSP, TFSA, or RESP) versus a non-registered account.

Is Justwealth Secure?

Sure!

Justwealth is as secure as any monetary establishment in Canada.

That’s to say that they put an incredible quantity of effort into cybersecurity, and your investments are shielded from fraud by the Canadian Investor Safety Fund as much as a most of $1,000,000 per account.

Even higher, is that not like the advisor that you simply’re doubtless coping with down at your native financial institution or credit score union department, Justwealth is legally accredited as a Portfolio Supervisor. That title means which might be legally liable for managing your cash in your personal finest curiosity – and never merely to get the utmost fee out of your portfolio. You’d suppose that this authorized standing could be customary throughout Canada, however it’s truly not! In actual fact, the time period “monetary advisor” doesn’t actually have any authorized standing in any respect!

Justwealth Charges

Each robo advisor (together with Justwealth) has two layers of charges:

1) The charges that they cost you in an effort to become profitable as an organization. These are normally referred to as the corporate’s administration price, and it’s expressed as a share of the sum of money you present have invested.

2) The charges that the funding corporations that create the ETFs cost you. These charges are additionally known as administration charges – or Administration Expense Ratios (MERs).

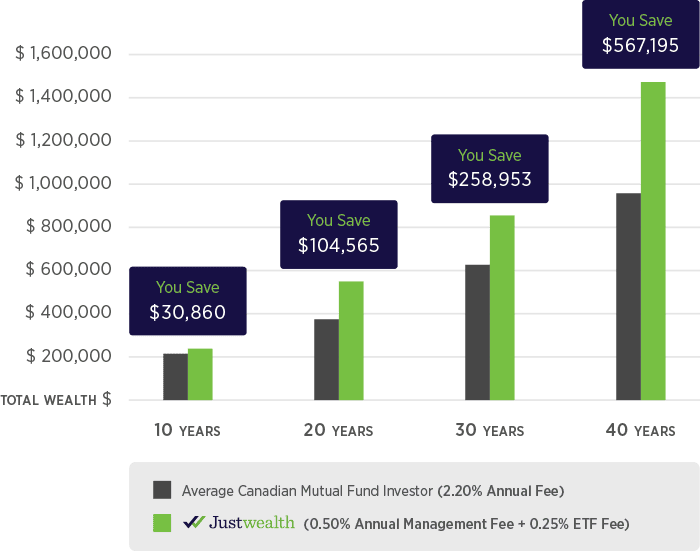

Justwealth’s administration price of 0.40% to 0.50% may be very aggressive with their rivals – and MUCH decrease than what Canadian mutual funds cost!

Relying on what portfolio(s) you choose in your nest egg, the ETF price will in all probability be within the 0.15%-0.25% vary. Which means the overall charges that you simply’ll pay might be 0.55%-0.75%. That distinction vs the standard mutual funds that your financial institution or credit score union is pedaling provides up in a rush (as you’ll be able to see under)!

Justwealth Assessment: Monetary Planning

One of many huge benefits that Justwealth has over most different Canadian robo advisors is that they provide a way more complete monetary planning facet to their providers.

Right here’s the deal: Most robo advisors will declare that they’ve some model of monetary planning obtainable. From what I’ve personally skilled, and from the suggestions I’ve gotten on lots of of web site feedback and emails over the past eight years, I do know that what that “monetary planning” promise truly means in observe can differ broadly.

To be honest, each robo has some model of “e mail us or soar on a chat and we’ll reply your easy query about the best way to use a TFSA or RRSP – or one thing related.”

Justwealth takes it to a different stage although. Proper from Day 1 you get a devoted Private Portfolio Supervisor (who has a fiduciary accountability to you). This individual will information you thru tax-efficient portfolios, tax-loss harvesting, and clarify any rebalancing strikes which have been made inside your account.

The one different robo advisor in Canada that gives something like that is CI Direct (the previous Wealthbar) – and so they don’t provide almost the account choices or funding returns that Wealthbar does.

There’s substantial worth in having somebody obtainable to reply questions, and who’s personally conversant in your wants and portfolio targets. This planning assist – together with the sheer ease of getting began – are the primary causes somebody may select to go along with a Justwealth portfolio versus DIYing it with an all-in-one ETF.

So what does having a devoted Private Portfolio Supervisor and a help workforce – with a fiduciary obligation – imply?

It signifies that when Justwealth assigns you a portfolio supervisor and workforce, that workforce is obligated to place YOU first. Not Justwealth, not something that will profit them, however you and your particular wants. Justwealth Portfolio Managers are registered with a provincial Securities Fee as an Advising Consultant. This requires a excessive diploma of {qualifications}, expertise, and the obligation to behave with honesty, care, and in the very best curiosity of your consumer.

Justwealth vs Wealthsimple

All playing cards on the desk right here, I used to be beforehand a giant fan of Wealthsimple, and as Canada’s largest robo advisor they clearly nonetheless have rather a lot going for them. Their consumer interface, and the straightforward fantastic thing about their design is just the prettiest on-line platform I’ve ever interacted with.

That stated, they’ve made some fairly huge errors over the previous few years, together with:

- Shifting their focus away from the Wealthsimple robo advisor (generally known as Wealthsimple Make investments) to higher-profit areas like buying and selling cryptocurrency.

- Encouraging prospects to commerce in dangerous new areas like personal credit score and crypto versus holding issues easy with a concentrate on fundamental index investing rules.

- Making some actually rookie errors in terms of bond ETF choice.

- Together with gold of their portfolios (gold is an terrible long run funding).

- Not including extra customization to their 3 Wealthsimple Make investments choices (Justwealth has over 80 distinctive portfolios obtainable for you).

So given all of these info, it was merely not possible to maintain them within the prime spot. Right here’s the direct Wealthsimple vs Justwealth comparability:

|

|

|

|

Variety of Portfolios Obtainable |

Over 80 totally different portfolios engineered to both develop your wealth, generate revenue, or protect wealth. |

3 customary portfolios, plus SRI and Halal choices. |

|

Personalised Monetary Advisor |

||

|

5-year returns (balanced portfolio) |

||

|

$100-$500 Prompt Money Again |

||

*5-year return numbers are taken from Moneysense as a impartial Third-party comparability

A Peak Inside Justwealth

Justwealth Cellular App Assessment

Newly launched close to the top of 2023, the Justwealth App at present has an ideal 5-star score after 10 critiques within the Apple App Retailer.

Very like their web site, it’s not the fanciest app that you simply’re prone to see, however you are able to do the next pretty simple:

- Test the present worth of your portfolio.

- See your transactions.

- Add or withdraw funds.

- Set-up an auto-contribution plan for the last word comfort.

- Create a brand new funding account.

Find out how to Open a Justwealth Account

to be sure you get your bonus money, and 10 minutes later you ought to be properly into the method of choosing which portfolio(s) work finest in your money.

- Your social insurance coverage quantity.

- Your principal chequing/present account info (route and transit quantity might be discovered on a cheque or in your on-line banking profile if you happen to go to the “cancelled cheque” possibility).

- Images (each side) of government-issued ID equivalent to a passport or drivers license.

You’ll then be requested for some info in your employment, funds, and investing expertise in an effort to streamline you into the very best possibility in your distinctive scenario. You may e-sign most account kinds whereas onboarding, making the method a lot quicker than it was once to open an funding account.

Justwealth Forms of Accounts

Justwealth affords the everyday accounts that you’d count on from a robo advisor. These are:

- RRSP

- Spousal RRSP

- TFSA

- Non-Registered account

- RRIF

- FHSA

- RESP

- LIRA

- LIF

*You can even open a US greenback account for a few of these choices.

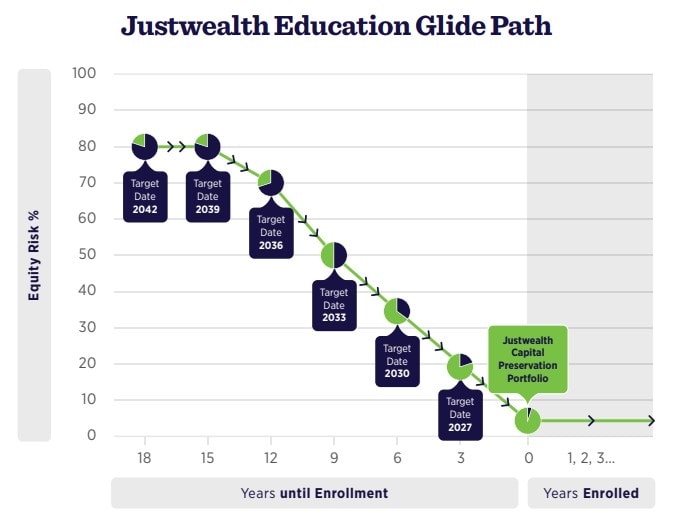

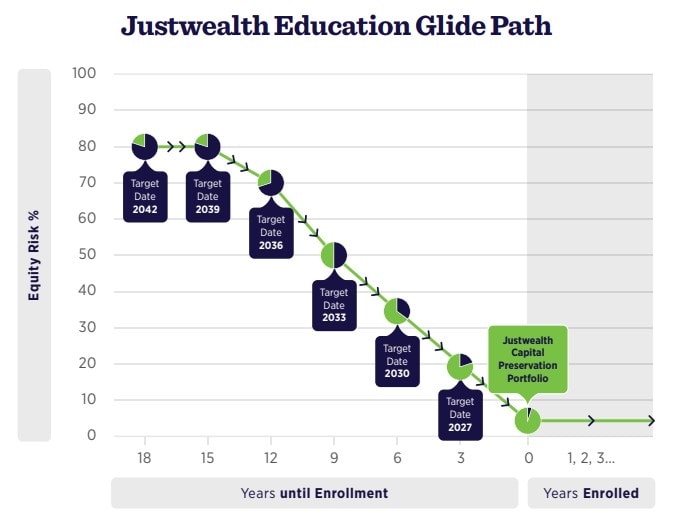

Proper now, they’re the one on-line funding supervisor in Canada that gives Training Goal Date Portfolios. They’re designed to develop along with your youngster and robotically rebalance because the goal date approaches. Which means that by the point your youngster graduates, the cash might be prepared for them. One other perk of the Justwealth RESP is that there isn’t any minimal requirement to open the sort of account.

As for different Justwealth accounts, the minimal quantity to get began is a hefty $5,000. Whereas this is perhaps positive for somebody transferring an account, it’s a big sum for anybody youthful and simply beginning out. This can be a huge disadvantage in my eyes, particularly when different robo advisors together with Wealthsimple don’t have any minimal requirement.

Justwealth Assessment: The RESP Benefit

Maybe the product that almost all put Justwealth on the map was their RESP portfolio. Regardless that it has been much-commented on by Canadian monetary writers, no different robo advisor has rolled out something related.

The thought is fairly cool. Basically, what Justwealth did was take the goal date fund concept and adapt it to RESPs. Goal date funds are structured in order that as traders get nearer to retirement, their funding portfolio robotically shifts to much less and fewer dangerous property – no want for the investor to fret about what the proper stability is or anything.

Justwealth’s RESP funds are principally the identical premise. If it’s nonetheless 10+ years earlier than your baby is headed to school or college, then you’ll be able to afford to take a little bit extra threat in your portfolio, whereas in the event that they’re off to the ivory tower subsequent yr, you then in all probability don’t need to be taking a lot threat in any respect. Justwealth will deal with that transition with their goal date fund.

As you’ll be able to see above, you merely choose the goal date that your youngster might be headed to college, and Justwealth will slowly transfer you from a portfolio that has more-stock-and-less-bonds to a portfolio that doesn’t embody any shares in any respect since you’ll be utilizing the RESP cash within the subsequent few years.

If my dad and mom would have used the sort of account as an alternative of a fundamental excessive curiosity financial savings account possibility that was the default at their financial institution (and which the financial institution little doubt made some huge cash off of) I might have went to high school with 1000’s of {dollars} extra in my RESP accounts (someplace round 40-60% resulting from how properly Canadian shares did between 1995 and 2009).

Justwealth FHSA Account

In 2023 the Federal Authorities launched the First House Financial savings Account (FHSA) and Justwealth was one of many first robo advisors to supply an FHSA account. Right here’s a fast have a look at the foundations behind the Justwealth FHSA Account:

- Applies to Canadian residents aged 18-71 who didn’t stay in a house they (or their partner) owned within the final 4 years

- You may contribute as much as $8,000 per yr, to a most contribution of $40,000 over 15 years

- The annual deadline to contribute is December thirty first

- You’ve gotten 15 years from the day you open the account to make use of your FHSA to buy your first residence

- Contribution room solely begins being obtainable within the yr you open your account

- Solely $8K of unused contribution room carries ahead in any yr, so you’ll be able to by no means have greater than $16,000 of contribution room

- Your funding grows tax free so long as you buy a qualifying first residence – if you happen to don’t find yourself shopping for a house, you pay tax on the features, or you’ll be able to switch the cash to your RRSP with out affecting your RRSP contribution room

Justwealth is exclusive amongst robo advisors in that they already had the right resolution for FHSA accounts resulting from their creation of target-date RESP accounts. The principal of adjusting threat with regard to your time horizon may be very related between an RESP and an FHSA.

In case you are prone to want the cash in 3 years or much less, you need to be in extraordinarily conservative investments. For those who’re 10+ years away from needing entry to your capital, then it’s statistically very doubtless you’d be finest served by an account that balances shares and bonds a little bit extra.

What ETFs Does Justwealth Use?

Justwealth prides itself on utilizing the very best ETFs of their portfolio – no matter which firm creates them.

That’s a key distinguishing characteristic from different robo advisors who typically solely use in-house ETFs (for instance BMO Smartfolio goes to make use of largely BMO ETFs) or ETF suppliers who they’ve a commission-based settlement with – even when these ETFs aren’t “finest at school”.

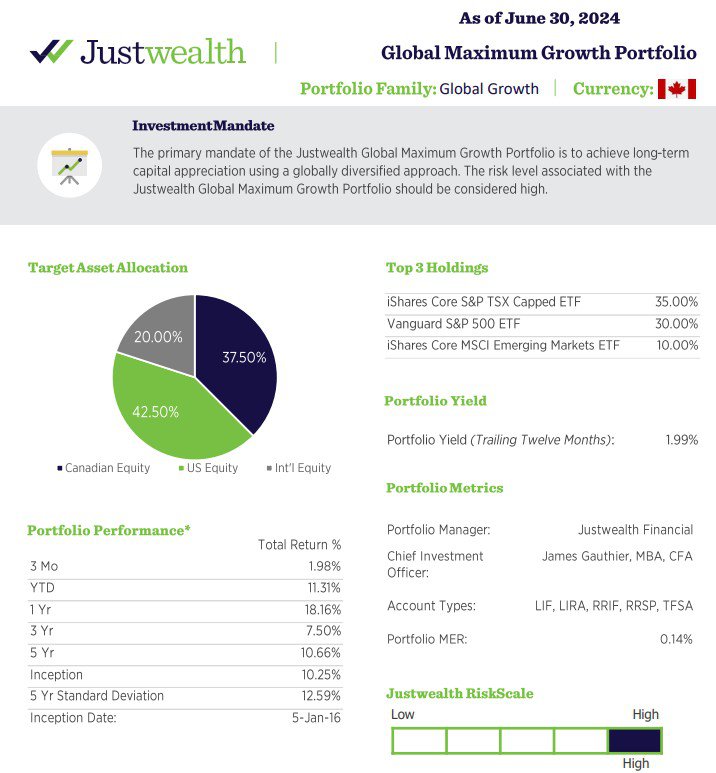

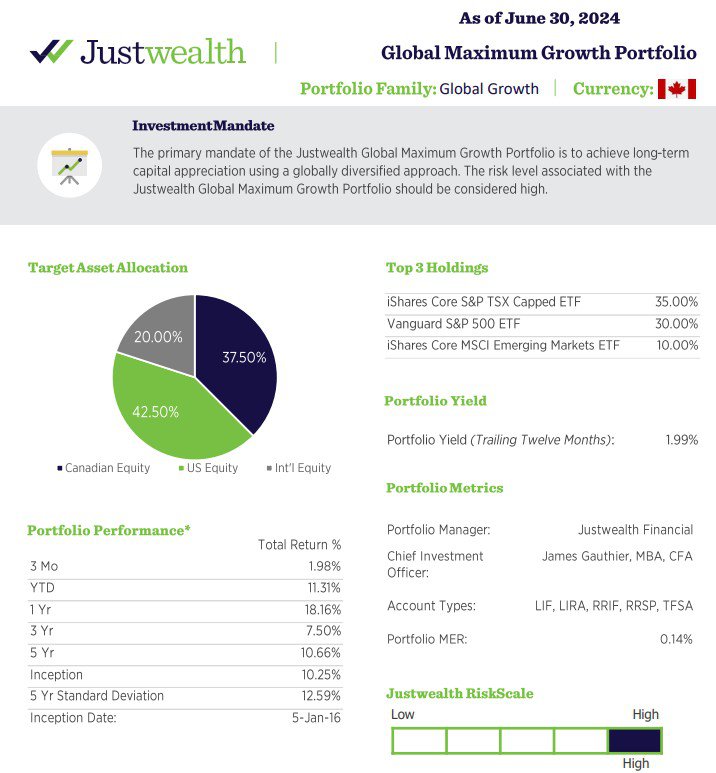

By taking a look at your fund’s little info profile (just like the World Progress Portfolio under) you’ll be able to see precisely what ETFs your cash might be invested into in addition to probably the most related portfolio metrics equivalent to yield, account compatibility, and MER.

For my part, not being restricted to particular ETF companions is a significant benefit for Justwealth and provides them a reputable option to say that they’re the one robo advisor that’s not handcuffed to some extent of their quest to get the very best ETF for his or her portfolio.

Who Is Justwealth?

Whereas Justwealth has been onerous at work the previous few years to up their know-how recreation (together with main updates in 2023 and 2024). At this time they make use of a Chief Expertise Officer, however at their roots, this firm is a monetary administration agency. Their bread and butter is offering the very best monetary recommendation doable, and designing the very best asset allocation for every of their quite a few portfolios.

I snagged a number of screenshots from Justwealth’s “about us” web page to focus on the backgrounds these people have.

Each Andrew Kirkland and James Gauthier are old fashioned funding professionals. Andrew is a Licensed Monetary Planner and Chartered Funding Supervisor that has over 15 years of expertise within the monetary trade.

James Gauthier (arguably the man most liable for Justwealth’s outperformance) has been liable for selecting property to place in portfolios for over 25 years. Along with doubtless being probably the most expertise asset allocator at any of Canada’s robo advisors, James can be a Licensed Monetary Analyst. Richard Burton-Williams has an MBA from the distinguished College of Chicago Sales space Faculty of Enterprise.

The underside line is that these aren’t “tech start-up bros”. These are skilled monetary professionals who come from many years of serving to people select the very best investments for his or her particular threat profiles.

Justwealth’s Portfolio Assessment Service

If you wish to take a check run on the type of customer support and monetary experience that you simply’ll be getting with Justwealth I like to recommend testing their free portfolio evaluate service. So far as I’m conscious, they’re the one Canadian robo advisor to supply such an fascinating free have a look at your present investments.

The thought is that you simply submit a have a look at your present investments, and in a few days you’ll get a report from one among Justwealth’s portfolio managers that outlines how your present portfolio stacks up within the areas of charges, funding diversification, account construction, and tax effectivity.

For those who’re a longtime MDJ reader then chances are high there gained’t be a lot in there that you simply weren’t conscious of already, however I reckon for many Canadians which have been getting their investments and recommendation from Canadian banks and credit score unions, they is perhaps in for a little bit of a shock.

Justwealth Assessment: Is It Proper for You?

As you’ve in all probability gathered from studying my Justwealth evaluate, I’m very impressed with the evolution of the corporate over the past eight years.

In case you are the kind that doesn’t thoughts placing in a number of afternoons of studying, and doesn’t thoughts performing some rebalancing math a number of occasions a yr, then I’d in all probability persist with opening up a DIY on-line brokerage account and utilizing our greatest ETFs in Canada checklist to construct your personal portfolio.

Most Canadians aren’t “that sort” although. Most individuals simply need the best, most handy option to develop their investments – with out a bunch of individuals stealing cash from them through excessive charges and dangerous funding choices. If they will get some strong monetary planning in terms of tax effectivity as a part of the discount – even higher!

On the finish of the day, that’s what Justwealth affords: The most straightforward and handy option to take a chunk of your paycheque, and make investments it in an evidence-based method for the long-term.