KPIT Applied sciences Ltd – Shaping the way forward for mobility

Based in 2018 and primarily based in Pune, KPIT Applied sciences Ltd. is a number one software program and system integration companion for the worldwide mobility ecosystem. The corporate is a trusted collaborator for main automotive business leaders, having established over 25 strategic partnerships with Authentic Tools Producers (OEMs) and Tier 1 suppliers to drive mobility transformation. KPIT’s technique focuses on constructing deep, long-term relationships with choose mobility OEMs. It has established enduring partnerships with key gamers like Honda, Renault, BMW, PACCAR, Navistar, Stellantis, Jaguar, Volkswagen, and Mercedes-Benz. As of FY24, the corporate boasts a community of 30 centres of excellence, 700+ manufacturing packages, 75+ platforms and instruments that caters to 25+ OEMs/ Tier1 strategic companions.

Merchandise and Providers

The merchandise companies supplied by the corporate finds area utility in automobile engineering and design, E/E structure, community and middleware, software program and system integration, digital engineering, autonomous driving and Superior Driver Help System (ADAS), physique electronics, chassis, cockpit, propulsion and so on.

Subsidiaries: As of FY24, the corporate has 22 subsidiaries and one affiliate firm.

Funding Rationale

- Increasing order e book – The corporate secured a number of notable new offers in Q2FY25. A outstanding European automotive producer has chosen KPIT for a number of strategic tasks in autonomous, middleware, and diagnostics areas. Moreover, one other European automotive producer has entered strategic engagements with the corporate within the physique electronics, related, and electrical powertrain domains. In the US, the corporate has gained two new offers – one with a number one automotive producer within the electrical powertrain and related domains, and one other with a business automobile producer within the related, middleware, and powertrain sectors. Moreover, the corporate has secured a serious take care of a number one Asian automotive producer within the autonomous and powertrain domains.

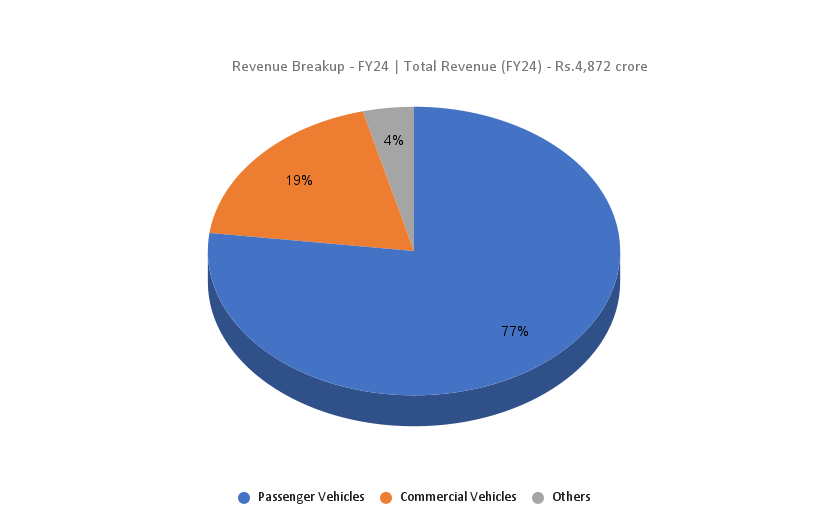

- Progress methods – Diversifying from its conventional passenger vehicles phase, KPIT is aiming to broaden its choices capitalising on the software program integration alternatives in off-highway and business autos (CV) phase. The corporate is dedicated to double its CV consumer base. It additionally has plans to develop capabilities to use its experience in different segments comparable to marine, railways, aviation and house. KPIT partnered with ZF Group, a world expertise firm supplying superior mobility merchandise and techniques, to advertise QORIX (a subsidiary of KPIT) as an unbiased firm with a give attention to growing world class automotive middleware stack. Constructing on its value-added companies, the corporate has acquired 26% stake (with an choice to additional enhance the stake) in Swiss primarily based N-Dream AG, an early mover in cloud-based gaming aggregation platform.

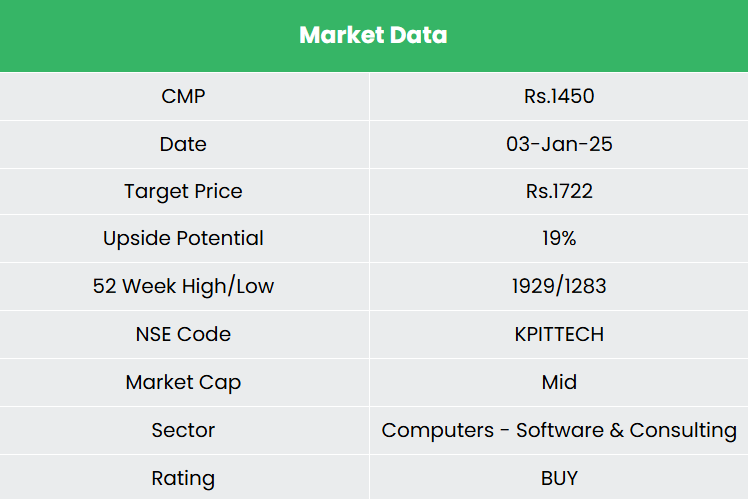

- Q2FY25 – Throughout the quarter, the corporate generated a income of Rs.1,471 crore, a rise of 23% in comparison with the Rs.1,199 crore of Q2FY24. This development was pushed by the Asia area and the middleware and powertrain segments. EBITDA improved by 28% from Rs.240 crore of Q2FY24 to Rs.306 crore of Q2FY25. Web revenue stood at Rs.204 crore, which is a rise of 45% from Rs.141 crore of the corresponding interval in earlier yr. Complete contract worth of recent offers gained in Q2FY25 stood at $ 207 million, with new offers coming from Europe, USA and Asia. The corporate has one of many lowest ranges of attrition within the business.

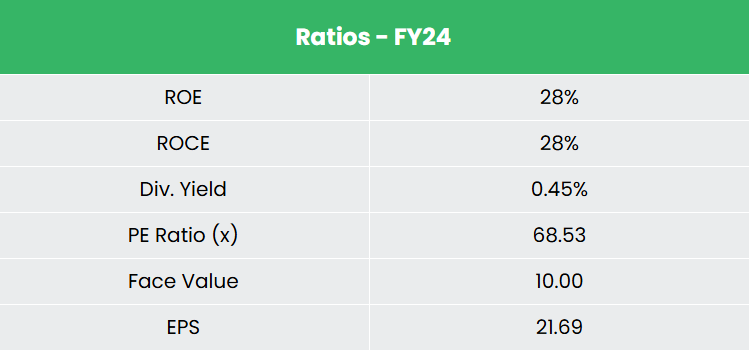

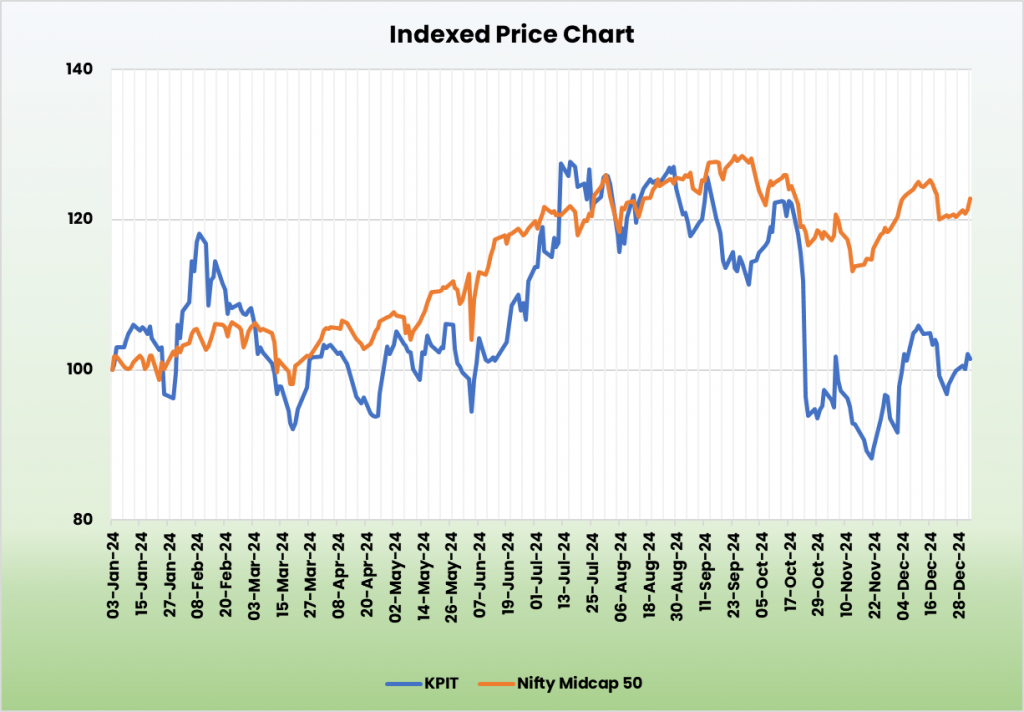

- FY24 – KPIT generated income of Rs.4,872 crore, a rise of 45% in comparison with FY23 income. Working revenue is at Rs.991 crore, up by 56% YoY. The corporate posted web revenue of Rs.595 crore, a rise of 56% YoY.

- Monetary efficiency – The corporate has generated income and PAT CAGR of 34% and 61% over the interval of three years (FY21-24). Common 3-year ROE & ROCE is round 27% and 31% for FY 21-24 interval. The corporate has a sturdy capital construction with a debt-to-equity ratio of 0.14.

Trade

The Indian vehicle business has lengthy been a dependable gauge of the financial system’s well being, given its important position in each macroeconomic development and technological progress. The sector is increasing, fuelled by robust international direct funding (FDI), rising exports, and eco-friendly initiatives, making it a horny funding alternative for international stakeholders. The rising middle-class revenue and a big youth inhabitants are driving demand for larger sophistication within the automotive market. This has resulted within the business present process a transition from conventional {hardware} to software-defined automobile (SDV) architectures, which is opening new income streams for mobility OEMs and is predicted to boost cost-efficiency, pace up function deployment, and enhance shopper experiences. Moreover, investments in AI are remodeling numerous sides of auto manufacturing, efficiency, and person interplay.

Progress Drivers

- Authorities initiatives Automotive Mission Plan 2026, scrappage coverage, production-linked incentive scheme are anticipated to drive the market.

- 100% FDI allowed below automated route within the vehicle sector.

- In March 2024, The Cupboard authorised an allocation of over Rs. 10,300 crore (US$ 1.2 billion) for the IndiaAI Mission, marking a big step in direction of bolstering India’s AI ecosystem.

Peer Evaluation

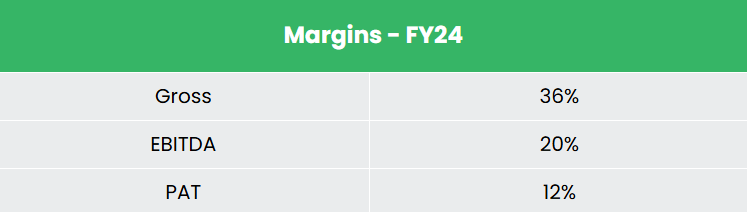

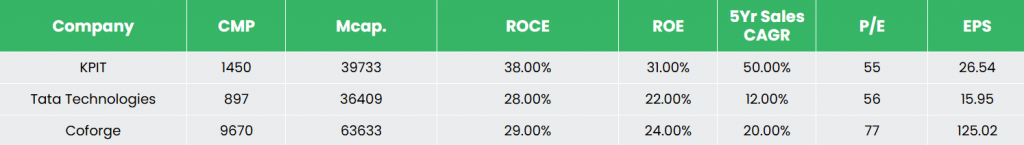

Rivals: Tata Applied sciences Ltd, Coforge Ltd and so on.

When in comparison with its friends, KPIT presents an inexpensive worth relative to its gross sales development and margin enlargement potential. It’s also producing higher returns from the invested capital, indicating optimum utilisation of funds.

Outlook

The corporate has supplied a cautious income forecast, projecting a development vary of 18-20% on the decrease finish, as a result of doable delays in undertaking commencements by purchasers. Nonetheless, it has elevated its revenue development forecast, now anticipating an increase of 0.2 to 0.3 share factors above the earlier estimate of 20.5%. The corporate plans to spice up profitability by securing extra fixed-price tasks. Administration can also be specializing in strategic partnerships and potential acquisitions to strengthen its market place. Leveraging its experience in rising applied sciences, together with deep consumer relationships and trusted partnerships, has led to important deal wins. Along with buying new offers from the present purchasers, the corporate is in discussions with new purchasers from Europe and America to construct long-term giant engagements.

Valuation

We anticipate the corporate to maintain its development momentum backed by giant deal wins and its confirmed execution capabilities. We advocate a BUY score within the inventory with the goal worth (TP) of Rs.1,722, 51x FY26E EPS.

Threat

- Deal delays – The corporate’s turnover may get impacted when there’s any delay in new undertaking launch by purchasers.

- Foreign exchange threat – The corporate has important operations in international markets and therefore is uncovered to foreign exchange threat. Any unexpected motion within the foreign exchange market can adversely have an effect on the corporate.

Be aware: Please be aware that this isn’t a advice and is meant just for instructional functions. So, kindly seek the advice of your monetary advisor earlier than investing.

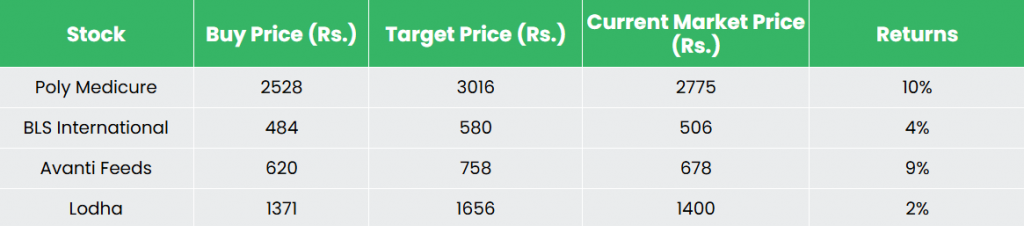

Recap of our earlier suggestions (As on 03 January 2024)

Different articles it’s possible you’ll like