On November 1, 2024, the previous AlphaCentric Strategic Revenue Fund was rebranded as AlphaCentric Actual Revenue Fund with a brand new sub-advisor, broader technique, and new expense ratio to accompany its new title.

CrossingBridge Advisors will handle the funding technique by using a workforce method. Portfolio managers are T. Kirk Whitney, CFA, who joined the agency as an analyst in 2013, Spencer Rolfe, who first joined in 2017, and David Sherman, CIO. CrossingBridge, with over $3.2 billion in property as of 8/31/24 was chosen to use a bottom-up, worth method to the technique.

The fund’s deal with “actual revenue” is new, however the agency’s just isn’t. All CrossingBridge methods begin with the identical philosophical assertion: “Return of principal is extra essential than return on principal.” Their hallmark is searching for undervalued income-producing investments having “ignored components” that result in worth appreciation. The fund will personal a mixture of bonds and shares to supply revenue and capital appreciation.

The revised funding mandate is to spend money on firms instantly or not directly related to actual property and actual property. Actual property contains hard-asset companies, pipeline homeowners, delivery firms, and so forth. The managers anticipate investing in some fairness and most well-liked securities, in addition to some debt.

Though it is a new devoted technique for CrossingBridge, they’ve positions – asset-backed securities, mortgage-backed securities, and a few actual property firms – of their current funds that might qualify for the Actual Revenue portfolio. This would be the first mutual fund by which CrossingBridge invests a considerable allocation in equities, so buyers ought to anticipate considerably larger volatility than CrossingBridge’s conventional choices.

The opposite warning is that CrossingBridge is inheriting a portfolio constructed by different managers with different disciplines. It’s regular for funds to see a good quantity of portfolio turnover of their first month or months. Potential buyers may wish to wait a bit earlier than leaping in.

Three the explanation why the fund could also be price your consideration.

Onerous property are engaging property.

These actual property/onerous asset investments are essentially totally different from pure monetary asset investments. Forests, farmland, pipelines, and warehouses are all long-lasting bodily objects that generate predictable revenue streams over predictable time frames. That signifies that they’ve a sequence of points of interest:

- Diversification: These property can cut back portfolio danger by offering a counterbalance to monetary property. Actual property, for instance, has a weak constructive relationship with the inventory market and a weak unfavourable relationship with bonds.

- Inflation safety: Onerous property have a tendency to keep up or improve in worth over time, whilst inflation rises. Actual asset returns are typically correlated with inflation, which signifies that they rise as inflation does.

- Revenue technology: Many onerous property, comparable to actual property and commodities, can generate common revenue streams.

- Lengthy-term appreciation: Onerous property can admire over the long run, offering potential for capital positive aspects. That’s most pronounced for those who’re counting on a affected person worth investor to accumulate them at costs under their intrinsic values.

Many advisers take into account these to be “different investments” that may occupy 5-20% of a portfolio.

The CrossingBridge workforce are distinctive stewards of your cash.

CrossingBridge advises, or sub-advises, six open-ended mutual funds, and one exchange-traded fund. The newest addition was the Nordic Excessive Revenue Bond. All are income-oriented, lively, and capacity-constrained. As well as, all have top-tier risk-adjusted returns since inception.

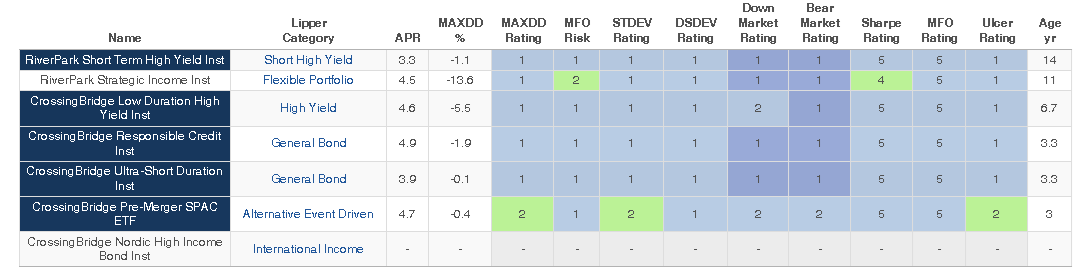

MFO Premium permits us to trace funds, together with ETFs, on an uncommon array of measures of risk-awareness, consistency, and risk-adjusted-performance. For the sake of these not keen to obsess over whether or not an Ulcer Index of 1.3 is good, we all the time current color-coded rankings. Blue, in varied shades, is all the time the highest tier, adopted by inexperienced, yellow, orange, and crimson. Under are all the danger and risk-return rankings for all of the funds suggested or sub-advised by CrossingBridge since inception.

Whole and risk-adjusted efficiency since inception, all CrossingBridge funds (by 9/30/2024)

Supply: MFO Premium fund screener and Lipper international dataset. The class assignments are Lipper’s; their validity is, in fact, open to dialogue.

Right here’s the brief model: each fund, by nearly each measure, has been a top-tier performer since launch. That displays, in our judgment, the virtues of each an intense dislike of dropping buyers’ cash and a willingness to go the place bigger companies can not.

Some members of MFO’s dialogue group fear that a number of the new funds are successfully clones of current ones. To evaluate that concern, we ran the three-year correlations between the entire funds that CrossingBridge advises or subadvises.

| RPHIX | RSIIX | CBLDX | CBRDX | CBUDX | SPC | |

| RiverPark Quick Time period Excessive Yield | 1.00 | |||||

| RiverPark Strategic Revenue | 0.54 | 1.00 | ||||

| CrossingBridge Low Length Excessive Yield | 0.70 | 0.81 | 1.00 | |||

| CrossingBridge Accountable Credit score | 0.60 | 0.67 | 0.75 | 1.00 | ||

| CrossingBridge Extremely-Quick Length | 0.80 | 0.48 | 0.71 | 0.45 | 1.00 | |

| CrossingBridge Pre-Merger SPAC ETF | 0.14 | 0.36 | 0.33 | 0.13 | 0.28 | 1.00 |

The correlations are persistently low; every new CrossingBridge fund brings one thing new to the desk.

The fund they’re inheriting is sort of small, about $55 million in property, and CrossingBridge already has substantial investments in actual property and actual property in its different funds, so the adoption poses minimal extra stress on administration.

A worth-oriented onerous asset portfolio affords affordable revenue and affordable development.

Mr. Sherman was clear that this fund is more likely to expertise “extra volatility than our Strategic Revenue Fund with larger upside in comparison with a high-yield bond index. We have now a bias towards draw back safety so we’re taking a look at fixed-income plus fixed-income-like fairness. That may provide considerably decrease volatility than a inventory/bond hybrid fund however may also doubtless have much less upside.” The yield of a portfolio like that is “most likely 6-7%” and lively administration of the portfolio has the prospect of including 150-250 bps when measured over affordable time frames.

Web site: CrossingBridge Advisors and AlphaCentric Actual Revenue Fund. On the level of publication, AlphaCentric had solely begun updating the fund’s pages to replicate these adjustments; for instance, the previous administration workforce was nonetheless listed. People searching for to know CrossingBridge’s method may begin with their web site, test the Company Finance Institute’s overview of onerous or actual property, after which test again with AlphaCentric.