“For the younger the times go quick and the years go sluggish; for the outdated the times go sluggish and the years go quick.” – Anna Quindlen, A lot of Candles, Loads of Cake: A Memoir of a Girl’s Life.

Secular bear markets with low returns alongside excessive volatility usually deter youthful traders from beginning to make investments, but they provide large shopping for alternatives. Prioritizing the long-term want to avoid wasting for retirement over short-term curiosity is one other main hurdle to beginning to make investments.

I wrote Dwelling Paycheck To Paycheck and the Position of Monetary Counselors to indicate that about seventy-five p.c of Individuals don’t have sufficient saved to cowl three months of dwelling bills. In line with surveys, many individuals are selecting to overspend on groceries, eating out, clothes, leisure, meals supply companies, pets, journey, and/or alcohol. How a lot would an individual who saved and invested 5 {dollars} per weekday have on the finish of ten years in a secular bear market?

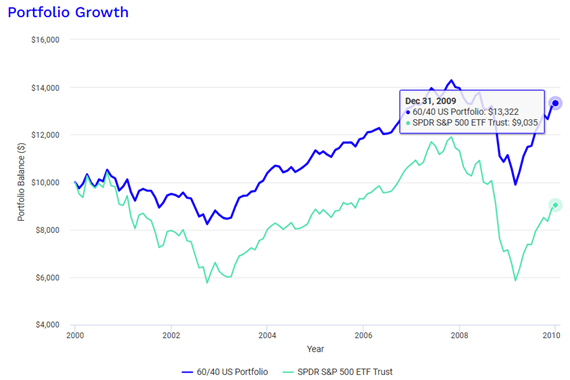

As the bottom case, Determine #1 reveals how $10,000 invested in 2000 would have carried out through the bursting of the Dotcom Bubble and the Nice Monetary Disaster. The standard 60% inventory/40% bond portfolio would have returned about 3% over the ten-year interval, barely beating inflation.

Determine #1: Development of $10,000 within the 2000 – 2010 Secular Bear Market

Supply: Writer Utilizing Portfolio Visualizer – Backtest Portfolio – Development of $10,000

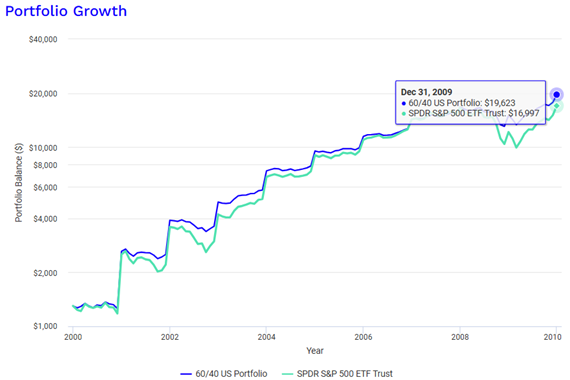

Determine #2 reveals the identical secular bear marketplace for somebody who begins with $1,300 and contributes that quantity annually adjusted for inflation. By 2010, the investor would have been saving about $1,660 per yr. The investor would have been “shopping for low” and was not considerably harm by investing 100% in shares. The annualized return would have been 31%.

Determine #2: Funding Basis Throughout a Secular Bear Market

Supply: Writer Utilizing Portfolio Visualizer – Backtest Portfolio – Greenback Value Averaging $1,300 / yr

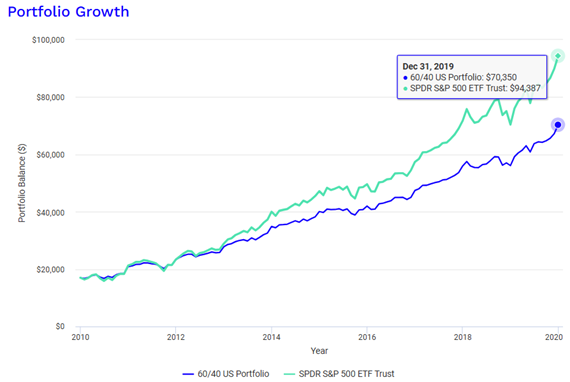

Saving $15,000 to $20,000 in ten years would have offered a springboard for the subsequent ten years when a secular bull market began. The $16,997 on the finish of 2010 would have grown to $42,328 by the top of 2019 if invested within the S&P 500, however by contributing $1,660 per yr adjusted for inflation, the portfolio would have grown to $94,387 as proven in Determine #3.

Determine #3: Development Spurt Throughout a Secular Bull Market

Supply: Writer Utilizing Portfolio Visualizer – Backtest Portfolio – Sequence Of Return Threat – $1 Million with 4% withdrawal / yr

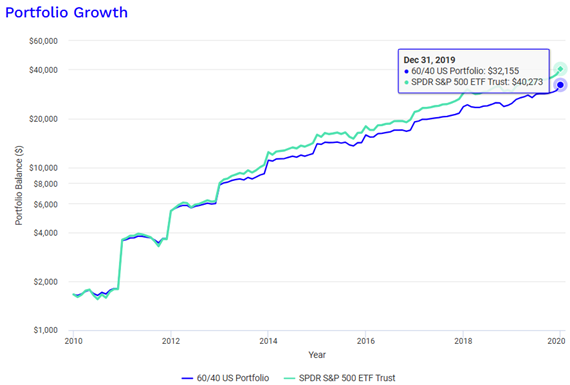

What if our younger investor skipped the secular bear market from 2000 to 2010 and began investing $5 per day adjusted for inflation from 2000 ($1,660 per yr)? If one started investing in 2010 with $1,660 within the S&P 500, the quantity portfolio would have grown to $40,273 in comparison with $94387 had they been investing for the total 2000 to 2019 interval. The Lesson For Younger Traders: Time available in the market is extra necessary than timing the market.

Determine #4: Time Within the Market Is Extra Vital Than Timing the Market

Supply: Writer Utilizing Portfolio Visualizer – Backtest Portfolio – Sequence Of Return Threat – $1 Million with 4% withdrawal / yr

The actual world implication is that saving $5 per working day is not going to obtain the elusive million-dollar retirement portfolio, however it’s a begin. Matt Krantz wrote If You’d Maxed Out Your 401(ok) for the Final 30 Years, You’d Have This A lot at The Motley Idiot. He concluded that an individual with an preliminary funding of $7,313 in 1988 which was the utmost allowed for a 401(ok) that yr saved investing on the most 401(ok) restrict, she or he would have amassed a $1.4 million by 2018 not together with employer matches. He assumed a beginning glide path stock-to-bond ratio of 80% shares. Nevertheless, he added catch-up contributions at age 50.

I used Retirement Financial savings by Age: Averages, Medians, Percentiles US by DQYDJ, and Practically half of American households haven’t any retirement financial savings by USA Info to make the next generalizations. Retirement financial savings by age for somebody nearing retirement present that roughly one in seven folks approaching retirement has about a million {dollars} in monetary property. Monetary property exclude dwelling fairness which is included in internet price calculations. The median family approaching retirement age has round $60,000 in retirement financial savings.

Jessica Walrack at U.S. Information and World Report explains in “How A lot You Ought to Save by Month and by Age?” that individuals ought to develop a customized financial savings method. She suggests devoting twenty p.c of 1’s paycheck in direction of financial savings and investing if doable. She provides {that a} affordable goal for beginning a financial savings plan is to have the equal of 1 yr of wage saved by age thirty and thrice by age forty. Essentially the most dependable method to begin is by automating the method.

I match the instance by Mr. Krantz pretty intently. Within the early 1990’s my financial savings was very modest. As a two-income family, we started contributing the utmost to retirement financial savings. We have been lucky sufficient to seek out employers with good advantages and with pensions and stick with them till retirement. We made catch-up contributions when eligible. We invested in our properties and maintained emergency financial savings. One breakthrough got here for me within the mid-2000s once I began studying retirement planning books like Retire Safe!: A Information To Getting The Most Out Of What You’ve Bought by James Lange as a result of I realized concerning the significance of monetary planning and the impression of asset location on lifetime taxes. Lesson For Younger Traders: Enhance your monetary literacy.

As a part of my very own monetary planning, I realized concerning the large impression that working within the latter years earlier than retirement makes since you proceed to contribute to financial savings as a substitute of withdrawing. Life in Retirement: Pre-Retiree Expectations and Retiree Realities by TransAmerica Heart for Retirement Research discovered that fifty-six p.c of retirees retired before deliberate. The commonest causes are health-related comparable to bodily limitations, incapacity, or ailing well being, and employment causes comparable to unhappiness, organizational modifications, job loss, and/or a buyout. I used to be lucky to work two years past my regular retirement date. Lesson For Younger Traders: Construct a “margin of security” into your plans for the sudden.

Throughout my dad and mom’ or my lifetimes, we skilled the nice despair, World Conflict II, Chilly Conflict, stagflation of the Nineteen Seventies, Dotcom Bubble, and Nice Monetary Disaster. It conditioned me to hope for the most effective however put together for the worst. Private financial savings charges through the Sixties and Nineteen Seventies have been between 10 and 13 p.c, however have fallen to round 4 p.c presently. Retirement recommendation within the books that I’ve learn not too long ago is to have “No Regrets”. I’ve been lucky to work internationally for eleven years, to place our son by means of college with no faculty debt, to have fairly good well being contemplating most cancers (cured), and to have a safe retirement. I remorse not having a greater work/life steadiness. I’m taking part in a some catch up. Lesson For Younger Traders: Have work/life steadiness which doesn’t sacrifice saving for emergencies and the long-term.

If in case you have not executed so but, strive setting some New 12 months’s resolutions to make your retirement planning profitable and persist with it.