Macrotech Builders Ltd – Constructing a greater life

MacroTech Builders Ltd., a part of the Lodha Group, is considered one of India’s largest residential actual property builders. Based in 1995 and based mostly in Mumbai, the corporate excels in luxurious, premium, and mid-income housing. With 65,000+ houses delivered throughout 100 mn sq. ft., its portfolio spans practically 40 initiatives. Increasing into annuity revenue streams, it has expanded into amenities administration, industrial warehousing, and leasing retail and workplace areas. The corporate has most operations in MMR, Pune, and Bengaluru.

Merchandise and Companies

- Residential actual property: Luxurious, premium, mid-income, and inexpensive segments (~60% gross sales from mid-income and inexpensive).

- Logistics & industrial parks: Constructed-to-suit constructions, customary amenities, and land parcels for manufacturing, warehousing, and information facilities.

- Business areas: Company workplaces, IT campuses, boutique workplaces.

- Retail initiatives: Procuring and leisure areas.

Subsidiaries: As of FY24, the corporate has 14 subsidiaries, 3 joint ventures and 4 affiliate firms.

Progress Methods

- Industrial Parks Enlargement: Diversifying into logistics and industrial parks with a 4,500-acre growth in Palava and Higher Thane, Mumbai, providing glorious connectivity through rail, highway, and ports.

- Concentrate on Information Facilities: Making ready the Palava web site for information middle use by promoting land parcels to main gamers and exploring annuity fashions via land leasing.

- Strategic Acquisitions: Acquired stakes in three industrial and logistics park entities for ₹307 crore and a 100% stake in Opexefi Companies, enhancing capabilities in industrial and digital infrastructure.

- Excessive-High quality Land Financial institution: Leveraging premium land holdings to draw main purchasers; Amazon India bought ~39 acres in Palava at ₹12 crore/acre for a hyper-scale information middle.

- Managed Enlargement: Participating in high-value offers with main information middle gamers, negotiating land gross sales at ₹20 crore/acre for future developments.

Operational Efficiency

Q2FY25

- Income: ₹2,630 crore, a 50% enhance from ₹1,750 crore in Q2FY24.

- Pre-Gross sales: Improved by 21% YoY, rising from ₹3,540 crore to ₹4,290 crore.

- Working Revenue: Grew 75%, reaching ₹960 crore in comparison with ₹550 crore in Q2FY24.

- Web Revenue: Doubled to ₹420 crore from ₹210 crore YoY.

- New Tasks: Signed two developments in North and East Bengaluru with a Gross Growth Worth (GDV) of ₹3,800 crore.

FY24

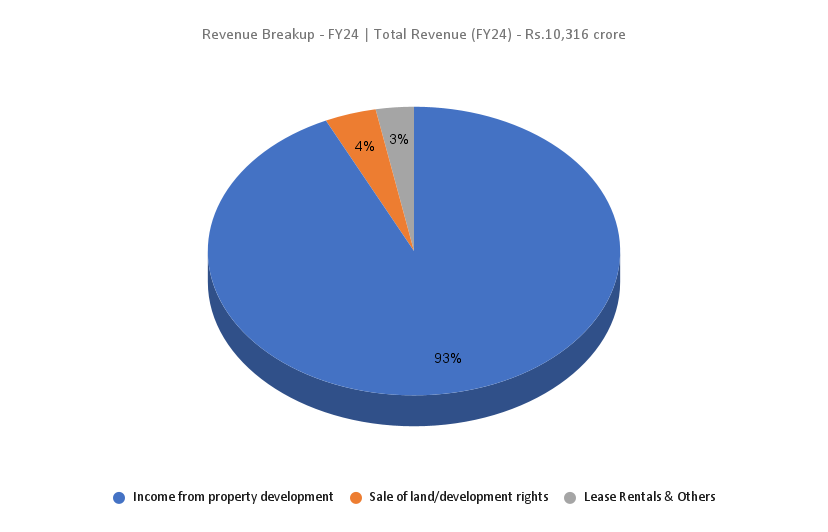

- Income: ₹10,316 crore, up 9% from FY23.

- Pre-Gross sales: ₹14,520 crore, a 20% YoY development.

- Working Revenue: ₹3,430 crore, a rise of 15% YoY.

- Web Revenue: ₹1,610 crore, a 19% YoY development.

- New Launches: 30 launches, together with new phases at present initiatives.

- Bengaluru Foray: Entered the Bengaluru market with two profitable mission launches.

Monetary Efficiency (FY21-24)

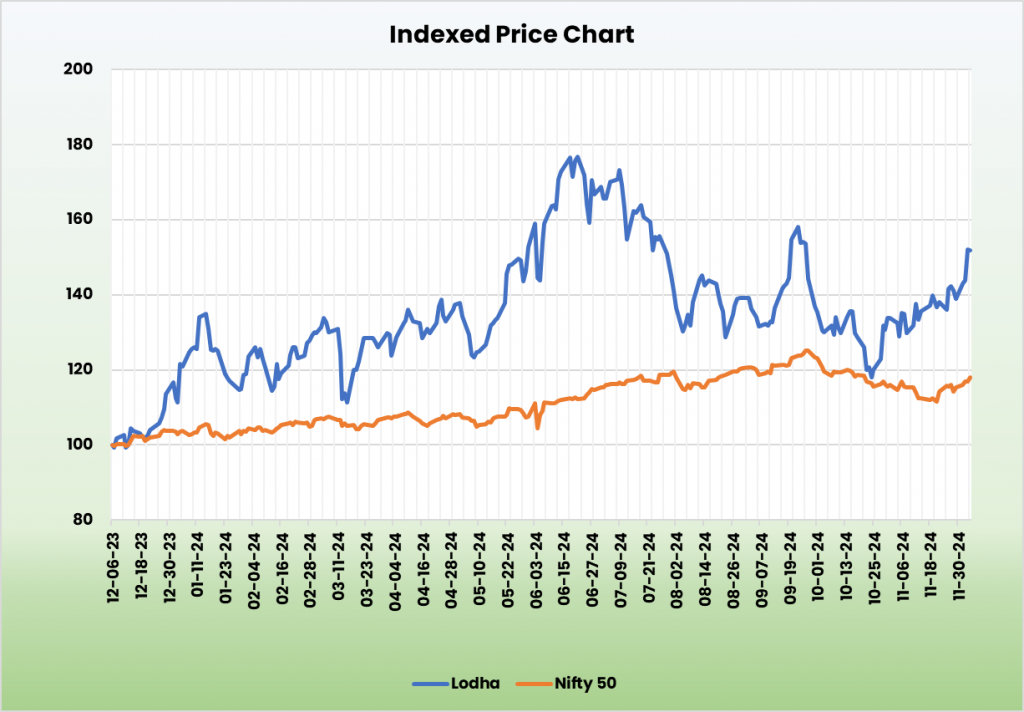

- Income Progress: Achieved a 3-year CAGR of 24% (FY21-24).

- Revenue Progress: PAT grew at a 3-year CAGR of 69% (FY21-24).

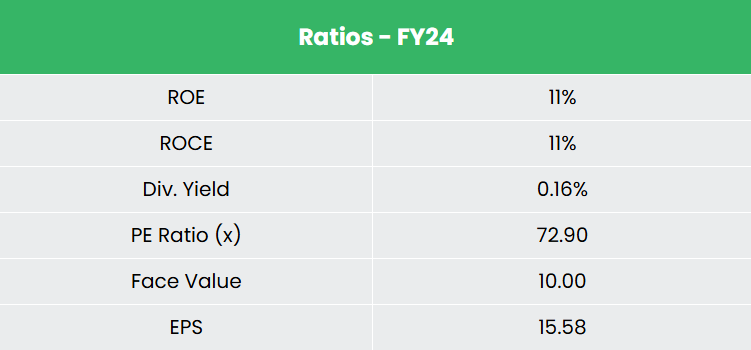

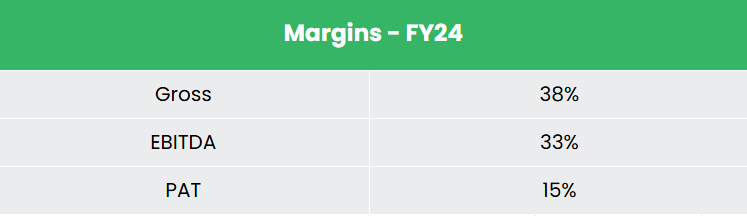

- Return Ratios: Maintained a mean ROE and ROCE of 10% every over FY21-24.

- Debt-to-Fairness: Robust stability sheet with a ratio of 0.44.

- Pre-Gross sales Progress: Recorded a 3-year CAGR of 34% in pre-sales (FY21-24).

Business outlook

- Key Sub-Sectors: Housing, retail, hospitality, and industrial.

- Housing Demand Drivers: Robust job creation, rising incomes, favorable affordability, and desire for high quality dwelling areas.

- Progress Components: Urbanization, increasing rental market, and rising property costs.

- Company Sector Enlargement: Elevated demand for workplace areas and concrete housing.

- Business Progress: Rising demand for retail and workplace areas alongside city housing growth.

Progress Drivers

- FDI Coverage: 100% FDI allowed for township and settlement growth initiatives.

- Sensible Metropolis Mission: Goals to modernize 100 cities, enhancing high quality of life with tech-driven city planning.

- Future Progress: Actual property sector projected to succeed in $5.8 trillion by 2047, contributing 15.5% to GDP (up from 7.3%).

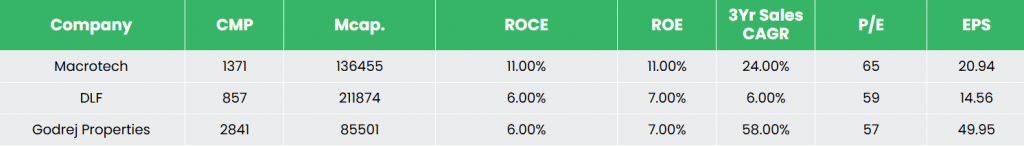

Aggressive Benefit

Macrotech stands out amongst rivals like DLF Ltd and Godrej Properties Ltd by delivering superior returns on capital invested. This efficiency is pushed by a constant enhance in gross sales, highlighting the corporate’s environment friendly operations and strategic focus.

Outlook

- Pre-Gross sales Progress (FY25): Concentrating on ~20% development in pre-sales to Rs.17,500 crore, with a 5-6% value enhance.

- Quantity Progress: Anticipated 4-5% in present places and ~10% in new places.

- New Launches: Plans to roll out 17 new initiatives in FY25 (excluding present mission expansions).

- Future Objectives: Aiming for a 20% ROE and Rs.500 crore rental revenue by FY26.

- Strategic Power: Robust model flexibility permits gross sales throughout varied value factors.

- Progress Drivers: Palava and Higher Thane initiatives recognized as key development catalysts.

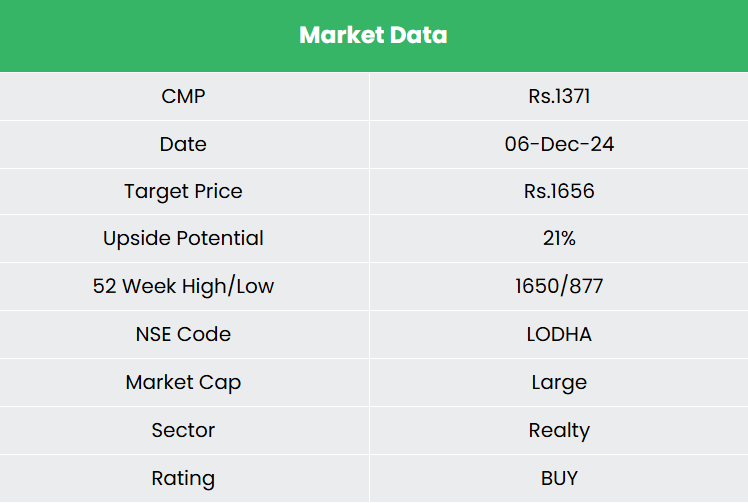

Valuation

Macrotech is well-positioned to realize its administration steering, supported by its sturdy operational capabilities, various revenue streams throughout value factors and consumer segments, and regular growth into new geographies. We advocate a BUY score for the inventory with a goal value (TP) of Rs.1,656, based mostly on 55x FY26E EPS.

Dangers

- Macro-Financial Circumstances: Excessive inflation, financial slowdowns, or elevated rates of interest may affect the corporate’s turnover.

- Enter Prices and Regulatory Modifications: Rising enter prices might squeeze revenue margins, whereas regulatory delays in approvals may disrupt money move.

Word: Please notice that this isn’t a suggestion and is meant just for academic functions. So, kindly seek the advice of your monetary advisor earlier than investing.

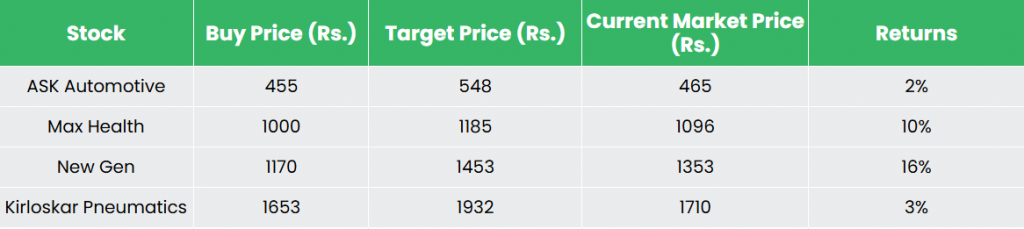

Recap of our earlier suggestions (As on 06 December 2024)

Newgen Software program Applied sciences Ltd

Different articles you might like