Netflix exhibits a gradual stream of earnings

Netflix (NFLX/NASDAQ) shareholders had been glad on Thursday, as they noticed share costs rise 5% in after-hours buying and selling on the again of one other glorious earnings announcement. (All figures in U.S. {dollars}.) Earnings per share got here in at $5.40 (versus $5.12 predicted) and revenues had been $9.83 billion (versus $9.77 billion predicted).

Paid memberships additionally topped expectations, at 282.7 million, in comparison with the 282.15 million predicted by analysts. Netflix chalked up the rise in viewers to new hit exhibits reminiscent of The Good Couple, No one Needs This and Tokyo Swindlers, in addition to new seasons of favourites Emily in Paris and Cobra Kai. Waiting for the subsequent quarter, Netflix is banking on the brand new season of Squid Recreation and its foray into the world of dwell sports activities. Two Nationwide Soccer League (NFL) video games and a massively anticipated boxing bout between Jake Paul and Mike Tyson signify new sights for the streaming big.

United Airways shares take to the sky

Tuesday was an enormous earnings day for United Airways (UAL/NASDAQ) as earnings per share got here in at $3.33, properly outpacing the $3.17 that analysts had been predicting. (All figures in U.S. {dollars}.) Revenues had been $14.84 billion (versus $14.78 billion predicted). Shares had been up greater than 13% on the outperformance and the information that the airline was beginning a $1.5-billion share buyback program.

Company income was up greater than 13% yr over yr, whereas primary economic system seat gross sales clocked an much more spectacular 20% improve. Final week, the corporate introduced new worldwide routes headed to Mongolia, Senegal, Spain, Greenland and extra.

The perfect on-line brokers in Canada

The inflation dragon has been slain

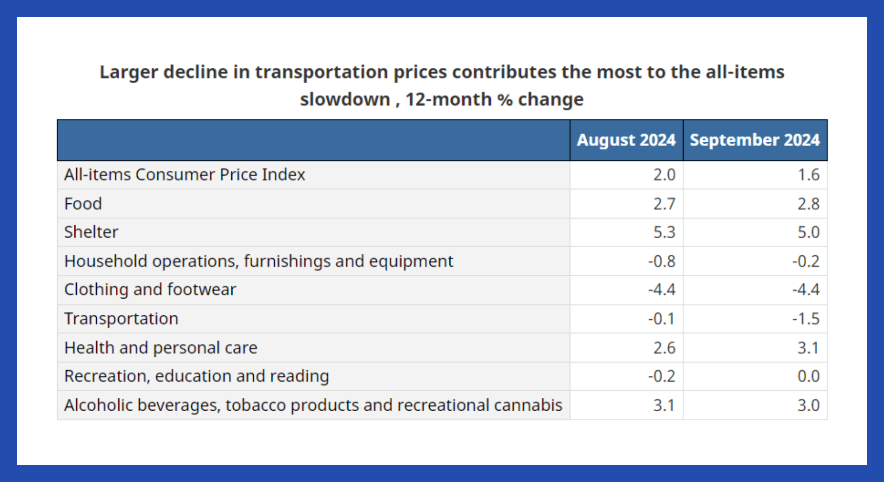

It doesn’t appear that way back that annualized inflation charges had been topping 8%, and there seemed to be no finish in sight. Effectively, the top has arrived. Statistics Canada introduced this week that the Client Worth Index (CPI) annualized inflation price for September had dropped all the best way all the way down to 1.6%. That’s considerably decrease than the Financial institution of Canada’s 2% goal.

Led by deflation in clothes and footwear, in addition to transportation, the downward development seems to be widespread. Gasoline was additionally down 10.7% from this time final yr.

Supply: Statistics Canada

In fact, elevated shelter prices stay the key concern for a lot of Canadians. Hire will increase had been up 8.2% year-over-year; whereas that’s down from August’s determine of 8.9%, it’s nonetheless a bitter capsule to swallow for a lot of.