Estimated studying time: 12 minutes

Study our June 2024 funds replace and acquire precious insights into managing your funds. Uncover the instruments and methods we use to remain on observe.

Why I Share Our Month-to-month Price range

For anybody new to CBB, this briefly explains our month-to-month funds replace.

I stay up for placing this submit collectively because it lets us see the place we spend our cash.

A funds additionally acts as a diary on your bills so you possibly can look again to see success and failure.

Our funds replace additionally lets readers know that we aren’t excellent and should make adjustments like everybody else.

We use the instruments (Free funds Binder), and I hope you’ve downloaded your free copy.

Alright, let’s get into this.

Percentages For Our June 2024 Price range

Our year-to-date share chart is one other option to chart our family funds.

June 2024 Family Price range Percentages

Financial savings of 37.00% embrace investments and financial savings based mostly on our internet earnings.

Our life ratio is 32.21% and incorporates all the things from groceries, leisure, miscellaneous gadgets, well being/magnificence, clothes, and many others., all variable bills.

In June, we went over the life class resulting from spending greater than regular on well being, magnificence, and instruments for the storage. I’ll clarify extra intimately under.

Transportation is 1.77%, which covers gasoline, insurance coverage, and upkeep for our car, which is paid.

Our home and car are paid for, and now we have zero shopper debt; nonetheless, we nonetheless pay property taxes and upkeep charges. In June, this value was 15.98%.

The projected bills of 12.29% can change based mostly on what we encounter month-to-month, corresponding to a brand new merchandise we have to save for.

52-Week Financial savings Problem

In December, I began a 52-week Financial savings Problem and requested my readers in the event that they wished to take part.

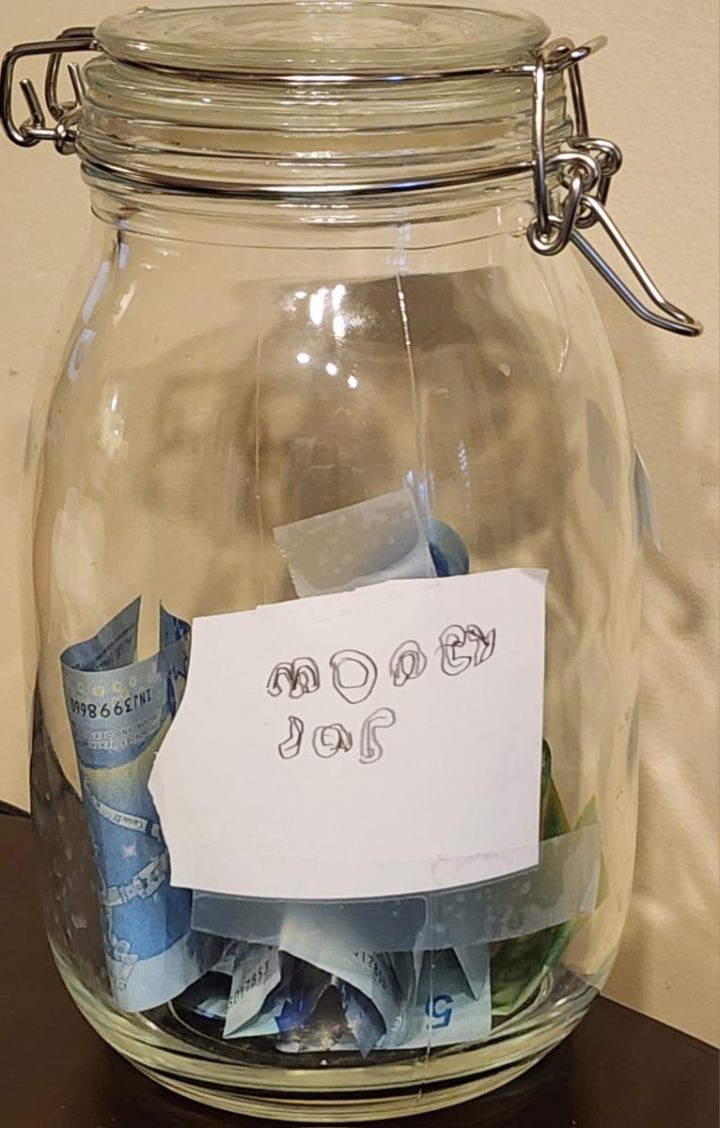

Under is the jar we created to save lots of the cash for twelve months.

Our son wished to take part, so he determined to save lots of his allowance or some other cash he earned.

He’s saving $5 weekly from his allowance within the financial savings jar.

In June, he saved $20 for the month plus an additional $10, which his aunt had given him.

The yearly complete so far, June 2024, is $100 in financial savings.

He created a Moolah Jar label for his cash financial savings jar, which I assumed was humorous.

52-Week Financial savings Challenger Replace

Under is the report from a CBB fan taking part within the year-long financial savings problem.

Howdy,

It’s me, TFSASaver, with my month-to-month replace on the funds problem

I bought $75 of issues I not want on Fb Market, used $10 of present playing cards, and located .35 cents out for my walks.

So, the overall for June is $85.35 in my TFSA financial savings.

Thanks!

Completely satisfied Canada Day

Grocery Meals Financial savings Jar June 2024 Replace

Why will we observe our grocery reductions for your entire 12 months?

Monitoring Our Grocery Reductions For One Yr + Free Printable

I’ll tally it on the finish of the 12 months to see how a lot we saved shopping for lowered meals merchandise.

Learn the 2023 Finish of Yr Grocery Meals Financial savings Jar Evaluation.

We saved $217.48 for June utilizing coupons, rewards apps, and Flashfood.

To this point, in 2024, buying discounted meals has saved us $891.31.

June 2024 Price range Estimation and Precise Price range

Under are two tables: Our June 2024 Price range and our Precise Price range.

Our June 2024 funds represents two adults and a 9-year-old boy.

Price range Color Key: It’s a projected expense when highlighted in blue.

Since Could 2014, we’ve been mortgage-free, redirecting our cash into investments and residential enchancment initiatives.

Spending lower than we earn and budgeting has been the best option to repay our debt and get monetary savings.

Such a funds is a zero-based funds the place all the cash has a house.

Estimated June 2024 Price range

We could not want all the cash we budgeted for in every class; nonetheless, keep in mind the quantity is just an estimate from the earlier 12 months.

Don’t overlook to funds for projected bills as a result of your complete month can fail resulting from not planning.

Precise June 2024 Price range

Our Canadian Banks

Breakdown Of Our June 2024 Price range

Under are a few of our variable bills from June that I’ll talk about.

Clothes

We spent $288.94 on clothes, which remains to be underneath funds for the month of June.

In some months, our clothes bills are larger, and at different occasions, we hardly spend something.

Mrs. CBB bought clothes from Terra Greenhouse in June after we visited to purchase vegetation.

It was an impulse store from the lowered rack of high-end clothes, which was 50% off.

She wasn’t going to purchase it, however she hadn’t splurged on herself shortly, so I mentioned, get it.

She additionally bought some denims from Goodwill as she’s been losing a few pounds.

Grocery Price range June 2024 Price range

Our month-to-month grocery funds is $900 plus a $25 stockpile funds.

We spent $726.80, or $173.20, underneath funds for our June groceries.

In the previous few months, now we have discovered that we purchase the identical meals week after week.

Additionally, we observed that we aren’t consuming as a lot as we used to.

A lot of our grocery bills have been from the Flashfood app or 50% off at Zehrs or Consumers Drug Mart.

I feel I discussed that we purchase bagged salads solely at 50% off because it’s higher for us.

It was turning into too onerous to complete a head of lettuce and different veggies to make a salad.

To get rid of waste, we go for lowered and frozen greens.

Plus, now we have tomatoes, zucchini, garlic, spring onions, and inexperienced peppers rising within the backyard.

We additionally nonetheless have loads of meat and fish in our freezer to eat earlier than we purchase extra.

Well being And Magnificence

June was an enormous month for well being and sweetness bills as a result of we went to get laser hair removing touch-ups.

Whereas there, Mrs. CBB bought a face exfoliation scrub for $115.

It was additionally the month when all the things within the toilet wanted replenishment.

All the pieces from nutritional vitamins to shampoo, conditioner, face serums, rest room paper, paper towels, hand cleaning soap, moisturizer, and deodorant was changed.

We paired it with Consumers Optimum 20x factors days and obtained a reimbursement as reward factors.

At Costco, she additionally picked up an enormous container of Organika Collagen for round $40.

Lastly, all of us bought a Meals Intolerance Check to find out if we had meals sensitivities.

I’ll clarify extra in a weblog submit, however the outcomes had been thrilling.

House Upkeep

I’ve been spending a bit of cash shopping for instruments for my storage to restore small engines, corresponding to lawnmowers, snow blowers, and weed wackers.

I hope to do that as a interest/enterprise after I retire, so I’m studying alongside the best way.

I’ve met two retired males in our neighborhood who do that and luxuriate in the additional spending cash.

You might name this my retirement marketing strategy B and running a blog on CBB.

What do you intend to do while you retire? Do you’ve a plan B?

FlashFood App

Please use my code while you join Flashfood! Cash for you and cash for me.

Each one that indicators up will get a $3 or $5 credit score, a freebie Flashfood gives for brand spanking new app prospects.

Additionally, Flashfood has added a small service payment to each order, which I really feel is suitable.

Use my referral code, MOCD28ZN4, for the $3 or $5 credit score.

Your first buy should be over $15.

In June, we picked up plenty of high-protein yogurt with no added further sugar for $1.50 for every bundle of 4.

Together with the yogurt, we discovered this distinctive Bergeron Classique Cheese from No Frills, which was so low-cost, $0.25, that we couldn’t go it up. It was effectively value it.

PC Optimum Rewards Factors June 2024

Over 45 days, we’ve earned 202,850 PC Optimum Factors, or roughly $202, in the direction of free merchandise.

Since 2018, now we have earned 8,659,385 PC Optimum Factors or $8,660.

We began 2024 with underneath 7 million PC Optimum Factors, or $7000, and are working in the direction of $8000.

The method of saving them began after our son was born in 2014.

Between diapers and formulation, we amassed factors quicker than we may spend them.

Sure, now we have redeemed many occasions, however solely throughout their Mega Bonus Occasion at Christmas.

Under are weblog posts for anybody desirous to be taught how we earn PC Optimum Factors.

TD Rewards Credit score Card June 2024

Our TD Visa has a cash-back stability of $467.39.

Dream Air Miles June 2024

Most factors are from our home and automotive insurance coverage, which gives Air Miles.

There was some extent the place we had to decide on Money Miles or Dream Miles.

Since my household lives within the UK, we felt the Dream Miles would have labored finest for us.

June 2024 CBB Internet Price Replace

General CBB June 2024 Price range + Internet Price Replace

We now have $7707.39 value of money in rewards factors from TD Visa and Consumers Drug Mart.

In June, we realized a $30,165.64 internet value enhance from our retirement investments, adopted by money and emergency financial savings.

Not too dangerous of a month.

I hope to see you once more to learn my July 2024 funds replace in August.

Please drop me a query or remark under.

In case you’re new, don’t overlook to subscribe.

Thanks for studying,

Mr. CBB

You will discover all of the CBB month-to-month funds updates from 2012-present in our library.