I exploit the free Constancy retirement planning instrument to keep watch over our present investments relative to our spending. Utilizing that instrument revealed two basic drivers of monetary success in retirement.

| Good Returns | Dangerous Returns | |

|---|---|---|

| Low Spending | OK | OK |

| Excessive Spending | OK | Not OK |

Though my spouse mentioned the 2 basic drivers had been solely too apparent, the planning instrument offers us an thought of how low is low and the way excessive is excessive.

Standard Retirement Calculator

The Constancy retirement planning instrument makes use of a traditional strategy. It gathers your investments and asks you ways a lot you intend to spend. Then it simulates future returns to see how effectively your investments will cowl your deliberate spending. It’s a hit in case your projected steadiness is above zero on the finish of your planning horizon. Many retirement planning instruments work like this. I simply occur to make use of the one from Constancy as a result of it’s out there and free.

It isn’t straightforward to make use of the instrument to mannequin large monetary selections reminiscent of staying in a high-cost-of-living space after retirement versus relocating as we did final time in Transferring to Decrease Value of Residing After You Retire. You’ll be able to run the projections and save the report as a PDF, change the assumptions, run it once more, save the brand new report as a PDF, and evaluate the 2 PDFs. When you’d like to return to your authentic assumptions, you have to keep in mind the place you made modifications and again out all of your modifications.

Once I evaluate the consequences of various ranges of spending, I exploit my login to run one degree of spending and my spouse makes use of her login to run a special degree of spending. Then we evaluate the 2 PDFs. It really works for a easy A-B comparability but it surely’s tough to do greater than that.

MaxiFi

Different monetary planning purposes are higher geared up for tactical planning. MaxiFi is one in every of them.

MaxiFi is on-line monetary planning software program from an organization led by Boston College economics professor Larry Kotlikoff. The Normal model prices $109 for the primary 12 months ($89/12 months for renewal) and the Premium model prices $149 for the primary 12 months ($109/12 months for renewal). I purchased the Premium model final 12 months to see the way it labored.

I performed with the software program however I’m not an influence consumer. Reader Dennis Hurley is extra skilled with MaxiFi. He helped me stand up to hurry. I’m solely describing how I used MaxiFi. It will not be the formally right approach as supposed by the software program maker. I’m not paid by MaxiFi or anybody else to write down this overview. I don’t profit financially in any approach in case you purchase MaxiFi or every other software program.

MaxiFi takes an unconventional strategy. It doesn’t hyperlink your accounts. It solely asks for the overall quantity in your pre-tax, Roth, and taxable buckets. It doesn’t ask what investments you’ve in your accounts. You enter your anticipated secure return for every bucket within the settings. It doesn’t ask how a lot you intend to spend until it’s one-time or episodic (“particular bills”). The software program calculates your out there discretionary spending based mostly on the precept of consumption smoothing.

Discretionary spending in MaxiFi is in financial phrases. It isn’t what we usually consider as discretionary in on a regular basis life. MaxiFi treats housing, taxes, Medicare Half B premiums, life insurance coverage, and particular bills as mounted spending. All the things else is discretionary spending. You’d suppose meals isn’t discretionary however that’s simply how MaxiFi categorizes issues. If the time period “discretionary” bothers you, simply give it a special identify or just name it “different.” Discretionary spending in MaxiFi represents a dwelling normal.

Base Plan and Maximized Plan

MaxiFi begins by asking about your present monetary state of affairs and your assumptions for inflation, anticipated returns, your required retirement age, when you’ll begin withdrawing out of your retirement accounts, and if you’re pondering of claiming Social Safety. This generates a Base Plan.

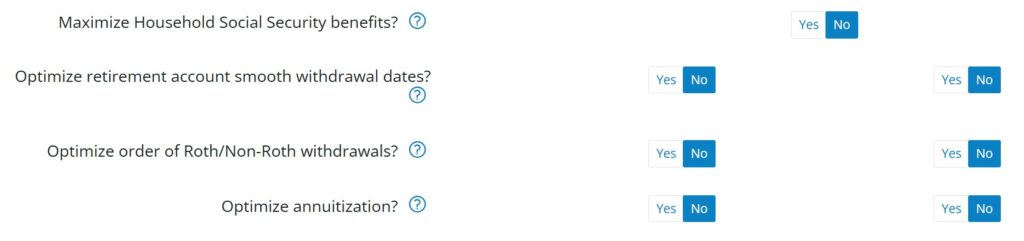

Then it affords to enhance the Base Plan by robotically testing modifications to when you’ll declare Social Safety, when you’ll begin easy withdrawals out of your retirement accounts, whether or not you’ll withdraw from pre-tax accounts first or Roth accounts first, and whether or not you’ll take into account shopping for an annuity.

You’ll be able to say sure or no to which merchandise you need the software program to alter. MaxiFi will generate a Maximized Plan by testing completely different combos of these gadgets and selecting a plan that has the very best lifetime discretionary spending. When you’re proud of the modifications, you’ll be able to apply them to the Base Plan in a single click on.

Discretionary Spending as a Metric

MaxiFi sees a change as an enchancment when it will increase the calculated discretionary spending. I deal with the annual discretionary spending from MaxiFi solely as a metric. I see it as a dwelling normal out there to me, not because the software program mandating that I have to really spend that quantity yearly. I solely use the quantity of discretionary spending to match completely different conditions. I do know {that a} transfer is an efficient one if it will increase my out there discretionary spending.

Social Safety Claiming Technique

When you’re married and also you set the utmost age to 98 or 100 for each of you, MaxiFi will almost certainly counsel that you simply each delay claiming Social Safety to age 70. Don’t be shocked if you see it differs from the output of different instruments reminiscent of Open Social Safety.

Open Social Safety makes use of mortality tables with weighted chances of dwelling to completely different ages. MaxiFi makes use of mounted ages out of your inputs. When you say each of you’ll stay to 100 for positive, the perfect technique naturally is to delay to age 70 for each. You’ll see completely different methods if you create completely different profiles with each spouses dwelling to 85 or one partner dwelling to 95 and the opposite dwelling to 83, and so forth. I like Open Social Safety’s strategy higher on this regard.

The utmost age inputs additionally have an effect on annuity options within the Maximized Plan. When you say each of you’ll stay to 100 within the profile, shopping for an annuity will naturally be useful in case you activate optimizing annuities. I set the annuity choices to “no” once I run a Maximized Plan.

Assumptions, Assumptions, Assumptions

MaxiFi is a modeling instrument. It may’t predict the longer term. No software program can. All outputs are based mostly on a selected set of assumptions. I robotically add “based mostly on this set of assumptions” to each output I learn from MaxiFi.

The Maximized Plan is perfect solely based mostly on one set of assumptions. The optimum plan shall be completely different below a special set of assumptions. I see the worth of MaxiFi not as a lot in producing a withdrawal and spending plan based mostly on a set of assumptions however extra in testing completely different assumptions.

Different Profiles

MaxiFi makes it straightforward to match completely different situations. You duplicate the Base Profile into an Different Profile, make modifications within the Different Profile, and evaluate it with the Base Profile. You’ll be able to have as much as 25 different profiles and evaluate between completely different profiles. This helps reply all kinds of “Can I afford it?” and “Ought to I do A or B?” questions:

Can I retire now versus 5 years from now?

Can I afford to purchase an costly home or a second house?

Will serving to my youngsters derail my retirement?

Ought to I promote investments and notice capital features to pay money for a house or get a mortgage?

Ought to I keep in my present house or downsize or relocate?

Ought to I promote my home or lease it out as a result of my mortgage is beneath 3%?

These large monetary selections require extra consideration as a result of they are typically one-time, all-or-nothing, and expensive to change.

You’ll see the influence in your out there discretionary spending if you evaluate outputs between different profiles. You recognize you’ll have extra money to spend in case you work one other 5 years, however by how a lot? You create one profile with retiring now, duplicate it, change the retirement date, and evaluate. You recognize you’ll have much less cash for retirement in case you assist your youngsters or grandkids, however by how a lot? You duplicate your present profile into another profile, add the additional bills, and evaluate it together with your present profile.

Instance

A reader mentioned he was all for transferring from a excessive cost-of-living space however promoting his house will set off taxes on a big capital achieve effectively past the $500k tax exemption. The NYT buy-or-rent calculator I utilized in the earlier put up doesn’t keep in mind the built-in capital achieve. MaxiFi does.

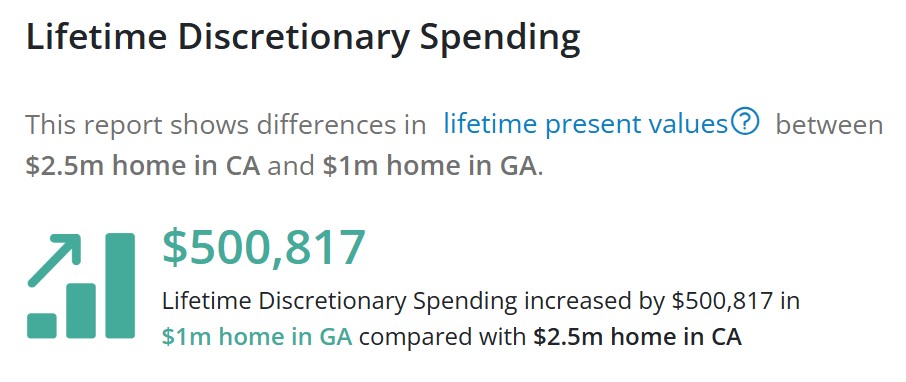

I created one hypothetical profile in MaxiFi with a house in California price $2.5 million having a price foundation of $500k ($2 million unrealized capital achieve earlier than the tax exemption). I duplicated it into one other profile and made modifications to promote the house in California, pay federal and state taxes on the capital features, and purchase a $1 million house in Georgia. MaxiFi reveals this once I in contrast the 2 profiles:

It reveals how a lot the lifetime discretionary spending would enhance based mostly on a set of assumptions by promoting the California house and transferring to Georgia regardless of having to pay capital features taxes on $2 million. I can create further profiles and evaluate once more with the house worth rising sooner in California than in Georgia or completely different inflation charges and completely different funding returns.

MaxiFi can’t predict the longer term however it may well aid you mannequin completely different situations.

Roth Conversions

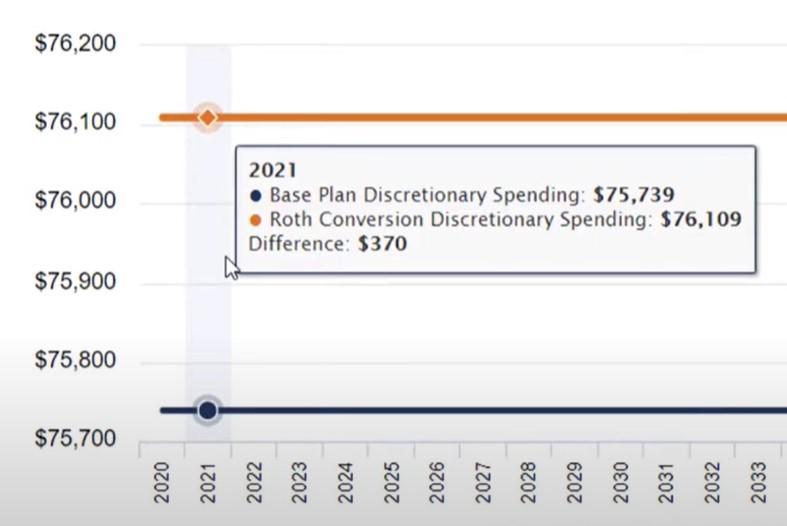

You too can use different profiles to mannequin Roth conversions. MaxiFi doesn’t counsel how a lot you must convert however you’ll be able to take a look at changing completely different quantities between age X and age Y in different profiles. Right here’s a video from MaxiFi on the way to mannequin a Roth conversion:

Ignore the Precision

Any modeling software program will calculate to the precise greenback however I ignore the precision. As a result of projections are based mostly on assumptions, it is going to be a miracle if a projection will get the primary two digits right in actual life. It’s tough to even get the primary one digit proper.

Within the earlier instance, if a retired couple sells a $2.5 million house in California and strikes to Georgia, will they actually enhance their lifetime discretionary spending by $500,817? It might develop into $300k, $400k, $600k, or $700k. I don’t suppose you’ll be able to have excessive confidence it’ll be $500k in actual life. All you’ll be able to say is that promoting and transferring is directionally helpful if the assumptions aren’t too far off.

The Roth conversion video from MaxiFi reveals that the conversion quantity being thought-about would elevate the annual discretionary spending from $75,739 to $76,109 based mostly on a set of assumptions. I’d name this end result a toss-up. The $370 distinction is simply too small as a result of it’s lower than 0.5% of the annual discretionary spending. Changing that quantity in actual life may very well be higher or it may very well be worse. I can’t even say it’s directionally helpful. I’d search for strikes that make an even bigger distinction.

Monte Carlo

The Premium model of MaxiFi consists of Residing Normal Monte Carlo®, which simulates how completely different funding methods and spending behaviors influence your dwelling normal. The $40 value distinction between the Stand model and the Premium model within the first 12 months isn’t a lot. You would possibly as effectively get the Premium model to see if the Monte Carlo studies are useful however I discover the usual studies extra helpful than the Monte Carlo studies.

An issue with Monte Carlo is that it at all times reveals a variety of outcomes. My out there spending will be $50k a 12 months if returns are poor or it may be $200k a 12 months if returns are good. So do I spend $50k or $200k? If I spend $50k a 12 months and returns aren’t that dangerous, I’ll have a ton of cash left that I might’ve loved. If I spend $200k a 12 months and returns are poor, it gained’t be sustainable. This isn’t distinctive to MaxiFi. That’s simply the character of the beast. No software program can take away this uncertainty.

I discover extra worth within the studies within the Normal model of MaxiFi as a result of I solely use the annual spending from the software program as a metric to match completely different situations. I don’t go by the spending output from the software program for my precise spending. If you wish to save a bit bit of cash, perhaps begin with the Normal model and improve to Premium if you resolve to make use of MaxiFi long run.

Help

MaxiFi has a consumer’s handbook on its assist web site and how-to movies and webinars on YouTube. The corporate additionally affords on-line workplace hours twice a month to reply questions. When you can’t determine the way to mannequin one thing, you’ll be able to ship an e-mail to MaxiFi customer support they usually’ll let you know. If you need a MaxiFi skilled to overview your plan and aid you interpret the outcomes, it’s $250 for a one-hour video session. I get the sense that they actually wish to aid you make good monetary selections with the software program.

Different Software program

I’m happy with MaxiFi total. It’s cheap and helpful to mannequin large monetary selections. No software program can predict the longer term or take away uncertainty however you don’t must throw up your arms and go away large monetary selections to intestine emotions.

It’s unrealistic to anticipate any software program to offer you a withdrawal plan that gained’t result in having a giant pile of cash on the finish when returns are good or having to regulate the spending down when returns are poor. That’s not how I exploit MaxiFi.

Set a variety of assumptions and consider the big selection of outcomes. You continue to gained’t understand how precisely a giant monetary resolution will prove in actual life however you’ll have some thought of a spread and perceive what’s going to affect the outcomes. It’s a steal to pay solely $109 or $149 for a instrument that can assist you make large monetary selections which might be one-time, all-or-nothing, and expensive to change.

MaxiFi isn’t the one monetary planning software program. I can’t say it’s the perfect as a result of I haven’t used many different software program to match. I solely understand it’s extra highly effective than the free Constancy retirement calculator. NewRetirement and Pralana are in the identical $100 – $150 value vary. When you have large monetary selections arising and also you’re unsure which software program to make use of, strive all of them and choose your favourite. I’m going to purchase Pralana to strive it when my MaxiFi license expires.

Say No To Administration Charges

If you’re paying an advisor a share of your property, you’re paying 5-10x an excessive amount of. Learn to discover an impartial advisor, pay for recommendation, and solely the recommendation.