Our buddies and long-time MFO Premium subscribers at S & F Funding Advisors of Encino, CA requested not too long ago if we may replicate metrics primarily based on Lipper’s World Information Feed that Barron’s stopped publishing; specifically, Lipper Mutual Fund Funding Efficiency Averages – Specialised Quarterly Abstract Report.

We then coordinated with the oldsters at Lipper to make sure we used all the identical funds, share courses, and classes to match their averages, which we did.

S & F makes use of these averages, particularly the Basic Fairness Common, for its quarterly studies and benchmarks. Basic Fairness contains 16 of the extra frequent US Fairness classes, together with Small-, Mid-, Massive- and Multi-Cap Worth, Core, and Development funds. (The particular definition might be discovered on our Definitions web page, beneath Averages.

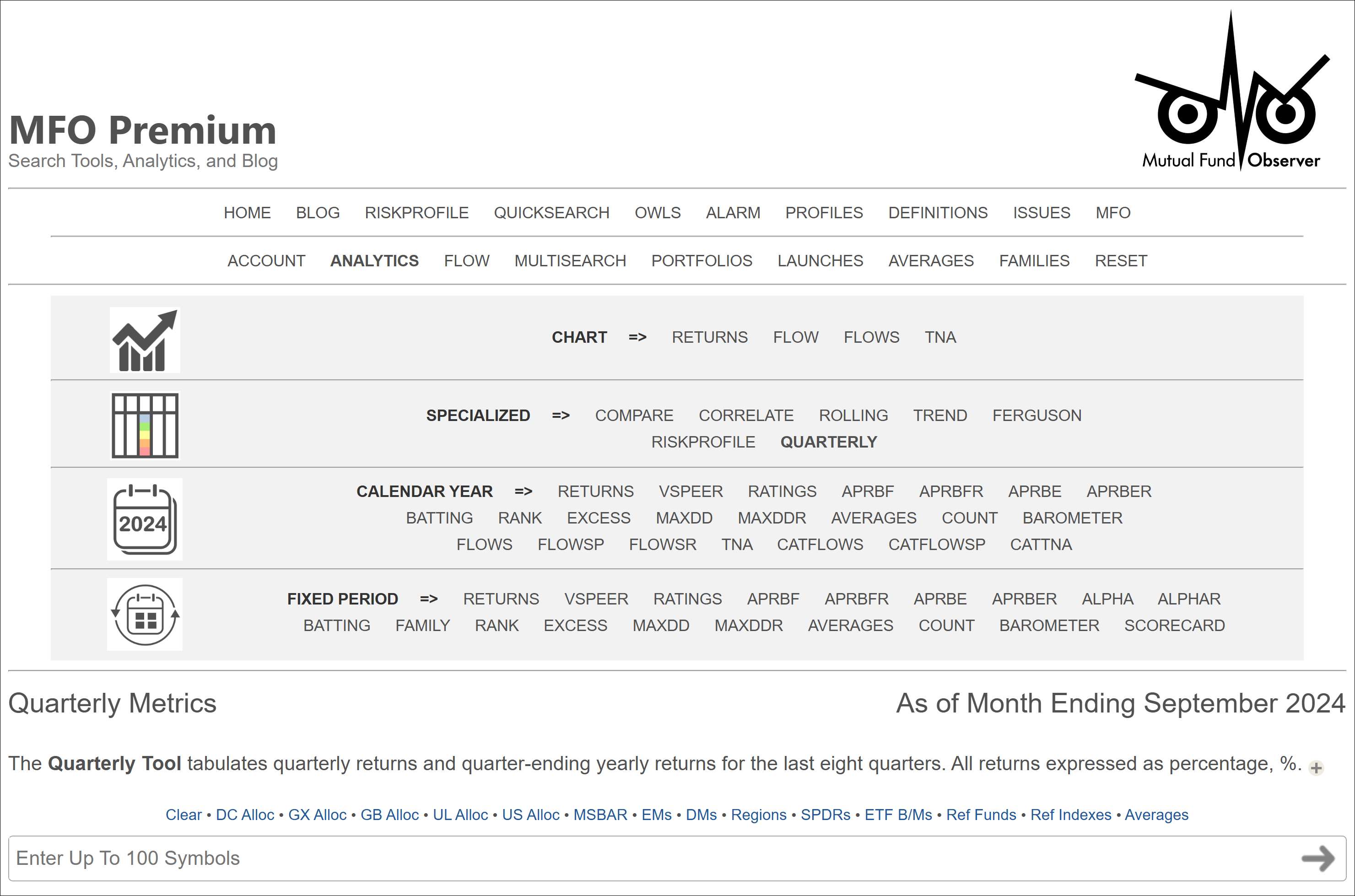

As is typical with subscriber ideas, we took the chance to increase the device set for all customers. The new Quarterly metrics, which embody returns and peer rankings for the previous eight quarters, plus attendant quarter-ending annual returns and peer rankings, might be accessed in a number of methods, the quickest by way of the Analytics hyperlink on the Navigation Bar within the high of any web page, as seen within the screenshot under:

Quarterly Instrument on MFO Analytics Panel

Customers can enter the ticker symbols of explicit funds, or use the short-cut hyperlinks to get quarterlies of say State Road Sector ETFs (SPDRs), Morningstar’s Barometer ETFs (3×3 cap/model), or class averages, which come from the Pre-Set Screens in MultiSearch, the positioning’s most important search device.

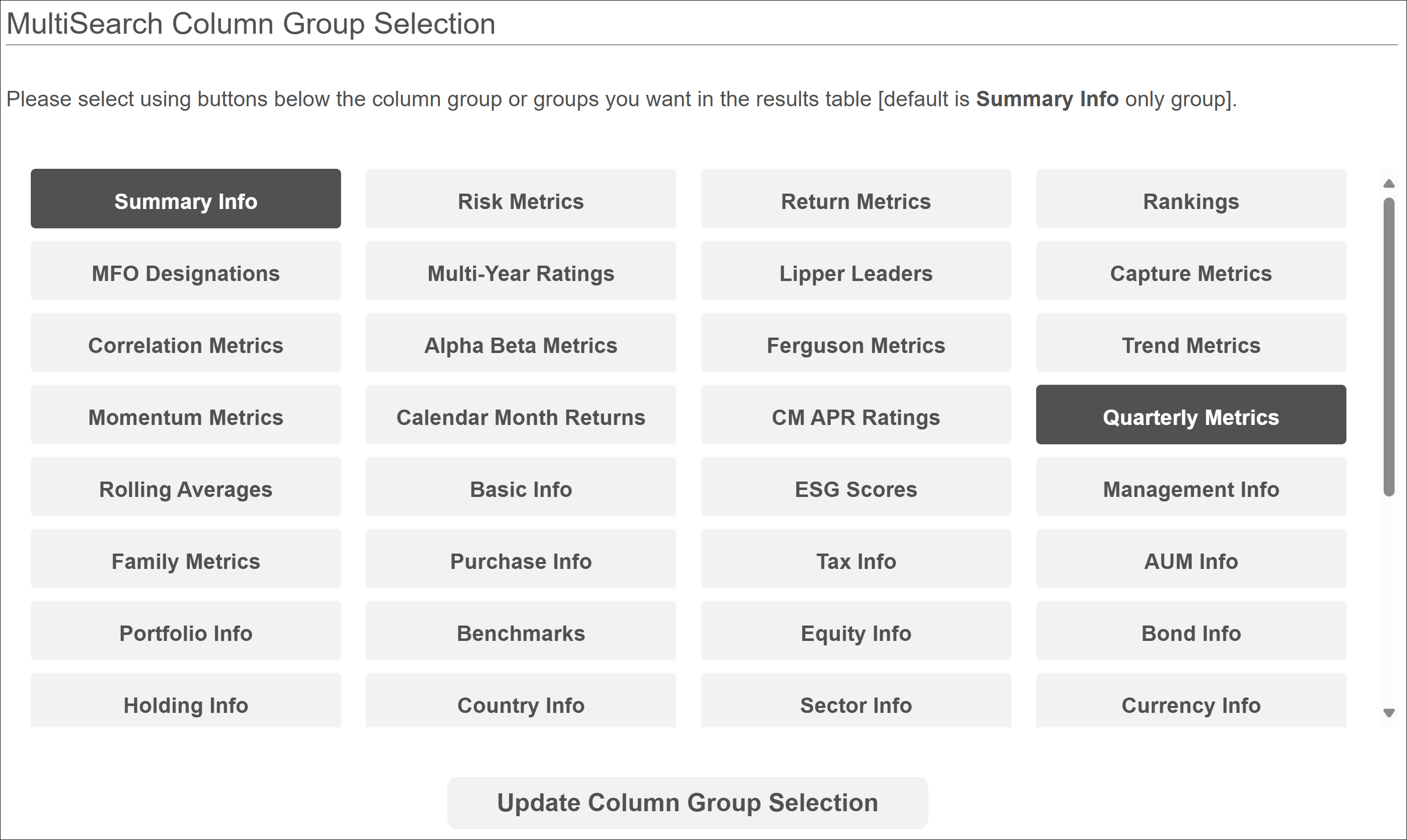

One other option to entry the Quarterly Metrics is thru MultiSearch. As soon as search standards are chosen, customers can open the Quarterly Metrics by way of the Group Button, proven right here:

Quarterly Group Choice in MultiSearch

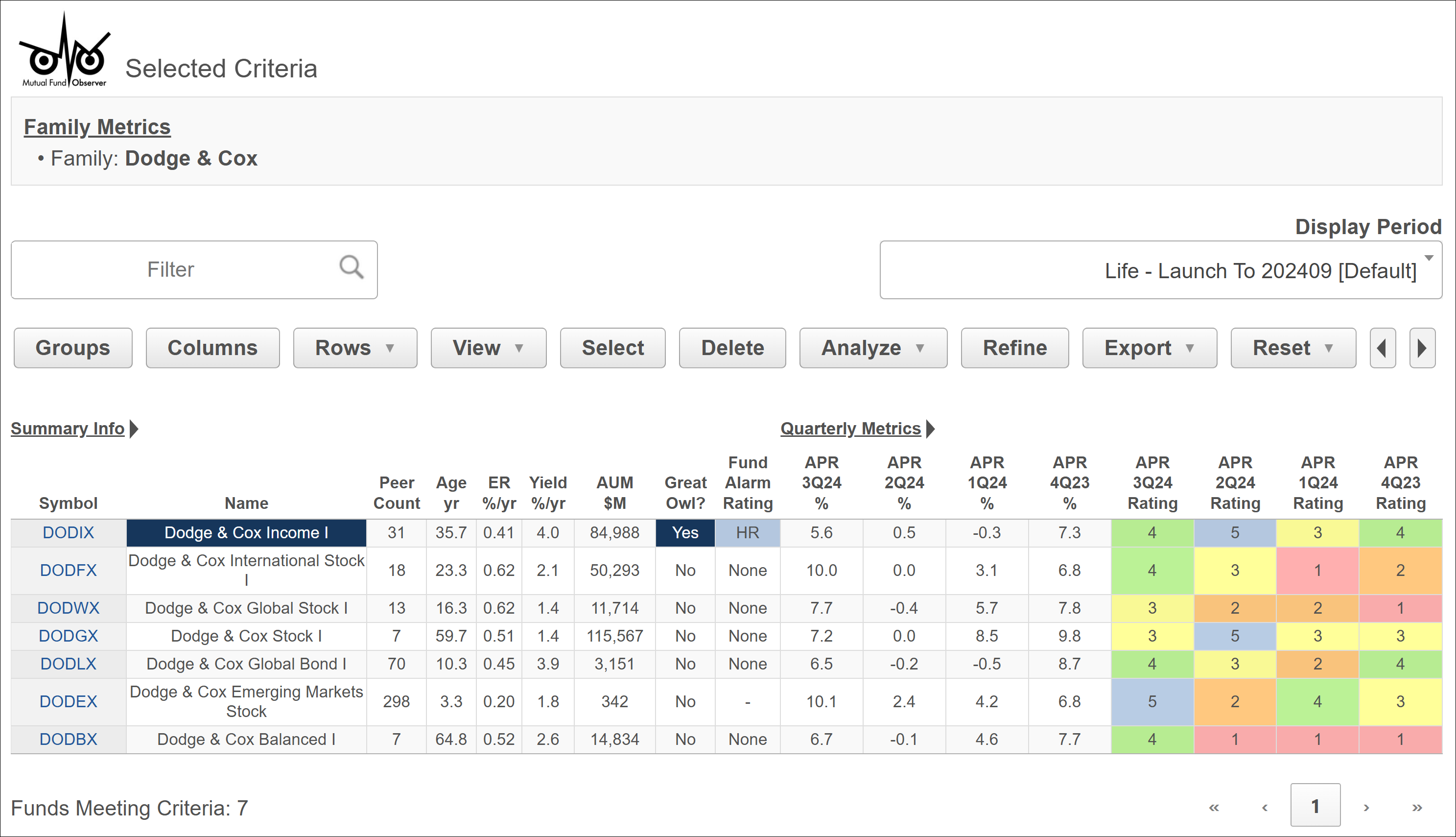

And, lastly, listed below are the brand new quarterlies, utilizing the Dodge & Cox household funds, for the final 4 quarters, starting with the nice one which simply ended.