What’s moomoo Canada?

Moomoo is an internet brokerage created with the aim of offering a platform for buyers of all expertise ranges to interact with the market. Moomoo is an impartial model of Hong Kong-based FUTU Holdings, which is a NASDAQ Listed world monetary establishment.

Whereas moomoo was based in Silicon Valley in 2018 it shortly expanded throughout the globe. In 2021 they earned the highest spot for on-line brokerage apps in Singapore, and it’s utilized for worldwide buying and selling in Australia. In Japan, moomoo has change into the best choice for US shares buying and selling.

Moomoo formally launched in Canada in September 2023. Then on March 26, 2024, they rang the opening bell on the Toronto Inventory Change to rejoice their approval as a TSX and TSXV non-trading member.

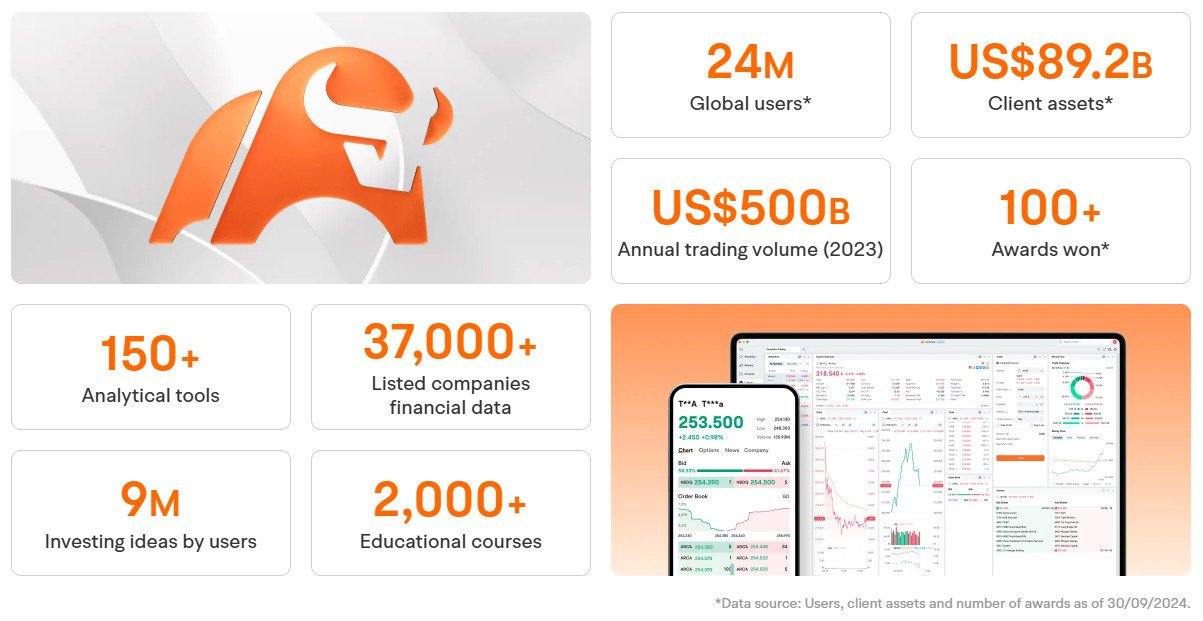

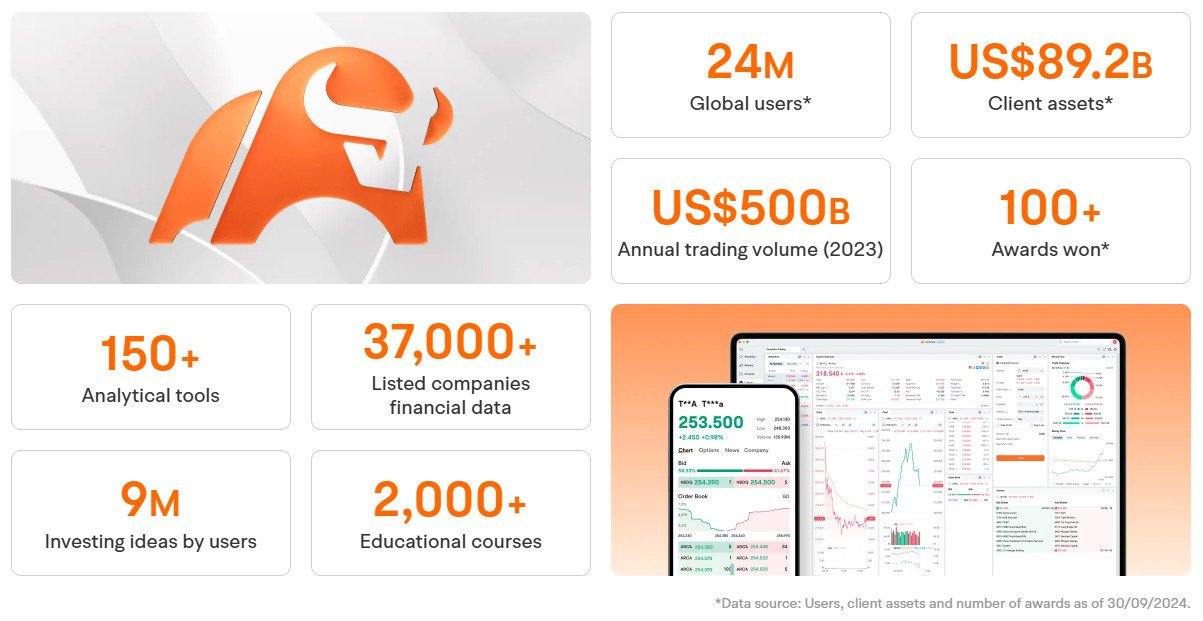

The next infographic taken from their web site offers you an concept of their world presence.

Is it Secure and Trusted?

Whereas moomoo is a more recent brokerage out there to Canadians, and has a reputation that some discover foolish regardless of the supposed connection to a bull market, it’s certainly a respectable brokerage.

Moomoo Monetary Canada Inc., a model of FUTU Holdings listed on the NASDAQ, can also be a member of the Canadian Investor Safety Fund (CIPF) and is regulated by the Canadian Funding Regulatory Organisation (CIRO).

This protects the securities of shoppers as much as $1 million for every basic account. It’s vital to notice, nevertheless, that whereas the CIPF protects eligible prospects within the occasion of a CIRO supplier member’s insolvency, it doesn’t cowl losses incurred as a consequence of fluctuations in market values.

Moomoo Canada Charges

With on-line brokerages, charges have to be low with a view to be a high contender within the Canada low cost brokerage scene. In terms of charges with moomoo you gained’t be paying a lot! This is without doubt one of the stand-out options of this new-to-Canada on-line brokerage.

| Canadian Shares and ETFs | CAD $0.0149/share, Minimal CAD $1.49 per commerce |

| US Shares and ETFs | US $0.0099/share, Minimal US $1.99 per commerce |

| US Choices (inventory choices and index choices) | $0.90/contract, Minimal $1.50 per orderExercise/assignments price: $0 |

| Margin Fee (in USD) | Underneath $100,000: 8.83%$100,000 – $1 million: 8.33%$1 million – $50 million: 8.08%$50 million – $200 million: 7.83percentOver $200 million: 7.83% |

| FX Charges | 0.09% plus USD $2 per transaction |

| Account Charges (Opening and Closing) | $0 |

| Account Minimal | $0 |

| Deposits by way of Financial institution Switch (EFT) | $0 |

| Digital Statements and Commerce Confirmations | $0 |

| Withdrawal Charges | From money, margin, and TFSA accounts the primary withdrawal per 30 days is free, then value $2-$12 every. The primary withdrawal per 30 days from RRSP accounts value $50; subsequent withdrawals are $52-$62 every. |

| Inactive Account | $0 |

As you possibly can see within the desk above, moomoo provides shares, ETFs, and choices at a really reasonably priced value. We additionally like to see that there are not any account charges and no withdrawal charges. All this on high of a $0 account minimal so you may get began investing at any level!

Nevertheless, there are not any caps on buying and selling charges, so for buyers buying and selling massive blocks of shares, they may pay a excessive value. In distinction, many different brokers have a most buying and selling price.

Account Choices

Moomoo Canada provides a restricted number of accounts, providing simply 4 completely different account varieties. It is a downfall as different high Canadian on-line brokers supply a way more various number of account choices and holdings. Moomoo Canada’s present account choices are:

Registered Retirement Financial savings Plans (RRSP): Inside a moomoo RRSP account, you possibly can put money into shares, ETFs, and choices, with taxes deferred till you make a withdrawal, usually throughout retirement. RRSP accounts can be found for people, in addition to for spouses.

Tax Free Financial savings Accounts (TFSA): TFSAs are a extremely useful account possibility for Canadian buyers. They help you put money into shares, ETFs, and choices, with the added benefit of tax-free earnings and withdrawals.

Money accounts: Money accounts are easy and versatile, permitting you to purchase and promote shares, ETFs, and choices. They usually are available numerous kinds, together with particular person, joint, company, and group accounts, however moomoo solely provides particular person accounts at this cut-off date.

Margin accounts: Margin accounts allow you to borrow cash towards your securities to commerce at aggressive charges. Nevertheless, it’s vital to notice that that is the one account kind the place you’ll be required to pay curiosity.

Sadly, they don’t supply First Dwelling Financial savings Accounts (FHSA), Registered Training Financial savings Plans (RESP), RIFs, LIRAs, company and joint accounts – all of that are very talked-about accounts with Canadians, for good cause. In addition they don’t have sure common asset lessons reminiscent of bonds or mutual funds. So, for shoppers who prefer to open many account varieties and asset lessons, after which maintain all of their investments with one brokerage, moomoo won’t be an excellent match.

Moreover, for some cause, for those who want to open a TFSA account with moomoo, you need to open it as your first account with them. That is probably vital to notice as a result of it means it’s a must to plan the order by which you open accounts.

Moreover, in relation to establishing your account, transfers in form (of money or securities) from a money or margin account to an RRSP or TFSA aren’t supported.

As you might have in all probability gathered, the account choices and ease of opening them haven’t been a formidable function of moomoo!

Funding Choices

Moomoo Canada has pretty restricted asset lessons. Sadly, they’re solely open to US and Canadian markets. Listed below are the funding selections that moomoo Canada does supply:

Shares: Shares, or shares/equities, signify possession in an organization. Investing in shares provides the potential for larger returns over time, as they’ve traditionally outperformed different funding choices reminiscent of money equivalents, GICs, or bonds. Nevertheless, this comes with a better stage of threat. Moomoo has over 7000 US shares, and all of the shares listed on the most important Canadian buying and selling platforms.

ETFs: ETFs include a diversified mixture of property, together with shares, bonds, or commodities, serving to to unfold threat throughout numerous asset lessons. With moomoo, you possibly can select from over 5000 US-listed and Canadian-listed ETFs. These embrace Index ETFs, Bond ETFs, All-In-One ETFs, Sector-Particular ETFs, Commodity ETFs, Dividend ETFs, Issue-Based mostly ETFs, Inverse ETFs, and Leveraged ETFs.

Choices: An possibility grants the client the best, however not the duty, to purchase or promote an underlying asset or safety at a predetermined worth, on or earlier than a specified date. Choices buying and selling could be advanced and includes inherent dangers, so it might not be appropriate for novice buyers. To study extra about Choices buying and selling and our high picks for choices brokers, try our Choices Buying and selling Information in Canada article. Moomoo provides choices that may be held in your money, margin, TFSA, and RRSP accounts. They at present solely supply US inventory choices.

Money Plus: This earns you 2% p.a. money rebates which can be mechanically redistributed every week. It could solely be held in your margin and money accounts.

Moomoo’s on-line buying and selling platform is widely known for its superior buying and selling instruments and world market entry. They provide real-time alerts with free entry to up to date market knowledge each 0.03 seconds.

Moomoo additionally provides the choice to customise your buying and selling charts with many alternative options:

- Multi-Monitor Setups

- Technical Indicators

- Drawing Instruments

- Customized Indicators

There are additionally many options for inventory evaluation when buying and selling shares. These embrace info on:

- Quick Sale Quantity

- Institutional Holdings

- Firm Valuation

- Monetary Experiences.

Moomoo additionally provides a demo paper buying and selling account. This provides you an opportunity to see how moomoo’s buying and selling platform works, with out investing your personal cash. The paper buying and selling demo offers you $1 million in digital cash and entry to greater than 10,000 shares and choices. This demo additionally contains academic assets and the chance to participate in paper commerce competitions.

Moomoo Cellular App Overview

At this level, we count on all on-line brokers, banks, and so forth. to supply shoppers useful, easy-to-navigate inventory buying and selling apps in order that they’ll carry out actions anytime, anyplace, with their cellular machine or pill.

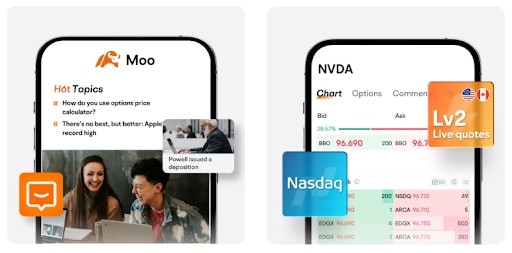

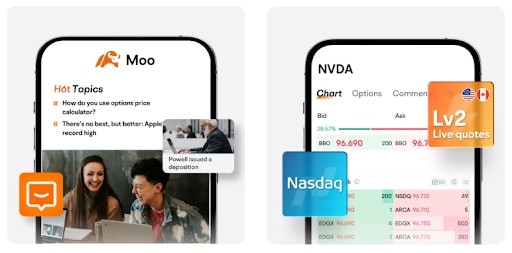

The moomoo Buying and selling & Investing cellular app is an easy-to-use app with many features. The app can be utilized to commerce US shares from 4am to 8pm ET, and Canadian shares from 8am to 5pm ET. It may be used to research shares, and you’ll have interaction with specialists and different customers to view reside streaming and trending discussions. Moreover, the app may also be used to entry monetary information from credible sources reminiscent of Bloomberg, Dow Jones, Benzinga, and Investorplace, all without cost!

Here’s a screenshot from their web site displaying a few of their app options:

Android customers and Apple customers alike price it extremely: 4.5 stars from over 31,000 opinions on the Google Play Retailer, and 4.6 stars from 1000 opinions on the Apple App Retailer. Customers generally touch upon the benefit of use and the easy structure and group of the app.

The app can also be linked to 24/7 buyer care: skilled assist from licensed professionals by reside chat, telephone, or electronic mail.

For a extra in-depth take a look at their cellular app, try their App Options web page of their on-line Assist Heart.

Moomoo may also be downloaded for desktop buying and selling for many who want to make use of their pc when making trades however they don’t supply web-based buying and selling.

Easy methods to Open an Account

The method of opening an account with moomoo Canada is fairly easy. In line with their web site’s Assist Heart, it’s a easy 5 step course of:

- Submit an utility by way of both the app or on the web site

- Your account will probably be accredited inside 2 enterprise days if all of the supplied info is verified

- If extra paperwork are required, the directions will probably be despatched by way of electronic mail

- An electronic mail will probably be despatched containing your account particulars as soon as accredited

- Lastly, entry the Consumer Portal to replace your short-term password

For all accounts, that you must have Canadian citizenship or tax residency. The next desk outlines what you want particularly for every account kind:

| Particular person Margin Account | Tax-Free Financial savings Account | Registered Retirement Financial savings Plan | Particular person Money Account |

| A Canadian Social Insurance coverage Quantity (SIN)

A sound residential deal with in Canada A sound cell phone quantity A sound private electronic mail addressTo be 21 years outdated or older |

A Canadian Social Insurance coverage Quantity (SIN)

A sound residential deal with in Canada A sound cell phone quantity A sound private electronic mail addressTo be 18 years outdated or older |

A Canadian Social Insurance coverage Quantity (SIN)

A sound residential deal with in Canada A sound cell phone quantity A sound private electronic mail deal with$7,000 CAD or extra in internet property To fulfill the minimal age requirement: 19 years outdated in BC, NB, NS, and NL, and 18 years outdated in AB, SASK, MAN, ON, QC, and PEI To be youthful than 71 years outdated |

A Canadian Social Insurance coverage Quantity (SIN)

A sound residential deal with in Canada A sound cell phone quantity A sound private electronic mail deal with To be 18 years outdated or older |

From our expertise, account opening takes 1-3 days.

After you have opened an account you should use the moomoo app so as to add one other account kind. However please observe, that for those who want to open a TFSA with moomoo, it have to be opened as your first account.

Moomoo vs Qtrade – Canada’s Prime Brokerage

|

||

|---|---|---|

| Account Choices |

|

|

| ETF Charges | Free shopping for AND promoting of 100+ ETFs | $1.49 – $1.99 per buy. |

| Buying and selling Charges | $6.95/commerce for Investor Plus Program members, $7.75 for buyers aged 18-30, $8.75 for everybody else |

|

| Security | CIPF Member, IIROC regulated | CIPF Member, CIRO regulated |

| Person Expertise | Constantly rating #1, excessive availability and pleasant to prospects. Constructed completely for Canadian customers. | General optimistic stories and extremely rated app. |

| Analysis Instruments | Has been on the high of Canadian brokerage rankings on this class for over a decade. | Free demo paper buying and selling ($1 million digital cash). Standout entry to academic assets together with 60-depth stage 2 quotes, superior market instruments & market knowledge, 24/7 world market information |

| promotion | Immediate Signal Up Bonus: $150-$2,150 | $2,000 fee rebate card and 6% money rebate for 60 days upon enroll. As much as $200 Money Bonus. |

| Signal Up | Go to Qtrade | Go to Moomoo |

Moomoo Canada Overview FAQ

Is moomoo best for you?

As an internet Canadian brokerage, moomoo is sweet, however not one of the best. It has some stand-out options, however falls quick in lots of areas when in comparison with different choices reminiscent of Qtrade and Questrade. Nevertheless, regardless of the downfalls, they nonetheless come out above the massive financial institution brokers.

Whereas we love the low charges and in-depth on-line buying and selling interface, it’s missing in account choices and asset lessons, and has an absence of worldwide market choices. This causes it to drop down in our rankings. If you’re most centered on US and Canadian shares and ETFs and are proud of the restricted account choices, then moomoo could also be a sensible choice for you.

In any other case, we suggest you try our listing of the Prime On-line Brokers in Canada, the place you’ll see that Qtrade is ranked on the high. To study why, go to our full Qtrade evaluation.

As ordinary, we’re at all times eager to listen to from our readers. Should you’ve had any experiences with moomoo Canada, whether or not optimistic or damaging, let me know. Your enter helps maintain our 2024 moomoo Canada evaluation related to readers.