Motherson Sumi Wiring India Ltd. – Main wiring harness participant

Integrated in 2020, Motherson Sumi Wiring India Ltd. (MSUMI) is a outstanding full-system options supplier within the wiring harness phase for Authentic Gear Producers (OEMs) in India. MSUMI is a three way partnership between Samvardhana Motherson Worldwide Restricted (SAMIL) and Japan’s Sumitomo Wiring Programs, Ltd. (SWS), a worldwide chief in wiring harnesses and elements. With 26 amenities throughout India, the corporate provides complete options from product design to manufacturing, meeting, and built-in electrical programs.

Merchandise and Companies

MSUMI provides all kinds of harnesses for various autos together with passenger and business autos, two and three-wheelers, farm tools and off-road autos. Its companies additionally embody 3D computer-aided design (CAD), printed circuit board (PCB) design and routing, 3D printing, prototyping, digital and bodily validation and know-how implementation help.

Subsidiaries: As of FY23, the corporate doesn’t have any subsidiary or affiliate corporations.

Development Methods

- Market Management: Provides to 10 out of 12 passenger automobile fashions in India and expanded with three new amenities in FY23.

- Vertical Integration: Localizes manufacturing of elements like cables and connectors.

- Sturdy Parentage: Advantages from SAMIL and SWS when it comes to know-how and R&D capabilities.

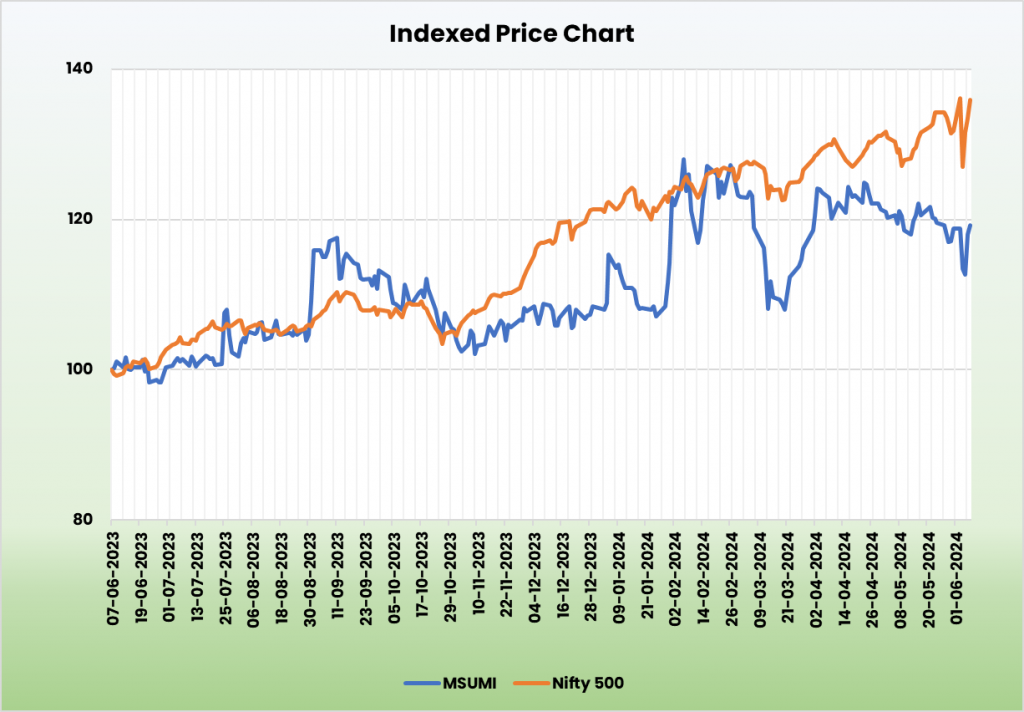

- Trade Outperformance: Surpassed trade progress by 11% in FY24 because of elevated demand and traits in premiumization and SUVs.

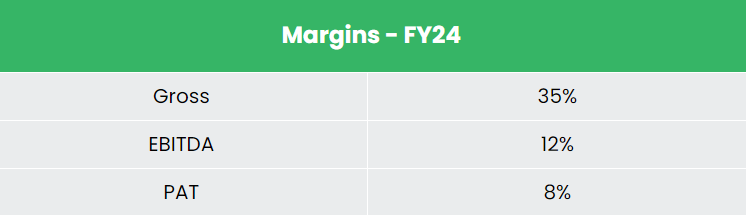

Monetary Highlights

Q4FY24

- Income: Rs. 2,233 crore, a 19% improve from Rs. 1,872 crore in Q4FY23.

- Working Revenue: Rs. 291 crore, a 32% improve from Rs. 221 crore in Q4FY23.

- Web Revenue: Rs. 191 crore, a 38% improve from Rs. 138 crore in Q4FY23.

FY24

- Income: Rs. 8,328 crore, an 18% improve in comparison with FY23.

- Working Revenue: Rs. 1,013 crore, up 27% YoY.

- Web Revenue: Rs.638 crore, a progress of 31% YoY.

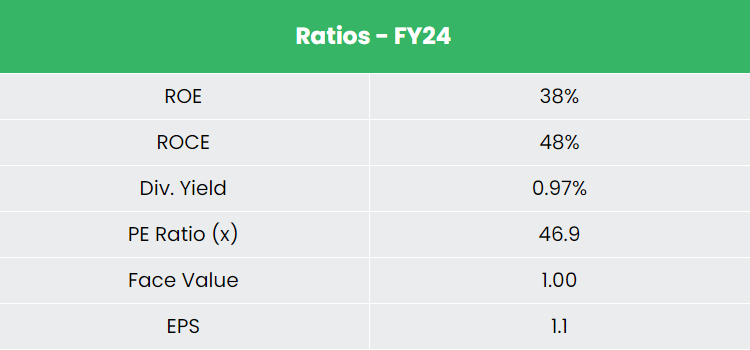

- Return on Capital Employed (ROCE): 48%, in comparison with 44% in FY23.

Monetary Efficiency (FY21-24)

- Income and PAT CAGR: 28% and 17%, respectively, over three years.

- Common ROE & ROCE: 48% and 60%, respectively, over the FY21-24 interval.

- Capital Construction: Debt-to-equity ratio of 0.15.

Trade Outlook

Market Enlargement: India’s auto elements trade is rising because of rising vehicle demand and rising incomes.

Localization Efforts: The rising presence of world vehicle OEMs has elevated the localization of elements.

Financial Contribution: By 2026, the sector is predicted to be price US$ 200 billion, contributing 5-7% of India’s GDP.

Funding Plans: By FY28, the trade goals to take a position US$ 7 billion to spice up the localization of superior elements.

Manufacturing Incentives: Elevated incentives are driving the growth and development of the sector.

Development Drivers

- FDI Coverage: 100% FDI is allowed below the automated route for the auto elements sector.

- BNCAP Initiative: The Bharat New Automotive Evaluation Program (BNCAP) is predicted to strengthen the auto element worth chain.

- FDI Influx: The Indian automotive trade attracted $35.65 billion in FDI from April 2000 to December 2023.

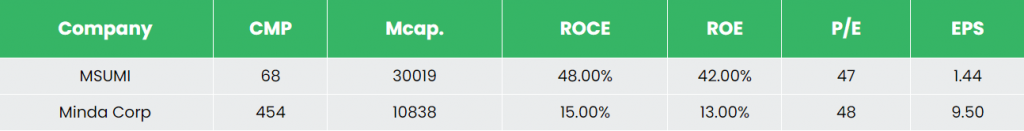

Aggressive Benefit

In comparison with rivals like Minda Company Ltd., MSUMI generates higher returns on invested capital. MSUMI’s dominance within the wiring harness enterprise is bolstered by minimal competitors, giving it a monopoly within the phase.

Outlook

Market Management: MSUMI leads the wiring harness trade with excessive entry obstacles and important operational scale.

Development Alternatives: The rising SUV and related autos market presents important progress potential.

Strategic Areas: The corporate’s amenities are strategically situated close to main vehicle hubs.

Enlargement Plans: Two new amenities are within the pipeline to cater to the increasing vehicle market.

Capex Steering: FY25 capex steerage is Rs. 200 crore for progress, growth, productiveness, high quality enchancment, and asset upkeep.

Resilience: The corporate’s diversified places and premium operations place it properly for sustained progress.

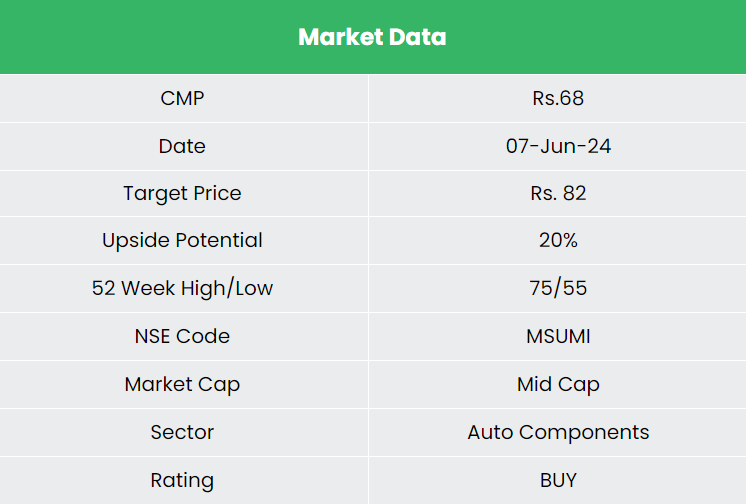

Valuation

MSUMI dominates the home wiring harness trade, supported by robust parentage from SAMIL and superior applied sciences from SWS. We suggest a BUY score with a goal value of Rs. 82, based mostly on a 50x FY26E EPS.

Dangers

Technological Adaptation: Failure to adapt to quickly evolving automotive trade applied sciences might have an effect on market share.

Buyer Retention: Incapacity to keep up pockets share with current key prospects might influence income.

Disclaimer: Please be aware that this isn’t a advice and is meant just for academic functions. So, kindly seek the advice of your monetary advisor earlier than investing.

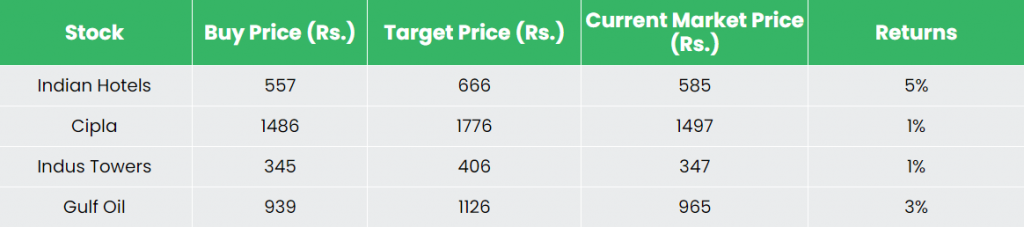

Recap of our earlier suggestions (As on 07 June 2024)

Different articles it’s possible you’ll like

Publish Views:

6,268