Newgen Software program Applied sciences Ltd – Digital transformation platform supplier

Based in 1992 and based mostly in New Delhi, Newgen Software program Applied sciences Ltd. supplies a unified digital transformation platform, NewgenONE. Catering to international B2B purchasers, its providers streamline operations and improve buyer experiences. Income primarily comes from software program licensing, with extra earnings from providers and assist. Newgen serves numerous sectors, together with banking, insurance coverage, healthcare, authorities, telecom, and BPOs. As of FY24, it has 4,400 workers and 500 energetic prospects throughout 76 international locations, together with marquee purchasers in India, the USA, Canada, UAE, Saudi Arabia, the UK, and extra.

Merchandise and Providers

Newgen Software program affords a sturdy platform with key options together with:

- Contextual Content material Providers (ECM)

- Clever Course of Automation (BPM)

- Omnichannel Buyer Engagement (CCM)

- Low-code Utility Improvement

- Synthetic Intelligence and Knowledge Science

Subsidiaries: As of FY24, the corporate has 8 wholly owned subsidiaries.

Development Methods

- Various Income Portfolio: The corporate’s income spans 17 key sectors, with main contributions from Banking & Monetary Providers (74%), Insurance coverage (14%), Authorities (4%), and others (9%).

- Insurance coverage Phase Development: Aiming to extend the insurance coverage section to 40% of complete income by specializing in product diversification and increasing its buyer base in India, the Center East, APAC, and the US.

- Geographic Enlargement: In FY24, Newgen opened new places of work in New York and Saudi Arabia to assist its progress technique, notably within the US and Center Jap markets.

- Redefined Gross sales Technique: The corporate has redefined its gross sales method for the US market to additional drive progress in its key sectors.

- Order Guide Enlargement: Newgen persistently expands its order ebook, securing important offers like a Rs.25 crore challenge from an insurance coverage firm and a Rs.16.9 crore deal within the home infrastructure financing sector.

- Worldwide Contracts: Newgen secured worldwide contracts, together with a US$ 1.5 million order from a US-based monetary establishment and an identical contract with a monetary leasing firm in Saudi Arabia, together with an settlement with a monetary establishment in Singapore.

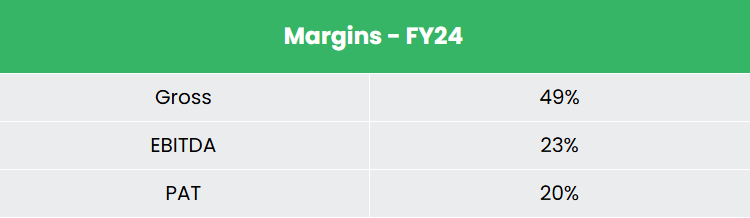

Monetary Efficiency

Q2FY25

- Income Development: Income elevated 23% to Rs.361 crore, up from Rs.293 crore in Q2FY24.

- EBITDA Development: EBITDA improved 46% to Rs.83 crore, with the margin rising from 19% to 23%.

- Internet Revenue Enhance: Internet revenue surged 46% to Rs.70 crore, with the margin rising from 16% to 19%.

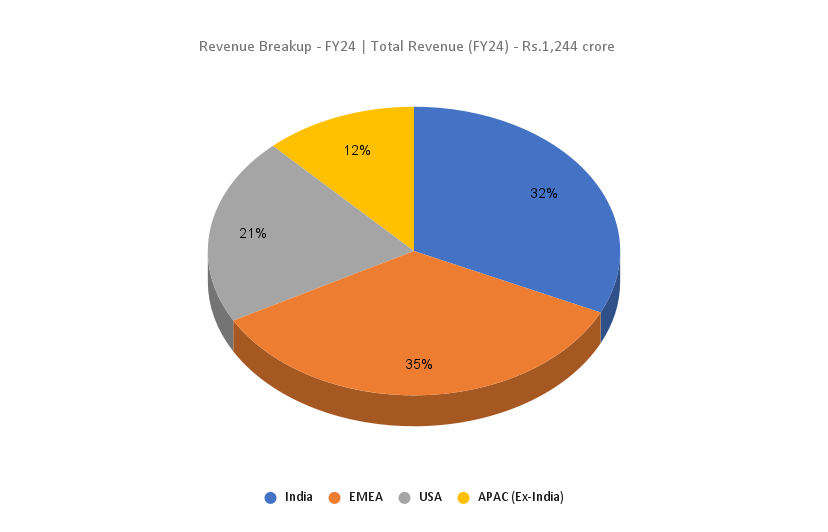

- Regional Efficiency: Robust YoY progress in EMEA (21%), India (19%), APAC (53%), and the USA (17%).

- License Gross sales: License gross sales grew 52% throughout the quarter.

- Operational Power: Continued robust efficiency throughout key metrics, driving profitability.

FY24

- Income Development: The corporate generated Rs.1,244 crore in income, a 28% enhance in comparison with FY23.

- Working Revenue: Working revenue reached Rs.288 crore, up 36% YoY.

- Internet Revenue: Internet revenue stood at Rs.252 crore, a 42% YoY enhance.

Monetary Efficiency (FY21-24)

- Income & PAT Development: The corporate achieved a 3-year CAGR of 23% in income and 26% in PAT (FY21-24).

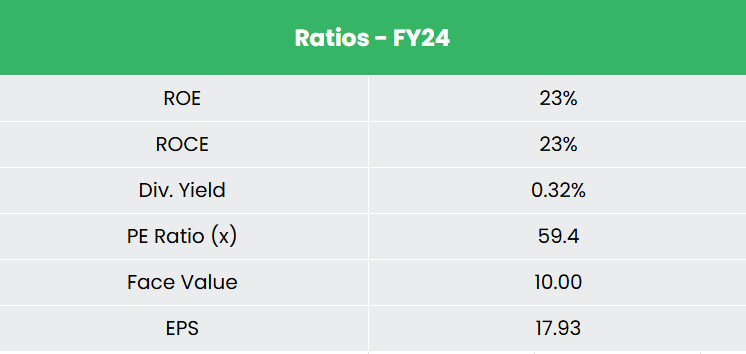

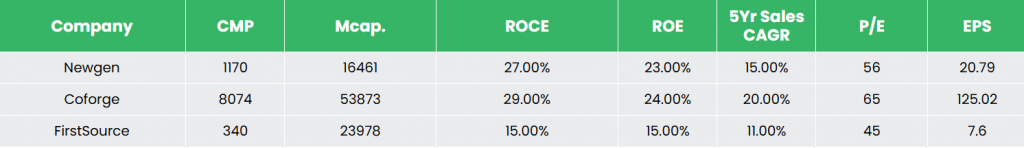

- ROE & ROCE: Common 3-year Return on Fairness (ROE) and Return on Capital Employed (ROCE) stand at 22% and 26%, respectively.

- Capital Construction: The corporate maintains a robust capital construction with a debt-to-equity ratio of 0.03.

Business outlook

- India is enhancing digital capabilities by deep-tech improvements and adopting rising applied sciences like AI, cybersecurity, and IoT.

- The IT sector is a key driver of financial progress, projected to achieve US$ 350 billion by 2026, contributing 10% to the nation’s GDP.

- The business is well-diversified throughout sectors akin to BFSI, telecom, and retail.

- India stays the main offshoring vacation spot for international IT companies.

- The tech sector is on observe to double its income, concentrating on US$ 500 billion by 2030.

- The general public cloud providers market is predicted to develop from US$ 6.2 billion in 2022 to US$ 17.8 billion by 2027, with a CAGR of 23.4%.

Development Drivers

- Union Price range 2024-25: Allocation of Rs.1,16,342 crore (US$ 13.98 billion) for the IT and telecom sector.

- PLI Scheme – 2.0: Cupboard authorized a Rs.17,000 crore (US$ 2.06 billion) outlay for IT {Hardware}.

- IndiaAI Mission: Cupboard authorized over Rs.10,300 crore (US$ 1.2 billion) for the IndiaAI Mission in March 2024, strengthening India’s AI ecosystem.

Aggressive Benefit

Newgen Software program Applied sciences Ltd. is producing secure returns from its capital, pushed by constant gross sales progress. The corporate boasts greater working revenue margins of 24%, in comparison with its opponents like Coforge Ltd. (15%) and Firstsource Options Ltd. (15%). This means a larger potential for margin-accretive profitability, positioning Newgen as a extra environment friendly participant within the business.

Outlook

- Newgen goals to attain $500 million in income by FY27.

- The corporate locations a robust give attention to analysis and improvement, having filed 45 patents, with 24 already granted.

- Whereas sustaining a robust presence within the banking sector, Newgen anticipates increasing its footprint within the insurance coverage sector.

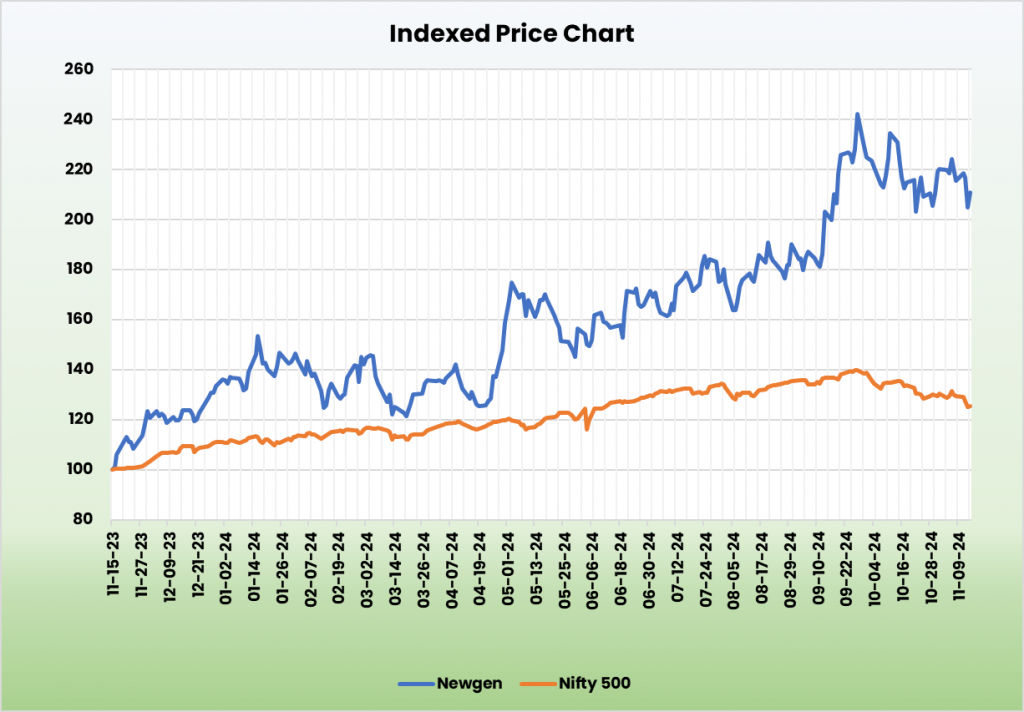

- With a sturdy market place, increasing order ebook, and a give attention to numerous verticals and geographies, the corporate is persistently delivering margin-enhancing efficiency, a pattern anticipated to proceed.

Valuation

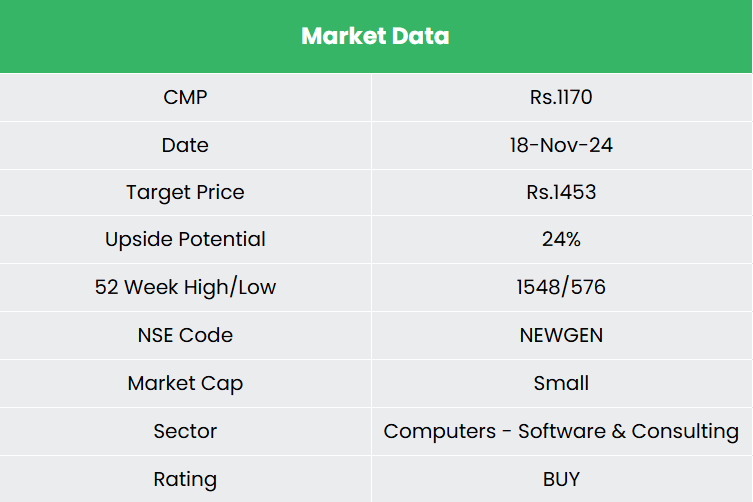

Newgen’s robust enterprise mannequin, give attention to numerous verticals, and growth into mature markets are anticipated to drive improved operational efficiency. We suggest a BUY score for the inventory with a goal worth (TP) of Rs. 1,453, based mostly on a 39x FY26E EPS.

Dangers

- Foreign exchange Danger: With important operations in overseas markets, Newgen is uncovered to foreign exchange danger. Unexpected fluctuations within the foreign exchange market might adversely have an effect on the corporate’s monetary efficiency.

- Macroeconomic Challenges: Tighter financial and monetary insurance policies, together with recessionary circumstances in key markets, might decelerate the corporate’s means to safe new offers.

Notice: Please be aware that this isn’t a suggestion and is meant just for academic functions. So, kindly seek the advice of your monetary advisor earlier than investing.

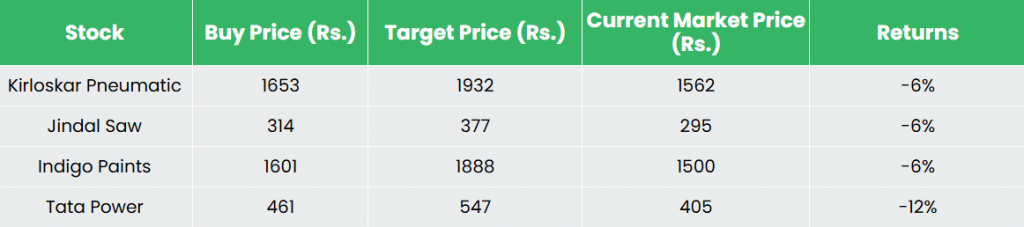

Recap of our earlier suggestions (As on 14 November 2024)

Different articles you could like