Expensive pals,

Welcome to the Samhain / the approaching of the darkish version of the Mutual Fund Observer!

October is an attention-grabbing month. Historically perilous for the monetary markets. It begins with the sullen remnants of summer season and ends with festivals of the harvest (even for these of us in cities) and of the approaching season when nature slips into dormancy. Halloween, whose gross sales now start in August and whose iconic ghouls now glower at Santa Claus in Costco, is rooted in Samhain, a pagan Celtic pageant welcoming the approaching of “the darkish half” of the 12 months.

So, have a good time, whereas we will, “Autumn…the 12 months’s final, loveliest smile.”

(The phrase is usually attributed to the poet William Cullen Bryant (1794-1898) although I can’t for the lifetime of me discover it within the unique.)

On this month’s subject …

My colleague Devesh had the uncommon alternative to talk with Mohnish Pabrai, a famend Indian investor who embraces lots of Warren Buffett’s rules and had an extended acquaintance with Charlie Munger. Mr. Pabrai introduced his concentrated type of investing within the US market a 12 months in the past with the launch of his Wagons Fund. Wagons, as in “it’s time to circle the wagons, boys!” wagons. Devesh talks with him in particular depth in regards to the six buckets into which just about all of his belongings circulate.

We share a Launch Alert for an interesting new fund from CrossingBridge, CrossingBridge Nordic Excessive Revenue Bond Fund, which went stay on October 1. It’s a high-income technique from a singularly profitable adviser in a particular market area of interest that no different fund touches. At base, the Nordic market is massive, clear, rapidly rising … and a venue for smaller European and American issuers to lift capital when different avenues are foreclosed.

Our colleague Lynn Bolin shares two essays this month. Within the first, Lynn notes that “we’re at an inflection level with short-term rates of interest falling and the yield curve” normalizing. He hopes to supply some perception into the following six to 12 months out there by momentum measures within the 800 funds and ETFs he tracks. Within the second, he examined choices for pursuing “Underconsumption Core,” a kind of “cottagecore to your finances” monetary motion that appears to be taking maintain on TikTok. With one thing like 65% to 75% of Individuals dwelling paycheck to paycheck, he displays on some helpful concepts on learn how to lower spending and save extra.

The Shadow, vigilant as ever, chronicles SEC actions in opposition to two well-known companies, a half dozen attention-grabbing choices within the pipeline, bits of excellent information for buyers … and a couple of dozen demise notices.

Lastly, I got here very near ending a fund profile for this subject, a course of derailed by:

For you metropolis of us, that’s the again of our gardens. And that’s a possum. Most significantly, that’s a possum firmly wedged below the fence, midway between our yard and Colin’s. In lieu of ending edits on the fund profile, I labored on excavating Peter (or Petra) Possum. Failing at that, I launched myself to my new neighbor Colin, who borrowed a shovel and labored on undercutting P’s hindquarters. (That was about as standard as you may think.)

Finally sighting, P was lastly freed from the fence however unable, or disinclined, to extricate itself from its gap. And so, as Chip publishes this subject, I’m going to go provide it a paw-paw.

No, that’s not a cute method of claiming “high-fiving a possum.” It’s a non-commercial (tasty) fruit native to the Midwest. Simply the factor to take the sting out of a day-long confinement. I hope. Anyway, we’ll share the profile in November! Thanks to your endurance.

Sensible individuals say “hello!”

I had the chance to talk this week with three units of sensible individuals. The always-engaging David Sherman chatted in regards to the peculiar delights of the Nordic high-yield bond market. The outcomes of that chat are chronicled within the Launch Alert for CrossingBridge Nordic Excessive Revenue Bond.

I had event to be within the Twin Cities to assist my son, Will, transfer to a brand new residence. I took the chance to drop by The Leuthold Group the place I received to talk with long-time confidant Paula Mikl, CIO Doug Ramsay, and portfolio supervisor Chun Wang. We mentioned market valuations (silly excessive, once more), the funding administration enterprise (issues are fairly secure for them, their ETF isn’t cannibalizing belongings, they usually’re partnered with a Texas agency to increase their distribution community), and Leuthold Core (each the fund and the ETF). The ETF prices 60 bps lower than the fund and has a barely increased yield with minor divergences in efficiency. Each funds have the identical tactical allocation, the distinction is that the ETF implements it by shopping for about 24 ETFs. That makes the technique low cost however “much less granular on the business stage” than the fund. Since inception, each the returns (45.79% vs 45.61%) and volatility are remarkably shut. Among the agency insiders personal the fund, others are shopping for the ETF. Being Minnesota, we had espresso … and I received a extremely cool cell phone-enabled espresso mug out of the go to!

I had event to be within the Twin Cities to assist my son, Will, transfer to a brand new residence. I took the chance to drop by The Leuthold Group the place I received to talk with long-time confidant Paula Mikl, CIO Doug Ramsay, and portfolio supervisor Chun Wang. We mentioned market valuations (silly excessive, once more), the funding administration enterprise (issues are fairly secure for them, their ETF isn’t cannibalizing belongings, they usually’re partnered with a Texas agency to increase their distribution community), and Leuthold Core (each the fund and the ETF). The ETF prices 60 bps lower than the fund and has a barely increased yield with minor divergences in efficiency. Each funds have the identical tactical allocation, the distinction is that the ETF implements it by shopping for about 24 ETFs. That makes the technique low cost however “much less granular on the business stage” than the fund. Since inception, each the returns (45.79% vs 45.61%) and volatility are remarkably shut. Among the agency insiders personal the fund, others are shopping for the ETF. Being Minnesota, we had espresso … and I received a extremely cool cell phone-enabled espresso mug out of the go to!

Lastly, I had an opportunity to speak a bit with Minyoung Sohn and John Fenley. Min managed the $8 billion Janus Development and Revenue Fund from 2004-07, left Janus to discovered ArrowMark Companions the place he managed Meridian Enhanced Fairness and grew the corporate to a $24 billion agency, after which left ArrowMark to discovered Blue Room Investing.

Lastly, I had an opportunity to speak a bit with Minyoung Sohn and John Fenley. Min managed the $8 billion Janus Development and Revenue Fund from 2004-07, left Janus to discovered ArrowMark Companions the place he managed Meridian Enhanced Fairness and grew the corporate to a $24 billion agency, after which left ArrowMark to discovered Blue Room Investing.

John’s profession is marked by excellence in worldwide small-cap investing, a technique that he pursued at Hansberger and Denver Investments the place he managed Westcore Worldwide Small Cap which ultimately grew to become a part of Segal, Bryant & Hamill. Whereas there, John grew to become their Director of Basic Worldwide Methods. He joined Blue Room in 2023. Between them, Min and John have a shelf filled with efficiency awards and accolades. The agency is profitable and dedicated to doing good, as a lot as doing effectively. A part of that course of consists of discussions, nonetheless of their infancy, about returning to the ’40 Act world, both with their very own fund(s) or as sub-advisers on a global small-cap or lengthy/brief fairness technique. Given their file and good sense, both growth can be a serious win for buyers. We’ll preserve you apprised.

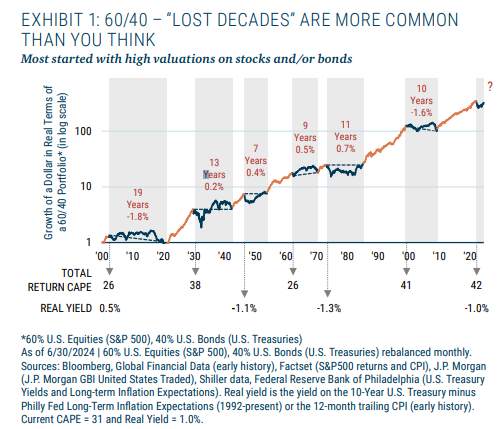

Misplaced a long time

GMO supplied an attention-grabbing and sobering reminder to the “the market is my buddy” crowd. For those who had been born in 1900 and lived till your 85th 12 months, you’ll have spent greater than half of your whole life experiencing “misplaced a long time” within the monetary markets.

Greater than half your life. Yikes.

This, in a nutshell, is the argument for diversification – these numbers would look far completely different with a slice of Japanese equities, for example – and for specializing in affordable targets (my retirement portfolio must earn 6% a 12 months for me to have an inexpensive prospect of safety after I cease full-time work), affordable time frames (three years isn’t it), and an inexpensive set of life selections (by no means purchase a brand new automotive, stay within the house you want quite than the house you need, discover pleasure in individuals quite than possessions, prepare dinner).

What a distinction a field makes

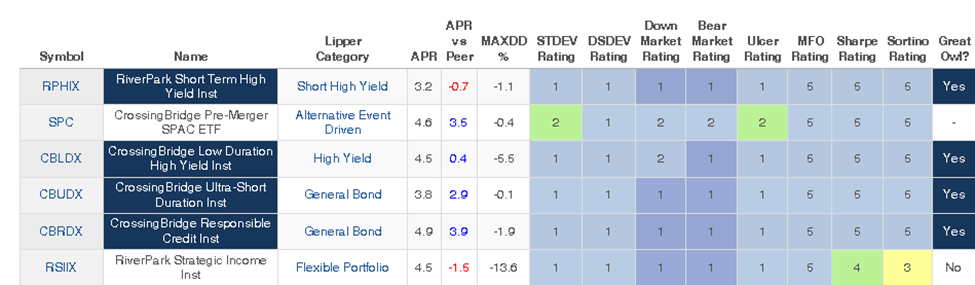

In our Launch Alert for CrossingBridge Nordic Bond, we embrace a desk of the risk-adjusted efficiency because the inception of all of the CrossingBridge Funds. (Quick model: high tier throughout the board.) Every is in comparison with its Lipper peer common.

CrossingBridge founder David Sherman notes that Morningstar and Lipper assign the funds to dramatically completely different peer teams and has some reservations about Lipper’s assignments.

CrossingBridge Pre-Merger SPAC ETF (Monetary Inventory, however previously Small Cap Development, at Morningstar, Different Occasion-Pushed at Lipper)

I feel the CrossingBridge Pre Merger SPAC ETF needs to be categorized within the ultra-short period bond class because it meets the period definition backed by US Treasuries in SPAC escrows and the Fund all the time redeems or sells however by no means rolls into offers.

RiverPark Strategic Revenue (Excessive Yield Bond at Morningstar, Versatile Portfolio at Lipper)

RiverPark Strategic Revenue is a versatile conservative high-yield fund. It has the pliability to scale back high-yield publicity and transfer into funding grade when spreads appear overvalued or different situations exist from a bottom-up, worth investor standpoint. Versatile class funds are sometimes top-down funds making calls on rates of interest, time period construction, and financial views.

CrossingBridge Low Period Excessive Yield (Multisector bond at Morningstar, Excessive Yield at Lipper)

CrossingBridge Low Period Excessive Yield (CBLDX) has traditionally been a max of 65% excessive yield and a period mandate of sometimes 2 or much less … so completely different than the standard excessive yield class. These variations are the rationale behind altering the identify and refiling a prospectus with SEC for evaluate (nonetheless awaiting feedback) to Excessive Revenue.

All of which is value realizing as a result of the simple judgments – “it’s a five-star fund! Purchase!” – are pushed by these sometimes-questionable peer group assignments. The explanation that MFO focuses much less on rankings and extra on a supervisor’s technique and impulses is to maintain you from performing based mostly on “peer-adjusted efficiency” when, effectively, they aren’t really friends.

The 4 questions it is advisable ask your self

- Do I do know what the supervisor is doing?

- Does my portfolio want what he’s doing?

- Have they managed to do it persistently, amid altering markets?

- Am I comfy with the short-term dangers, together with volatility and peer underperformance, that I’m prone to expertise?

Something lower than 4 “yeses” means “not for me!”

The World Goes Spherical

We be aware with unhappiness the closing of Rondure International Advisors, a woman-owned funding adviser based in 2016 and headquartered in Salt Lake Metropolis, Utah. Laura Geritz, CFA is Rondure’s founder, co-CIO, and CEO. She started her profession at American Century as a bilingual investor relations consultant, a place that continues to form her fascinated about her buyers, their wants, and her obligations to them. She moved to the investing aspect in 1999 at American Century and ultimately joined Wasatch Funds in 2006. She has been phenomenally profitable as knowledgeable investor. Lewis Braham, writing in Barron’s about her work at Wasatch Worldwide Alternatives, concluded that she “crushed” her friends (“Ought to You Observe a Star Cash Supervisor?” Barron’s, 9/10/2016). Her sign cost, Wasatch Frontier Rising Small International locations, returned 15 instances what her opponents did. However as she traveled to these challenged and striving nations, she got here to a poignant and highly effective conclusion:

Someplace alongside the trail of getting cash, I received too busy to do as a lot good as I aspired to.

Founding Rondure was a method to return to that want. The agency has three core rules: earn a living for our purchasers, Do Good, and be nice companions.

Within the final week of September 2024, Ms. Geritz penned the “Ultimate Shareholder Letter,” which is each somber and modestly mysterious:

It’s with heavy hearts and considerate consideration that we inform you that the Rondure New World Fund shall be liquidated on October 18, 2024, and with this closure, we can even be closing Rondure International Advisors.

The financial panorama of our rising markets-focused methods has been difficult for a while. Our whole crew has been devoted to going through these challenges with the fixed goal to attain long-term constructive returns for our purchasers and buyers. Sadly, latest unexpected developments inside our enterprise have compelled us to reevaluate our means to proceed. It’s a painful end result and definitely not a call we anticipated ever having to make, significantly after we assume rising markets stay such an attention-grabbing and compelling long-term funding. We didn’t make this resolution evenly, however in the end, consideration of the financial and operational realities of continuous the agency have led us to appreciate closing is one of the best end result for our purchasers.

In a subsequent dialog, Laura pointed to the sudden and sudden confluence of things, unmanageably rising prices and well being challenges, as conspiring to make it unimaginable for Rondure to proceed. Her two priorities now are caring for her workers and her buyers. She is working to make it attainable for her shareholders to achieve entry to the soft-closed Grandeur Peak Rising Markets Alternatives Fund in the event that they wish to keep publicity to the type and belongings. That’s a uncommon and considerate gesture however hardly stunning given her character.

We want all concerned godspeed.

Thanks, as ever . . .

To The Few, The Proud, The Ongoing Contributors: Wilson, S&F Funding Advisors, Gregory, William, the opposite William, Stephen, Brian, David, and Doug! Legitimately, thanks, guys.

An distinctive variety of of us, and a variety of distinctive of us, made contributions this month which is able to dramatically develop the alternatives we will pursue. So because of the Suranjan Fund, Dr. Mary of Atlanta Monetary Psychology (thanks for the type phrases! We attempt exhausting to persuade common of us that they will make sense of the system if they only have religion and preserve it easy.), Mitchell of Washington, Leah from Cambridge, Frederic of Wisconsin, Rad of California, Andrew from Orefield, Sunny of California, Martin from Columbus, and Mark of Michigan.

And my expensive departed buddy Nick Burnett, by way of the beneficiant intermediation of his spouse, Debbi. Of all of the individuals I’ve recognized, Nick is the one who most earned the accolade, “bigger than life.” Cheers, buddy. Thanks, Debs!

You Matter

Act prefer it.

The kids are watching.

And ready, to inherit what we depart them.

The devastation in locations that had been alleged to be idyllic and iconic – locations like Asheville, North Carolina, the place pals have been celebrating retirement – has been a lot on my thoughts. “Now we have biblical devastation by way of the county,” mentioned Ryan Cole, the assistant director of Buncombe County Emergency Providers. And but Asheville was usually sufficient described as “a local weather haven,” insulated from the worst results of world warming.

Demise threats in opposition to an organization proprietor in Springfield, Ohio – “family-built, American-owned, making metallic work in America since 1965 … some say American manufacturing isn’t what it was. Apparently, they haven’t hung out in Springfield” – who had the temerity to say publicly that his Haitian staff had been good staff, has been on my thoughts. “They arrive to work day-after-day. They don’t trigger drama. They’re on time. I want I had 30 extra.” That led to a voicemail on the corporate answering machine: “The proprietor of McGregor Metallic can take a bullet to the cranium and that might be 100% justified.” His youngsters and 80-year-old mom have additionally been threatened.

Demise threats in opposition to an organization proprietor in Springfield, Ohio – “family-built, American-owned, making metallic work in America since 1965 … some say American manufacturing isn’t what it was. Apparently, they haven’t hung out in Springfield” – who had the temerity to say publicly that his Haitian staff had been good staff, has been on my thoughts. “They arrive to work day-after-day. They don’t trigger drama. They’re on time. I want I had 30 extra.” That led to a voicemail on the corporate answering machine: “The proprietor of McGregor Metallic can take a bullet to the cranium and that might be 100% justified.” His youngsters and 80-year-old mom have additionally been threatened.

Jimmy Carter, who improbably celebrated his 100th birthday, on 30 September 2024, has been on my thoughts. Mr. Carter was identified with mind most cancers in 2015. He entered hospice in 2023 and misplaced the love of his life that very same 12 months. That they had been married for 77 years. His household often frames his future when it comes to weeks. And nonetheless, he persists. He was not an awesome president, his abilities and temperament didn’t align with the challenges of the job, however he was arguably one of the best particular person to carry that workplace within the 20th century. I nonetheless keep in mind Mr. Carter’s cumbersome sweaters in winter, and his resolution to put in photo voltaic panels on the roof of the White Home. Mr. Reagan had them ripped out. The youthful President Bush quietly put in photo voltaic on a upkeep constructing on the White Home grounds and President Obama restored them to the White Home roof.

Nazi propaganda has been on my thoughts, too. The Nationwide Socialist propaganda had two pretty distinct phases, the “make Germany nice once more” part from about 1932 – 1937 and the “eradicate the enemy inside” part from about 1938 – 1945. Some fascinating new work by students at Cambridge on a lately uncovered British intelligence evaluation from April 1942, apparently unread for 80 years, focuses on Hitler’s rising obsession with “the enemy inside,” which the British speculate was pushed by a rising realization that his trigger was misplaced. As his desperation grew, his underlings accelerated the Ultimate Answer, a part so virulent that focus camp commanders had been persevering with genocide even after they knew the warfare had been misplaced and that Allied forces would seize their camps inside days.

The usage of such rhetoric – “the risk from outdoors forces is much much less sinister, harmful and grave than the risk from inside,” descriptions of home opponents as “vermin” and immigrants as “poisoning the blood of the nation,” all at a single Veteran’s Day speech – by an American aspiring to guide the nation, has been on my thoughts. So much.

That reality that people cheered, likewise.

The toughest act of religion, generally, is recalling that even in perilous instances, you matter. We’re, every of us, academics. We’re instructing our neighbors what we consider them. We’re instructing youngsters who they need to grow to be. And we’re instructing ourselves, in small each day actions taken and never taken, who we’ll grow to be.

The toughest act of religion, generally, is recalling that even in perilous instances, you matter. We’re, every of us, academics. We’re instructing our neighbors what we consider them. We’re instructing youngsters who they need to grow to be. And we’re instructing ourselves, in small each day actions taken and never taken, who we’ll grow to be.

Actually, do you wish to be the individuals you see on TV? If not, then don’t act like them. Be a very good steward of the world gifted to us. Respect those that most loudly disagree with you, realizing {that a} good coronary heart nonetheless lies beneath many fevered phrases. Be mild along with your flaws. Be stalwart in your willingness to do good: to vote, to encourage others, to cease the doom-scrolling, to talk when it comes to insurance policies quite than merely personalities, to push those that result in take the devastation wrought by a warming planet critically, to help these whose lives have been shredded. Channel Jimmy.

Know that touching one life is healthier than touching none. Planting one tree is healthier than leaving the sector barren.

Know that the kids are watching.

As ever,