Because the nation was rising from the pandemic, rents exploded. Two years later, the stress on rents is beginning to ease in response to a rise in multifamily building, together with condo buildings.

However the COVID-era surge continues to hang-out renters, who’re paying about 20 p.c greater than they did in 2019, although wholesome wage will increase lately offset a few of that.

The nation is within the grips of “an unprecedented affordability disaster,” Harvard’s Joint Heart for Housing Research concludes in its new report. The middle estimates that about half of U.S. renters – some 22 million households – spent at the very least 30 p.c of their revenue on rental housing in 2022. That’s the best share in over a decade. About 12 million of them spent greater than half their revenue on housing.

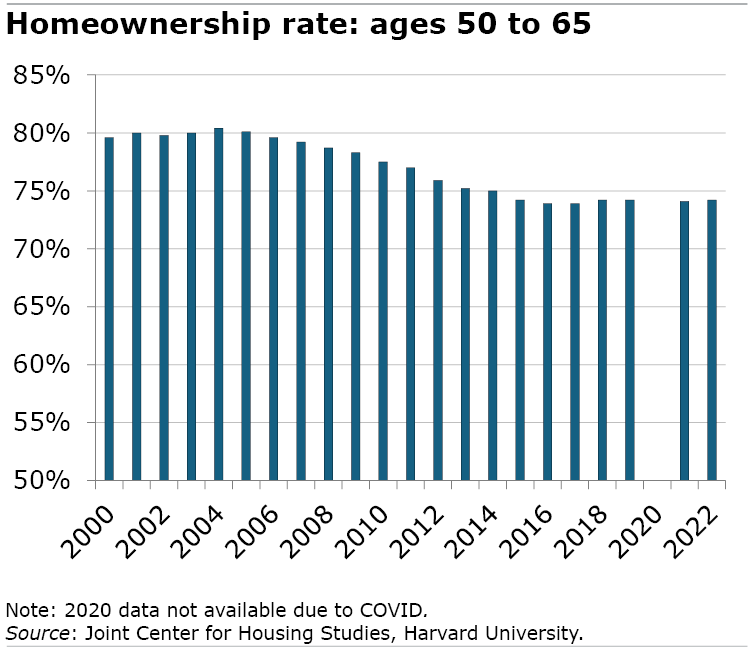

A associated development detected by Harvard’s housing middle final yr is regarding for future retirees: declining homeownership amongst older employees that can expose rising numbers of them to rising rents after they retire.

Any house owner will let you know a giant benefit they’ve over renters is that the funds on a fixed-rate mortgage don’t enhance. Rents do and, as we’ve seen just lately, typically by rather a lot. Rising rents are notably a pressure on retirees since they’ve much less revenue than after they had been working.

One other bonus of homeownership is that it’s a type of pressured retirement saving. Each mortgage fee provides a bit of bit to dwelling fairness, which is cash retirees can use to complement their revenue. They’ve to date been reluctant to faucet that cash. However it’s, nonetheless, a supply of wealth that’s accessible to them.

To the extent that homeownership is a type of retirement wealth, issues appear to be heading within the mistaken path.

Twenty years in the past, homeownership amongst 50- to 65-year-olds – largely boomers – hit an all-time excessive of 80 p.c, the housing middle stories. After which the Nice Recession occurred, and homeownership began dropping. At this time, 74 p.c of older employees personal their properties.

That downward development “probably foreshadows decrease homeownership charges for older adults sooner or later,” the middle predicted.

If that prediction is true, the absence of this main supply of wealth can solely imply the necessity for inexpensive rental housing for retirees that the middle has warned about for years will proceed to develop.

Squared Away author Kim Blanton invitations you to comply with us @SquaredAwayBC on X, previously generally known as Twitter. To remain present on our weblog, be part of our free electronic mail checklist. You’ll obtain only one electronic mail every week – with hyperlinks to the 2 new posts for that week – once you enroll right here. This weblog is supported by the Heart for Retirement Analysis at Boston Faculty.