Sector & Thematic funds have gotten standard…

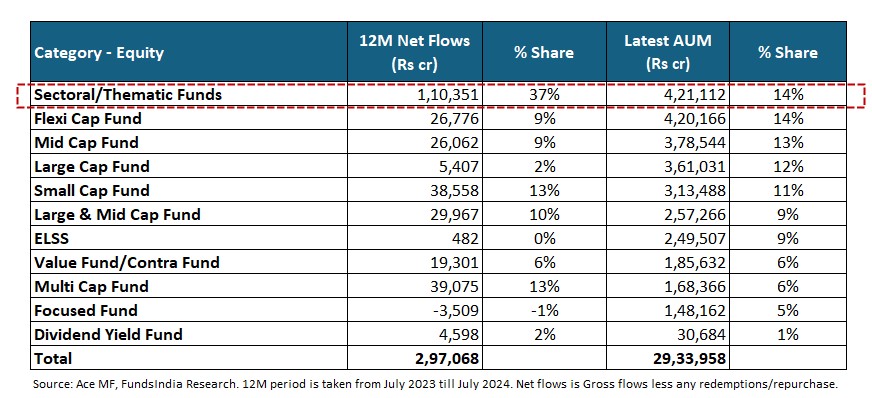

Over the previous 12 months, greater than 1/third of fairness mutual fund internet inflows have gone into sector and thematic funds.

It’s now the largest fairness class (three years in the past it was ranked fifth).

..Led by robust latest returns

A number of sector & thematic funds have delivered excessive returns within the latest previous resulting in a robust curiosity in these funds.

This has additionally resulted in a lot of new Sector & Thematic NFOs being launched by totally different AMCs.

All this results in a easy query:

Ought to You Contemplate Thematic & Sector Funds for Your Portfolio?

Let’s discover out…

In case you are evaluating sector and thematic funds, there are 5 challenges to be addressed

CHALLENGE 1: PERFORMANCE IS CYCLICAL

Assume you needed to put money into any sector or thematic fund right this moment, which fund would you select?

The intuitive choice can be to go along with the top-performing funds of the previous couple of years. You run a screener, kind sector & thematic funds from highest to lowest 1-year or 3-year returns, and discover out the present prime funds with the very best returns. Easy proper?

However right here is the place issues get slightly counter-intuitive.

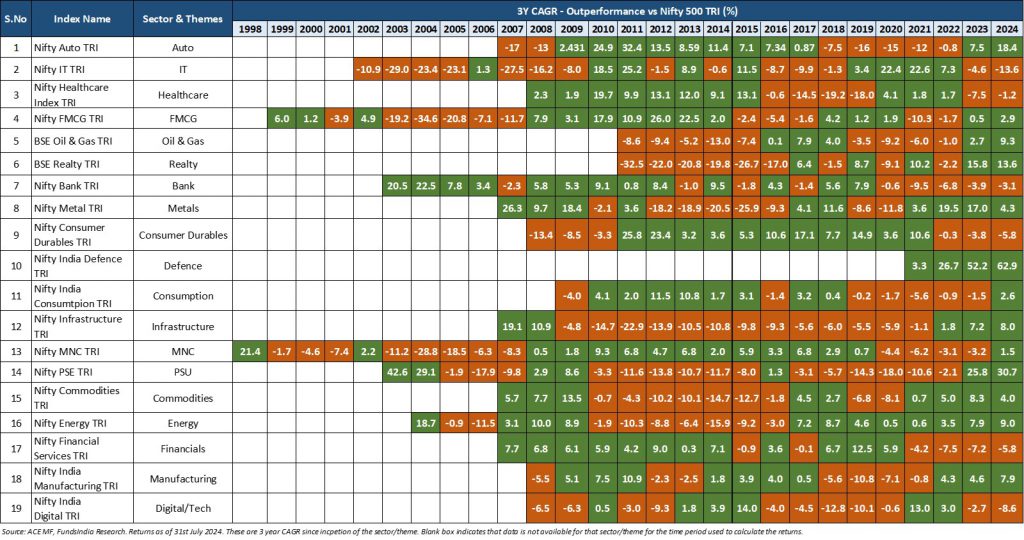

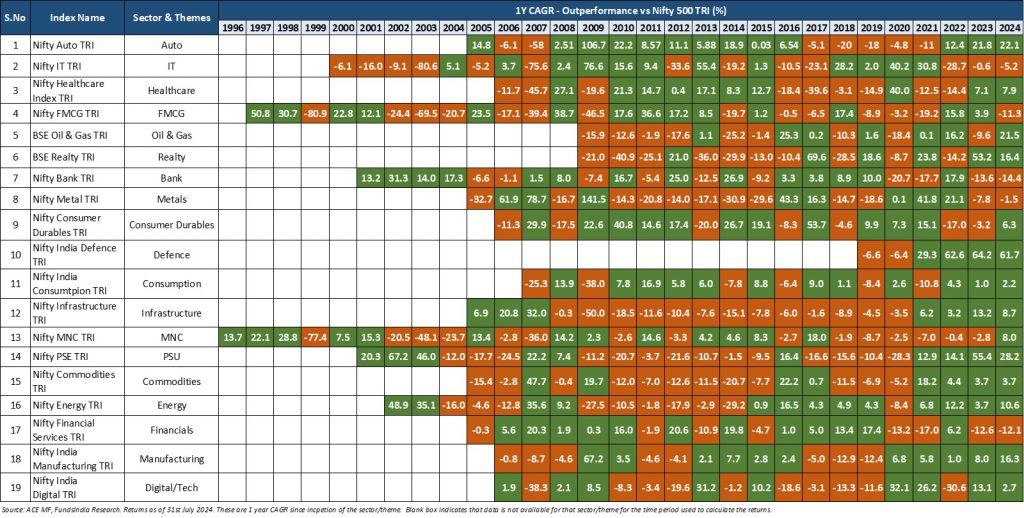

For the final 29+ years, we evaluated the historic rolling return development (1Y and 3Y) of standard sectors and themes vs broader index Nifty 500 TRI. Within the tables beneath, the durations of outperformance are proven in inexperienced and underperformance in purple.

1-Yr Rolling Returns (CAGR) Outperformance of Sector/Themes vs Nifty 500 TRI

3-Yr Rolling Returns (CAGR) Outperformance of Sector/Themes vs Nifty 500 TRI

As you’ll be able to see from each the 1Y and 3Y tables, sectors and themes don’t outperform the Nifty 500 TRI throughout all durations.

For each sector and theme, phases of outperformance are inevitably adopted by phases of underperformance.

The important thing takeaway for us is- Efficiency of sectors and themes are cyclical.

This occurs as a result of most sectors are cyclical and are delicate to the modifications within the enterprise and financial cycle.

So, in case you base your selections solely on previous efficiency, then you’ll probably enter the sector/theme which has had robust outperformance and exit the sectors with underperformance.

Right here is the place you’ll be able to go flawed,

- Once you enter a sector/theme after a 3-5Y interval of robust outperformance, there’s a excessive probability that the cycle could flip and you find yourself capturing the longer term underperformance.

- Once you exit a sector/theme after a 3-5Y interval of robust underperformance, there’s a excessive probability that the cycle could flip and you’ll find yourself lacking the longer term outperformance.

To achieve success in sector and thematic investing, you want to have the ability to consider cycles (enterprise and valuation), act countercyclically, and time entry and exit factors.

Takeaway – Basing your choice on previous efficiency will be deceptive as efficiency of thematic and sector funds is cyclical. Thus, timing the entry and exit primarily based on analysis of the cycle is essential.

CHALLENGE 2 – TIMING IS DIFFICULT

To enter and exit a selected sector/theme on the proper time and considerably outperform the broader benchmark (Nifty 500 TRI) it’s good to get three issues proper

- Valuation cycle – it is best to be capable to enter near the underside of the valuation cycle (low-cost or cheap valuation) and exit near the highest of the valuation cycle (very costly valuations).

- Earnings cycle – it is best to be capable to enter the sector or theme when it’s on the backside/early levels of the earnings cycle and exit on the late levels of the earnings cycle.

- Proper Fund to Make investments – it is best to be capable to determine a fund which may totally seize the underlying sector/theme and doesn’t dilute the technique over time.

Getting all these 3 circumstances persistently proper over the long run is DIFFICULT.

Takeaway – In India and Globally, there is no such thing as a proof of any fund or fund supervisor efficiently pulling off the sector rotation technique over lengthy durations of time.

CHALLENGE 3 – COST OF MISTIMING IS VERY HIGH

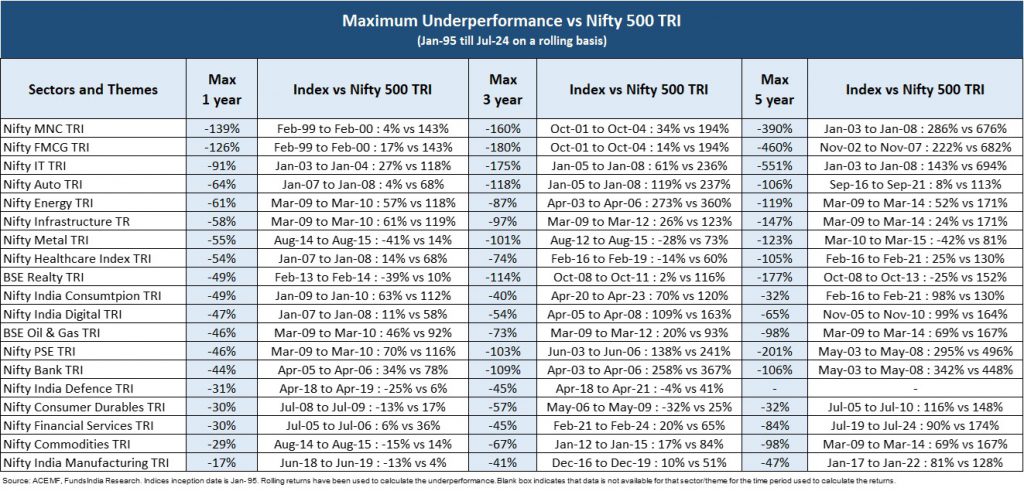

Sector & themes have typically gone by lengthy stretches of underperformance when in comparison with different diversified indices. The diploma of underperformance as seen from the desk will be extraordinarily sharp and swift erasing a number of years of beneficial properties.

To know this higher, we have now calculated the utmost underperformance of sectors and themes over a 1, 3 and 5-year rolling foundation.

As you’ll be able to see from the above sectors and themes,

- On a 1 yr foundation – 14 out of 19 have most underperformance >40% – highest underperformance was 139%

- On a 3 yr foundation – 15 out of 19 have most underperformance >50% – highest underperformance was 180%

- On a 5 yr foundation – 11 out of 19 have most underperformance >100% – highest underperformance was 551%

Sector and Thematic funds are thought-about dangerous because the diploma of underperformance vs Nifty 500 TRI is drastic in case you get the timing flawed.

Why does this occur?

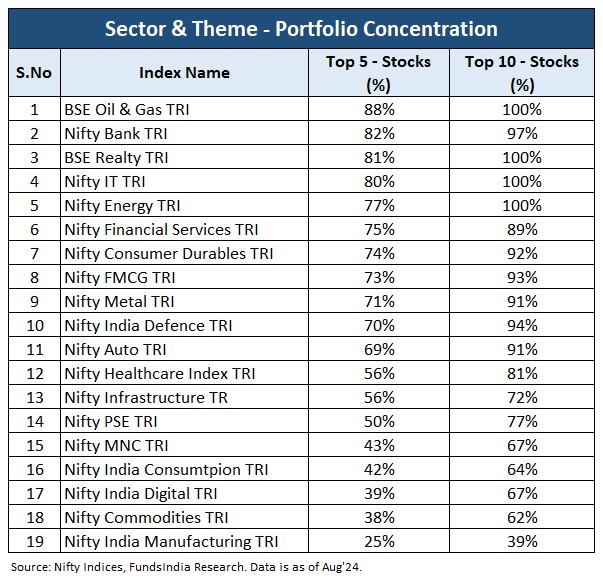

Majority of the sectors and themes have 2/third of their portfolio concentrated in 5-10 shares.

Thus the diploma of underperformance in case you get the timing flawed will be very excessive as there two ranges of focus danger

- Not like diversified funds, which make investments throughout sectors, you might be concentrated in solely that particular sector/theme

- Even inside that particular sector/theme, the portfolio is concentrated in simply 5 to 10 shares

Takeaway – In the event you get the timing flawed, the diploma of underperformance will be important!

CHALLENGE 4 – UNLIKE DIVERSIFIED FUNDS, ‘BUY AND HOLD’ APPROACH MAY NOT WORK WELL

In case you are investing in good diversified funds then generally they have a tendency to outperform the broader market (Nifty 500 TRI) over a 7-10 yr timeframe unbiased of the entry level.

However the purchase and maintain strategy (extending the time-frame) could not work in your favour in case you are investing in sector and thematic funds.

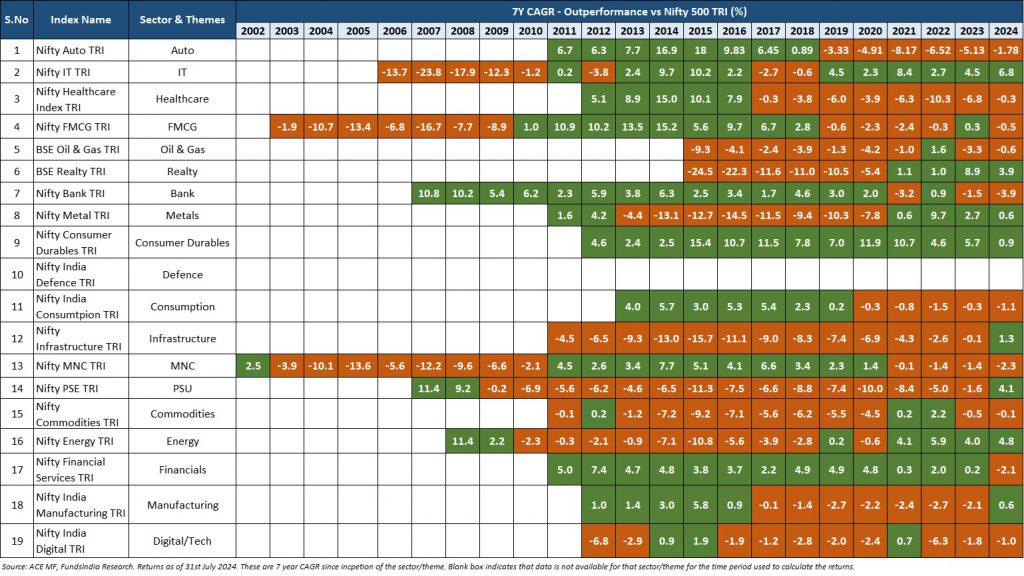

Within the desk beneath we have a look at the 7-year and 10-year outperformance of those sectors and themes (outperformance in inexperienced and underperformance in purple) versus Nifty 500 TRI.

7-Yr Rolling Return Efficiency (CAGR) of Sector & Thematic Funds vs Nifty 500 TRI:

10-Yr Rolling Return Efficiency (CAGR) of Sector & Thematic Funds vs Nifty 500 TRI:

As you’ll be able to see from the above tables, a number of sectors and themes have persistently underperformed the broader market even over a 7 yr and 10 yr timeframe. These are very lengthy stretches of underperformance and generally the underperformance has been important.

Takeaway – Extending the time-frame (purchase and maintain) can’t repair flawed timing, as typically sectors and themes have underperformed for lengthy durations (7-10 years).

CHALLENGE 5 – EVEN IF YOU GET EVERYTHING RIGHT, YOU ARE LIKELY TO BE UNDER-ALLOCATED

Most buyers, after doing all of the exhausting work, find yourself having very small exposures (<5%) to sector/thematic funds which doesn’t make a lot distinction to general portfolio efficiency.

So even in case you get the 1) sector/theme, 2) timing and three) fund choice proper over the long term, you have to to have a moderately significant publicity to transfer the needle with respect to your general returns!

Takeaway – You’ll need to have a significant portfolio publicity to make a distinction to your general returns.

What do you have to do?

- Given the 5 challenges,

- Problem 1 – Efficiency is Cyclical

- Problem 2 – Timing is Troublesome

- Problem 3 – Value of Mistiming is Very Excessive

- Problem 4 – Not like diversified funds, ‘Purchase and Maintain’ strategy could not work

- Problem 5 – Even in case you get every little thing proper, you might be prone to be under-allocated

Most buyers are higher off investing in diversified fairness funds the place persistence and a very long time horizon act as an benefit eradicating the necessity to time.

- For skilled buyers with a excessive danger urge for food, eager to discover sector & thematic investing we might counsel beginning small with a restricted publicity (<20%) and rising it over time as you achieve expertise and experience. You may observe the 3U & 3O framework to enter and exit the suitable sectors & theme on the proper time

3U – To Enter the suitable sector & theme on the proper time

- Un-Cherished – no investor curiosity (no inflows/persevering with outflows)

- Beneath-Performer – underperforming (Nifty 500 TRI over 3-5 years)

- Beneath-Valued – cheap valuations

3O – To Exit the suitable sector & theme on the proper time

- Over-Owned – lot of investor curiosity (very excessive inflows)

- Out-Performer – excessive outperformance vs Nifty 500 TRI over 3-5 years

- Over-Valued – very costly valuations

- At FundsIndia, we use Sector and Thematic funds as part of our ‘Excessive Danger’ Bucket and restrict it to <20% of general portfolio.

Different articles you could like

Submit Views:

2,387