In the event you’ve been studying Can I Retire But? so long as I’ve, you understand there’s been no scarcity of protection on retirement calculators.

Whereas doing analysis for this put up, I dug up 22 such articles printed on the location since 2012. Amongst them, no fewer than 82 distinct retirement calculators are talked about. Of those, 20 have been vetted and reviewed totally by Chris and Darrow (certainly one of them was birthed by none aside from Darrow himself!).

In at this time’s put up, I’ll evaluation NewRetirement’s PlannerPlus retirement calculator. I’ll examine its options to these of Constancy’s Investments’ Retirement Evaluation device (don’t fear in case you don’t have an account at Constancy–I take advantage of it right here solely as a foundation for comparability).

To remain true to the rigor Chris and Darrow have dropped at this matter prior to now, I’ll take a deep dive into each instruments, striving to match parameters and assumptions in such a manner as to yield an apples-to-apples comparability.

Backstory

I first discovered about NewRetirement in a evaluation Chris printed proper right here again in November 2020. Intrigued by his favorable protection, and studying that NewRetirement provided a free tier–what they name merely the Fundamental version–I made a decision to provide it a attempt.

Constancy’s on-line Retirement Evaluation device had been my go-to retirement calculator as much as that time. I used to be fairly happy with its options, and had no intention of buying and selling it in for one more. All the identical, the prospect of making an attempt out a brand new calculator, and evaluating its outcomes to Constancy, appeared like a great way to cross-check my assumptions.

I used to be sufficiently impressed with NewRetirement’s Fundamental version to tug the set off on PlannerPlus, a paid improve requiring a subscription. The fee was $72/12 months, billed yearly, and it got here with a no-nonsense cancellation coverage (frugal shopper that I’m, buying one more subscription was no small feat).

I used PlannerPlus fairly extensively that first 12 months. However because the renewal date approached, I made a decision to cancel my subscription. Why pay for a service I used to be getting elsewhere totally free?

True to their phrase, NewRetirement canceled my subscription with nary a fuss, kindly requesting solely that I inform them why. Here’s what I wrote:

Thanks in your quick response, and above all for the hassle-free cancellation…the underside line is that my retirement accounts are with Constancy, who supply an excellent retirement calculator freed from cost. It doesn’t make sense for me to pay for duplication…

NewRetirement Redux

Three years on, I’ve simply taken the newest iteration of PlannerPlus for a take a look at drive. To say it has come a great distance since my first expertise could be an understatement.

I’m tremendous impressed with its options and capabilities, and might now say unequivocally that it’s superior to Constancy’s Retirement Evaluation device. I clarify why within the paragraphs that observe.

Fundamental Version

Preliminary Setup

NewRetirement is centered round a wizard-style person interface that makes getting into your data a breeze. It ought to take you not more than 5 or 10 minutes to finish the preliminary setup.

The onerous half can be gathering your private data; stuff you may not know off the highest of your head, like account balances, bills and anticipated social safety advantages.

You’ll begin together with your account balances. The device options an possibility to hook up with your exterior accounts, thereby holding the quantities within the device synchronized with these accounts (I choose to enter this data manually).

You’ll additionally must enter an estimate of your month-to-month bills. In the event you haven’t a clue what you spend, you can begin with a tough guess. Then come again later to replace it when you’ve gotten a extra correct quantity.

You’ll even be requested to produce the social safety profit you anticipate to obtain at your full retirement age (in case you don’t know this quantity, it’s in all probability excessive time you discover out). In the event you’re amassing social safety already, this half needs to be simple.

For the needs of this evaluation, I arrange a hypothetical portfolio consisting of liquid belongings totaling $1.5M, unfold over quite a lot of taxable and tax-advantaged accounts. I additionally embrace a $500K residence fairness part to spherical out the web value at $2M. Lastly, I plugged in my very own bills and social safety estimates.

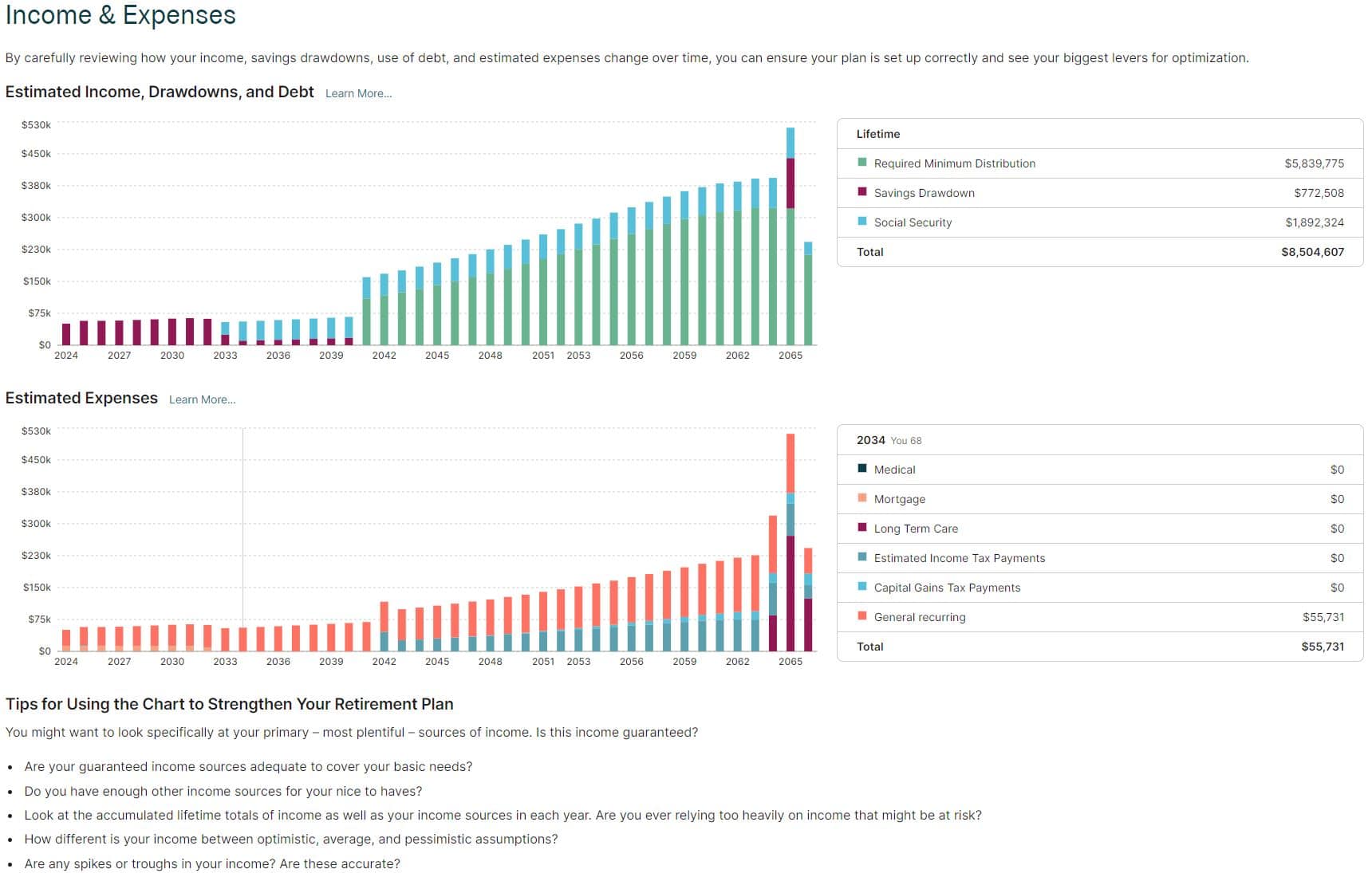

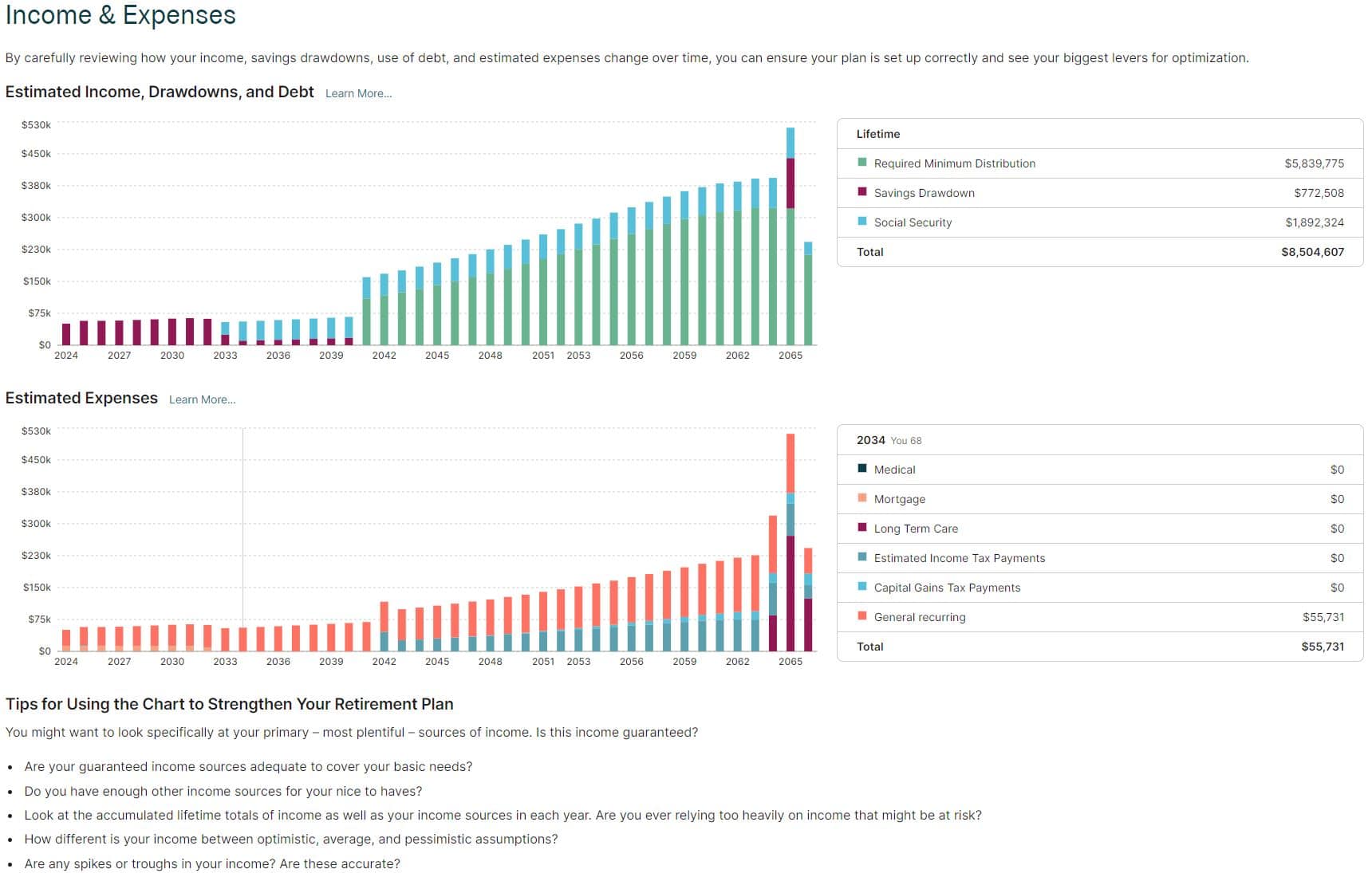

Plan Wellness

By the point you full your first tour of the wizard, you’ll have a reasonably good image of your monetary outlook.

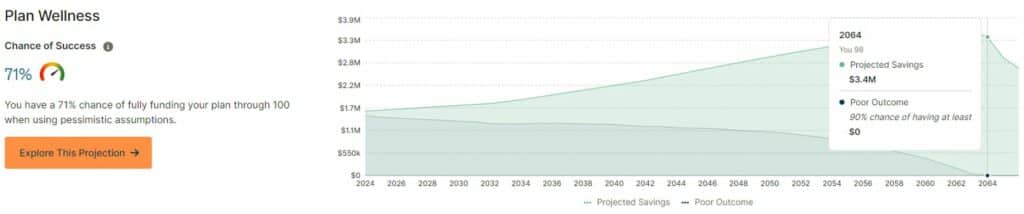

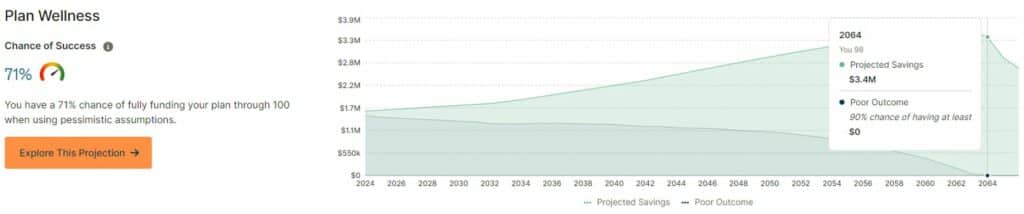

The Plan Wellness chart types the centerpiece of your individualized plan. Primarily based in your inputs, it forecasts your financial savings annually over the course of your anticipated lifetime. It additionally forecasts your general likelihood of success, the place success is outlined as not outliving your financial savings.

NewRetirement makes use of Monte Carlo evaluation, randomly various asset returns and inflation over many tons of of hypothetical trials, to undertaking doubtless outcomes within the Plan Wellness chart.

The highest, mild inexperienced line is a straightforward, linear projection of your lifetime financial savings primarily based in your market return and inflation assumptions: optimistic, pessimistic or common.

The decrease, darkish inexperienced line represents the ninetieth percentile of Monte Carlo trials primarily based in your return and inflation assumptions. Which means 90% of the trials projected outcomes that got here in at or above this line. Conversely, 10% of the trials projected outcomes beneath this line.

Observe that figures right here and all through the device are expressed in future, or inflation-adjusted, {dollars}.

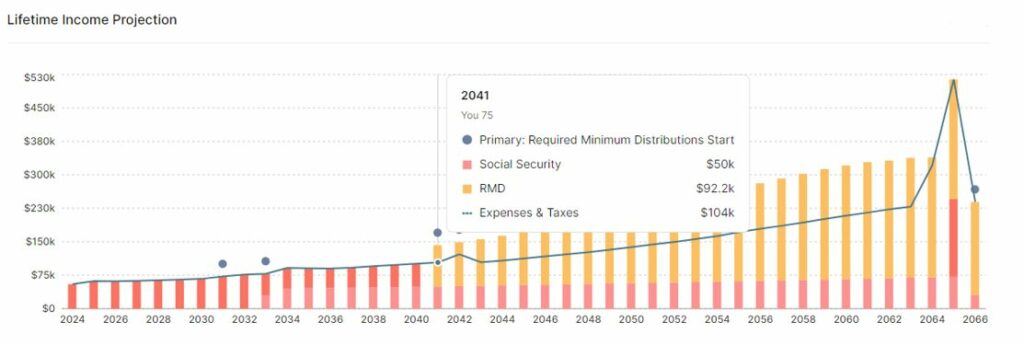

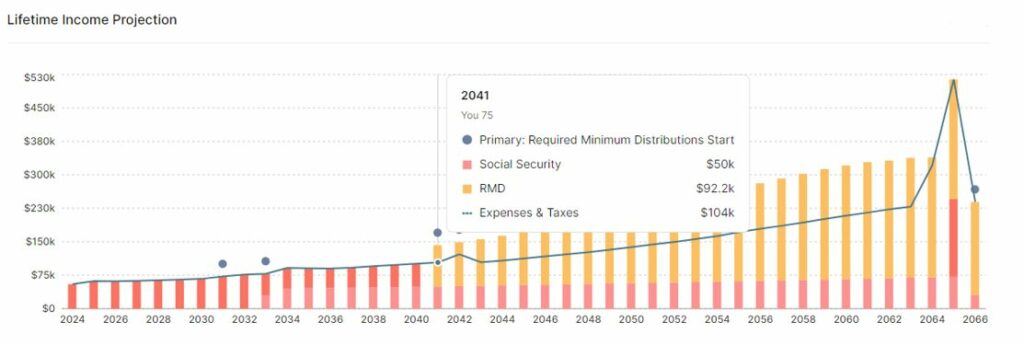

NewRetirement options dozens of insightful charts. Lots of them, just like the Lifetime Earnings Projection chart above, keep seen always on the right-hand facet of your display, and replace in real-time to mirror any change you make to your plan.

One among my favourite options is the Plan Up to date popup, which seems any time I alter an enter or assumption. This provides me on the spot suggestions on the affect of that change to my plan.

The popup above displays a change in technique for extra earnings over the course of my lifetime. Right here it reveals me the affect of redirecting that earnings from a non-interest-bearing checking account to a brokerage account, by which the cash could be invested within the markets.

Opinionated Defaults

NewRetirement Fundamental comes out of the field with default, opinionated assumptions. These are for unknowns such because the magnitude and variability of market returns, inflation, social safety value of dwelling changes, tax charges, and so on.

That the assumptions are opinionated shouldn’t be a foul factor. Quite the opposite, NewRetirment’s assumptions are well-informed. However with out default assumptions, NewRetirement wouldn’t be capable of ship the easy-to-use, streamlined person expertise that it does.

Market Returns

NewRetirement’s assumptions are conservative. For instance, it forecasts market returns starting from 2% to five% for its pessimistic and optimistic extremes, respectively. It features a center return that’s an arithmetic common of the 2.

You provide the device with a set of identified portions–your age, earnings, account balances, bills and the like–and it spits out a believable forecast of your monetary future knowledgeable by these assumptions.

NewRetirement Fundamental is, by design, simple to make use of. It doesn’t overwhelm you with a baffling array of knobs and dials, every of whose features you will need to decipher and fine-tune manually.

PlannerPlus

In the event you’re like me, nevertheless, you want to show knobs and dials. You need to check out your personal assumptions; to ask what-if inquiries to see how properly your nest egg may stand up to completely different eventualities.

NewRetirement satisfies the wants of the timid and adventurous alike. In case you are within the former camp, the Fundamental version ought to greater than match the invoice. However in case you are within the latter, PlannerPlus provides you full management over the knobs and dials.

Portfolio Return Assumptions

Armed with the superior characteristic set of PlannerPlus, the very first thing I modified was the return assumptions on my hypothetical accounts. The default extremes–2% and 5%–are too conservative, for my part, notably for my growth-oriented portfolio allocations.

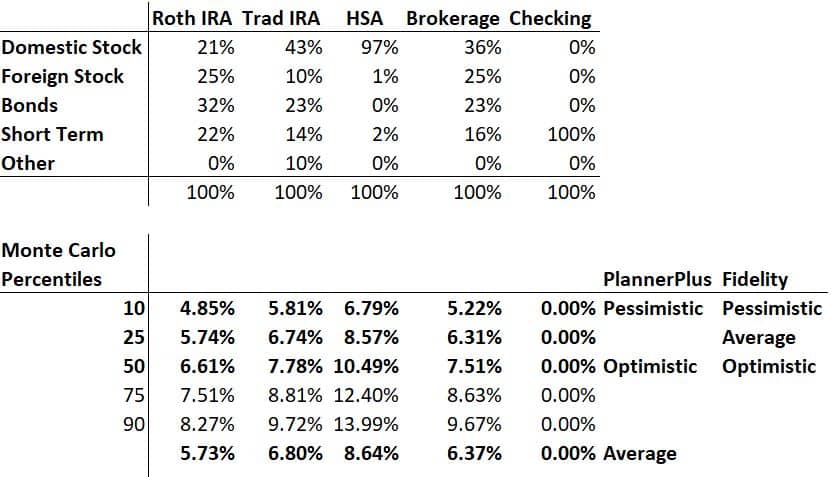

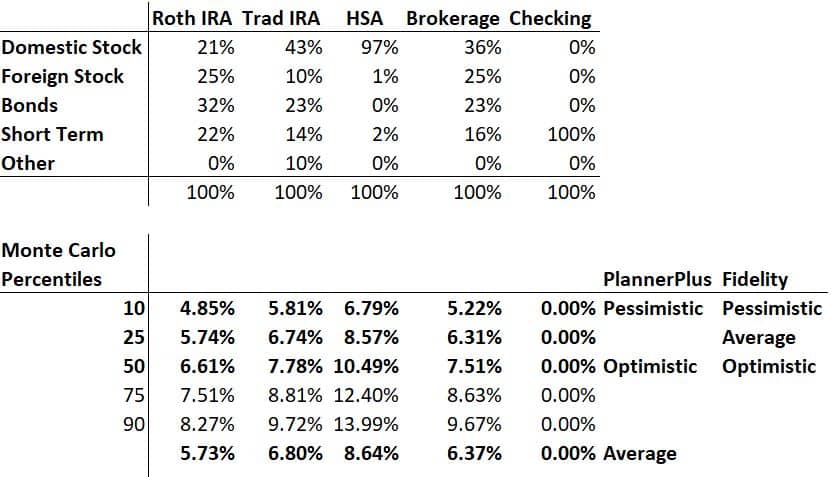

To reach at extra real looking extremes, I ran a Monte Carlo evaluation on every of my accounts utilizing a powerful (and free!) on-line device referred to as PortfolioVisualizer.

Here’s a desk that summarizes the outcomes of that evaluation.

The Monte Carlo percentiles characterize returns over a 40-year time interval, which maps fairly intently to how for much longer I anticipate to dwell (God prepared).

I used the tenth percentile of outcomes for my pessimistic portfolio return assumptions, and the fiftieth percentile for my optimistic return assumptions. PlannerPlus takes the center of those extremes to supply a 3rd, common forecast.

Digging Deeper

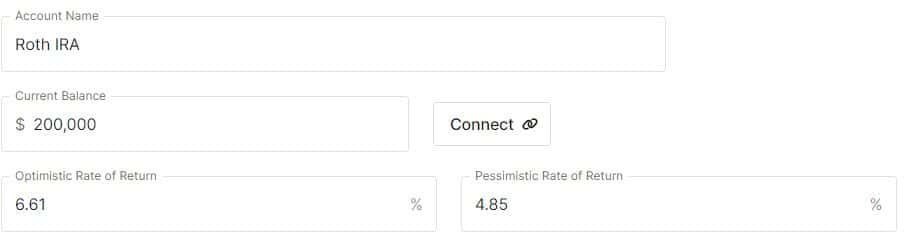

To grasp the values within the desk above, let’s zero in on simply the Roth IRA. Plugging within the allocation percentages for every asset class, PortfolioVisualizer ran 10,000 hypothetical trials, randomly various annual returns in every trial primarily based on the historic imply and volatility of the asset class.

The tenth percentile (pessimistic) represents the ten% of the ten,000 trials for which the return was 4.85% or decrease. The fiftieth percentile (optimistic) represents the 50% of trials for which the return was 6.61% or decrease.

I entered these values into the info entry display for my Roth IRA in PlannerPlus.

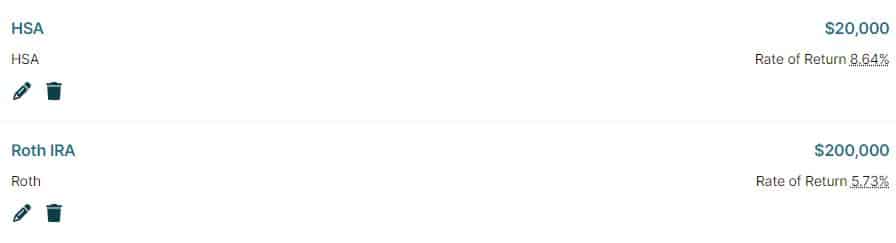

Observe the speed of return on my Roth IRA within the graphic beneath–it’s 5.73%. That is the arithmetic common of the optimistic and pessimistic assumptions I entered above.

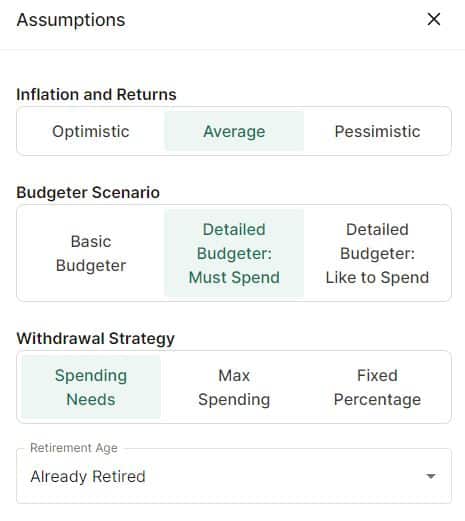

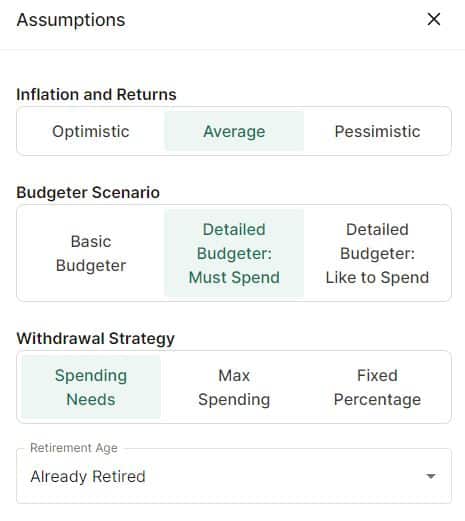

This charge of return displays my present choice for Inflation and Returns within the Assumptions management panel of PlannerPlus.

Now, with the press of a single button, I can view the affect to my monetary forecast of making use of optimistic, common or pessimistic market return assumptions.

Constancy’s Return Assumptions

How does Constancy’s Retirement Evaluation device deal with anticipated portfolio returns? I’m not totally certain. The closest I might come to answering that query got here from perusing documentation it publishes right here and right here. Neither doc solutions the query straight.

I believe Constancy’s methodology is much like NewRetirement’s, or is a minimum of primarily based on sound assumptions. However I can’t ensure.

Regardless, I desire a device to provide me the choice to produce my very own assumptions. NewRetirement’s PlannerPlus provides me that freedom, whereas Constancy’s Retirement Evaluation device doesn’t.

Expense Estimates

PlannerPlus handles bills like some other parameter. There’s the short and soiled Fundamental Budgeter that has you enter a single month-to-month quantity. Then there’s the extra nuanced Detailed Budgeter that permits you to itemize your bills. The latter extra intently resembles the best way I take advantage of Constancy’s expense budgeter.

Constancy’s Retirement Evaluation device permits you to break down bills by class, and to separate every class into both important or discretionary expense buckets.

PlannerPlus permits you to break up particular person expense classes into must-spend and like-to-spend parts. This provides you finer-grained management over what falls into the important and discretionary buckets.

PlannerPlus goes a step additional. It provides you a one-click toggle between your must-spend and like-to-spend budgets, so you may see at a look the distinction in affect belt-tightening (or loosening) will make to your monetary forecast.

If nothing else, utilizing the Detailed Budgeter forces you to take an in depth have a look at your bills, which in and of itself is a helpful train. Why? As a result of how a lot you spend in retirement is maybe an important–and underrated!–piece of the retirement puzzle.

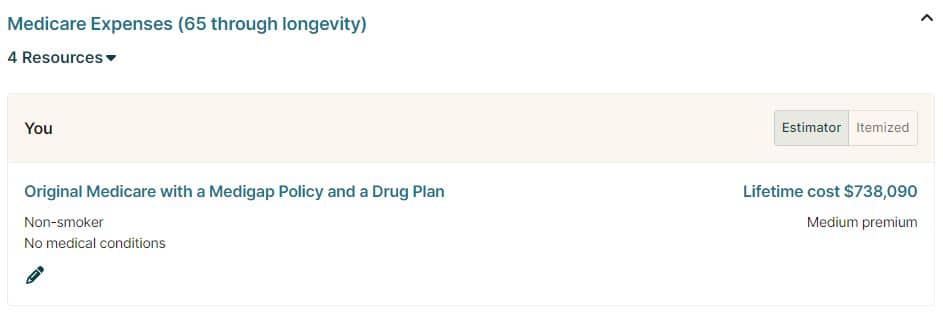

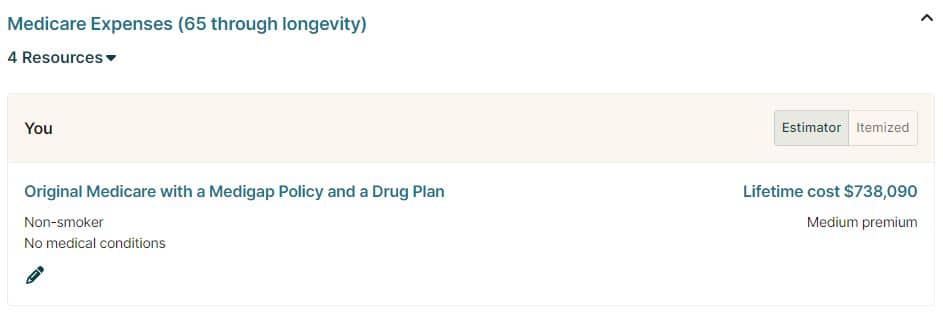

Well being Care Prices

PlannerPlus consists of Medicare bills in its default assumptions, and estimates my value to be $738K over the course of my lifetime. This quantity modifications relying on the premium stage and protection kind I select–elements A and B solely, Medigap, drug plan, and so on.

Constancy’s Retirement Evaluation device makes no such assumption, and merely asks me to account for Medicare prices in my detailed expense estimates–regrettably, by calculating and getting into these estimates manually.

To steadiness the comparability, I eliminated the Medicare estimate from PlannerPlus. Positive, I might have amortized PlannerPlus’ $738K over 35 years within the Constancy calculator, however this is able to have been time consuming and error susceptible.

I point out this as a result of the hypothetical forecasts offered on this evaluation omit lifetime Medicare prices, and due to this fact skew extra optimistic than if I had left them in.

Within the subsequent part, I’ll present you the impact on my PlannerPlus forecast of including Medicare prices again in.

Evaluating the Outcomes

To the extent that I might, I duplicated my Constancy inputs and assumptions in PlannerPlus. How do the outcomes differ? Let’s begin with my PlannerPlus forecasts.

PlannerPlus Outcomes

On the optimistic facet of the ledger, PlannerPlus provides me a 99% likelihood of funding my retirement by means of age 100. So too within the common case. However on the pessimistic facet of the ledger, it provides me only a 71% likelihood of not outliving my financial savings.

Even within the pessimistic case, PlannerPlus says I’ve only a 10% likelihood of working out of cash by the point I attain 98. To the extent that I belief the assumptions behind the forecast, I feel I can sleep at evening with these odds.

Medicare Add-Again

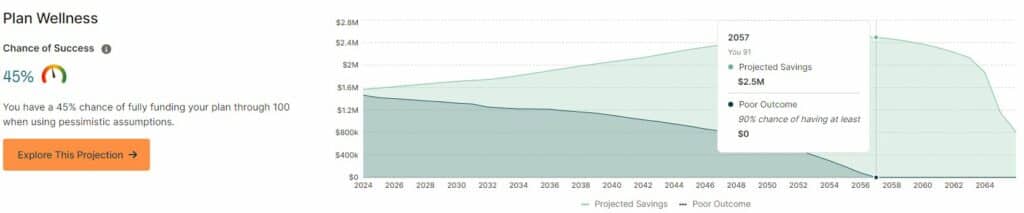

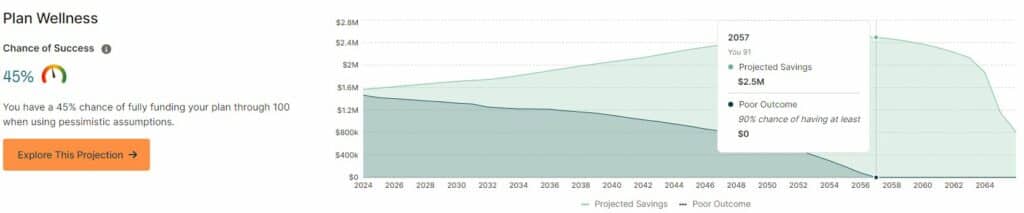

What occurs if I add again Medicare prices (recall that I eliminated these to remain stage with the Constancy comparability)? I’m nonetheless sitting fairly, with 99% and 98% possibilities of success within the optimistic and common circumstances, respectively.

However the pessimistic case seems significantly worse.

PlannerPlus provides me only a 45% likelihood of success, in contrast with the 71% if I omit Medicare prices. This will appear dire, however I nonetheless have only a 10% likelihood of working out of cash by the point I’m 91, and practically even odds of constructing it to 100 given fairly pessimistic market return and inflation assumptions. I nonetheless suppose I can sleep at evening with these numbers.

Constancy Retirement Evaluation Outcomes

Constancy’s device doesn’t present single, chance-of-success possibilities for every of its optimistic, common and pessimistic forecasts (in the event that they do, I couldn’t discover them). So on that dimension it’s inconceivable to make a direct comparability to PlannerPlus.

In Constancy’s pessimistic forecast–what they name considerably beneath common market situations–the worth of my portfolio can be a minimum of $6.5M after I attain 100, and that’s on the 90% confidence interval. Which means in 90% of Constancy’s Monte Carlo simulations, the terminal worth of my portfolio was $6.5M or higher (in future {dollars}).

PlannerPlus, however, places me at breakeven (or higher) after I’m 98 on the identical confidence interval.

Takeaways

Why the large discrepancy in terminal financial savings projections? Maybe I’m misunderstanding some basic side of 1 or the opposite, or each, instruments. Or perhaps it’s a tiny distinction buried within the weeds someplace, that when compounded over a interval of 40 years provides as much as an enormous discrepancy. Perhaps it’s a flaw within the methodology in a single or the opposite device.

It’s doubtless due a minimum of partially to a distinction in market return assumptions. However Constancy doesn’t disclose its return assumptions, so I can’t ensure.

Assuming I’m not misunderstanding the device(s)–and that, regardless of the appreciable impedance mismatch between them, I’m certainly evaluating apples to apples–there is a vital perception right here. It’s that retirement calculators are imperfect instruments, and that none can predict the long run with absolute certainty. Even the greatest device can do no higher than mannequin an unsure future.

This final level is a vital one. It ought to remind us that retirement calculators usually are not set-it-and-forget-it instruments.

If a retirement calculator says I’ve only a 45% likelihood of dwelling to 100 with out working out of cash, you may guess I’ll be working the numbers once more subsequent 12 months, and the 12 months after that; then evaluating the forecasts to actuality and refining my assumptions accordingly.

Darrow and Chris have explored the subject of retirement calculator accuracy for years. For a visit down that rabbit gap, take a look into the curated checklist right here (sorted latest to oldest).

NewRetirement Pricing

Earlier than taking the plunge on PlannerPlus, take NewRetirement Fundamental for a spin. In the event you like what you see, then take into account an improve. The Fundamental version is, in fact, free. A PlannerPlus subscription will set you again $120/12 months ($10/month), billed yearly.

NewRetirement gives a 3rd possibility–NewRetirement Advisors–for $1,650/12 months ($137.50/month). NewRetirement Advisors provides you entry to fee-for-service, complete retirement planning with a Licensed Monetary Planner (CFP), who will act in your greatest curiosity as a fiduciary.

In the event you resolve to buy a subscription, think about using the hyperlink right here. It’s going to assist me, Chris and Darrow cowl the prices of sustaining the weblog, and contribute to our effort to dial again adverts on the location.

Bonus Options

PlannerPlus is chock stuffed with options I didn’t cowl within the Constancy comparability, however that however advantage a point out.

Insights

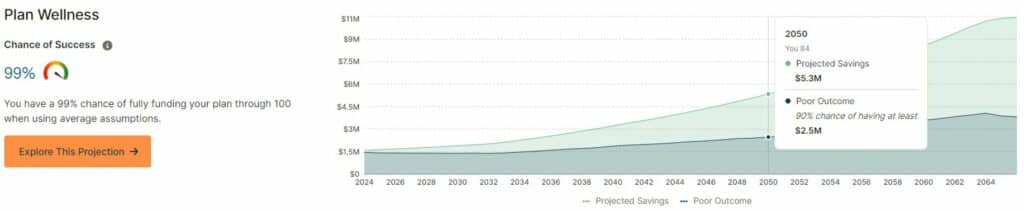

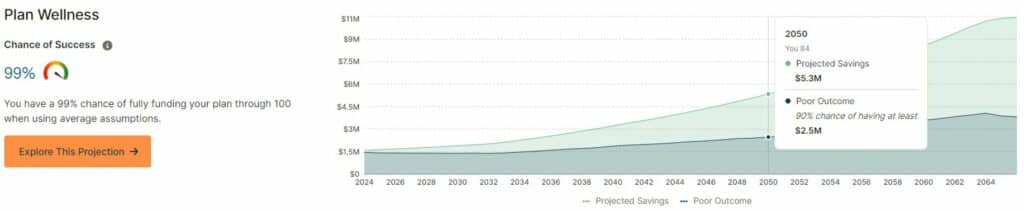

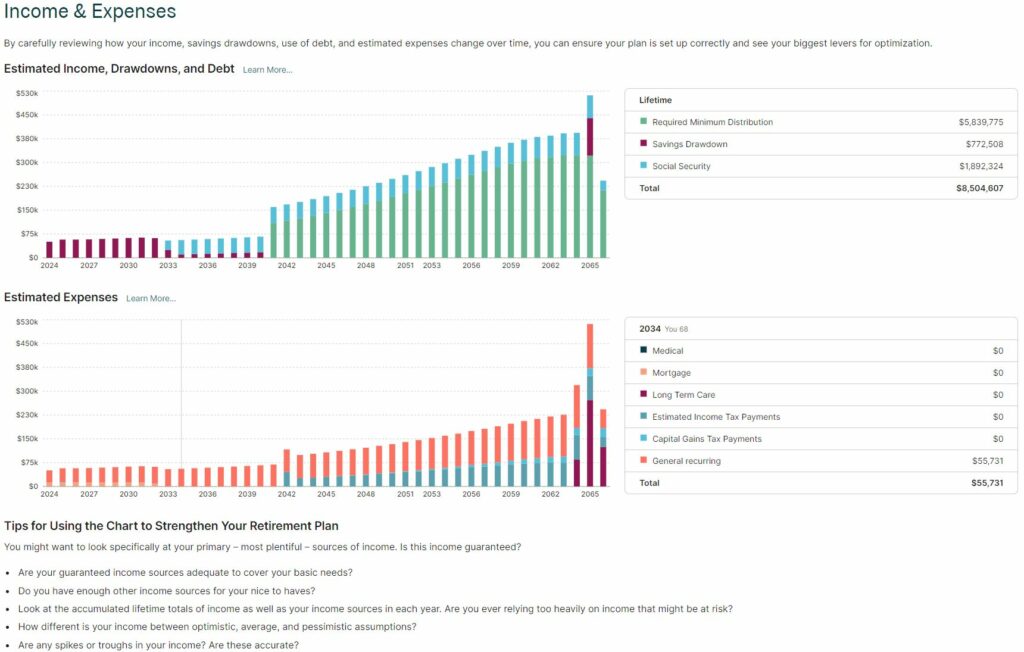

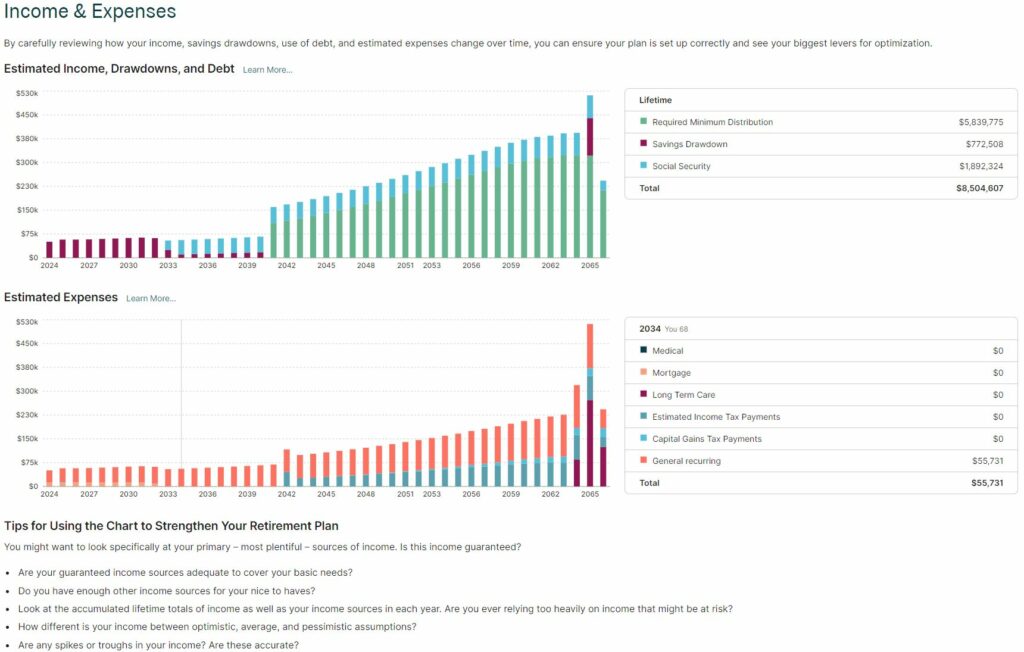

One among these is the Insights sidebar, which helps you to zoom in on myriad matters corresponding to internet value, money stream, earnings, bills, financial savings, Medicare, taxes and plenty of extra.

Every matter comprises an in depth, individually tailor-made evaluation primarily based in your inputs, and contains a wealthy set of charts and graphs that can assist you visualize these insights.

Right here is however one instance–the Earnings & Bills perception–to whet your urge for food:

Explorers

There’s additionally an Explorers sidebar, the place you may run Monte Carlo evaluation in your portfolios, various parameters corresponding to market returns, normal inflation, medical inflation and wage progress.

It’s also possible to attempt varied what-if eventualities, corresponding to various your funding returns by a single proportion level, or exploring the affect of dwelling 5 years longer than anticipated. You possibly can even discover social safety and Roth conversion eventualities.

Coach Strategies

Lastly, there’s a Coach Strategies sidebar. This characteristic takes a holistic view of the present state of your plan, figuring out potential hassle spots and/or alternatives, and gives ideas for the way you may handle them.

Nitpicks

Though I’m utterly offered on the PlannerPlus expertise, I’ll point out a few nitpicks.

First, PlannerPlus expresses all greenback figures in inflation-adjusted, or future {dollars} (Constancy’s device permits you to toggle between current and future {dollars}). This has the impact of biasing me to the upside when taking a look at forecasts, notably people who stretch far into the long run.

My mind thinks in current {dollars}. I’d fairly not do the psychological conversion from future to current {dollars} each time I ponder a forecast.

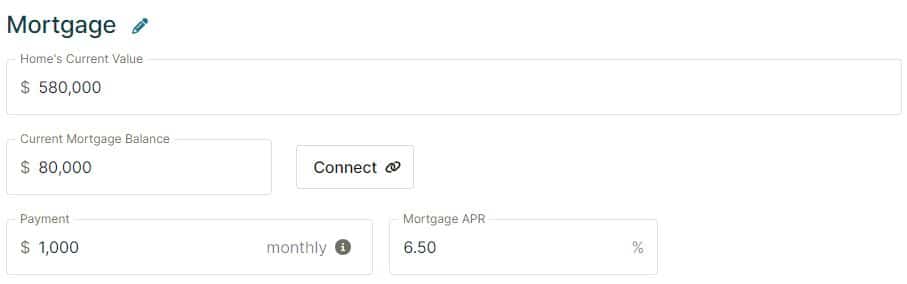

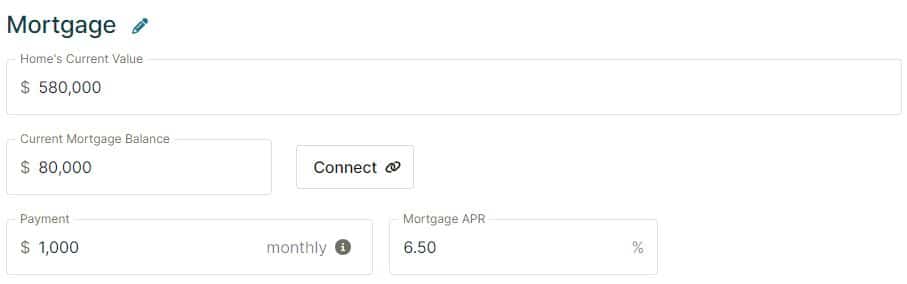

Second, in case you’re not cautious, PlannerPlus will overstate the fairness in your house. Within the information entry display for Housing, it asks you to enter your house’s present market worth. It subtracts your mortgage steadiness (if any), and calls the distinction your whole residence fairness.

In fact, in case you promote your home you’ll doubtless must pay wherever from 6% to 10% of its market worth in dealer charges and enhancements. When you’ve got an costly home, this may scale back the precise worth of your house fairness by a substantial quantity. In the event you don’t account for this, the overstatement can be mirrored in PlannerPlus’ projected internet value estimate.

This drawback is well remedied by discounting the market worth of your house by 6% to 10%, and getting into that quantity as a substitute, within the House’s Present Worth entry.

Lastly, I needed to make use of the companies of a third celebration device–PortfolioVisualizer–to generate believable extremes for my optimistic and pessimistic portfolio return assumptions. It could be good if PlannerPlus built-in such a device into its personal calculator.

Maybe NewRetirement already plans so as to add this characteristic. Contemplating the variety of enhancements which have appeared within the three years since I first used PlannerPlus, I’d not be stunned to see it flip up in a future launch.

Programming Observe

On the conclusion of final month’s put up, Ought to You Pay Off Your Mortgage?, I discussed that it could not be attainable for me to learn and reply to your feedback. I used to be rafting the Colorado River within the Grand Canyon the week that put up was printed.

Having since learn these feedback, and spending a great deal of time ruminating on them, I’m now critically rethinking my determination not to repay my mortgage. Thanks a lot in your insights, a lot of which I had not beforehand thought-about.

I’ll be in the identical church, however a unique pew, this month. I can be mountaineering within the magnificent hills of Pink Rock Nationwide Conservation Space west of Las Vegas.

As ever, please don’t let this discourage you from leaving a remark, and/or conversing amongst yourselves. These usually are not solely useful to me (see above), however little question different readers as properly.

* * *

Priceless Assets

- The Finest Retirement Calculators may also help you carry out detailed retirement simulations together with modeling withdrawal methods, federal and state earnings taxes, healthcare bills, and extra. Can I Retire But? companions with two of one of the best.

- Free Journey or Money Again with bank card rewards and enroll bonuses.

- Monitor Your Funding Portfolio

- Join a free Empower account to achieve entry to trace your asset allocation, funding efficiency, particular person account balances, internet value, money stream, and funding bills.

- Our Books

* * *

[I’m David Champion. I retired from a career in software development in March 2019, just shy of my 53rd birthday. To position myself for 40+ years of worry-free retirement, I consumed all manner of early-retirement resources. Notable among these was CanIRetireYet, whose newsletters I have received in my inbox every Monday morning for the last ten years. CanIRetireYet is one of exactly two personal finance newsletters I subscribe to. Why? Because of the practical, no-nonsense advice I find here. I attribute my financial success in no small part to what I have learned from Darrow and Chris. In sharing some of my own observations on the early-retirement journey, I aim to maintain the high standard of value readers of CanIRetireYet have come to expect.]

* * *

Disclosure: Can I Retire But? has partnered with CardRatings for our protection of bank card merchandise. Can I Retire But? and CardRatings might obtain a fee from card issuers. Some or the entire card gives that seem on the web site are from advertisers. Compensation might affect on how and the place card merchandise seem on the location. The location doesn’t embrace all card firms or all obtainable card gives. Different hyperlinks on this website, just like the Amazon, NewRetirement, Pralana, and Private Capital hyperlinks are additionally affiliate hyperlinks. As an affiliate we earn from qualifying purchases. In the event you click on on certainly one of these hyperlinks and purchase from the affiliated firm, then we obtain some compensation. The earnings helps to maintain this weblog going. Affiliate hyperlinks don’t enhance your value, and we solely use them for services or products that we’re aware of and that we really feel might ship worth to you. Against this, we have now restricted management over a lot of the show adverts on this website. Although we do try to dam objectionable content material. Purchaser beware.