Again after I first began writing about private finance again in 2005, the Finest ETFs in Canada rating was a reasonably brief record!

There was no such factor as a Canadian all-in-one ETF (additionally referred to as portfolios ETFs) like there are in the present day.

Whereas an enormous a part of my portfolio continues to be in Canadian dividend shares, Canadian ETFs that commerce on the Toronto Inventory Change (in Canadian {dollars}) make up the steadiness.

I’ve develop into an increasing number of satisfied that whereas dividend investing continues to be a good way to behaviourally management your worst investing impulses, low-fee index ETFs are actually nice choices for lots of people. That is very true in terms of getting worldwide diversification. I’d have tens of hundreds of {dollars} extra in my funding account in the present day if I hadn’t needed to pay comparatively excessive MER charges on my worldwide ETFs a pair a long time in the past.

However whereas elevated competitors amongst Canadian ETF firms has meant nice innovation and decrease costs, it has additionally led to quite a lot of misinformation and poor merchandise making their solution to {the marketplace}. It was that the phrase trade traded fund – or ETF – was code for “boring index fund that you just’ll see talked about nerdy private finance writers”.

Today nonetheless, each firm tries to connect the ETF acronym (together with a catchy ticker image) to any product they’ll piece collectively. A lot of them are dangerous investments and bear no resemblance in any respect to the unique merchandise within the early days of ETF investing.

As a consequence, it’s extra necessary than ever for savvy traders to concentrate on what actually issues in terms of constructing their portfolio. In my quest to decide on the Finest Canadian ETFs in 2024, you’ll see that I place quite a lot of emphasis on low MERs, passive administration investing ideas, and general simplicity. All the ETFs beneficial under even have substantial liquidity and the businesses behind the merchandise have long-term observe data.

How I Select Which ETFs to Embrace in My Portfolio

Because of the completely different objectives and threat tolerances of varied sorts of traders, what we determined to do was “examine apples to apples” and select the highest Canadian ETFs throughout a number of classes, specializing in three measurable areas.

1) MER charges

2) Breadth of diversification (what number of shares and bonds are included)

3) Tax effectivity (far more necessary to Canadians investing exterior of their RRSP and TFSA)

My Prime 11 Favorite BEST ETFs in Canada for 2024

- iShares Core Fairness ETF Portfolio (XEQT) – The best doable ETF answer. Full XEQT assessment.

- Horizons S&P/TSX 60 ETF (HXT) – Finest TSX ETF

- BMO Combination Bond Index ETF (ZAG)- Finest Canada bond ETF

- Horizons S&P 500 Index ETF (HXS)- Finest U.S shares ETF for Canadians

- Vanguard FTSE International All Cap ex Canada Index ETF (VXC) – Finest worldwide ETF for Canadians

- Vanguard All-Fairness ETF Portfolio (VEQT) – Finest all-in-one ETF. Full VEQT assessment.

- FTSE Canadian Excessive Dividend Yield Index ETF (VDY) – Finest dividend ETF

- Vanguard FTSE Canada Capped REIT Index ETF (VRE) – Finest Canadian REIT ETF

- iShares Canadian Development ETF (XCG) – Finest Canada development ETF

- Function Excessive Curiosity Financial savings ETF (PSA) – Finest Money ETF

- TD Canadian Fairness Index (TTP) – Finest Canadian broad market ETF

We have now dozens extra selections for ETFs to spend money on for Canadians, in Canada and internationally. Simply carry on scrolling and studying our what are our authors and editors consider the most effective investing alternatives and particularly ETFs. You’ll be able to jump over to the record of Canada’s finest ETFs [45 options to choose from].

How To Purchase ETFs in Canada for Low cost

The essential concept is that if shares or bonds are particular person bananas, then you definitely first want to choose a retailer that you just prefer to go to, after which determine which bunch of bananas you need.

1. Decide a Canadian on-line dealer and join. Learn our Qtrade assessment to see why we expect it’s the most effective, view our Canadian dealer comparability right here.

2. Whilst you’re within the join stage, do your self a favour and join a TFSA, and RRSP, and a non-registered account. You would possibly by no means use one or two of them, nevertheless it’s simpler to only do it abruptly when you’re doing the preliminary setup.

3. Dedicate half-hour to understanding how “procuring at this retailer” works. Every dealer can have a bit tutorial that exhibits you methods to sort in your ETF ticker image, after which what number of items of the ETF you need to purchase. Our methods to purchase shares information additionally illustrates this.

4. Determine which “bunch of bananas” seems finest, by studying our greatest ETFs in Canada information above.

5. After you have chosen your bunch of bananas, you pay for them by deciding how a lot cash you need to make investments at the moment, after which dividing that quantity by the price of the ETF.

For instance, let’s say I’ve $1,000 to speculate this month, and I need to use VEQT. I’d enter the initials VEQT into my inventory buy display screen, and see that one unit of VEQT prices $37.07. So I’d divide $1,000 by $37.07 to get 26.97.

Whereas I’ve near sufficient cash to buy 27 items of VEQT, I can’t fairly make it, so as an alternative I enter “26” into my buy display screen, then click on “market order” (it’s also possible to use restrict order, it simply provides a bit complexity), and you will notice a affirmation message pop up that claims one thing like:

“Would you prefer to buy 26 items of VEQT for $963.82?” .

Then you definitely hit “Purchase” – and increase – you simply purchased a batch of 10,000+ inventory bananas from all around the world!

Our Unique Finest ETFs in Canada Record (48 Choices)

Scroll down under the the comparability chart for full descriptions for every ETF, however with out additional ado, right here’s the MDJ editorial workforce’s Finest in Canada ETF Record.

|

Vanguard FTSE Canada All Cap Index ETF |

|||||

|

iShares Core S&P/TSX Capped Composite Index ETF |

|||||

|

BMO S&P TSX Capped Composite Index ETF |

|||||

|

BMO Combination Bond Index ETF |

Canada Authorities and Company Bonds |

||||

|

Vanguard Canadian Combination Bond Index ETF |

Canada Authorities and Company Bonds |

||||

|

BMO Low cost Bond Index ETF |

Tax Environment friendly Canada Bond Publicity |

||||

|

Vanguard Canadian Brief-term Bond Index ETF |

Brief Time period Canada Bonds |

||||

|

American ETF (CAD) to Purchase in Canada |

Horizons S&P 500 Index ETF |

||||

|

American ETF (CAD) to Purchase in Canada |

iShares Core S&P U.S. Whole Market Index ETF |

||||

|

American ETF (CAD) to Purchase in Canada |

Vanguard S&P 500 Index ETF |

||||

|

American ETF (CAD) to Purchase in Canada |

BMO S&P 500 Index ETF (CAD) |

||||

|

Worldwide ETFs to Purchase in Canada |

Vanguard FTSE International All Cap ex Canada Index ETF |

The World’s Shares – Minus Canada |

|||

|

Worldwide ETFs to Purchase in Canada |

iShares Core MSCI All Nation World ex Canada Index ETF |

The World’s Shares – Minus Canada |

|||

|

Worldwide ETFs to Purchase in Canada |

Vanguard FTSE Rising Markets All Cap Index ETF |

||||

|

Worldwide ETFs to Purchase in Canada |

Vanguard FTSE Developed All Cap ex North America Index ETF |

Developed Markets – Minus Canada and USA |

|||

|

iShares Core Fairness ETF Portfolio |

4 ETFs (hundreds of underlying shares) |

||||

|

Vanguard All-Fairness ETF Portfolio |

7 ETFs (hundreds of underlying shares) |

||||

|

International Shares and Bonds (80% shares, 20% bonds) |

7 ETFs (hundreds of underlying shares) |

||||

|

iShares Core Development ETF Portfolio |

International Shares and Bonds (80% shares, 20% bonds) |

8 ETFs (hundreds of underlying shares and bonds) |

|||

|

Vanguard Development ETF Portfolio |

International Shares and Bonds (80% shares, 20% bonds) |

7 ETFs (hundreds of underlying shares and bonds) |

|||

|

Vanguard Balanced ETF Portfolio |

International Shares and Bonds (60% shares, 40% bonds) |

7 ETFs (hundreds of underlying shares and bonds) |

|||

|

iShares Core Revenue Balanced ETF Portfolio |

International Shares and Bonds (60% shares, 40% bonds) |

8 ETFs (hundreds of underlying shares and bonds) |

|||

|

International Shares and Bonds (60% shares, 40% bonds) |

7 ETFs (hundreds of underlying shares and bonds) |

||||

|

Vanguard Conservative ETF Portfolio |

International Shares and Bonds (40% shares, 60% bonds) |

7 ETFs (hundreds of underlying shares and bonds) |

|||

|

iShares Core Conservative Balanced ETF Portfolio |

International Shares and Bonds (40% shares, 60% bonds) |

8 ETFs (hundreds of underlying shares and bonds) |

|||

|

International Shares and Bonds (40% shares, 60% bonds) |

7 ETFs (hundreds of underlying shares and bonds) |

||||

|

Vanguard Conservative Revenue ETF Portfolio |

International Shares and Bonds (20% shares, 80% bonds) |

7 ETFs (hundreds of underlying shares and bonds) |

|||

|

iShares Core Revenue Balanced ETF Portfolio |

International Shares and Bonds (20% shares, 80% bonds) |

8 ETFs (hundreds of underlying shares and bonds) |

|||

|

iShares Canadian Development ETF |

Canada Excessive Development Shares |

||||

|

S&P/TSX Canadian Dividend Aristocrats Index Fund |

|||||

|

iShares Canadian Choose Dividend Index ETF |

|||||

|

FTSE Canadian Excessive Dividend Yield Index ETF |

|||||

|

IShares Core S&P/TSX Composite Excessive Dividend Index ETF |

|||||

|

BMO Canadian Dividend ETF |

|||||

|

iShares Core MSCI Canadian High quality Dividend Index ETF |

|||||

|

Vanguard FTSE Canada Capped REIT Index ETF |

|||||

|

BMO Equal Weight REITs Index ETF |

|||||

|

IShares S&P TSX Capped REIT INDEX ETF |

|||||

|

CI First Asset Canadian REIT ETF |

|||||

|

Vanguard Retirement Revenue Fund |

13,337 shares, 18,330 Bonds |

||||

|

100 Largest Tech Corporations in USA |

|||||

|

Avantis Worldwide Small Cap Worth ETF |

Small Cap Worth from Non-USA International locations |

||||

|

Socially Accountable Investing |

6 ETFs (hundreds of underlying shares and bonds) |

||||

|

Function Excessive Curiosity Financial savings ETF |

|||||

|

Horizons Money Maximizer ETF |

3, however 99.41% in Nationwide Financial institution |

||||

|

Horizons Excessive Curiosity Financial savings ETF |

That is the brief record of finest Canadian ETFs taken from the 37 ETF suppliers in Canada, together with BMO Asset Administration, Vanguard Investments Canada Inc., BlackRock Canada, and Horizons ETFs Administration (Canada) Inc.

In order for you the simplest doable solution to diversify your cash, then shopping for an all-in-one ETF is your finest wager. In the event you open a Qtrade low cost brokerage account, you should buy and promote the VEQT ETF without spending a dime. It’s the most effective deal stepping into Canada. Robb Engen over at Boomer and Echo has written extensively about how he makes use of VEQT for the whole thing of his funding portfolio.

In order for you the bottom value listed portfolio – together with the power to do your individual portfolio math and chubby Canadian shares – go together with the mixture of HXT, VXC, and ZAG.

If the objective to your portfolio is to generate earnings (versus maximizing development alternatives whereas chopping prices) then VRIF, VRE, and VDY are nice locations to begin.

See under for a extra detailed rationalization on our greatest at school.

Try our article on methods to purchase shares in Canada and our Canadian on-line brokers comparability for an in depth look on methods to purchase ETFs in Canada.

Finest Canadian Inventory Market ETF

It’s wonderful how a lot simpler and cheaper it’s to spend money on a Canadian inventory market ETF in the present day than it was after I began investing roughly 15 years in the past.

Competitors has labored its magic and costs have come down considerably throughout the asset class. You’ll be able to’t go unsuitable with any of our prime 4 choices: HXT, VCN, XIC, or ZCN.

Finest In Class: Horizons Horizons S&P/TSX 60 ETF (HXT)

- Lowest Payment (after rebate) of 0.04%

- Prime 60 Shares in Canada

- Swap-based ETF means low monitoring error

- Excellent for tax-efficient investing

I personally love HXT not just for its slight value benefit, but in addition for its tax benefits in non-registered accounts. In the event you’re investing in a non-registered account or a company account, turning these Canadian dividends into tax-deferred capital good points could make an enormous distinction.

Honourable Mentions:

- Vanguard FTSE Canada All Cap Index ETF (VCN)

- iShares Core S&P/TSX Capped Composite Index ETF (XIC)

- BMO S&P TSX Capped Composite Index ETF (ZCN)

- All have an identical low MERs of 0.06%

- All give entry to some smaller-cap Canadian shares

- Wonderful worth – particularly in an RRSP or TFSA

Finest Canada Bond ETFs

Certain, there isn’t quite a lot of love on the market for bonds today. That stated, they’ll nonetheless carry out a useful stabilizing perform to your portfolio. In the case of Bond ETFs, we’re all about getting low charge entry to super-stable authorities and blue-chip company bonds.

Finest In Class: BMO Combination Bond Index ETF (ZAG)

- Extremely Low MER 0.08%

- Entry to broadest diversification of bonds

- Secure and steady – good for rebalancing

Honourable Mentions:

- TD Canadian Combination Bond Index (TDB

- Vanguard Canadian Combination Bond Index ETF (VAB)

- BMO Low cost Bond Index ETF (ZDB)

- Vanguard Canadian Brief-term Bond Index ETF (VSB)

- TDB is barely cheaper than ZAG, however ZAG offers you entry to a broader vary of bonds (1,600 vs 1,100 and has extra liquidity)

- VAB nearly an identical to ZAG

- ZDB has some fascinating tax effectivity options for non-registered accounts

- VSB makes use of solely short-term bonds, so the typical size of the bond it holds is shorter than the others

Finest USA Shares ETF for Canadians

If that is the kind of ETF you’re most considering, i counsel you additionally learn our extra detailed breakdown and comparability on this finest Canadian greenback ETFs for U.S fairness article.

Finest in Class: Horizons S&P 500 Index ETF (HXS)

- Barely greater MER than opponents

- Beneficial tax-efficient construction can save traders $$$ on dividend taxation

- Virtually zero monitoring error because of swap-based construction

Honourable Mentions:

- iShares Core S&P U.S. Whole Market Index ETF (XUU)

- Vanguard S&P 500 Index ETF (VFV)

- BMO S&P 500 Index ETF (ZSP)

- TD US Fairness Index ETF (TPU)

- XUU and TPI have the bottom MER charge at 0.07%

- XUU has the broadest publicity to smaller American shares

- VFV, TPU, and ZSP are practically an identical when it comes to holdings and costs

Finest Worldwide ETFs for Canadians

Finest In Class: Vanguard FTSE International All Cap ex Canada Index ETF (VXC)

- Tremendous quick access to all the world of shares exterior of Canada

- Widest doable publicity (wider than XAW)

- Excellent for the “Two ETF Portfolio”

Honourable Mentions:

- iShares Core MSCI All Nation World ex Canada Index ETF (XAW)

- Vanguard FTSE Rising Markets All Cap Index ETF (VEE)

- Vanguard FTSE Developed All Cap ex North America Index ETF (VIU)

- XAW is a detailed second to VXC providing a barely decrease MER for much less general diversification

- VEE is ideal for focused traders who need immediate entry to rising markets

- VIU is ideal for focused traders who need immediate entry to developed markets exterior of the USA and Canada

Finest Broad Market Canadian ETF

Whereas the TSX 60 Composite Index has been a dependable benchmark for “Canadian shares” there are lesser-known indexes which might be debatably a greater measure of all the Canadian inventory market. One such index is the Solactive Broad Canada Index. T

he distinction between the 2 indexes is that whereas the TSX 60 Composite index tracks the 60 largest firms in Canada (ranked by their market capitalization), the Solactive Broad Canada Index tracks the 270 largest firms.

Now, that feels like an enormous distinction, however in observe it’s really not that huge a deal. The 60 greatest firms are A LOT larger than the subsequent 210 firms – so the efficiency of the 2 indexes goes to be fairly near the identical. Actually, Canada’s largest firms have traditionally had a little bit of a bonus over the smaller firms that make up the underside of the broader Canada index.

That stated, one fascinating facet of the TD Canadian Fairness Index ETF is that it has a barely decrease MER because of its decrease index-licensing prices. Which means Solactive is charging TD lower than S&P fees different ETF suppliers. It’s a minutely-small distinction, nevertheless it’s fascinating to notice.

Maybe the most effective use of TTP is in terms of harvesting a capital loss in a given yr. For instance, say you had been investing in XIC, HXT, or VCN to get your Canadian inventory publicity. These two ETFs don’t use the Solactive Broad Canada Index, and consequently, you would promote your items of XIC, HXT, or VCN, deduct the funding loss out of your taxes, and instantly purchase TTP.

This might keep away from the superficial loss guidelines, whereas on the identical time supplying you with portfolio publicity to a really very comparable set of investments. It’s doable that you just would possibly achieve or lose a couple of hundredths of a p.c in returns within the month that you just personal TTP (relying on how the smallest 200 or so Canadian firms did) earlier than promoting these items and shopping for again your items of the preliminary ETF that you just had.

Finest Canadian All-in-One Portfolio ETFs

We’ve acquired an in depth breakdown on Canadian all-in-one ETFs that we’ve up to date each couple of years for the reason that very first portfolio ETF by Vanguard got here out a couple of years in the past.

Lengthy story brief, these immediate diversifiers have been a sport changer for all the trade. With shrinking charges and the worth of simplicity on their facet, it is a superb answer for the “set it and neglect it” investor.

Finest Canadian Dividend ETFs

Selecting the Finest Dividend ETF in Canada has been our jam at MDJ since they first got here to Canada. Whereas many readers now want to choose their very own particular Canadian Dividend Shares, there isn’t any denying the easy, easy worth of immediately diversifying your Canadian dividend earnings with one ETF buy.

As extra of the unique readers who’ve caught with MDJ for over a decade entered into retirement (at all kinds of ages) the concentrate on producing earnings versus risk-embracing development, has pulled to the forefront. Happily, the Canadian market presents among the most constant dividend payers round!

In case you are different methods to optimize your retirement earnings and provide you with a strong retirement plan, then I like to recommend trying out Kyle’s on-line course titled ‘Fear Free Retire’. In it, Kyle covers all the important thing components that make a profitable retirement plan, and the frequent errors most Canadians make.

Are You Saving Sufficient for Retirement?

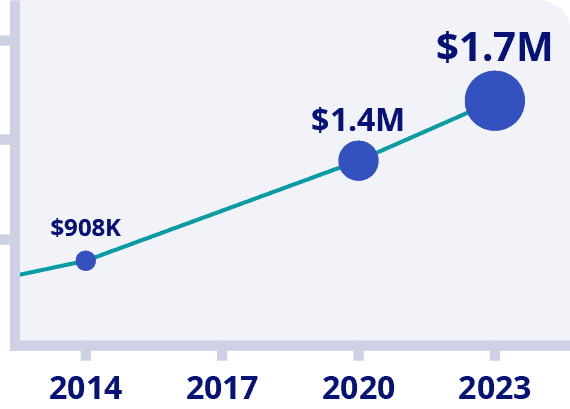

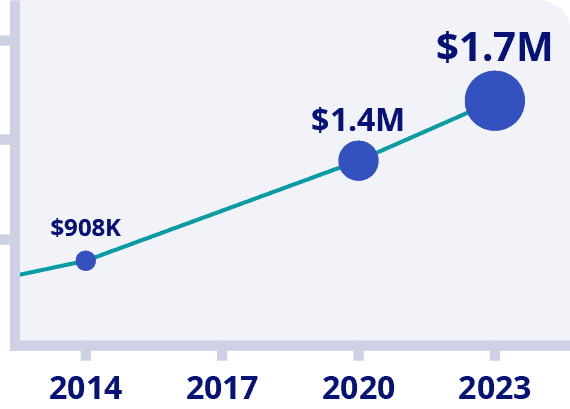

Canadians Consider They Want a $1.7 Million Nest Egg to Retire

Is Your Retirement On Monitor?

Grow to be your individual monetary planner with the primary ever on-line retirement course created solely for Canadians.

Attempt Now With 100% Cash Again Assure

*Information Supply: BMO Retirement Survey

Finest Canadian REIT ETFs

Much like Canadian Dividend ETFs, Actual Property Funding Trusts (REITs) maintain a particular place within the income-investors coronary heart. Whereas the asset class has had a little bit of a tough go of it currently, in an income-starved world they provide a easy solution to spend money on actual property. (One thing many Canadians are after of their portfolios.)

It’s also possible to learn my information to investing in Canadian REITs and our comparability between holding a Canadian REIT ETFs and a person REIT.

Finest In Class: Vanguard FTSE Canada Capped REIT Index ETF (VRE)

- By far the bottom MER 0.38%

- Strong publicity to all kinds of actual property sectors

- Equally, glorious geographical range

Honourable Mentions:

- BMO Equal Weight REITs Index ETF (ZRE)

- IShares S&P TSX Capped REIT INDEX ETF (XRE)

- Barely extra holdings than VRE

- Considerably greater value – necessary for an income-specific product

Finest Canada Development ETF: iShares Canadian Development ETF (XCG)

Whereas many MDJ traders gravitate towards mature firms with a gentle file of dividend will increase, there are at all times traders on the market with an urge for food for threat, and who need development in any respect potential prices. For them. XCG guidelines the roost.

- Comparatively excessive MER at 0.55% that I hope to see lower with extra competitors

- Fast entry to Canada’s quickest rising tech firms

- Has carried out fairly effectively over the past couple of years

Finest Specialty Canadian ETFs

This was our catch-all class for the most effective Canadian ETFs that didn’t actually match neatly into any class. Every of those does one thing fully completely different:

Finest Retirement Revenue ETF: Vanguard Retirement Revenue Fund (VRIF)

- Invested in all kinds of funding grade bonds from around the globe, in addition to a sprinkling of inventory indexes

- Nice choice for a retiree who doesn’t need the danger of a pure-stock portfolio

- Said objective is a constant 4% return annually (after charges)

- MER of 0.32%

Finest Bitcoin ETF: Function Bitcoin ETF (BTCC.B)

- Canada’s hottest and liquid Bitcoin ETF

- Straightforward publicity

- Bitcoin isn’t actually my factor personally… however if you need a straightforward solution to get in on it…

- MER of 1.00% is indicative of the charges on this area

Finest Know-how ETF: Invesco Nasdaq 100 ETF (QQC-F)

- In the event you assume the tech sector goes to expertise explosive development going ahead, the simplest solution to make investments utilizing Canadian {Dollars} is QQQ

- Tracks the Nasdaq-100 index (100 greatest tech firms within the USA)

- A really cheap MER of 0.25%

Finest Worth ETF: Avantis Worldwide Small Cap Worth ETF (AVDV)

- Full credit score to Ben Felix for this suggestion and for his push to elucidate issue investing to Canadians

- Fundamental concept right here is that over the long-term small-cap worth shares are inclined to outperform the bigger market-cap indexes (such because the S&P 500 or the TSX 60)

- 0.36% MER

Finest ESG ETF: BMO Balanced ESG ETF (ZESG)

- Created for traders trying to make investments alongside their socially accountable values

- 60% Fairness, 40% Mounted Revenue

- 50% Canada, 35% USA, 15% Different

- A aggressive 0.20% MER

Finest Canadian Money ETFs

Finest in Class: Function Excessive Curiosity Financial savings ETF (PSA)

- Present finest general charge

- All Money ETFs are fairly comparable

- Money ETF returns will go up and down relying on rates of interest

Honourable Mentions:

- Horizons Money Maximizer ETF (HSAV)

- Horizons Excessive Curiosity Financial savings ETF (CASH)

Finest Canadian ETFs for RRSP and TFSA

For the overwhelming majority of Canadians with investments within the inventory market, their whole portfolio consists of their RRSP and TFSA.

Hey, for those who can constantly max out these registered accounts annually, you’re doing fairly darn effectively!

In the case of selecting the precise finest ETFs to your RRSP and TFSA it boils all the way down to the next questions:

1) How a lot do you worth simplicity?

2) Are you snug doing a bit math a couple of occasions a yr with a view to rebalance your portfolio and lower MER charges to absolutely the bone?

3) Would you like a particular tilt towards Canadian shares, income-producing investments, or one other area of interest?

Relying in your solutions to those questions, the most effective ETF in Canada will range from individual to individual.

When making a suggestion to a broad viewers I completely love VEQT for younger traders, after which the remainder of the all-in-one ETF household. There may be simply an excessive amount of worth to maintaining it easy, and getting individuals to take motion by logging into their on-line dealer account one a month and shopping for the identical ETF over and over.

If we need to re-balance our portfolios within the old-school approach, we are able to shave a couple of MER factors off through the use of HXT, ZAG, and XUU for our Canadian fairness, Canadian bond, and American fairness parts respectively.

Lastly, for those who’re simply searching for a really protected and steady pure earnings play, I actually assume that VRIF is value a detailed look.

Which Canadian ETF has had the most effective returns in 2023?

The ETFs with the most effective returns in 2023 typically centred round Bitcoin ETFs (which had been coming off an atrociously dangerous 2022). The reality is that you just shouldn’t be 2023 ETF efficiency if you wish to attempt to predict what ETFs can have the most effective returns in 2024.

Right here’s a fast have a look at prime performing ETFs in 2023.

- GI Galaxy ETF USD (BTCX)

- Function Bitcoin ETF (BTCC)

- GI Galaxy Ethereum ETF USD (ETHX)

- Tesla Yield Shares ETF (YTSL)

- Horizons International Semiconductor ETF (CHPS)

And only for kicks, right here’s the most effective ETF returns for 2022.

- Ninepoint Vitality Fund (NNRG)

- Ishares S&P 500 TSX Capped Vitality Index ETF (XEG)

- BMO S&P TSX Eql Weight Oil Gasoline Index ETF (ZEO)

- Ishares International Agri Index ETF (COW)

- Horizons US Greenback Foreign money ETF (DLR)

In the event you put a big a part of your portfolio into these firms proper now at all-time highs, the possibilities that they’ll proceed to outperform going ahead aren’t nice. As a substitute, keep on with diversifying your portfolio as we detailed above.

The truth that none of final yr’s finest performers aren’t on this yr’s record shouldn’t be an anomaly – it’s quite common.

Varieties of ETFs in Canada

It was that purchasing an ETF in Canada meant that you just had been passively investing in an enormous broad index of ETFs. However now there are such a lot of several types of ETF in the marketplace, that it may be tough to find out what actual funding that you just’re shopping for.

Actually, there are actually extra ETFs than shares in most developed nation’s inventory markets (which is fairly loopy when you concentrate on it). The overwhelming majority of those ETFs are mainly irrelevant and never value your time, however right here’s sort of a fast primer on the several types of ETFs in Canada.

| Sort of ETF | Description of What’s Within the ETF |

| Index Fund (Equities) | The most effective sort of ETF – low-cost, fundamental monitoring of an index just like the TSX 60 or S&P 500 |

| Index Fund (Mounted Revenue) | Tracks an index of bonds or cash market funds |

| Index Fund (Portfolio ETF) | A steadiness of the primary two sorts of ETFs – see this text for extra on multi functional ETFs or “Portfolio ETFs” |

| Ex-North America | That is just like an fairness index fund, however solely contains shares from exterior of North America |

| Creating Markets | That is just like an fairness index fund, however solely contains shares from growing nations (versus developed markets corresponding to Canada) |

| Commodity | Focuses on the costs of a single commodity corresponding to gold or soybeans |

| Nation-specific | Is often an equities index fund, however solely contains equities from that particular nation |

| Actual Property | Invests in a number of Actual Property Funding Trusts (REITs) |

| Crypto | An ETF that tracks the worth of Bitcoin or different cryptocurrencies |

| Sustainable | An ETF that tracks a portfolio of bonds or firms which have earned an environmental stamp of approval |

| Sector/Trade | Focuses on all the firms inside a sure trade corresponding to pc processing chips or pipelines |

Canadian ETFs Professionals

The primary professionals or causes to spend money on Canadian ETFs embrace:

1) Prompt diversification. There may be merely no simpler solution to effectively cut up your funding greenback up into so many baskets. The extra diversification you’ve got, the much less dangerous your general funding portfolio turns into.

2) The worth has gotten extremely low-cost. On account of competitors between the key Canadian ETF firms, the worth on the most well-liked ETFs is now all the way down to .05%-0.15% MER. While you examine that to the two.5% MER of most Canadian mutual funds beneficial by banks – we’re speaking a sliver of the worth!

3) Comfort. As a result of ETFs commerce like a inventory, you simply open up a web-based dealer account, and you may immediately purchase and promote ETFs with ease.

4) Extra alternative than ever earlier than. There are actually extra Canadian ETFs to select from than ever earlier than. Actually, there are such a lot of, I really can’t think about a kind of funding publicity you’d need, you can’t get by in the present day’s ETF market.

Canadian ETFs Cons

The primary ETF Cons in Canada (aka “Dangerous stuff about ETFs”) embrace:

1) Extra alternative than ever earlier than. Wait – I believed this was factor??? The reality is that most individuals don’t really need alternative when investing. Only a easy index ETF (which has been accessible for many years) is sort of at all times one of the best ways to go.

2) It may be more durable to DIY. I believe that opening up a brokerage account and shopping for an ETF may be very doable for most individuals. However that stated, it’s a sufficiently big psychological hurdle that it usually intimidates many individuals and considerably delays getting began in investing.

3) Advertising and marketing for actively-managed ETFs and high-fee ETFs. The is the principle con for my part, because it was that the phrase “ETF” was synonymous with “low-cost index investing choice.” This isn’t true any extra, as fund firms have sought to “muddy the waters” in terms of snagging your ETF funding money. Keep vigilant in terms of selecting the most effective ETFs to your wants!

Prime Canadian ETFs: FAQ

ETFs vs Mutual Funds – Why MER Can Make a Big Distinction

Diving into the ETFs vs mutual funds debate in Canada, the actual game-changer comes all the way down to the charges you’re forking over annually.

Understanding the Administration Expense Ratio (MER) is essential. This charge, a share of your whole property, is deducted yearly, regardless of your funding’s efficiency. It’s a silent killer of the expansion of your investments over time. A slight distinction in MER may imply the distinction of lots of of hundreds of {dollars} over an investor’s lifetime. That’s no pocket change!

Once we line up the typical fairness mutual fund vs Canadian ETFs, the disparity in annual charges is staggering—mutual funds can cost wherever from 10 to 40 occasions extra. This truth alone has steered a brand new technology of traders in direction of ETFs, shifting away from the mutual funds their predecessors have chosen. (And which sadly nonetheless have nearly all of property in Canada.)

Whereas the large distinction in charges ought to get many of the consideration, it’s not the one cause we should always select the easy choices within the ETFs vs mutual funds dialog. Right here’s a couple of extra benefits that ETFs have:

Ease of Buying and selling: Shopping for and promoting ETFs couldn’t be easier with a web-based brokerage account. Mutual funds? They usually require a name to customer support or a sit-down with an advisor.

Tax Effectivity: Usually talking, ETFs are nearly at all times extra tax-efficient in comparison with their mutual fund counterparts.

Management Over Investments: ETFs give you the flexibleness to purchase, promote, and rebalance as you see match, granting a degree of non-public management mutual funds can’t match.

Within the panorama of Canadian investing, these distinctions between ETFs and mutual funds should not simply footnotes—they’re pivotal elements steering knowledgeable funding choices.

Which Canadian ETF Ought to You Purchase?

Our funding portfolios must be as distinctive as our funding needs and desires.

Given that every of us will prize stability and threat vs reward a bit bit in a different way, it’s unimaginable to say which Canadian ETF is finest to your explicit scenario with out understanding you and your full monetary plan.

It’s additionally necessary to at all times remember that it doesn’t matter what anybody tells you, it’s unimaginable to know forward of time which ETF will produce the most effective returns over a given brief interval corresponding to a month – or perhaps a yr.

As a substitute, what you must concentrate on is defining your funding objectives, figuring out your threat tolerance, after which choosing the appropriate ETFs for that non-public investing profile.

The Finest Canadian ETFs steadiness out the necessity for simple diversification, alongside rock-bottom prices, to supply worth to Canadians that’s unparalleled in comparison with a decade in the past.

The important thing takeaway from our Final Information to the Finest ETFs in Canada for 2024 is that there are actually so many nice choices on the market in the principle classes, that it’s necessary to not get overwhelmed. Competitors has ensured that any of the ETFs that seem on this record supply unbelievable worth at an ideal worth.