What Is Qtrade Direct Investing? Is it Legit?

Qtrade Direct Investing is a part of Aviso Wealth, a nationwide monetary providers firm owned by the Credit score Union Centrals, CUMIS and Desjardins. Aviso manages near $120 billion in belongings, and has main operations in Vancouver and Toronto, with regional places of work throughout Canada.

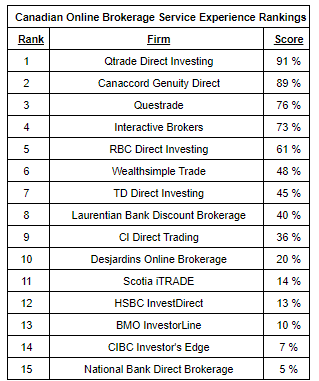

Qtrade is greater than a legit on-line dealer – it has been voted the highest Canadian brokerage 24 instances over the previous few years. I personally use Qtrade as my most important brokerage account. (I’ve a number of accounts open simply so I can get a firsthand have a look at the most recent adjustments that every brokerage places out annually.)

Moreover, a number of of the workforce members at Million Greenback Journey have a number of brokerage accounts. All of us agree that Qtrade is the #1 possibility in Canada for the overwhelming majority of DIY buyers.

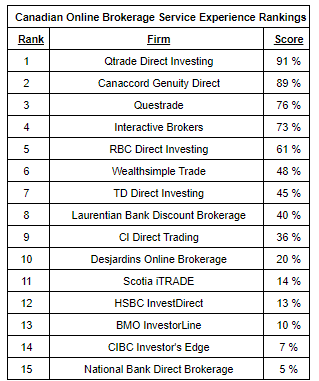

That mentioned, we’re not the one ones on this recreation. Moneysense Journal, Surviscor, and The Globe and Mail have constantly ranked Qtrade on the high of the pack over time.

We’ve been watching Canada’s brokers develop and evolve for greater than fifteen years now. Today, after we put collectively our on-line dealer assessment, we embody insights from round our editorial desk, and consider dozens of emails and feedback that we get every week.

Probably the most underrated comparability factors in relation to selecting a brokerage, is the consistency with which they’re able to keep on the high of their recreation. The standard innovation cycle signifies that a dealer comes out with a flashy new interface (typically with a brand new function or two) after which relaxation on their laurels for the subsequent few years as they fall behind – earlier than then recommitting the assets to catch up once more.

Qtrade is consistently on the forefront of latest options – and so they do it whereas preserving charges low. That consistency signifies that once you select Qtrade you received’t should accept less-than-stellar components of the innovation cycle – simply year-in, and year-out excellence.

Who desires to be bothered transferring all of their accounts over to the “new sizzling factor” yearly or two? I’ve no endurance for bureaucratic paperwork, so consistency is vital for me once I’m selecting monetary platforms.

The media has been embracing Qtrade Direct because the probably the greatest Canadian brokers, and has obtained significantly glowing opinions within the Globe and the Mail, MoneySense journal, in addition to a lot of our fellow Canadian private finance blogs. This Qtrade assessment is much from being the one extremely constructive one within the Canadian our on-line world.

“If investing to you is a years-long journey of wealth-building for targets like retirement and your kids’s postsecondary training, you then’ll get extra worth from Qtrade’s instruments and informative web site than you’ll by paying a couple of dollars much less per commerce: Grade: A+“

Rob Carrick, Globe and mail

Qtrade Fee Free ETFs

As an avid ETF investor, this can be a main facet of the Qtrade Canada assessment.

Qtrade’s dedication to the free buying and promoting of ETFs is a deal-breaking-win for me. Different Canadian brokerages provide free ETF purchases, however cost a buying and selling price when ETFs are bought to withdraw cash, or simply to rebalance a portfolio.

It’s necessary to notice that not all ETFs are created equal in relation to the Qtrade commission-free ETF buying and selling coverage. That mentioned, you may get publicity to no matter market you need utilizing these ETFs.

You will get tremendous sophisticated and look into area of interest ETFs such because the iShares Jantzi Social Index ETF (XEN) should you’re searching for socially accountable investing, or you should use the ultra-cheap broad ETFs that I choose.

Whereas Qtrade doesn’t technically have commission-free trades obtainable for all ETFs – they do have an inventory of over 100 ETFs (that they’re including to constantly) that may be purchased and bought as many instances as you need for the straightforward value of $0. That Qtrade free ETF checklist consists of simple methods to get publicity to no matter market you need.

You should purchase hyper-focused choices (though I don’t advise it) such because the Desjardins RI Canada – Low CO2 Index ETF (DRMC) should you’re searching for socially accountable investing, or you should use the ultra-cheap broad ETFs that I choose. My private favorite Qtrade commission-free ETFs are Horizon and iShares portfolio ETF choices.

There isn’t a minimal buy stage to qualify for these commission-free ETFs – you merely purchase them as you’ll every other inventory or ETF buy. Additionally – in contrast to Questrade – not is the shopping for and promoting of those ETFs utterly commission-free, there aren’t any ECN charges both.

This expansive, fee-free ETF choice retains Qtrade a minimize above the remaining, particularly for these of us who wish to maintain our investing easy and cost-optimized.

Extremely-cheap broad ETFs to purchase at no cost on Qtrade:

- Horizons S&P/TSX 60 Index ETF (HXT)

- Horizons S&P 500 Index ETF (HXS)

- iShares MSCI Rising Markets Index ETF (XEM)

- iShares World Actual Property Index ETF (CGR)

- iShares Canadian Authorities Bond Index ETF (XGB)

- iShares Core Progress ETF Portfolio (XGRO)

- iShares Core Fairness ETF Portfolio (XEQT)

- iShares Worldwide Elementary Index ETF (CIE)

- CI Canadian REIT ETF (RIT)

- If you’d like the best ticker image in Canada… “COW” (the iShares World Agriculture Index ETF) that can be obtainable – though it’s not in my portfolio!

All different ETFs will be bought at Qtrade’s customary low-commission charge of $6.95 per commerce (for Buyers Plus members).

Qtrade Charges & Fee

Qtrade’s non-ETF buying and selling charges are decisively cheaper than the charges charged by Canada’s large financial institution brokerages, however are barely increased than Questrade’s buying and selling charges.

Qtrade Buying and selling Charges, Commissions and Quarterly charges:

- On a regular basis buyers (those that don’t meet the 150+ trades per quarter or $500,000+ in belongings thresholds) are charged $8.75 per commerce.

- Investor Plus members will see a decrease charge of $6.95 per inventory commerce.

- Choices are $6.95 + $1.25 per contract.

- Inventory merchants between the ages of 18-30 may make the most of a decreased fee charge of $7.75 with no minimal stability and no quarterly charges, so long as they arrange a recurring deposit of $50+ every month.

- Digital statements don’t have any price, whereas paper commerce confirmations price $2.50.

- To switch your account out the price is $150.

- There’s a quarterly price of $25, however that could possibly be simply prevented, as per under.

Keep away from the Qtrade Quarterly Account Payment

- Qtrade has a $25 per quarter account price, however there are quite a few methods to flee this pesky price. My advice to new buyers is to arrange an automatic contribution to their brokerage account. This merely signifies that you ship $100 (or extra) out of your checking account to your brokerage account every month. Qtrade refers to this as a “recurring digital funds contribution” and it has no charges hooked up. Should you arrange this strong funding apply, then you’ll be able to keep away from Qtrade’s quarterly account charges it doesn’t matter what your stability or buying and selling ranges.

- Have a minimum of $25,000 in belongings on the final enterprise day of every 3-month interval (referred to as “quarters” within the investing world).

- Full two commission-generating trades within the previous quarter or both trades within the previous 12 months.

Qtrade Evaluate: Switch Charges

With a purpose to make it as enticing as doable to make Qtrade your go-to buying and selling platform, Qtrade presents to pay your switch charges that you can be charged out of your outdated dealer once you transfer over.

This switch price provide applies to of us that transfer over $15,000+ price of belongings, or who transfer over lower than $15,000 after which deposit as much as that quantity within the first 30 days.

With a purpose to make the most of this switch price reimbursement provide, you want to mail/fax an announcement out of your outdated buying and selling platform that particulars the prices you incurred. Then, inside 60 days, you’ll see the account credit score pop into your account.

Should you select to maneuver on from Qtrade in some unspecified time in the future, their switch price is $150. In fact the entire level of studying our Canadian on-line dealer opinions is that you’ll be able to make an knowledgeable resolution with a long-term selection in thoughts – and stop the time-consuming paperwork and switch charges incurred with a switchover.

Qtrade Evaluate: Account Choices

Qtrade has a wide range of account varieties which you can select from relying in your investing targets and wishes.

Money Accounts: Money accounts are fairly easy. You should purchase and promote shares, bonds, mutual funds, and different investments. Money accounts can be found as particular person, joint, company, and group. They’re clearly essentially the most versatile account sort.

TFSA: TFSAs are a priceless account sort for Canadian buyers. You’ll have the ability to put money into shares, bonds, ETFs, and mutual funds, however your earnings and withdrawals are sheltered from tax.

RRSP: Utilizing the Qtrade RRSP account you’ll be able to put money into shares, bonds, ETFs, and mutual funds, however the tax can be deferred till you make a withdrawal, ideally upon your retirement. RRSP accounts can be found for people, as a spousal plan. RRIFs (the pure conclusion to RRSPs) are additionally obtainable. There are additionally each Canadian Greenback and US Greenback Account choices.

FHSA: The brand new Qtrade First House Financial savings Account (FHSA) means that you can commerce in shares, bonds, ETFs, and mutual funds. It is a wonderful possibility for saving that first downpayment (and is even fairly cool should you plan to by no means personal a house. See our FHSA information for extra particulars.

Click on right here to open a Qtrade FHSA account and stand up to $200 in top-up money again.

Margin: Margin accounts assist you to borrow cash towards your securities to commerce at aggressive charges. Take into accout, that is the one account sort that you’ll want to pay curiosity on.

There isn’t a Qtrade minimal stability required to open an account, however there may be minimal stability required to keep away from the account price as mentioned above.

Qtrade additionally facilitates ultra-fast, tremendous handy EFT transfers to get cash out of your checking account to Qtrade – and again once more.

You may arrange Digital Fund Transfers (EFTs) with out fear about importing a void cheque or something like that, you merely login to your checking account by Qtrade’s EFT platform and also you’re set to go.

Qtrade Evaluate: Buyer Service

One of many greatest attracts of Qtrade is the customer support. This firm has created a repute for itself by way of its immediate buyer help and educated employees.

“Qtrade excels in each space—particularly in customer support.”

Mark Brown, Investing and Rankings Editor for MoneySense

You may attain Qtrade customer support in 3 ways: by telephone, by e mail, or by reside chat. They actually have a ‘allow us to name you’ function the place you’ll be able to depart your telephone quantity and they’ll get in contact as quickly as the subsequent customer support consultant is out there, that means you don’t have to remain on maintain.

When you’ve got ever been positioned on a irritating maintain for two+ hours, then had the top of the enterprise day minimize you off, once you’re “practically subsequent in line” – then you know the way priceless this dedication to customer support is!

It is a decisive benefit over the remainder of Canada’s low cost brokers.

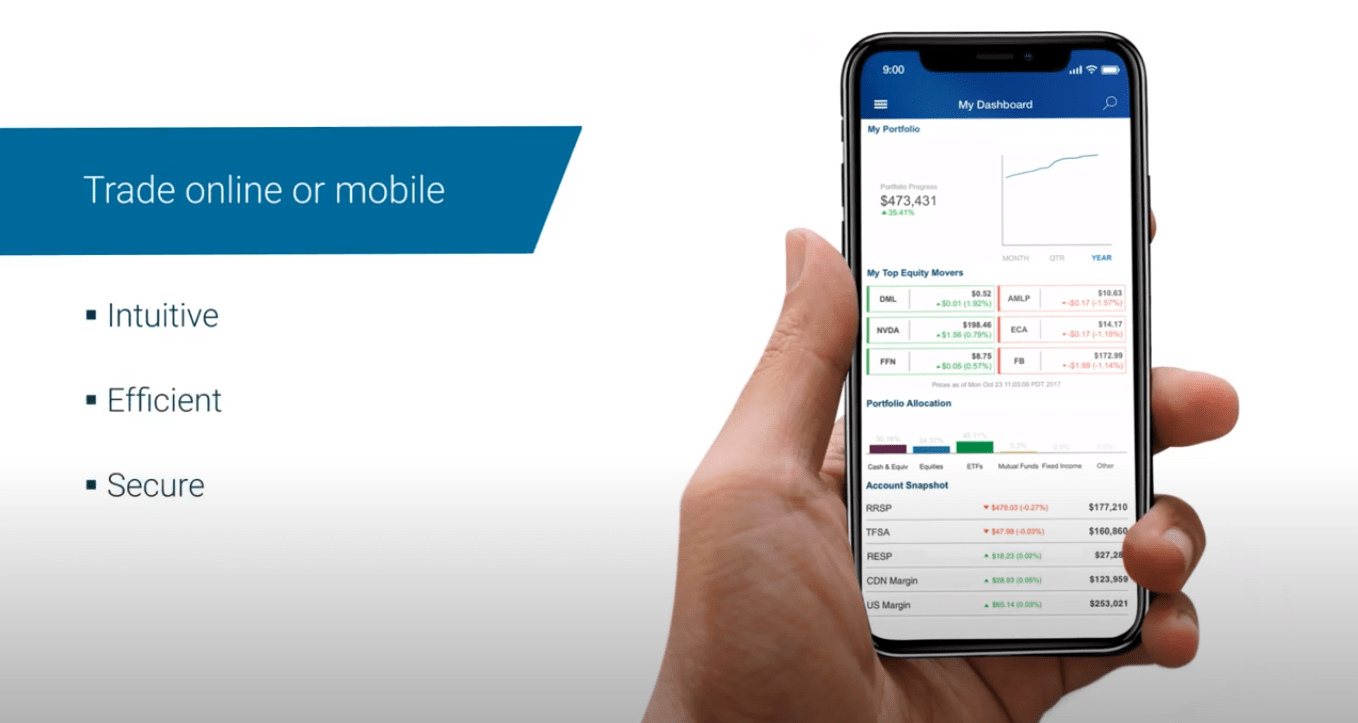

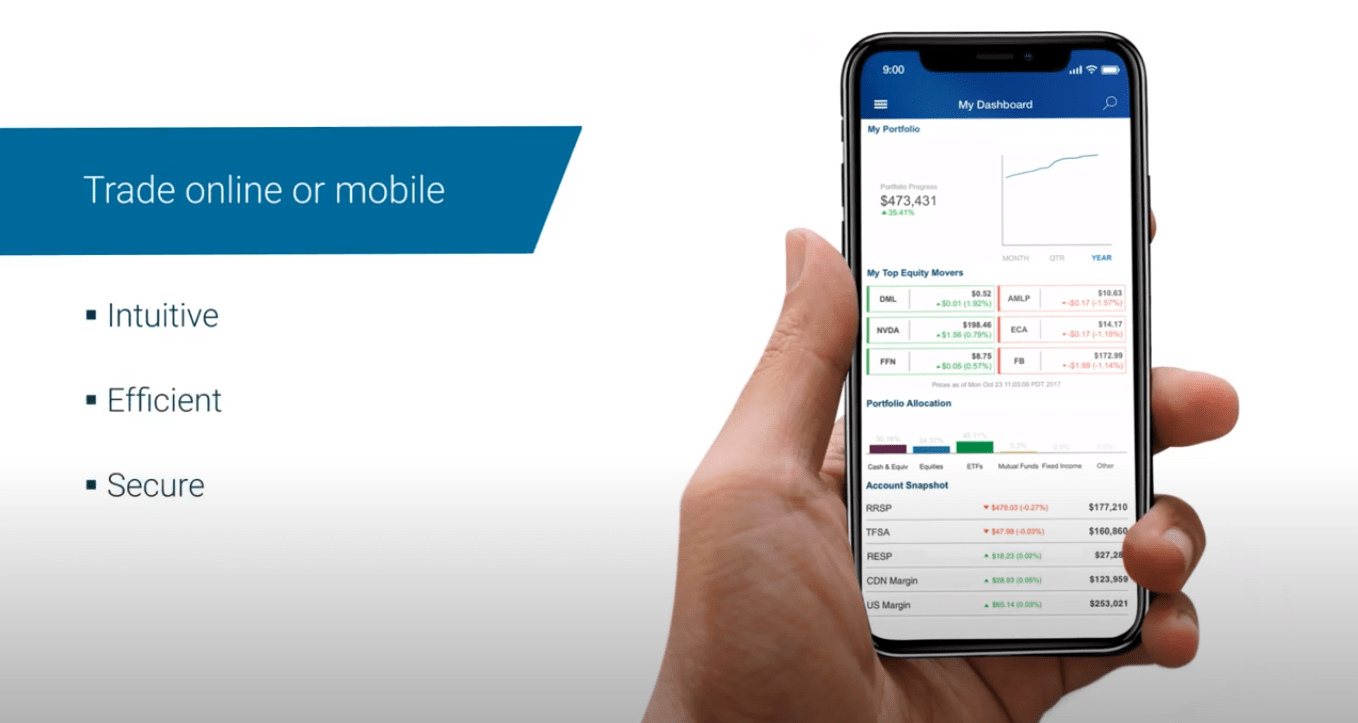

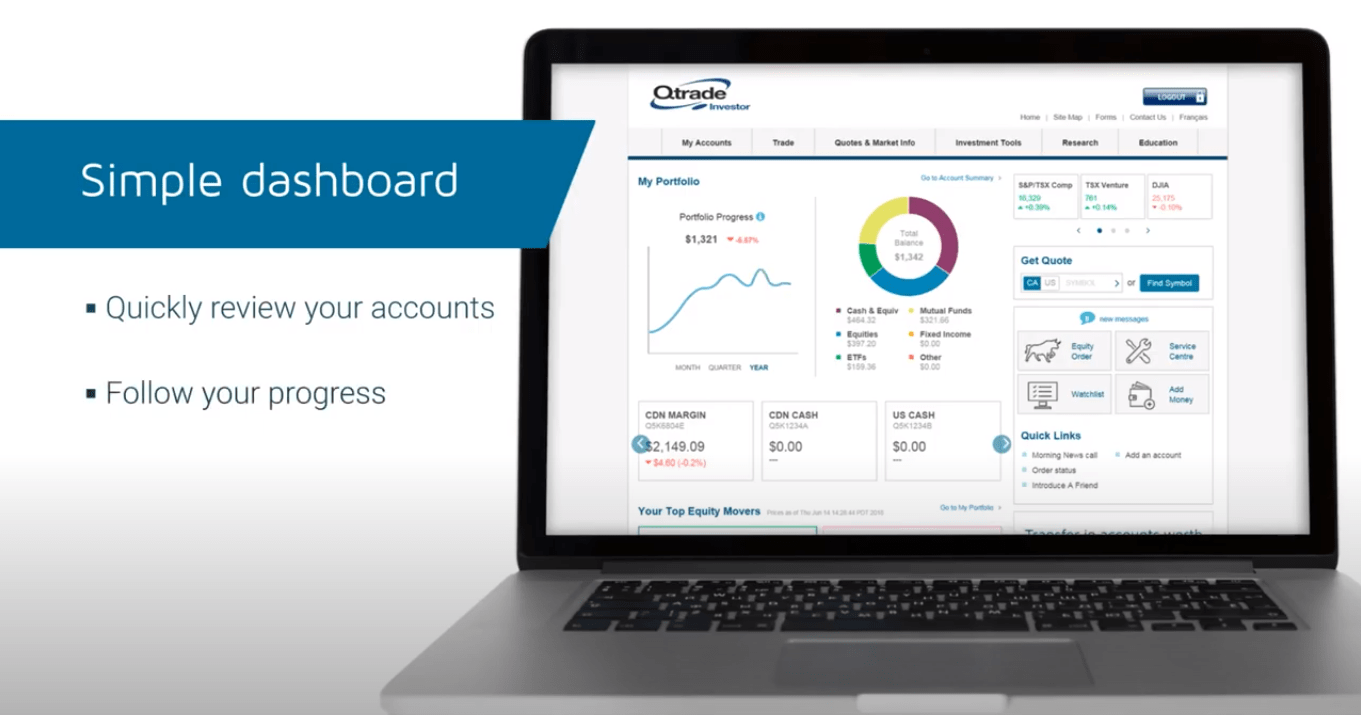

Qtrade undoubtedly will get bonus factors for having a transparent and easy-to-use web site and the Qtrade cellular app is a extremely refined method to commerce as nicely. In a chunk for the Globe and Mail, Rob Carrick acknowledged that “it’s cellular app helps you to do a variety of features and doesn’t minimize corners, which many different brokers have.”

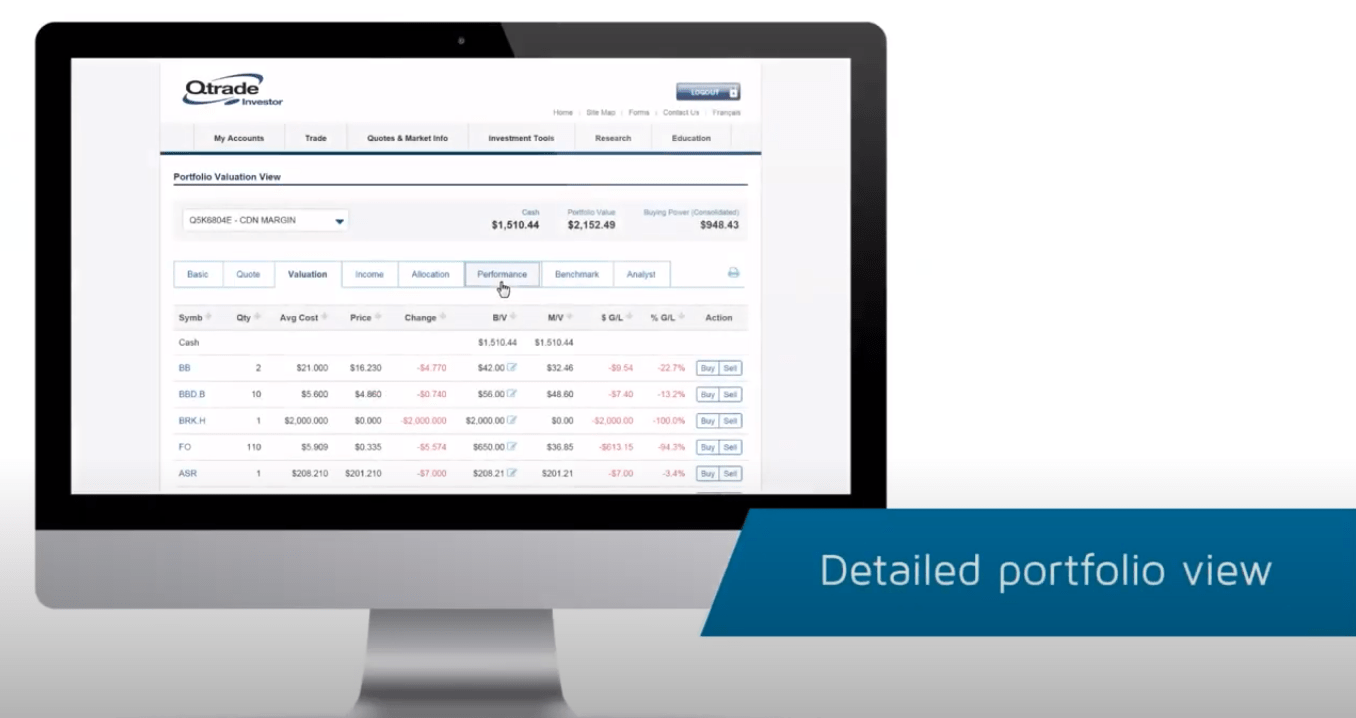

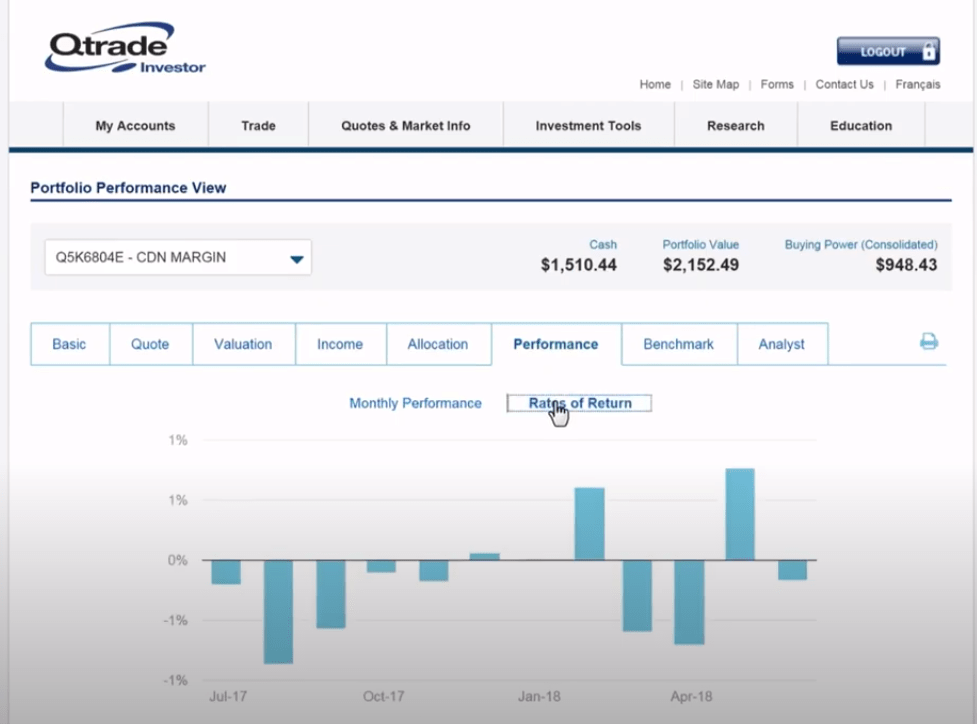

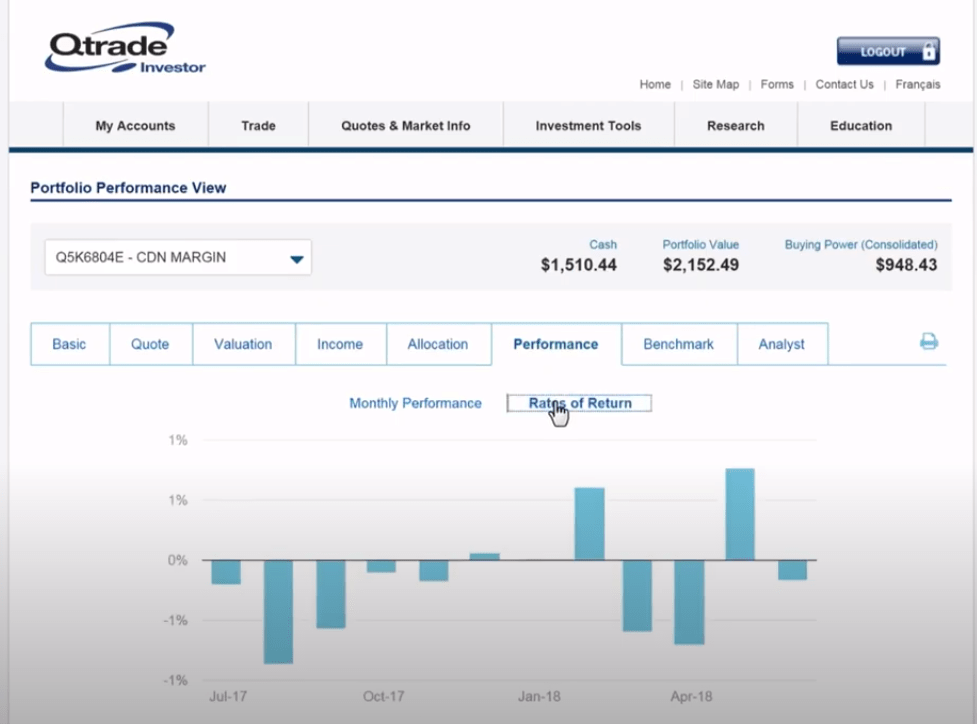

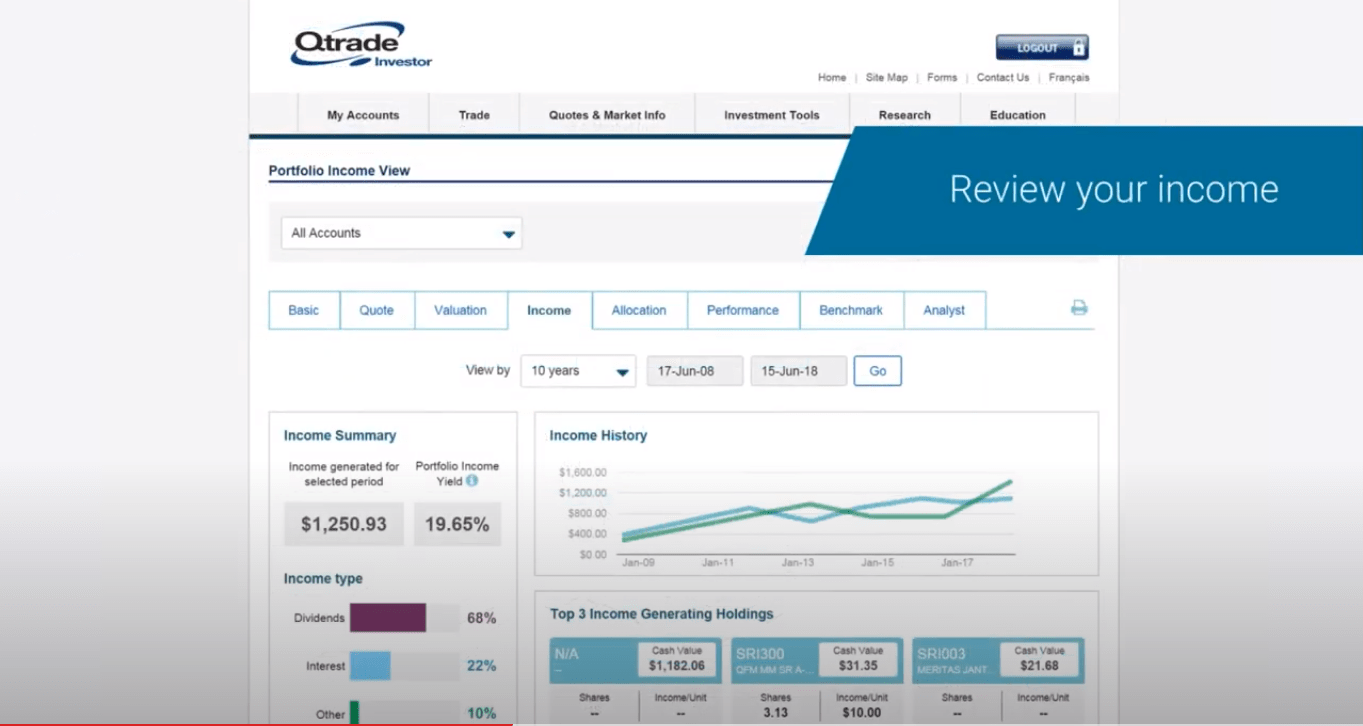

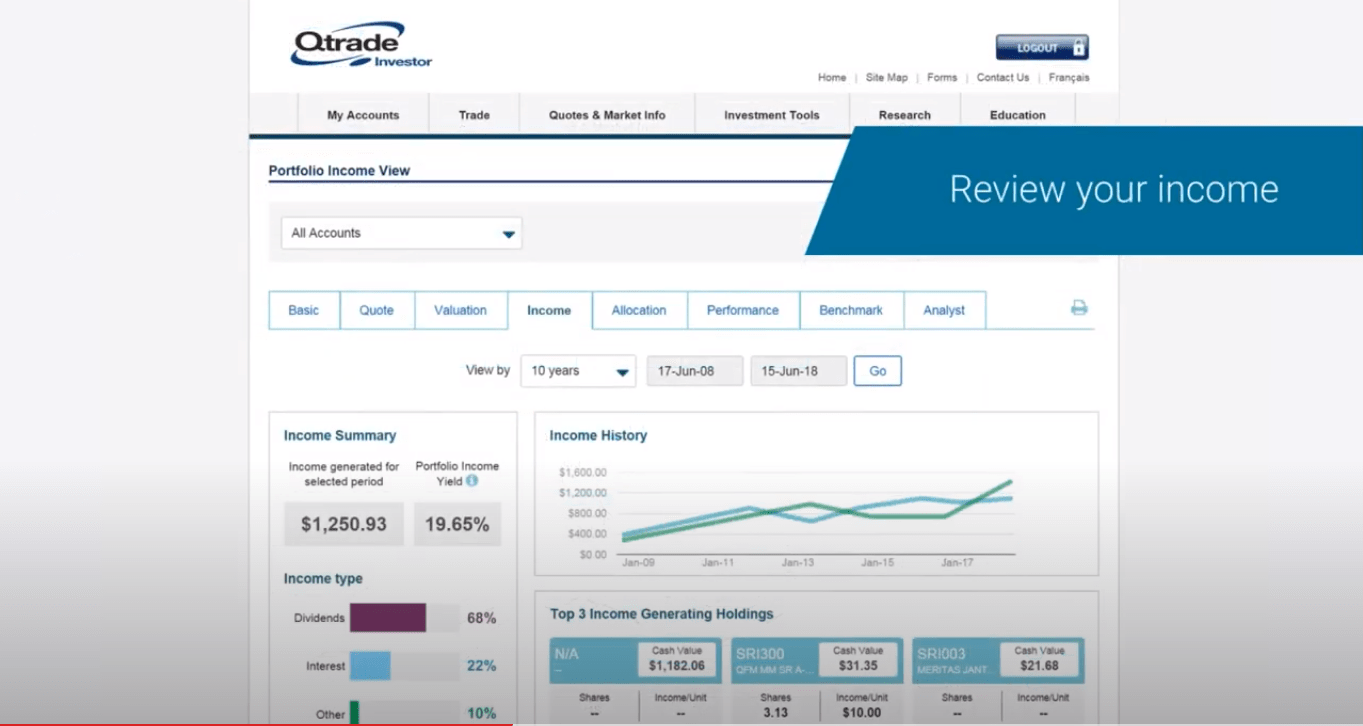

Under is a video demonstrating how their buying and selling system works:

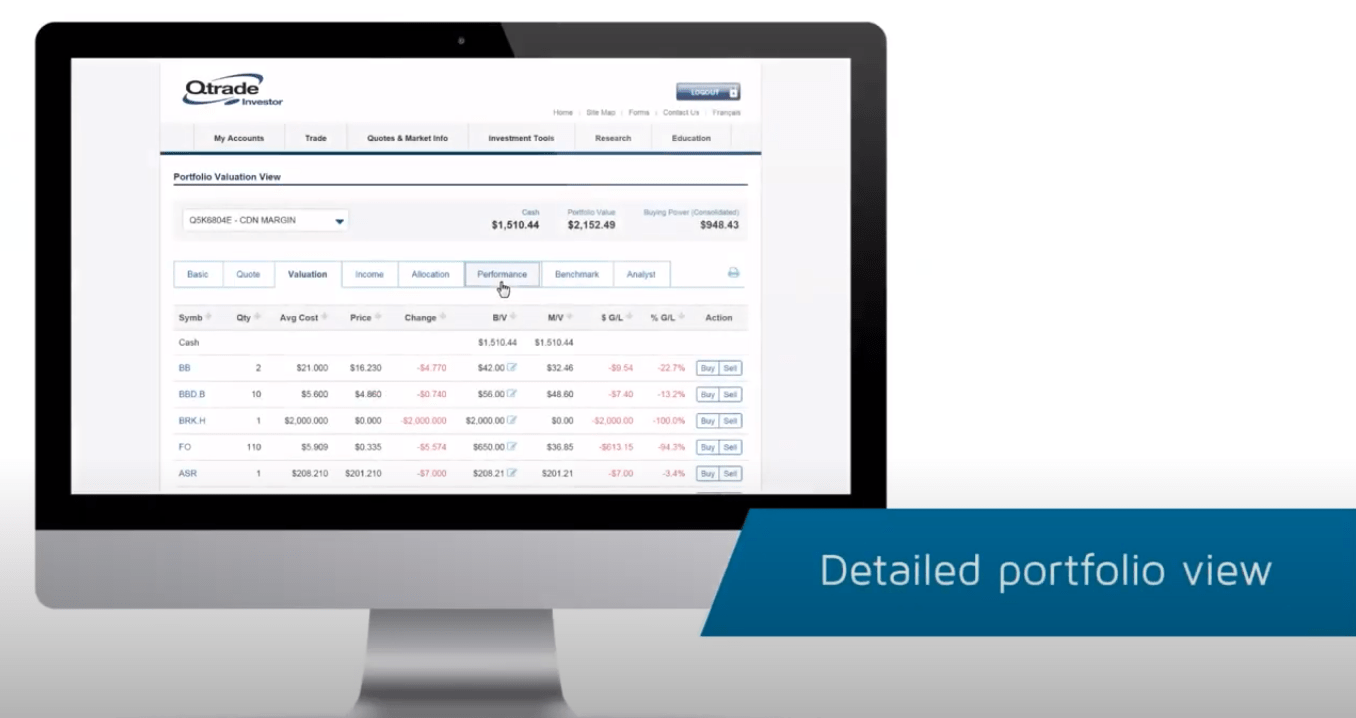

On each the web site and the Qtrade cellular buying and selling platform (rated #1 on our finest inventory buying and selling apps article), Qtrade means that you can simply navigate your investments, watchlists, inventory screeners, and market analysis instruments.

The inventory screeners are customizable and real-time quotes will present you the present inventory value in addition to further info together with dividend yield, earnings per share, 52-week highs and lows, and market cap.

Qtrade’s buying and selling platform makes inventory buying and selling a breeze as nicely. A click on on the ‘commerce’ button will assist you to select what sort of safety you want to make investments. You may commerce shares, ETFs, mutual funds, choices bonds, and GICs on US and Canadian exchanges. If you’d like, you may also set restrict orders and cease orders.

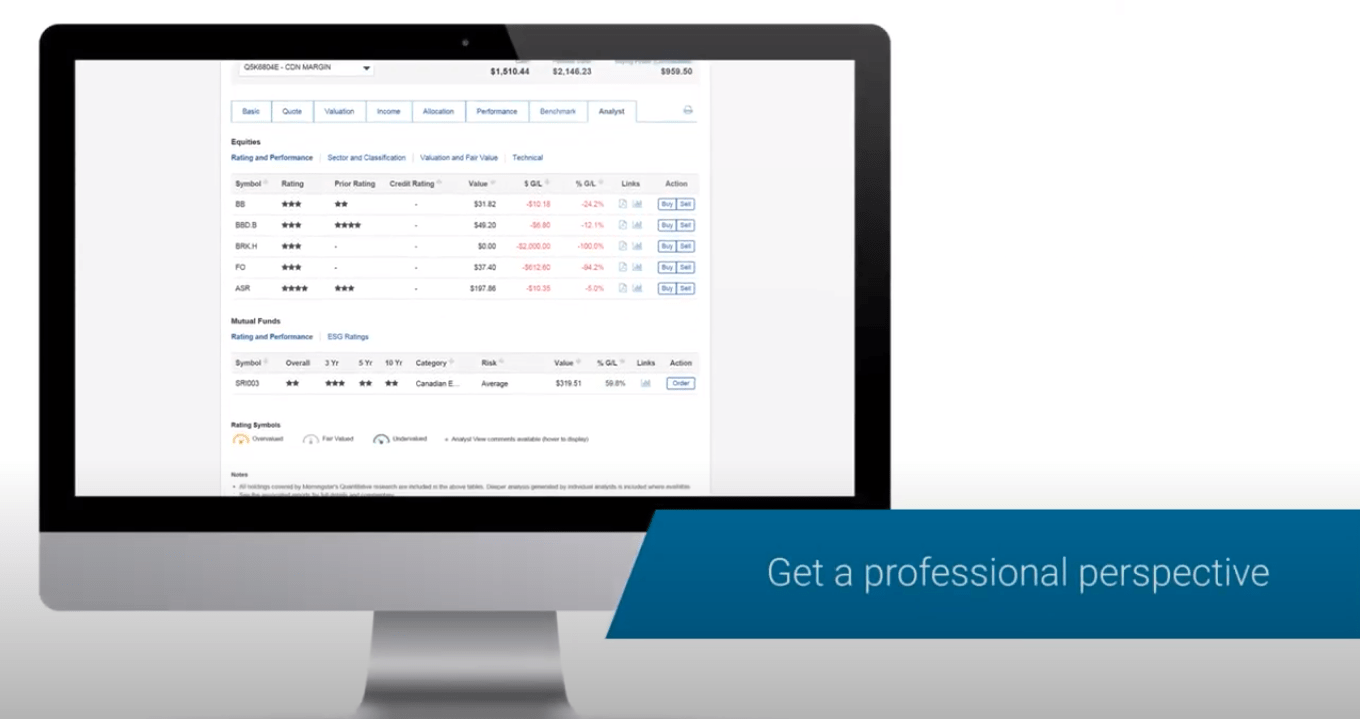

Buyers and columnists are additionally loving certainly one of Qtrade Direct latest instruments; Portfolio Rating. This software basically offers you a second opinion in your portfolio. You should use the data offered to check your portfolio towards home and world benchmarks.

It is going to additionally consider your securities and grade your portfolio towards 5 dimensions:

- Draw back protections

- Efficiency

- Diversification

- Earnings

- charges

It’s a helpful software to have that will help you make investments with extra confidence and handle your threat publicity.

The opposite distinctive facet of Qtrade’s buying and selling platform is their Portfolio Simulator and Portfolio Creator instruments. Simulator permits buyers to check how including particular ETFs, shares, or bonds would change the make-up of their portfolio (and observe the corresponding change to variables reminiscent of inflation, rates of interest, and US trade charges).

Creator generates an all-ETF portfolio designed particularly for you (based mostly in your solutions to a collection of questions). Moreover, for the detail-oriented DIYers on the market, it’ll present you your hypothetical ETF-portfolio’s risk-adjusted return based mostly on the Sharpe ratio, SF Ratio, and the Sortino ratio.

Under you could find further screenshots from Qtrade’s on-line buying and selling platform and the Qtrade cellular app under:

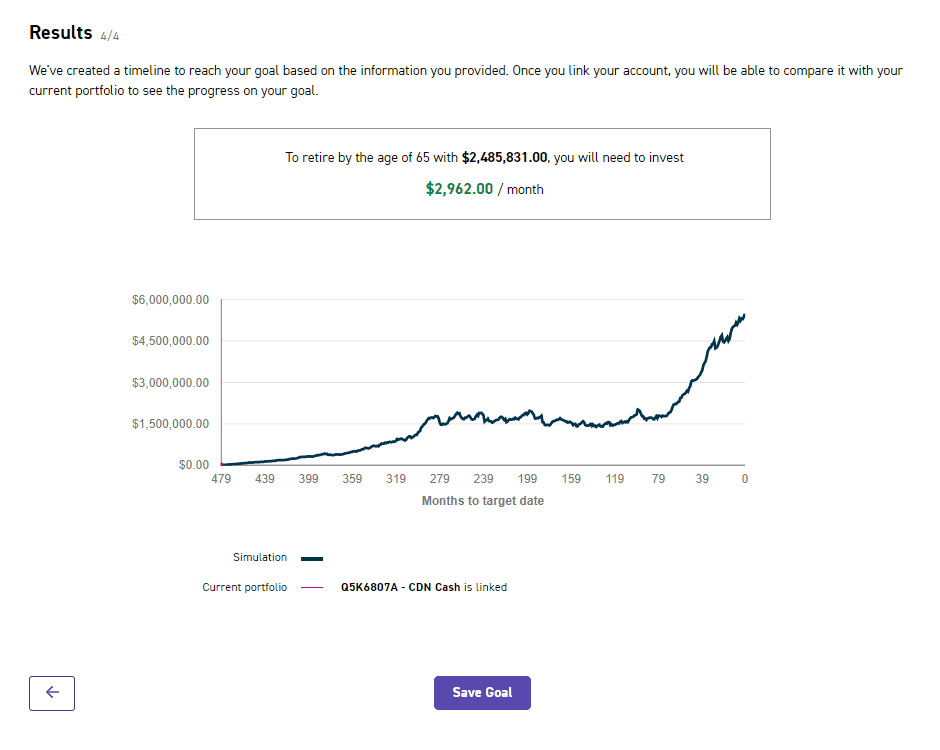

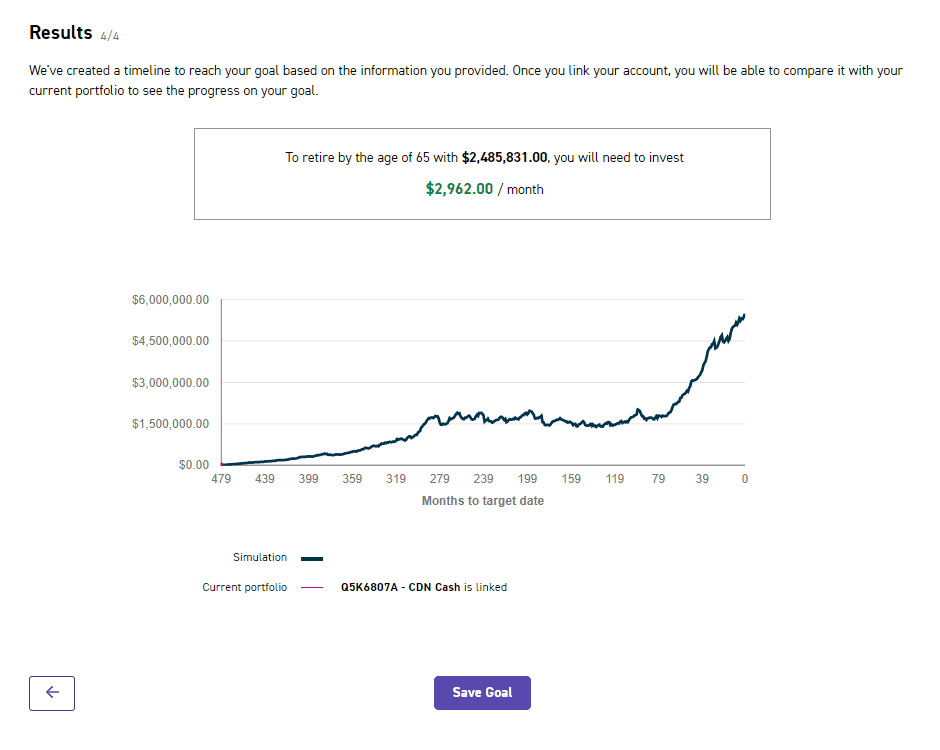

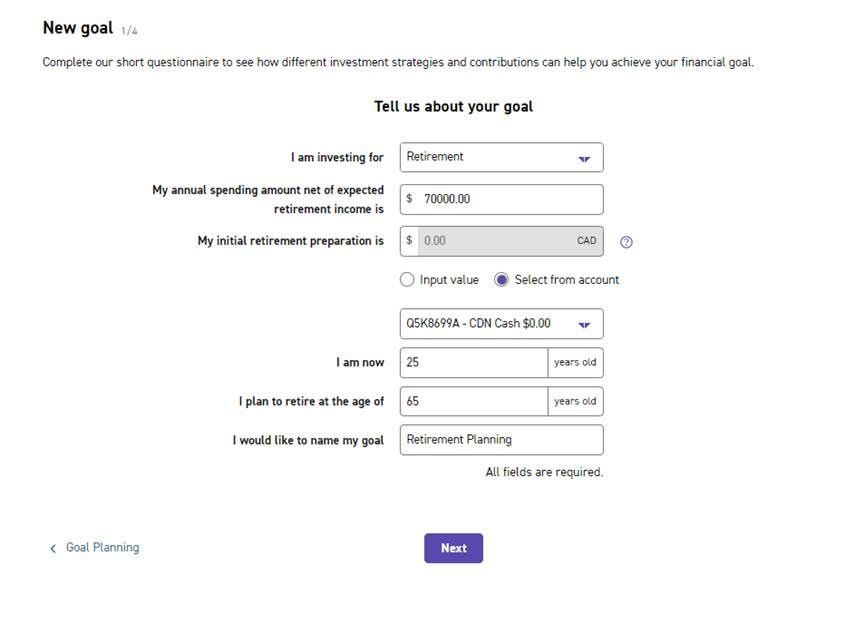

Qtrade New Purpose Planning Software

In Could 2023 Qtrade added a really cool new objective planning software so as to assist buyers visualize their subsequent steps and future progress. Customers can entry the software from their account dashboard.

The objective planning software was created with the intent to:

- Establish funding targets.

- Perceive risk-appropriate funding choices.

- Monitor progress in the direction of recognized targets over time.

- Assist visible learners by displaying visible projections of potential timelines.

- Permit buyers to “pivot” or change targets as circumstances change over time.

Qtrade’s platform innovation info described the brand new software as, “A fast and easy method to start to jot down your individual future. Whether or not you’re saving for a down cost on a home, planning for retirement, or attempting to hit one other monetary milestone, a user-friendly questionnaire helps you simply set your targets. Monitor your targets, verify in to observe your progress, and obtain personalised suggestions on how a lot you want to make investments every month to provide the confidence you want to obtain them.”

November 2022 Replace:

Qtrade’s most up-to-date person expertise improve features a very DIY investor-friendly onboarding course of that guides buyers to the suitable account relying on what their objective is. In fact, should you already perceive what you want, you’ll be able to decide to decide on your individual account possibility instantly (as you all the time may).

For buyers simply familiarising themselves with on-line brokers nevertheless, this can be a good little improve that can assist extra Canadians make the suitable funding decisions for his or her particular scenario.

For instance if you choose “saving for retirement” as your objective, then Qtrade will ask should you’d wish to open a TFSA, RRSP, Spousal RRSP, or LIRA/LRSP. If saving on your youngster’s training is the objective they’ll not solely give you a person RESP possibility, but in addition a household one.

The Investor Plus Program: Decrease Charges

Qtrade has an elite-tier program referred to as the Investor Plus Program which comes with a couple of perks and advantages (together with decrease buying and selling charges).

To qualify for the Investor Plus program it’s essential to have:

- A minimal of $500,000 in belongings throughout all accounts and beneath the identical consumer ID

or

- A minimal of 150 on-line commission-generation fairness or possibility trades throughout the instantly previous calendar quarter.

Perks and advantages embody discounted buying and selling fee charges, which can be mentioned under, in addition to a devoted telephone quantity to make sure quicker service plus no price for USD registered accounts.

Qtrade vs Questrade

Look, the underside line within the Qtrade vs Questrade battle is which you can’t actually go flawed. It comes right down to the tradeoff between rock-bottom charges and the most effective person expertise available on the market. That mentioned, if you’re primarily searching for ETF buying and selling – it’s gotta be Qtrade hands-down.

Right here’s a more in-depth have a look at the Qtrade vs Questrade comparability (click on on the hyperlink to view a full fledged comparability, that is only a fast abstract):

|

Sure! free shopping for AND promoting of 100+ ETFs. |

Free shopping for of ETFs, BUT does cost the conventional buying and selling price to promote ETFs. |

|

|

Persistently rating #1, excessive availability and pleasant to prospects |

Has made large features over the past three years, rated simply behind Qtrade by most publications |

|

|

Really elite customer support, mainly, the #1 motive to go along with Qtrade |

Have made some enchancment over the past 12 months, however nonetheless missing |

|

|

Very aggressive, $6.95/commerce for Investor Plus Program members, $7.75 for buyers aged 18-30, $8.75 for everybody else |

A all-time low $4.95 for as much as 500 shares, to a most of $9.95. |

|

|

ECN Charges (further buying and selling charges) |

Charged – typically small quantities for many buyers |

|

|

$25 per quarter – WAIVED IF you maintain $25,000 within the account OR you make 2 trades per quarter or 8 within the final 12 months OR you add $100+ automated recurring month-to-month contribution (our most well-liked possibility) |

||

|

Free Digital Funds Switch. Further price for transferring out. |

Free Digital Fund Transfers as much as $50,000 CAD and $25,000 USD. Further charges for wire transfers and transferring out. |

|

|

Analysis Instruments and Training Supplies |

Has been on the high of Canadian brokerage rankings on this class for over a decade |

Made glorious features in the previous couple of years |

|

Instantaneous Signal Up Bonus: $100-$2,000 |

||

Qtrade Provides TipRanks Rankings for 2023

Qtrade not too long ago introduced that they’ve sealed a partnership with the investing info service TipRanks. Going ahead, each Qtrade consumer will have the ability to entry the analysis offered by TipRanks Analyst Score.

Personally, I’m not large on figuring out my funding choices by way of analyst rankings, however it by no means hurts to have extra information factors (particularly once you get them at no cost).

The fundamental concept behind the TipRanks service is that they acquire the entire info and predictions that analysts are making with reference to particular shares, after which presents them in a pleasant tidy aggregated abstract. Metrics reminiscent of value targets and estimates can be prominently displayed alongside analyst quotes and proposals.

Qtrade customers will have the ability to entry this new investor info by the “Overview” and “Analyst Rankings” tabs inside their accounts.

Whereas DIY buyers could want to use analyst opinions to seek for broad trendlines, I’d warning them from studying too deeply into any single analyst opinion as analysts have a notoriously tough time navigating the two-way relationship with the shares that they cowl over the long run.

Qtrade Younger Investor Program

Qtrade has not too long ago made a powerful push to get younger individuals began on their platform. By providing specifically priced $7.75 inventory trades – and entry to the identical Qtrade fee free ETFs menu – Qtrade has made the inventory market extra accessible to younger buyers than ever earlier than.

Qtrade has additionally dedicated to eliminating the $25 account charges routinely for younger buyers.

With a purpose to qualify for the Qtrade Younger Investor Program you merely must fall within the 18-30 age group, and arrange a $50 monthly pre-authorized contribution out of your common financial institution/chequing account.

Buyers who’re simply beginning to handle their very own cash can take full benefit of Qtrade’s top-tier investor training supplies and entry to third-party investing reviews. This particular perk for our most visited age group is without doubt one of the driving powers behind this constructive Qtrade assessment.

Qtrade Evaluate FAQ

Rob Carrick’s Qtrade Evaluate 2024

Annually we eagerly await Rob Carrick’s dealer rankings on the Globe and Mail to see if he’s uncovered any angles that we missed or if we’re on the identical web page.

In 2024, the lengthy and wanting it’s that Carrick continues to be impressed with Qtrade, giving it an A score for the fifth 12 months in a row. Right here’s what he needed to say about our favorite on-line dealer:

Qtrade has lived on the high ranges of this rating for ages as a result of it’s all the time making large and small enhancements. Yet one more latest tweak is the addition of a goal-planning software that permits shoppers to set a goal quantity for a selected monetary milestone after which monitor their progress towards reaching it. The large pluses at Qtrade embody one of the user-friendly web sites on this rating, a superb app, commission-free buying and selling of 120 ETFs and a Portfolio Rating software that lets shoppers drill manner down into their portfolios to evaluate threat, diversification and extra.“

As a fast reminder, right here’s among the spotlight of what Carrick needed to say about Qtrade’s on-line dealer over the previous three years:

As has typically been the case on this rating over time, Qtrade Direct Investing is the dealer that does it finest. Different brokers beat Qtrade in particular areas like fee prices, however Qtrade’s general goodness turns into obvious as quickly as you log in and discover a neat little dashboard to get you on top of things in your investments. Qtrade’s constantly robust displaying on this rating speaks to a different of its virtues, fixed enchancment. Different brokers get higher in matches and begins, whereas Qtrade strikes ever ahead.“

Very similar to myself, Carrick has been most impressed with Qtrade’s consistency over the long run. Some brokerages will make a achieve right here or there, after which fall behind over time. However, it may be a chore to vary brokerages, so customers principally simply put up with a poor expertise.

Not Qtrade!

12 months after 12 months they carry the products so far as sustaining the straightforward excellence of buyer expertise, and pairing it with company-wide innovation.

Surviscor Qtrade Evaluate 2024

On the finish of 2023 Survisor launched their new Canadian on-line dealer rankings, and confirmed what we at MDJ had been listening to all year long: Qtrade customers are the happiest in Canada.

Glenn LaCoste, the Preside of Surviscor Group acknowledged, “Congratulations to Qtrade Direct Investing for its continued service response excellence and its breadth of service interplay decisions for all sorts of digital buyers.”

Christine Zalzal, the Head of On-line Brokerage and Digital Wealth over at Qtrade was completely satisfied to just accept the award stating, “What makes a fantastic on-line brokerage agency for buyers will not be solely a fantastic on-line buying and selling expertise but in addition being supported by a fantastic service workforce. At Qtrade, we’re all the time listening to our prospects. A powerful customer-focused tradition is embedded into our DNA. As extra Canadians discover the world of self-directed investing, we’re persevering with to put money into our individuals and our platform to assist construct their confidence to construct their wealth.”

Given the experience that Surviscor has 18 years of expertise in reviewing Canada’s on-line brokers, they’ve substantial credibility with the area. The information is the fruits of roughly 2,200 particular person service interactions all through the earlier 12 months.

Proper on the finish of 2023, Surviscor launched their 2024 desktop comparability for Canadian on-line brokerages. It was good to see their discovering mirror my very own, as Qtrade took the #1 place. Qtrade continues to out-innovate, and out-compete their brokerage rivals in relation to usability and buyer expertise.

Latest Enhancements to the Qtrade Buying and selling Platform and Analysis Instruments:

- New Portfolio Rating, which supplies a consumer’s portfolio a health-check by analyzing and grading its efficiency throughout 5 monetary dimensions

- Information service powered by Dow Jones

- Sector-specific newsletters with pricing predictions from Buying and selling Central

- Expanded providing of USD DRIP-eligible securities

- Spousal USD RRSP and RRIF merchandise

- Up to date choices buying and selling to boost real-time info

- Redesigned and expanded ETF and Inventory Screeners

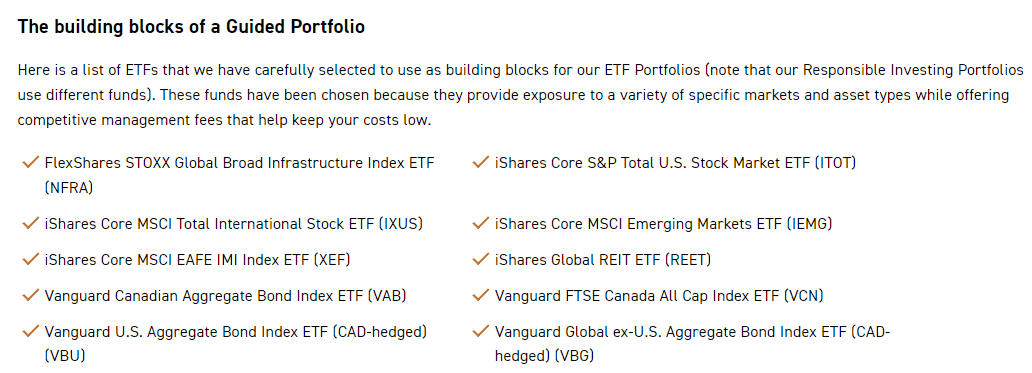

Qtrade Guided Portfolios

Along with being a wonderful low cost brokerage platform, Qtrade has additionally not too long ago launched a extra “hands-off” method to handle your cash, that they’re calling Qtrade Guided Portfolios.

Qtrade Guided Portfolios are an enormous leap ahead on the corporate’s outdated “semi-robo-advisor” often known as VirtualWealth.

Right here’s the deal on Digital Portfolios:

- It’s a brilliant quick and handy method to make investments your cash utilizing a passive investing technique that’s often known as index investing.

- While you open a Guided Portfolio account, Qtrade will ask you a collection of questions to find out what the most effective general mixture of belongings is for somebody along with your targets and threat tolerance. They wish to just remember to’re getting proper stability of shares and bonds (often known as equities and glued revenue).

- After getting the suitable match the cash that you just put in every month can be break up up into ETFs that monitor just about each large publicly traded firm on the planet – in addition to many various authorities bonds.

- It’s a wonderful math-backed investing possibility.

- Charges are fairly low (MER of .60% or decrease) and really aggressive.

- Can embody RRSPs/RRIFs, TFSAs, and different Canadian accounts.

- There are 6 totally different threat ranges – every have their very own portfolio: Earnings, Earnings + Progress, Balanced, Progress + Earnings, Progress, Max Progress.

- Every totally different portfolio will allocate your cash barely in a different way to those ETFs:

Total, Qtrade Guided Portfolios are a wonderful possibility for people that need that final in hands-off investing. The closest comparable product in Canada could be Wealthsimple Make investments. Should you’re keen to pay slightly bit extra in charges than should you constructed your individual index portfolio, you’ll get the right one-stop answer for constructing a nest egg.

You may signal as much as Qtrade Portfolios by clicking the button under and visiting their web site, or learn our detailed Qtrade Guided Portfolios assessment to see how they examine to Canada’s finest robo advisors.

Qtrade Pre-Market and After Hours Buying and selling

Qtrade not too long ago introduced that they are going to be providing pre-market buying and selling from 8:30-9:30am ET and after hours buying and selling from 4:00-5:00pm ET. Buying and selling is at the moment just for US markets (together with shares like Enbridge which might be traded on each the Toronto Inventory Change and the New York Inventory Change).

Particulars of the announcement included, “At present, these trades can solely be positioned by way of phone with an Funding Consultant. We plan so as to add prolonged market orders to our on-line platform in the end. We proceed to put money into and relentlessly enhance our consumer and companion expertise.”

Personally, after-hours buying and selling isn’t my factor because it’s extra geared in the direction of day merchants. Liquidity can typically be very low within the pre-market and after hours markets, resulting in pretty massive value strikes in a speedy style. That mentioned, I’m all the time completely satisfied to see Qtrade push the envelope and proceed to supply new choices for Canadian buyers.

Qtrade Evaluate Last Ideas

Look, it’s not rocket science.

Canadians need a web-based brokerage that’s low cost, simple to make use of, consists of all account choices, has nice customer support for that once-every-few-years when issues go flawed – AND they need all of it in a steady, reliable bundle.

It’s easy to conceive of – however onerous to ship month after month. That consistency has allowed Qtrade to slowly however certainly rise to the highest of the brokerage pecking order.

After practically 18 years of writing about on-line brokerages, they proceed to be one of the in-demand subjects from Million Greenback Journey readers. I keep small brokerage accounts in any respect of Canada’s largest brokerages, and use my very own expertise, together with the firsthand expertise of the remainder of the MDJ workforce to check brokerages. I additionally use Third-party information (reminiscent of that offered by the Globe and Mail and Surviscor) to get an enormous image really feel for what corporations are providing.

Lastly, I additionally depend on all of you. As our readership has grown over time, we’ve additionally included insights from our feedback part and the emails we obtain each day with reference to actual interactions that Canadians have with their DIY investing platforms.

However the extra issues change, the extra they keep the identical. Qtrade was a fantastic possibility again in 2007, and in 2024 it’s nonetheless holding down the highest spot. They’re at the moment providing an unimaginable promotion to draw new buyers, in addition to to carry over buyers from different brokerages.

The 2024 Summer time/Fall Qtrade promo provide combines a $100 money again minimal, plus 1% of your general stability (to a most of $2,100), with UNLIMITED trades for 2024, plus they’ll even cowl your switch charges that your outdated brokerage may cost you for switching to Qtrade.

The award-winning customer support that made them stand out within the first place, is accompanied by free-ETFs, distinctive portfolio evaluation instruments, and glorious desktop + cellular platforms. As I mentioned earlier than, I incorporate up-to-the-minute first hand expertise from throughout Canada.

When you’ve got one thing good or dangerous to say about any of the Canadian on-line brokerages, I’d be sincerely grateful on your enter. Any new info helps maintain our 2024 Qtrade assessment as essentially the most helpful one on the market.

“We congratulate Qtrade for its convincing win…and for its dedication to innovation and unmatched service ranges.”

Glenn LaCoste, President of Surviscor