What’s Qtrade Guided Portfolios? (Previously VirtualWealth)

Qtrade Guided Portfolios is the brand new robo advisor put out by our #1 rated on-line brokerage firm Qtrade.

Very similar to different robo advisors, the Qtrade Guided Portfolios mission is to:

- Use index investing (aka: passive investing) to assist Canadians make investments smarter.

- Make it as straightforward as attainable to get began after which flip a part of your paycheque right into a diversified funding portfolio every month.

- Reduce prices right down to roughly 1 / 4 of what Canadian mutual funds cost.

- Just be sure you are invested in investments that make sense in your private threat profile and distinctive investor mindset.

Moreover, one in every of Qtrade Guided Portfolios’ mission claims is “To construct investor confidence”. Personally, I discovered them to supply a number of transparency and monetary training for brand new buyers on their easy-to-navigate web site.

The parents behind Qtrade Guided Portfolios are Aviso Wealth. Aviso is a nationwide monetary providers firm that works with companies and people in all kinds of the way.

By combining their experience from their Qtrade on-line brokerage arm, with the NEI Investments wing of the corporate, and their credit score union-level expertise with particular person buyers, they had been capable of create an amazing general investing choice for Canadians.

How is Qtrade Guided Portfolios Completely different from the Qtrade Low cost Brokerage?

The distinction between the Qtrade Make investments Low cost Brokerage platform and Qtrade Guided Portfolios is that one is a DIY on-line dealer, whereas the opposite is a robo advisor.

The 2 platforms share the next traits:

- Low Value

- A lot better than advisor + mutual fund fashions

- Out there to Canadian buyers

- Good for ETF buyers

However there are some key variations as properly. Robo advisors are geared toward prospects who need the next:

1) An excellent straightforward hands-off option to make investments their cash.

2) No want to have a look at inventory market studies or be taught complicated investing terminology.

3) Embrace “index investing” (aka “sofa potato investing” or “passive investing”) and simply need a easy option to diversify their investments.

4) Simply want slightly assist getting all the things arrange in order that it’s fast, stress-free, and environment friendly.

In the meantime, DIY Canadian on-line brokers are aimed primarily at buyers who need to lower prices to the bone, commerce particular person shares, and are able to go their very own means with out extra assist.

|

Fingers-off Index Investing |

||

|

Time Dedication and Effort Degree |

||

|

0.35% to 0.60% firm administration charge (charged as a proportion of your portfolio), plus roughly 0.15% MER (in comparison with 2.5% MER for comparable mutual funds) |

||

|

Rebalancing for Your Threat Degree |

||

|

RRSP + TFSA + RESP + Non-registered accounts |

||

|

The best option to flip a part of your pay cheque into a superb funding portfolio. Final choice for person friendliness. |

||

|

$100 free + as much as $2,000 in cashback. |

Free Trial + $150 in Switch Charges |

|

Is Qtrade Guided Portfolios Secure?

Sure, Qtrade Guided Portfolios are very secure. They’re a part of the Credential Qtrade Securities Inc. This company entity is a member of the Canadian Investor Safety Fund (CIPF), which regulates Canadian banking entities. In different phrases, Qtrade has to play by the identical guidelines as RBC, BMO, TD, CIBC and many others.

The CIPF has a protection coverage that protects every account an investor has as much as $1 Million.

In fact, it’s price mentioning that no protection exists for poor funding selections. Qtrade Guided Portfolios are secure by way of safety from fraud, or something business-wise taking place to the corporate – however no funding platform can assure funding returns.

Qtrade Guided Portfolio Prices and Charges

One factor I actually like about Qtrade Guided Portfolios is the simplicity of their charge construction.

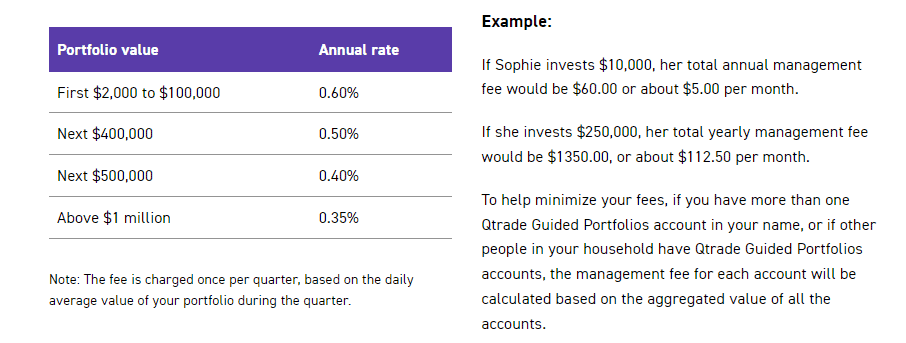

Qtrade Guided Portfolios prices you a hard and fast proportion of your portfolio. Right here’s how Qtrade explains it in their very own phrases:

A couple of extra factors to notice about Qtrade Guided Portfolios prices and charges.

- GST is after all added.

- In case you use Guided Portfolios as a non-registered account, the charges are tax deductible.

- There aren’t any transaction prices when your account is routinely rebalanced.

- Admin charges to use to distinctive requests akin to transferring out or closing an account.

General, these prices are very aggressive with Canada’s different robo advisors.

How do The Qtrade Guided Portfolios Make investments with ETFs?

Qtrade Guided Portfolios use a nobel-prize profitable technique often called passive investing. Some consultants have additionally known as any such investing “sofa potato investing” or “index investing”.

The concept behind the technique is actually: Look, it’s actually onerous to choose shares that do higher than common. There are such a lot of wealthy good individuals with supercomputers which might be attempting to choose the higher shares – you’re higher off not attempting to compete with them.

As a substitute, you’re means higher off to simply unfold your cash out throughout a bunch of corporations on the planet – in truth, why not ALL the publicly listed corporations on the planet?

Upon getting executed that, you may take away a few of the threat of your portfolio by buying authorities bonds. These are ultra-safe investments that pay small quantities of curiosity. The ETF VAB for insurance coverage is full of municipal bonds, provincial bonds, federal bonds, and some blue chip firm bonds (suppose RBC or Bell). You get all of those bonds in a single handy package deal.

What Qtrade Guided Portfolios does is take the next ETFs:

- FlexShares STOXX International Broad Infrastructure Index ETF (NFRA)

- iShares Core S&P Whole U.S. Inventory Market ETF (ITOT)

- iShares Core MSCI Whole Worldwide Inventory ETF (IXUS)

- iShares Core MSCI Rising Markets ETF (IEMG)

- iShares Core MSCI EAFE IMI Index ETF (XEF)

- iShares International REIT ETF (REET)

- Vanguard Canadian Mixture Bond Index ETF (VAB)

- Vanguard FTSE Canada All Cap Index ETF (VCN)

- Vanguard U.S. Mixture Bond Index ETF (CAD-hedged) (VBU)

- Vanguard International ex-U.S. Mixture Bond Index ETF (CAD-hedged) (VBG)

And it makes use of them to shortly and effectively diversify your retirement financial savings into buckets of shares and bonds from around the globe. You’ll get precisely the typical of the return from these belongings – minus the small charges.

Qtrade will resolve how a lot of every ETF it’s best to get based mostly on an preliminary questionnaire, and attainable comply with up conversations with regard to your threat stage. If one ETF is doing quite a bit higher than one other, Guided Portfolios will routinely rebalance your portfolio so that you promote some of what’s “on the high” and purchase a few of “what’s on the backside”. In different phrases – purchase low and promote excessive.

Relying in your threat tolerance and distinctive investing targets, Qtrade will suggest one of many following portfolios:

- Revenue

- Revenue & Development

- Balanced

- Development & Revenue

- Development

- Most Development

These portfolios are simply completely different combos of shares and bonds.

For instance, the Balanced Portfolio would provide you with a portfolio of fifty% bonds and 50% shares. So half of your cash would go to purchase bond ETFs, and half would go to purchase inventory ETFs.

The Most Development portfolio would don’t have any bonds, and be absolutely (i.e 100%) invested in shares from around the globe – utilizing the ETFs listed above.

Funding Account Choices

Qtrade Guided Portfolio Account choices embody a lot of the traditional accounts {that a} Canadian investor would want to use together with:

- RRSP

- TFSA

- RESP

- Non-Registered (also referred to as “money accounts”)

- Spousal RRSP

- LRSP/LIRA

In nearly any means you need to save and make investments, they have you ever coated. The one account sort that we’re ready on is a First Residence Financial savings Account (FHSA).

Qtrade Direct Investing on-line brokerage gives FHSAs so we hope to see this account sort accessible with Qtrade Guided Portfolios within the close to future.

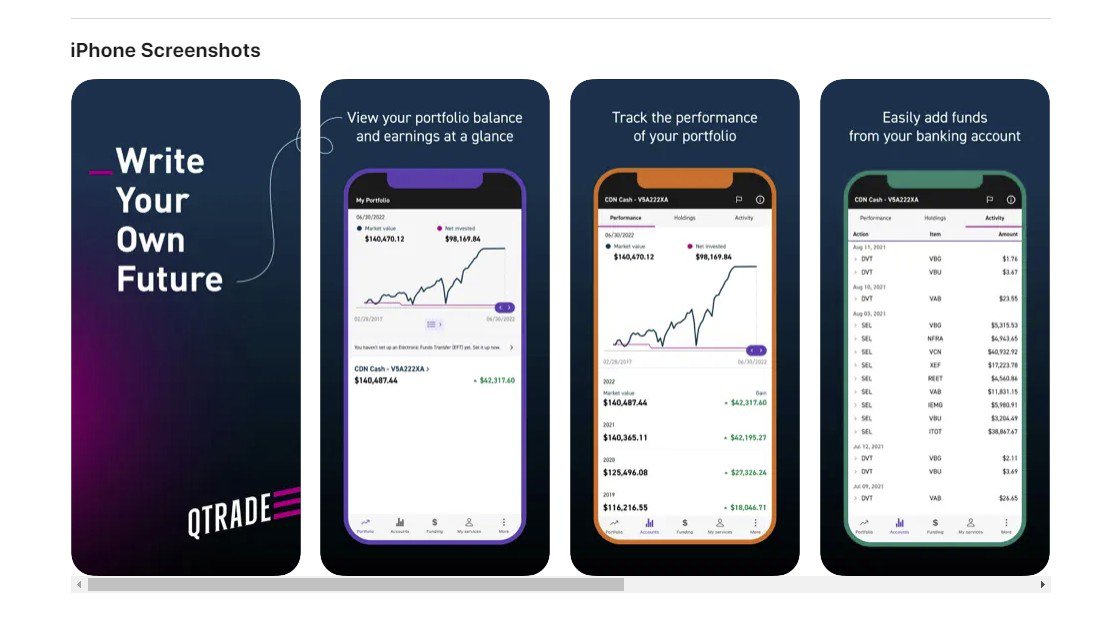

Qtrade Guided Portfolios Cell App

Whereas the Qtrade Guided Portfolios Cell App remains to be too new to have many scores within the app shops, it seems that the identical elite person expertise which characterizes their brokerage app is getting used right here as properly.

General, the Guided Portfolio cell app is minimalist and clearly communicates your index investing portfolio’s efficiency.

Qtrade Guided Portfolios Assessment: Accountable Investing

Qtrade Guided Portfolios gives a accountable investing choice via their RI portfolios. These portfolios are crafted by bearing in mind corporations’ environmental, social, and governance (ESG) efficiency.

As a result of Qtrade’s mum or dad firm Aviso Monetary owns a variety of monetary manufacturers, they’ve chosen to make use of their sister firm, NEI Investments, to provide the ETFs for the Qtrade Guided Accountable Investing Portfolios.

The ETFs they use are:

- NEI Canadian Bond Fund

- NEI U.S. Fairness RS Fund

- NEI International Whole Return Bond Fund

- NEI Worldwide Fairness RS Fund

- NEI Canadian Fairness RS Fund

Due to the additional calculations wanted to create these distinctive ETF merchandise, there’s a increased MER of .72%-.96% related to ESG-related portfolio merchandise.

In 2024, Cash Sense ranked Qtrade Guided Portfolios as the very best robo-advisor for socially accountable buyers.

Qtrade Guided Portfolios vs Justwealth

After we consider a robo-advisor akin to Qtrade Guided Portfolios, we all the time like to match it with our high really helpful robo-advisor, Justwealth.

Each Qtrade Guided Portfolios and Justwealth boast a number of spectacular options:

- Simple utility course of

- Quite a lot of funding account choices

- Personalized ETF portfolios tailor-made to your preferences and targets

- Considerably decrease prices in comparison with Canadian mutual funds

That can assist you see how they differ, we’ve created a comparability desk:

|

|

|

|

10 ETFs for the common portfolios, an extra 5 ETFs |

50 ETFs from 9 completely different suppliers which lead to over 80 |

|

|

Accountable Investing (RI) Choices Out there |

||

|

RESP, RRSP, Spousal RRSP, TFSA, Non-registered account, LRSP/LIRA, RLSP |

RESP, RRSP, Spousal RRSP, TFSA, Non-registered account, RRIF, LIRA, LIF, FHSA |

|

|

0.35% to 0.60% relying on portfolio worth |

0.40% to 0.50% relying on portfolio worth |

|

|

Administration Expense Ratios (MERs) |

||

|

No minimal, though a $2,000 money stability is required to be invested in a portfolio |

$5,000 (though there are exceptions for RESP and FHSA accounts) |

|

|

Customized Monetary Advisor |

||

|

Get $150 in Switch Charges |

$100-$500 Prompt Money Again |

|

Price construction: Justwealth prices a charge of 0.55% – 0.75% on all accounts (administration charge of 0.40% – 0.50% plus an ETF charge starting from 0.15% – 0.25%), whereas Qtrade Guided Portfolios prices roughly 0.50% – 0.75% (administration charge of 0.35% – 0.60% plus an ETF charge approaching 0.15%).

The administration account charge with every depends upon the account dimension. We discovered that Justwealth’s charge construction has a decrease administration charge till you surpass 1 million {dollars} in investments.

Account minimums: Qtrade Guided Portfolios don’t have any account minimal however they do have an “funding minimal” of $2000. When you’ve got lower than $2000, your account sits in money, however after you have greater than $2000 your account will probably be invested in a portfolio that meets your targets and threat tolerance. Justwealth has an account minimal of $5000, though there are exceptions for RESP and FHSA accounts.

ETF choices: Qtrade Guided Portfolios gives a collection of 10 ETFs, whereas Justwealth supplies entry to considerably extra ETFs with a depend of round 50. With Justwealth this permits for the creation of over 80 numerous portfolios designed to develop wealth, generate revenue, or protect capital. Each platforms additionally provide accountable investing (RI) choices, enabling buyers to align their portfolios with their values.

Vary of providers and accounts: Qtrade Guided Portfolios gives its buyers robo-advising solely, though their mum or dad firm gives Qtrade Direct Investing in case you are seeking to take your investments into your individual fingers with an internet brokerage. Justwealth focuses on robo-advising solely, nevertheless it supplies purchasers with a broader vary of account choices, together with FHSAs and target-date RESPs. Most notably, purchasers profit from the help of a devoted private monetary advisor.

Cell App: Each Justwealth and Qtrade Guided Portfolios have comparatively new apps with easy interfaces that will let you add funds to your account, view funding exercise, and observe your portfolio’s progress.

Our conclusion: Whereas Qtrade Guided Portfolios is a strong selection for a low-cost Canadian robo-advisor, it falls quick in a number of areas in comparison with trade leaders. Justwealth stays our high advice for good motive, providing unmatched advantages for on a regular basis buyers.

Plus, Justwealth at the moment encompasses a beneficiant sign-up bonus of as much as $500. You could find out extra about why we love and suggest Justwealth in our detailed Justwealth Assessment.

Qtrade Guided Portfolios Assessment: FAQ

Qtrade Guided Portfolios Assessment: Last Phrase

In the end, VirtualWealth was in want of an replace, and Qtrade Guided Portfolios delivered with a superb hands-off robo-advisor choice for Canadian buyers.

Qtrade Guided Portfolios gives a secure, simple, and stylish answer for managing investments. Nevertheless, as we outlined above, Justwealth continues to take the highest spot for a Canadian robo advisor attributable to its low charges, an extremely numerous vary of ETFs and account choices, and personalised advisors.

The principle query now’s whether or not you want to go for the benefit and peace of thoughts that comes with a robo advisor akin to Qtrade Guided Portfolios or Justwealth, or when you’d love to do some studying and make investments your effort and time right into a DIY on-line brokerage choice.