Is Questrade Secure & Safe?

Some of the frequent questions that I’ve gotten within the feedback under is:

Is investing my cash by means of a Questrade on-line brokerage account protected? Is Questrade as protected as RBC, TD, CIBC, ScotiaBank, and BMO?

– MDJ reader

The reply: Sure!

Right here’s the deal. Off the highest Questrade is a member of the Funding Trade Regulatory Group of Canada (IIROC) and the Canadian Investor Safety Fund (CIPF).

This reality holds lots of weight as a result of these organizations maintain its members to a fairly excessive commonplace so far as investor security goes. Because the CIPF was based in 1969, no eligible clients have suffered a lack of property. The CIPF has paid claims/bills of roughly $43 million, web of recoveries, on the odd event the place there was a member insolvency.

Questrade has been round since 1999, and controls over $30 billion in property as of 2024. On high of MoneySense and Rob Carrick giving them their stamp of approval, Questrade has gained eight annual awards as one among Canada’s Finest Managed Firms.

Lastly, Questrade has created an internet safety assure. The corporate will 100% reimburse you for any unauthorized transactions in any of your Questrade accounts that lead to a loss to you AND your account is insured for as much as $10 Million within the extremely unlikely occasion that Questrade goes broke (“bancrupt”). That is in fact on high of the most recent in on-line safety features. My guess is that for those who’re promising 100% reimbursement on losses, you’re going to take safety fairly critically.

“Once I first wrote this Questrade overview again in 2008, there have been only a few Canadian on-line low cost brokerage accounts out there to Canadians who wished to open a DIY RRSP account, TFSA, or non-registered account, and commerce their very own shares and ETFs.

Over the past 15 years, many Canadian on-line brokers have drastically improved their choices, however Questrade stays one of many high low-cost brokers because of their give attention to low charges and excellent account choices.

August 2024 Questrade Evaluation up to date by Frugal Dealer. The MDJ editorial staff collectively has a number of accounts with Questrade and advantages from every day firsthand expertise.

Questrade Charges – Centered on Dividend Investing and ETFs

Whereas Questrade has launched some shiny new options (and glorious advertising) the previous few years, the important thing cause that they’re one among our high selections for finest low value low cost on-line dealer in Canada is their low total charges, and particularly their low or no value buying and selling charges with issues like commission-free ETF purchases.

It’s value noting that Questrade has zero charges on standard accounts akin to RRSPs, TFSAs, RESPs, and non-registered accounts.

Questrade Charges Abstract

- Free ETF Purchases (there are charges on ETF gross sales)

- Low Fee on Trades @$4.95/ commerce

- ECN Charges Capped at $5.00 / commerce

- No Account Charges on RRSPs, TFSAs, RESPs, and Non-Registered Accounts

- $25 Quarterly Account Charges on different account sorts (if sure situations are met, the payment will likely be waived)

If you happen to’re new to MDJ, you may want to take a look round for extra data on why we advocate dividend investing and index-investing approaches for 99%+ of buyers. Principally, for those who’re making an attempt to leap into day buying and selling, time the market, or get wealthy on crypto, you had higher be keen to threat all of it, and dedicated to turning into educated on what it takes to be knowledgeable dealer.

We wouldn’t advocate this course, as far too many have misplaced far an excessive amount of with these techniques.

If, alternatively, you propose to make comparatively protected and constant investments with a excessive probability to earn a good return over time, then Questrade Canada is a spot to DIY your nest egg and lower your prices to the bone.

All through the years, consultants have echoed the concept that the typical investor can’t management their returns, they’ll (and may) management their funding prices. By controlling your prices, you might be including extra to the way forward for your cash, and that’s by no means a nasty factor.

Questrade ETF Charges

Some critics level out of their Questrade overview articles that Questrade solely covers free ETF purchases.

Whereas that is technically true, what they fail to say is that the overwhelming majority of our transactions will likely be purchases if we’re constructing a fundamental “sofa potato” passive index investing portfolio.

With the superb Canadian multi function ETFs out there to buyers immediately, many Canadians would do very nicely to only log into their Questrade RRSP or TFSA every month and buy that very same ETF over and over for his or her complete working lives.

Alternatively, if you wish to actually lower prices to their absolute minimal, you should buy your bond ETF, home market ETF, and worldwide ETF individually, after which rebalance every month just by including somewhat extra to the asset class that has the worst over the previous month, in an effort to hold your total asset allocation the place you need it.

The one promoting it is best to actually have to fret about is when your portfolio will get near the $1 Million degree and may’t be re-balanced by month-to-month additions, or when you’re prepared to begin promoting items of your portfolio to fund your retirement dwelling.

Paying $5 to take your spending cash out for the yr is a small worth to pay if you’ve had the advantage of investing without cost during the last 30+ years!

Evaluating Questrade’s Charges with Opponents in 2024

Right here’s how the Questrade free ETF buying stacks up towards a number of the large names in Canada.

|

$25 per quarter until sure necessities are met |

||||

|

$0 for 40 chosen ETFs; $9.99 for others |

$100 per yr until sure necessities are met |

|||

|

$25 per quarter until sure necessities are met |

||||

|

$25 per quarter until sure necessities are met |

||||

|

$100 per yr until sure necessities are met |

… How Does Questrade Examine with its #1 Competitor: Qtrade?

|

Sure! free shopping for AND promoting of 100+ ETFs. |

Free shopping for of ETFs, BUT does cost the conventional buying and selling payment to promote ETFs. |

|

|

Persistently rating #1, excessive availability and pleasant to clients |

Has made large features during the last three years, rated simply behind Qtrade by most publications |

|

|

Actually elite customer support, mainly, the #1 cause to go together with Qtrade |

Have made some enchancment during the last yr, however nonetheless missing |

|

|

Very aggressive, $6.95/commerce for Investor Plus Program members, $7.75 for buyers aged 18-30, $8.75 for everybody else |

A all-time low $4.95 for as much as 500 shares, to a most of $9.95. |

|

|

ECN Charges (extra buying and selling charges) |

Charged – usually small quantities for many buyers |

|

|

$25 per quarter – WAIVED IF you maintain $25,000 within the account OR you make 2 trades per quarter or 8 within the final 12 months OR you add $100+ computerized recurring month-to-month contribution (our most well-liked choice) |

||

|

Free Digital Funds Switch. Further payment for transferring out. |

Free Digital Fund Transfers as much as $50,000 CAD and $25,000 USD. Further charges for wire transfers and transferring out. |

|

|

Analysis Instruments and Training Supplies |

Has been on the high of Canadian brokerage rankings on this class for over a decade |

Made glorious features in the previous few years |

|

Immediate Signal Up Bonus: $100-$2,000 |

||

For an additional low payment various in Canada, take a look at our Questrade vs Wealthsimple comparability. For extra particulars on Questrade vs Qtrade view this comparability.

Globe and Mail’s 2024 Questrade Evaluation

For 2 consecutive years now Rob Carrick over on the Globe and Mail (their longtime private finance columnist for many who aren’t acquainted) has given Questrade a solid-if-unspectacular grade of a B+. That compares to 5 years in a row of A ranking for Qtrade.

He acknowledged the next when it got here to Questrade in 2024:

“If you happen to plan to commerce primarily in your smartphone, give Questrade a very good look as a result of its cellular app is among the most user-friendly. There’s a straightforward simplicity to the way in which it guides buyers by means of a commerce that may attraction to new and even skilled buyers. Pricing at Questrade is mid-market at a minimal $4.95, with digital communications community [ECN] charges including to the price of some trades.”

By the use of comparability, right here’s what Carrick needed to say about Qtrade:

“This constantly top-ranked dealer provides you one of many higher web sites and apps for taking care of your investments. Greater than many others, Qtrade has created a mini-me app that displays the excessive degree of utility within the web site, together with a quickie chart that reveals portfolio outcomes over the previous yr. On-line, there’s a Portfolio Rating device that slices and dices your holdings to offer insights on returns, charges, draw back threat, revenue and environmental, social and governance (ESG) elements. In contrast to some brokers, Qtrade by no means coasts.”

What Can I Spend money on With Questrade?

Questrade makes it straightforward to carry all your baskets in a single place, out of your tax-advantaged accounts to your dividend incomes investments. Relating to selecting an internet dealer, this is a vital characteristic to search for for those who worth simplicity and comfort.

While you open a Questrade account, you’ll be capable to spend money on:

- Worldwide and Canadian Shares

- Worldwide and Canadian ETFs (purchases are free!)

- Mutual Funds

- Choices

- Preliminary Public Choices (IPOs)

- Currencies

- Assured Funding Certificates

- Treasured Metals

We’ll get into extra element concerning the buying and selling charges and different data it would be best to take into account when planning your funding technique under on this Questrade overview.

Dividend Investing with Questrade

If you happen to’re like many MDJ readers buyers and are aiming to construct a strong portfolio of dividend-paying shares that generate money stream, you possible buy shares of your favorite Canadian dividend shares fairly commonly. This method is particularly efficient for those who’re utilizing the Smith Maneuver or investing in a non-registered account (versus an RRSP, TFSA, FHSA, or RESP).

Questrade affords aggressive per-trade charges for getting fundamental shares in addition to free ETF purchases. Right here’s a breakdown of Questrade’s payment construction for buying firm shares:

- Customary Commerce Charge: $4.95 per commerce

- ECN Charges: As much as a most of $5.00

For these unfamiliar with ECN charges, it stands for Digital Communication Networks. Primarily, firms cost Questrade about $0.0035 per share if you make a purchase order. Whereas there are methods to scale back these charges additional utilizing restrict orders and entire board tons, this usually complicates issues for the typical investor.

Let’s take a look at a typical instance for a month-to-month dividend investor focusing on Canadian Dividend Kings:

Suppose I resolve to allocate my $1,500 contribution equally amongst Canadian Utilities, Enbridge, and Canadian Nationwide Railway, that are favorites amongst dividend buyers. Right here’s the way it would possibly break down.

- Canadian Utilities (CU.TO) at $32 per share: 15 shares = $480

- Enbridge (ENB.TO) at $51 per share: 9 shares = $459

- Canadian Nationwide Railway (CNR.TO) at $160 per share: 3 shares = $480

If I wished to maximise my contribution, I may purchase one other couple shares of Canadian Utilities with the leftover funds, however let’s persist with this for now.

Every commerce would value $4.95 + ECN charges of roughly ($0.0035 x 10 shares) $0.035, totaling lower than $4.96 per commerce. So, for all three trades, the full value for the month can be ($4.96 x 3) = $14.88.

For bigger purchases – akin to shopping for $10,000 value of Canadian Utilities inventory (312 shares), the ECN charges would solely quantity to round $1.10. Personally, I don’t discover this to be an enormous distinction maker, nevertheless it’s value understanding why this additional little payment will present up in your transaction sheet.

That mentioned, the ECN charges are considerably distinctive to Questrade in terms of evaluating to Canada’s different high on-line brokerages. Proper now, Qtrade has a promotion the place they’ll allow you to commerce utterly without cost till the tip of the yr (so no ECN charges – or some other sort of charges!) Plus, they’ll put a bunch of money again in your pocket – so it’s fairly onerous to disregard the huge distinction there.

Questrade Lively Dealer Charges and Market Information Platforms

Questrade has just lately shifted its energetic dealer (generally known as “skilled dealer”) pricing mannequin from Questrade Enhanced and Questrade superior, to extra of an “ala carte” energetic buying and selling payment menu.

This plan is accessible to purchasers who subscribe to one among Questrade’s superior market knowledge choices. The superior market knowledge packages, out there each for Canadian and U.S. markets, are priced at CAD $89.95 and USD $89.95 monthly, respectively. These charges are absolutely rebatable, which suggests energetic merchants can doubtlessly offset these prices with $400+ of buying and selling exercise.

Questrade affords two major fee plans for energetic merchants: fastened and variable. The fastened plan is simple and would possibly attraction to merchants preferring predictability of their prices. For inventory trades, it expenses a flat price of $4.95 per commerce. Choice trades are additionally easy, costing $4.95 plus $0.75 per contract.

On the flip facet, the variable plan is designed for merchants who is likely to be buying smaller portions of pricey shares. For inventory trades, this plan expenses 1 cent per share, with a minimal payment of $0.01 and a most of $6.95. Choices buying and selling beneath this plan prices $6.95 plus $0.75 per contract.

As for ETFs, shopping for is free beneath each plans. Nevertheless, promoting ETFs prices $4.95 per commerce on the fastened plan and 1 cent per share on the variable plan, once more with a minimal of $0.01 and a most of $6.95.

These pricing buildings present flexibility for various buying and selling kinds, catering to each high-volume merchants and people dealing in smaller portions.

Opening a Questrade TFSA, RRSP, RESP Account

Opening your Questrade RRSP, TFSA, or RESP accounts is simpler than ever earlier than. Given how difficult this course of was prior to now, the Questrade staff has actually upped their recreation.

Opening your Questrade Canada account can now be finished utterly on-line, and in as little as 24 hours.

Principally you click on right here and our $50 questrade promotional provide code will likely be routinely utilized. You then merely choose which accounts you want to open. The principle choices out there are TFSA, RRSP, Margin (non-registered), and Foreign exchange. There are additionally choices for “extra” after which a Questrade Portfolios choice which is analogous to a robo advisor, and which I’ll discuss somewhat later.

The Questrade join course of will information you thru the next three steps:

- Create a person ID

- Construct Profile

- Setup Account

You’ll want a couple of paperwork and/or snippets of information together with:

- Your most well-liked electronic mail tackle (used to create your Consumer ID)

- Your title and residential tackle as they seem in your Authorities ID

- After creating your Consumer ID, you’ll want your new Questrade login and password

- Your Social Insurance coverage Quantity (SIN)

- Employment data together with your revenue, plus your revenue from different sources

- A Authorities-issued picture ID akin to a driver’s license or passport (which could be uploaded by way of scanned doc or image)

When you’ve accomplished the join with these paperwork, the ultimate step to opening your Questrade RRSP or TFSA is to go to your regular “all-in-one” checking account or chequing account that your pay will get deposited into, after which to ship your investing {dollars} over to your shiny new DIY Questrade account.

Upon getting funded your Questrade account out of your common checking account, and you might be prepared to take a position! You may arrange seperate Questrade RRSP and TFSA accounts as recurring payees, considerably serving to you save time sooner or later.

Technically – you possibly can open a Questrade brokerage account with none precise cash in it!

To be able to truly buy your first share of a inventory or unit of an ETF although, you’ll have to have at the least $1,000 within the account.

Whereas most of our readers know that we advocate sticking to dividend-stock investing and fundamental index investing, Questrade affords a ton of selection in terms of what you buy inside a TFSA or RRSP.

Questrade RRSP Account Particulars

Upon getting arrange your Questrade RRSP and have entered your deposit data into your on-line banking platform, it’s time to decide on easy methods to make investments that cash. It’s additionally value noting that Questrade will switch your present RRSP or TFSA over to their platform for FREE!

In case you haven’t brushed up on a number of the specifics of RRSPs these days, the purpose of the Registered Retirement Financial savings Plan is that will help you save for retirement however sheltering your investments from the tax man’s icy grasp, and permitting you postpone paying taxes when you’re working (and hopefully in a excessive tax bracket) to when you’re retired (and sure in a decrease tax bracket).

You may test your final tax return to learn how a lot you possibly can make investments inside your Questrade RRSP account. Lots of people don’t understand that RRSP room is sort of a tremendous wine – it simply will get higher with age! Annually the Canadian authorities lets you put as much as 18% of your revenue into your RRSP as much as a most quantity (in 2023 the RRSP contribution most is $30,780 for the previous yr).

This quantity is adjusted for those who contribute to a office pension plan. For instance, in case you are a trainer and make pre-tax contributions to a pension plan, you’ll get much less RRSP room than different Canadians would possibly.

If you happen to simply opened a Questrade RRSP account, and have by no means had different RRSP investments over time, it’s fairly potential that you’ve got a major quantity of room that you could make use of over the following few years.

Questrade TFSA Account Particulars

Your new Questrade TFSA account would be the flip of the RRSP. You’ll get taxed if you put cash into it, however there is no such thing as a “postponement” of taxes to fret about paying on the again finish if you take the cash out. Identical to the RRSP (and RESP for that matter), the TFSA is what’s generally known as a registered account, and consequently, the TFSA umbrella will stop taxes from eroding away your funding returns over time.

The opposite similarity the Questrade TFSA has along with your Questrade RRSP is that this can be very straightforward to open, as you merely choose which accounts you need to open if you register at Questrade for the primary time.

One level value noting in terms of your Questrade TFSA Account: It must be known as a Tax-Free Investing Account. I’ve lengthy believed that including the “S” to the TFSA has misled about 90% of Canadians into believing a TFSA is mainly only a premium model of a high-interest financial savings account. After all it’s so far more than that, and can be utilized to shelter the identical extensive number of investments because the Questrade RRSP account does.

You may contribute $6,000 per yr to your TFSA and the federal authorities has acknowledged that the plan is to extend that quantity together with inflation over the approaching years. Identical to it’s RRSP cousin, TFSA contribution room doesn’t disappear if it isn’t utilized in a given yr.

Many individuals aren’t conscious that this accumulation of TFSA room signifies that for those who have been 18-year-old (or older) as of 2009, then you definately now have $81,500 of funding area out there in your TFSA. That can get elevated to $88,000 in 2023.

Holding USD In My Questrade RRSP and TFSA

Investing in USD can prevent a ton of cash in foreign money conversion charges when you consider how a lot it prices to transform dividend revenue and new inventory purchases backwards and forwards over your investing lifetime. Questrade RRSPs and TFSAs to permit you maintain each USD and CAD in your portfolio – they usually do that for no added charges. (Every account remains to be $0.)

Questrade was the primary on-line low cost brokerage to permit buyers to carry USD in a registered account.

Questrade RESP and Household RESP Accounts

When you have youngsters and also you suppose they may someday attend post-secondary education of ANY KIND (it does NOT must be college) then you might be throwing away free cash by not opening a Questrade RESP account. Given how rapidly post-secondary schooling prices are rising (2.5x-3x the speed of normal inflation) are you able to afford to throw away free cash?

Right here’s easy methods to get $10,000 in free cash from our authorities.

- Setup a FREE Questrade RESP account and deposit $208.34 into it each month.

- Accumulate the free $500 Canada Training Financial savings Grant (CESG) annually, as much as a lifetime restrict of $7,200.

- Make investments the cash in a conservative all-in-one ETF and even only a fundamental Canadian bond ETF.

- The curiosity/funding return you’ll make by yourself cash that you just put it’s good – however you recognize what’s nicer? The $2,500-$3,000 return that you just make on another person’s cash! (Particularly when that another person is the federal government!)

In case your revenue is under $42,000 then there are some additional incentives for you.

The CESG money, plus your funding returns throughout the Questrade RESP account will likely be taxed as revenue within the fingers of the scholar. Which means it’s nearly at all times tax-free due to the big quantity of tax credit and deductions that college students take pleasure in. Your unique money could be withdrawn tax-free as you already paid tax on it earlier than investing it.

When you have a couple of little one, you possibly can mix their contribution room into one large easy-to-manage Questrade Household RESP account (which can be free to open with no annual charges). The benefit to those accounts is that you could deal with the withdrawals amongst your youngsters in no matter approach is handy for you.

What If My Little one Doesn’t Go to College? Do I Lose My Questrade RESP Cash?

Listed here are the details to consider for those who’re nervous about “losing” RESP contributions:

1) The Questrade RESP account could be energetic for as much as 35 years and you need to use the RESP cash for a HUGE number of post-secondary research. The whole lot from therapeutic massage remedy to airplane mechanic programs could be coated. This mixture signifies that it’s VERY possible your little one will be capable to use the RESP assist sooner or later.

2) If you happen to haven’t maxed out the CESG or contribution room for Little one 2, you possibly can merely take Little one 1’s RESP cash and use it for Little one 2 inside your Questrade Household RESP account.

3) When you have no youngsters that ever attend any form of post-secondary schooling, you possibly can roll $50,000 into your RRSP (assuming you might have the contribution room) and all you’d lose is the free CESG cash, and the funding earnings on the federal government’s money.

4) You may withdraw the cash you initially contributed tax-free with none penalties.

5) If you happen to withdraw the funding returns that you just made in your cash, you may be taxed as for those who earned the cash as revenue, plus an extra 20% penalty. (It is a not possible situation.)

Questrade Margin and Non-Registered Account

To start with – kudos to you for maxing out your Questrade RRSP and TFSA accounts! If you happen to haven’t finished that but, you possibly can most likely hold life easy and skip this a part of our Questrade overview.

Upon getting contributed the utmost quantity to your RRSP and TFSA accounts, and (for those who’ve acquired youngsters) the Questrade Household RESP is on autopilot, the next step turns into a excellent news – dangerous information scenario.

The excellent news is that you’re in nice monetary form, and there are alternatives out there for continued investing.

The dangerous information is that there is no such thing as a more room beneath your tax-sheltered registered account umbrella. From right here on out, you may be investing within the rain, and the tax man will get his chunk.

So, whereas there are semi-exotic accounts one may open in the event that they need to change overseas foreign money or make investments inside an organization, the choice most individuals will go for is a Questrade Margin Account.

The Questrade Margin Account is a flowery title for a fundamental non-registered account, with the added characteristic of with the ability to borrow cash from Questrade and make investments that cash alongside your individual. While you borrow cash to take a position it, that is known as “investing on the margin”.

Now, I don’t advocate investing on the margin until you actually actually know what you’re doing, and even then it usually isn’t a good suggestion. The principle takeaway from this although, must be that YOU DO NOT HAVE TO BORROW MONEY to take a position inside a Questrade Margin Account. Most on a regular basis buyers in Canada will likely be finest served by utilizing this account to spend money on Canadian-dividend payers (my Smith Maneuver account for instance) or different Canada-based ETFs.

You may nonetheless, put nearly any sort of funding in a Questrade Margin account. Right here’s a couple of extra fast Questrade overview details concerning the non-registered choice:

- You may spend money on short-selling (watch the Large Quick to have Margot Robbie in a tub telling you what this implies)

- There aren’t any contribution limits to fret about like there are with the Questrade RRSP, TFSA, and RESP accounts.

- Funding returns inside an unregistered account are nonetheless handled a lot nicer than revenue you make from a job. Capital features and dividends are eligible for particular tax remedy in Canada.

- There aren’t any taxes to fret about upon withdrawal like there are in a RRSP.

- You may interact in advanced choices buying and selling (not everybody’s factor).

- Questrade Margin accounts are ruled by margin falls. This half is necessary: If you happen to borrow cash from Questrade, and the funding drops under the margin requirement, Questrade will primarily demand that you just pay them their a reimbursement. If you happen to don’t instantly pay them again, Questrade can promote your investments and take the cash in lieu of your cost.

General, utilizing the Questrade Margin Account as a fundamental non-registered account is a good choice. Stepping into the extra unique choices like leveraged choices buying and selling is finest left to the extra skilled.

Questrade’s FHSA Account

Questrade was the primary of Canada’s on-line brokers to return out of the gate with a First Dwelling Financial savings Account (FHSA). You may learn all concerning the FHSA and easy methods to get essentially the most out of it (in addition to what investments we advocate) by trying out our final information to Canada’s FHSA.

There is no such thing as a payment to open the account, and buyers have all kinds of funding choices to select from. Keep in mind that to open a TFSA, it’s essential to be a Canadian resident and never have owned a house for at the least the previous 4 calendar years.

By being the primary dealer to supply purchasers this supercharged path to a down cost, Questrade was in a position to provide its purchasers the power to instantly begin saving. All preliminary indications are that accounts have been working easily. The ball is unquestionably now within the courtroom of the remainder of Canada’s brokerages to maintain tempo.

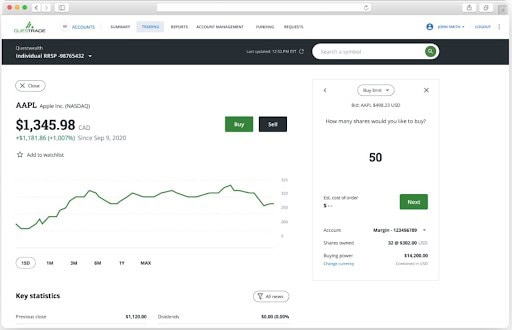

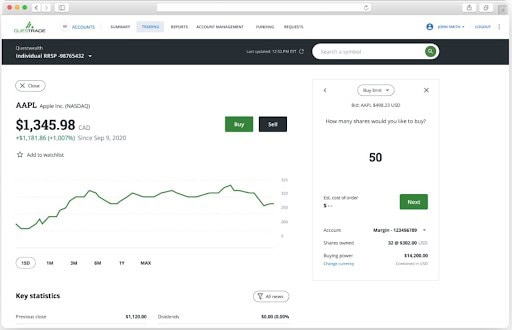

Questrade’s Buying and selling Platforms – A Peek Inside

Questrade, like many different on-line brokers which have been round for some time, has finished its finest in making an attempt to remain contemporary and related by way of offering a variety of buying and selling platforms to attraction to a variety of buyers.

Questrade Buying and selling

That is the platform most on a regular basis buyers will use. It’s easy interface permits customers to view their holdings and earnings multi function spot, and commerce with the clicking of a button.

It’s a safe, web-based platform, so that you’ll be capable to entry it simply from wherever with out worrying about security.

If you would like entry to extra superior instruments, you possibly can arrange alerts, in addition to entry studies and knowledge that will help you make knowledgeable purchases.

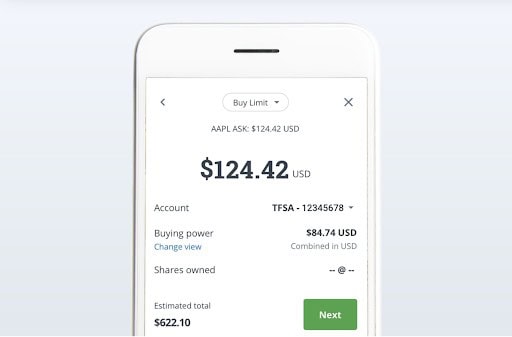

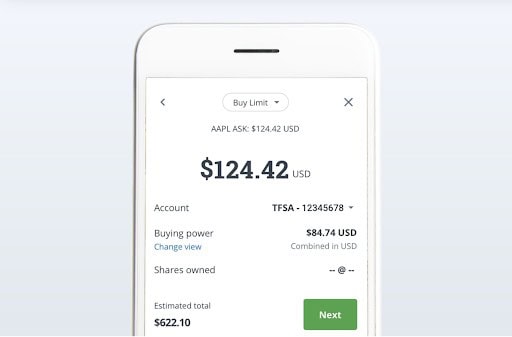

QuestMobile

We’ve acquired handy it to Questrade for his or her effort in making an attempt to create a person pleasant app that truly works, nevertheless it appears like they’re nonetheless on their quest to attain this objective.

With a 2.1 star ranking on the Google Play retailer, and a ton of detrimental critiques, it’s clear that whereas they’re engaged on it, it’s not fairly there but. Whereas they’ve tried to make it easy to make use of, they’ve taken away a number of the key options appreciated by customers. Others complain that the person expertise isn’t nice.

It does provide some fascinating options like real-time data, an summary chart and customizable alerts. It additionally has a studying mode for these trying to be taught the ropes earlier than placing up the money.

Whereas which may not be sufficient for some buyers, the app can be utilized on your fundamental buying and selling wants, however possible no more than that may be finished nicely.

Questrade Edge

For energetic merchants, Questrade Edge affords a variety of instruments to assist customers maximize their outcomes.

A number of the instruments included are charting to assist customers analyze and map knowledge, customizable alerts and workspace, superior buying and selling orders and a downloadable desktop model. One factor that Edge customers will get that others gained’t is entry to analysis powered by TipRanks.

Questrade World

If FOREX and CDFs are in your funding wheelhouse, Questrade World makes it straightforward to commerce currencies and commodities on worldwide markets.

Not solely will you be capable to commerce immediately on the platform, however additionally, you will have entry to reside charting, financial releases and alerts. It’s acquired each desktop and app variations, so you possibly can entry the platform from house and on the go.

Questrade Evaluation: Market Information Streaming

Questrade’s market knowledge feed is one among their strongest promoting factors. Like most brokerages, the info feed that you’ve got entry to is determined by the platform you subscribe to.

Each account at Questrade will get “snap quote” updates in your normal shares and ETFs, in addition to choices. What this implies is that if you search for shares or ETFs you get up-to-the-minute bid-ask costs, and may see the same old metrics together with worth highs and lows, market capitalization, dividend data, and many others. You additionally get to see the TipRanks evaluation and the Benzinga newsfeed.

Now, for those who’re knowledgeable day dealer (not my cup of tea personally) you might be possible interested by Questrade’s three premium knowledge streaming choices.

Streaming Bundle 1 ($19.95): Just for choices merchants. Give’s real-time pricing of all Canadian and US choices.

Streaming Bundle 2 ($89.95): Offers you entry to extra degree 2 market streaming knowledge for Canadian shares, ETFs, and choices.

Streaming Bundle 3 ($89.95): Provide you with entry to extra degree 2 market streaming knowledge for American shares, ETFs, and choices.

By subscribing to market knowledge streaming bundle 2 or 3 you additionally get barely decrease buying and selling charges on shares and ETFs.

QuestMortgage – Questrade’s BetterRate Mortgage Supplier

In 2022 Questrade determined to department out and embody a mortgage platform. The President and CEO of Questrade, Edward Kholodenko, instructed new customers that, “QuestMortgage will assist 1000’s obtain their dream of homeownership in a easy, clear and straightforward approach, in the end setting them on the trail in the direction of monetary success and safety.”

Right here’s what QuestMortgage guarantees clients going ahead:

- A easy person pleasant platform.

- Mortgage advisor help by means of renewing or making use of for a mortgage.

- Fully on-line interplay – no want to return in individual to a bodily location.

- An amazing low price from the beginning with their trademarked BetterRate promise.

On the finish of the day Quest Mortgage appears like a strong mortgage dealer resolution for folk that need to get issues finished on-line. I haven’t personally used this Questrade product (as I choose to barter my very own mortgage immediately with my monetary establishment) nevertheless it’s fascinating to see the DIY brokerage platform provide new merchandise like this.

Questrade Makes use of CWB Belief Companies

Within the curiosity of full disclosure with reference to how protected Questrade is, the corporate introduced in 2022 that CWB Belief Companies would now deal with the registered plans for Questrade as their official trustee.

The Belief firm acts as trustee for over 1.5 million accounts with property of over $90 billion.

Edward Kholodenko, the President and CEO of Questrade acknowledged, “”CWB Belief Companies is an industry-leader in registered plan trustee and custodial providers,” and went on so as to add, “Their modern and personalised options will assist fulfil our service necessities, add worth and in the end guarantee our purchasers develop into far more financially profitable and safe.”

What this implies to the typical buyer is that the mum or dad firm of CWB Belief Companies (Canada Western Financial institution) stands behind the protection of your registered accounts. Whereas the financial institution isn’t the most important in Canada, it’s nonetheless a fairly huge firm with a $2.2 billion market cap and is absolutely regulated by the Canadian authorities as a Schedule One Financial institution.

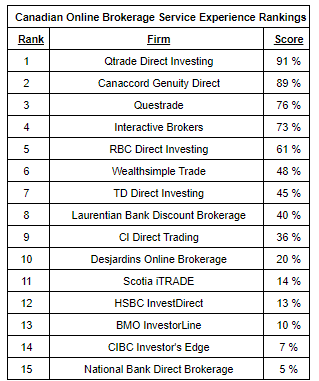

2023 Surviscor Questrade Dealer Rankings

Over the past 20 years Glenn LaCoste and his staff at Surviscor have ranked Canada’s on-line brokers in line with over 100,000 service interactions throughout 45 companies.

Questrade got here in a really respectable third place behind Qtrade and the very area of interest dealer CG Direct. ETF commissions on ETF promote orders, mediocre service expertise, and ECN charges have been cited as areas for enchancment. A lot improved buyer response occasions, chat providers, and the convenience of opening an account by way of cellular app have been cited as strengths.

LaCoste summed up the report by saying, “Excellent news continued all through 2022 as most agency response occasions improved for the second consecutive yr after a few years of neglect that was blamed on elevated buying and selling volumes. The obvious concern is the development throughout the large financial institution owned companies as 4 of the six fall outdoors the highest 10, a development that can be mirrored in our digital banking critiques.”

General, I used to be blissful to see Questrade proceed to enhance and be included amongst the leaders.

Questrade Buyer Service in 2020 – 2023

Whereas Questrade continued to guide the pack in terms of per-trade charges in Canada the push to DIY investing – mixed with Covid-related logistics points – led to buyer frustration with Questrade all through the final yr. With many commenters reporting wait occasions of 3-5 hours whether or not they used the call-in characteristic or on-line messaging, there was a premium to be placed on customer support.

Now that’s to not say that Questrade gained’t adapt and modify to those new market realities in 2023 (we predict it’s possible they’ll), however for now, Canadians’ constant expectation of strong customer support signifies that Qtrade has climbed to our #1 place in terms of crowning the King of the Low cost Brokerage mountain.

All of that mentioned, for those who’re an skilled investor that hardly ever requires assist when utilizing your low cost brokerage platform, then the constant dedication to low charges would possibly imply that Questrade remains to be the very best match for you.

Questrade Evaluation: FAQ

Questrade Evaluation: Remaining Verdict

My first foray into DIY investing accounts started 18 years in the past with Questrade. I nonetheless hold it energetic for the comfort of managing a particular non-registered account and to remain up to date with the platform’s newest options.

For the majority of my buying and selling, I now primarily use Qtrade. You may dive into the main points in my Qtrade Evaluation and see why I imagine it has pulled forward of Questrade during the last 5 years. Along with being a superb ongoing platform, Qtrade has a promo on proper now the place they offer you:

- Free trades till the tip of 2024

- $100-$250 money

- 1% money again on every little thing you make investments or switch over

- They pay your switch prices from one other brokerage

It simply doesn’t get higher than that. It’s the very best promotional provide from a Canadian brokerage that I’ve seen for accounts beneath $500,000.

I don’t imply to dump throughout Questrade – they’re nonetheless a strong selection and have made some critical enhancements since I launched into my DIY investing journey with them in 2005. The shift to Qtrade isn’t about Questrade falling brief, however moderately about Qtrade excelling in areas that matter to me.

I’ll hold updating my 2024 Questrade Evaluation all year long. As at all times, I welcome any of your latest experiences with the platform within the feedback under. Your insights are invaluable!