Again in 2006 once I first began MDJ, and commenced writing about Canadian on-line brokers, the Qtrade vs Questrade rivalry was already in full swing. Almost 20 years later, I’d say the Canadian brokerage scene has modified in that Qtrade and Questrade have opened up an excellent wider hole between themselves and Canada’s large financial institution brokerages.

As a longtime Canadian private finance creator, I’ve opened over a dozen dealer accounts during the last couple of many years. I’ve answered tons of of questions and feedback on brokers over time, and once I replace these brokerage comparability articles, I usually ask our employees writers for his or her enter as we’re all DIY buyers.

For me, the Questrade vs Qtrade battle comes all the way down to:

1) Qtrade is persistently ranked greater by way of third celebration media sources similar to The Globe and Mail, Surviscor, and Moneysense.

2) Qtrade merely has the most effective customer support in Canada proper now. That’s a significant benefit for retail buyers.

3) Qtrade’s free ETF shopping for AND promoting beats Questrade’s free ETF purchases (it fees to promote ETFs).

4) Qtrade’s present $400 on the spot money again if you happen to begin a $5,000 funding account supply is WAY higher than Questrade’s $50 in free trades. If you happen to begin an account (or transfer over an account from one other brokerage) with greater than $5,000, you may stand up to $2,150 again.

The Qtrade vs Questrade Fast Comparability

In case you are on the lookout for a fast comparability of Questrade vs Qtrade, take a look on the considerably visible chart under that touches all the primary areas on our complete dealer evaluations.

|

Sure! free shopping for AND promoting of 100+ ETFs. |

Free shopping for of ETFs, BUT does cost the conventional buying and selling charge to promote ETFs. |

|

|

Persistently rating #1, excessive availability and pleasant to clients |

Has made large good points during the last three years, rated simply behind Qtrade by most publications |

|

|

Actually elite customer support, principally, the #1 cause to go along with Qtrade |

Have made some enchancment during the last yr, however nonetheless missing |

|

|

Very aggressive, $6.95/commerce for Investor Plus Program members, $7.75 for buyers aged 18-30, $8.75 for everybody else |

A all-time low $4.95 for as much as 500 shares, to a most of $9.95. |

|

|

ECN Charges (extra buying and selling charges) |

Charged – usually small quantities for many buyers |

|

|

$25 per quarter – WAIVED IF you maintain $25,000 within the account OR you make 2 trades per quarter or 8 within the final 12 months OR you add $100+ automated recurring month-to-month contribution (our most popular possibility) |

||

|

Free Digital Funds Switch. Further charge for transferring out. |

Free Digital Fund Transfers as much as $50,000 CAD and $25,000 USD. Further charges for wire transfers and transferring out. |

|

|

Analysis Instruments and Training Supplies |

Has been on the high of Canadian brokerage rankings on this class for over a decade |

Made wonderful good points in the previous couple of years |

|

On the spot Signal Up Bonus: $150-$2,150 |

||

Please see our full-length Qtrade Assessment or Questrade Assessment for extra info on our two main brokers.

Brokerage Investing Account Choices

Again when MDJ began to match on-line dealer investing account choices there have been some large variations between the “haves” and the “have nots”. Fortunately, competitors has primarily assured that the majority brokers now supply the entire main Canadian account choices.

After we particularly evaluate the account choices for Qtrade and Questrade, we discover that there isn’t a lot distinction in any respect.

Each of our main brokerages supply the primary accounts that the majority Canadians will use: RRSP, TFSA, RESP, non-registered buying and selling accounts, margin buying and selling accounts, and joint funding accounts.

Moreover, each Qtrade and Questrade supply the next investing account choices: USD accounts, spousal RRSP accounts, choices buying and selling accounts, company buying and selling accounts, and principally any account that you simply’ll discover anyplace else. RDSP accounts proceed to be the forgotten account in Canadian private finance.

February 2024 Replace: Qtrade and Questrade have been two of the primary brokerages out of the gate when it got here to providing FHSA accounts.

The one differentiator between Qtrade and Questrade FHSA accounts is that Qtrade at present has a promotional supply accessible the place you may get tons of of {dollars} in on the spot money again (accessible for a restricted time). Apart from that, they’re nearly an identical.

You’ll have to have a minimal cost of $250 to get began and you’ll contribute as much as $8,000 per yr, to a lifetime most of $40,000. For extra info, learn our FHSA information.

Buyer Service Comparability

Whereas Questrade continued to guide the pack on the subject of per-trade charges in Canada, the push to DIY investing – mixed with Covid-related logistics points – led to buyer frustration with Questrade all through 2020 and 2021. With many commenters reporting wait occasions of 3-5 hours whether or not they used the call-in function or on-line messaging, there was a premium to be placed on customer support.

Now that’s to not say that Questrade received’t adapt and alter to those new market realities in 2024, however for now, Canadians’ constant expectation of strong customer support implies that Qtrade has climbed to our #1 place on the subject of crowning the King of the Low cost Brokerage mountain.

Questrade has reported that they’ve made an effort to considerably increase their customer support manpower, so we wait and see to what diploma long-term enhancements have been made.

All of that stated, if you happen to’re an skilled investor that hardly ever requires assist when utilizing your low cost brokerage platform, then the constant dedication to low charges would possibly imply that Questrade remains to be the most effective match for you.

Qtrade, then again, has actually doubled down on the subject of hiring sufficient customer support professionals, and ensuring they’re ready to their excessive requirements.

Don’t simply take my phrase for it…

“Qtrade excels in each space – particularly in customer support.”

MARK BROWN, INVESTING AND RANKINGS EDITOR FOR MONEYSENSE

“We congratulate Qtrade Investor for its convincing win…and for its dedication to innovation and unmatched service ranges.”

Glenn LaCoste, President of Surviscor

Rob Carrick over on the Globe and Mail has given Qtrade the best marks for a number of years now as nicely.

What it actually boils all the way down to is that Qtrade has a decade-and-a-half of expertise on the subject of being the chief of on-line dealer customer support.

There merely isn’t any comparability if you happen to’re on the lookout for a long-term brokerage resolution that you may belief to remain on high of the sport.

Frugal Dealer, MillionDollarJourney Founder

Questrade vs Qtrade ETFs

A lot to my delight, each Questrade and Qtrade have prioritized their ETF buying and selling methods, and each low cost brokers are far forward of Canada’s large banks on this space. Right here’s the deal:

Qtrade: Will will let you each purchase AND promote ETFs over 100 ETFs free of charge. Whereas not all ETFs are lined, index buyers (aka: Sofa Potato Buyers) can discover every part they want on this listing, together with my favourites:

- Horizons S&P/TSX 60 Index ETF (HXT)

- Horizons S&P 500 Index ETF (HXS)

- iShares MSCI Rising Markets Index ETF (XEM)

- iShares International Actual Property Index ETF (CGR)

- iShares Canadian Authorities Bond Index ETF (XGB)

- iShares Core Progress ETF Portfolio (XGRO)

- iShares Core Fairness ETF Portfolio (XEQT)

In case you are all about reducing charges to absolutely the bone, opening an account with Qtrade and rebalancing utilizing these ETFs is completely free. You merely can’t beat that.

Questrade: Will enable you purchase ETFs free of charge, BUT you need to pay while you promote ETFs. Which means while you’re rebalancing your sofa potato account, you’ll have to pay their regular buying and selling charges for every ETF order that you simply promote, every time you promote it. Shopping for ETFs free of charge remains to be a extremely whole lot, it’s simply not equal to what Qtrade is providing.

The Backside line is that Qtrade does ETFs higher.

Qtrade Investor vs Questrade Charges and Commissions

There is no such thing as a doubt that Questrade actually shines on the subject of charges and commissions. They’ve frequently emphasised this level over time, and their primary buying and selling charge of $4.95 for as much as 500 shares, and a most of $9.95 per commerce is a superb worth.

That stated, Qtrade’s $8.75 value per commerce (with a reduction all the way down to $6.95 for frequent merchants) isn’t any slouch both, and is available in under the buying and selling charges for RBC, TD, BMO and Scotiabank.

Right here’s a couple of different charge comparability factors within the Qtrade vs Questrade battle:

- ECN Charges: ECN charges are often comparatively small quantities tacked on to the bottom buying and selling charge. Qtrade by no means fees these charges whereas Questrade fees them when a commerce “removes fairness from the market”. For many buyers it’s a comparatively small quantity if it’s charged in any respect.

- Account Charges: Qtrade fees a $25 quarterly account charge – however will probably be robotically waived in both case if you happen to observe the steps we’ll define under. Questrade at present has no inactivity charge.

- ETF Buying and selling: Qtrade’s fee free ETFs are free to purchase and promote with no minimums, whereas ETFs at Questrade are solely free to purchase.

- Dividend Reinvestment Plan (DRIP) Charges: Qtrade and Questrade have each Canadian and American DRIPs which can be fully free.

- Foreign exchange Unfold Charges: Questrade will cost you roughly 5% extra in an effort to switch your cash from Canadian {Dollars} to United States {Dollars} – or vice versa.

- Switch Charges: Each Questrade and Qtrade will reimburse you as much as $150 to switch your dealer account over to them.

Avoiding the Qtrade Account Charges

If you wish to make the most effective use of Qtrade, it’s important that you simply take note of keep away from the pesky account charges. These can chew at small accounts pretty quickly. Every firm makes the quarter charge straightforward to waive offered that you simply…

Qtrade – Do one of the next:

1) My suggestion to new buyers is to arrange an automatic contribution to their brokerage account. This merely implies that you ship $100 (or extra) out of your checking account to your brokerage account every month. This is a superb preliminary purpose for a brand new DIY investor. Qtrade refers to this as a “recurring digital funds contribution” and it has no charges hooked up.

If you happen to arrange this strong funding observe, then you may keep away from Qtrade’s quarterly account charges it doesn’t matter what your stability or buying and selling ranges.

2) Have at the very least $25,000 in property on the final enterprise day of every 3-month interval (known as “quarters” within the investing world).

3) Full two commission-generating trades within the previous quarter.

4) Full 8 or extra trades within the final 12 months

5) The charge can also be waived if you’re thought-about a “Qtrade Younger Investor” (aged 18-30) and arrange a $50 PAC.

Qtrade vs Questrade Charges Backside Line

Qtrade is the most effective Canadian brokers for these whose portfolio and trades include largely Canadian ETFs. Questrade is the most cost effective dealer for anybody else.

Are Qtrade and Questrade Protected?

Sure!

Each Qtrade and Questrade are extraordinarily protected to make use of from a cyber safety standpoint.

The 2 brokers stand as protected havens within the Canadian monetary panorama, mirroring the safety stage of Canada’s famend banks similar to TD, RBC, BMO, CIBC, and ScotiaBank.

Their dedication to safeguarding investor property is clear not simply by way of superior digital safety measures but in addition by way of their membership within the Canadian Funding Safety Fund (CIPF). This government-backed initiative ensures that investments are protected as much as $1 million CAD in numerous accounts, providing peace of thoughts to buyers.

Notice: That’s not $1 million in mixed accounts, that’s $1 million in your RRSP, $1 million in a joint account, plus the cash in a TFSA, RESP, and many others.

Nevertheless, it’s essential to grasp that this security internet guards in opposition to institutional dangers like fraud or chapter – not market volatility. Funding choices, particularly these involving high-risk property, relaxation solely on the investor’s shoulders. The reassurance offered by Qtrade and Questrade is concerning the safety of your funds being held, not a assure in opposition to funding loss.

Evaluating Questrade and Qtrade Desktop and Cell App Platforms

You’ll be able to see from our shows under that each Qtrade and Questrade have actually created and refined wonderful desktop and cellular app platforms.

That stated, the Qtrade app has greater scores in each the Apple App Retailer and the Google Play Retailer.

General you may’t go improper with both possibility so far as their latest desktop rollouts go. Personally, I believe the consumer expertise is superb for each Questrade and Qtrade’s desktop platforms (which is why I take advantage of them and often keep off of investing cellular apps altogether).

That stated, I believe the Qtrade platform is a bit more beginner-friendly.

Globe and Mail Qtrade vs. Questrade Comparability

We have been glad to see that Rob Carrick over on the Globe and Mail agreed with our Qtrade vs Questrade take, with Qtrade taking dwelling the best score, however Questrade coming in proper behind with a strong B+.

In his 2022 dealer comparability Carrick wrote:

“As has usually been the case on this rating over time, Qtrade Direct Investing is the dealer that does it finest. Different brokers beat Qtrade in particular areas like fee prices, however Qtrade’s total goodness turns into obvious as quickly as you log in and discover a neat little dashboard to get you on top of things in your investments.”

Qtrade’s persistently robust exhibiting on this rating speaks to a different of its virtues, fixed enchancment. Different brokers get higher in suits and begins, whereas Qtrade strikes ever ahead.

There are large quantities of embedded worth, beginning the second you log into your account and see a dashboard that’s second to none in exhibiting what it’s essential find out about your portfolio.”

To be truthful, he does go away our favorite dealer some room for enchancment on the subject of exhibiting analyst analysis (my private least necessary issue when selecting a dealer as I desire to do my very own analysis).

In terms of Questrade, Carrick writes:

“What’s it with the “Q” brokers, Qtrade and Questrade? Each are excellent in the best way they by no means let up on making enhancements. An enormous add for Questrade recently is on the spot deposit, which helps you to switch cash, sometimes as a lot as $3,500 a day, into your account in actual time. Questrade has a pointy cellular app and a crisp, all-business web site for shoppers.”

In the end, it’s all the time good when our personal conclusions on the 2 high brokers in Canada are confirmed by Canada’s high private finance columnist!

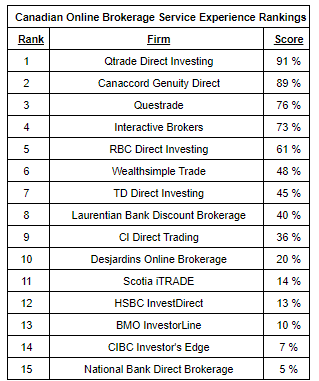

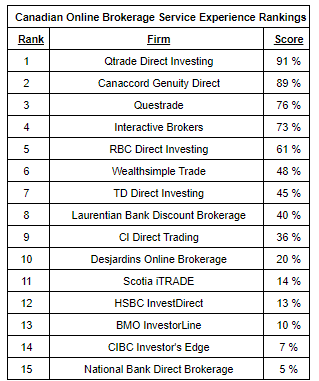

Surviscor 2023 Rankings: Qtrade vs Questrade

Every January for the previous 20 years an organization known as Surviscor releases Canadian dealer service expertise rankings. These rankings are the top results of over 100,000 factors of information being collected on consumer expertise by way of desktop and cellular, in addition to quite a lot of customer support and investor training efforts.

As you may see from the outcomes above, Qtrade was pretty dominant within the 2023 rankings. The one comparable on-line brokerage was the very area of interest CGD – which isn’t actually an possibility for a lot of the nation.

Questrade nonetheless pulled in a really respectful third place and Surviscor gave them excessive marks for his or her a lot improved buyer response occasions, chat companies, and the beginner-friendly nature of their cellular app. Some work nonetheless to be accomplished within the areas of ETF charges, service expertise, and ECN Charges.

Glenn LaCoste, the Preside of Surviscor Group acknowledged, “Congratulations to Qtrade Direct Investing for its continued service response excellence and its breadth of service interplay selections for all sorts of digital buyers.”

Christine Zalzal, the Head of On-line Brokerage and Digital Wealth over at Qtrade was glad to simply accept the award stating, “What makes an ideal on-line brokerage agency for buyers is just not solely an ideal on-line buying and selling expertise but in addition being supported by an ideal service staff. At Qtrade, we’re all the time listening to our clients. A powerful customer-focused tradition is embedded into our DNA. As extra Canadians discover the world of self-directed investing, we’re persevering with to put money into our folks and our platform to assist construct their confidence to construct their wealth.”

The Surviscor knowledge continues to help my anecdotal experiences with each corporations, in addition to the mixed knowledge of our editorial staff.

Questrade vs. Qtrade: Often Requested Questions

Evaluating the Qtrade vs Questrade Promo Gives

As we finish 2024 and look forward to 2025, the Questrade vs Qtrade comparability continues to high our suggestions for Canadian DIY buyers. These brokerages know that after you undergo the trouble of shifting over to them, you’re fairly more likely to keep. Consequently, they’re prepared to make incredible affords in an effort to tempt you over.

Proper now, Qtrade has the most effective promo supply for brand spanking new buyers that I’ve ever seen.

For this yr’s “RRSP season” Qtrade is providing people as much as $2,150 for opening a brand new account. That’s a ton of on the spot money only for attempting a brand new brokerage – however what I actually love concerning the newest Qtrade promo is the worth it has for smaller buyers. In case you are a brand new Qtrade buyer, and also you begin with $5,000, you’re going to get $400 again from Qtrade – that’s an 8% money again supply!

Listed below are a couple of particulars on this newest Qtrade supply.

| New Funds / Belongings Transferred | Cashback Bonus |

| $1,000 – $4,999 | $0 (solely $150 join bonus) |

| $5,000 – $24,999 | $250 Money Again + $150 |

| $25,000+ | 1% Money Again, Capped at $2,150 |

Another particulars embrace:

Whole property throughout all new Qtrade accounts will qualify. In different phrases, if you happen to swap over your TFSA and RRSP from one other brokerage, plus begin an RESP or FHSA with Qtrade, you may mix the entire property in these accounts in an effort to meet the funding thresholds within the chart above.

Questrade additionally has a singular promo supply code accessible for the time being, the place they are going to give you $50 in free trades while you open a brand new account. Whereas that’s higher than what you’ll discover at most Canadian brokerages, it simply doesn’t compete with this monster supply from Qtrade. Whereas I’m an enormous fan of Questrade’s commercials, I’m an excellent larger fan of Qtrade’s technique to put a refund within the pockets of their new clients!

Let’s have a look at what this implies within the context of contributing to your RRSP this yr: If you happen to earn an earnings of between $50,000 and $150,000 in Canada, you’re probably paying a marginal tax price of about 40%. Meaning, if you happen to open an RRSP account with Qtrade and make investments $5,000, you’ll immediately get:

- $2,000 again in your taxes

- $150 join bonus

- $250 money again bonus

- Free trades to make your first RRSP investments over the subsequent few months

That’s $2,500+ value of causes to get began ASAP.

By the best way, the maths is similar if you happen to’re beginning up an FHSA account, as an funding inside that account can be tax deductible as nicely!

Qtrade Refines Actual-Time Account Opening

One space that Qtrade labored onerous to refine in 2021 was their new account openings.

In consequence, they’ve now streamlined the method to the purpose the place an account may be opened inside minutes (qualifying for his or her best-in-class money again promotion) versus the previous 2-3 enterprise days technique.

It’s tremendous quick and intuitive to get began, and pairs neatly with the brand new digital-friendly branding that Qtrade determined to go along with of their newest design makeover.

The Head of Qtrade and VirtualWealth®, Christine Zalzal had this to say about Qtrade’s transfer to quicker real-time account openings: “Extra Canadians than ever wish to make their very own funding choices. Whether or not they’re new or skilled buyers, Qtrade is concentrated on empowering them to execute on their choices shortly and with confidence. We all know Qtraders will respect getting their account opened virtually instantaneously once they apply.”

One of many methods wherein Qtrade has been in a position to stay within the high echelon of Canadian on-line brokers from Day 1, is their continued dedication to revolutionary excellence. It’s nice to see that they present no indicators of slowing down!

Why Qtrade Is Our Prime Canadian Dealer For 2024

I’ve been writing about Canadian on-line brokerages for nearly twenty years now! In that point, I’ve all the time tracked the Qtrade vs Questrade comparability fairly carefully, as they have been usually the 2 finest dealer choices accessible to Canadian DIY buyers.

Qtrade’s present $2,150 promotional supply is just not solely the most effective present supply on the desk – it’s the most effective one which I’ve seen within the final 19 years (particularly on the $5,000 stage).

Other than that straightforward win, I merely discover that the benefits that Qtrade has on the subject of customer support and an easier-to-navigate platform – plus the free ETF gross sales consideration – are definitely worth the $2-per-trade benefit that Questrade has on the subject of inventory buying and selling.

Qtrade’s constant excellence over time consists of profitable the battle for the #1 spot within the Globe and Mail rankings in 2023, 2022, 2021, 2020, 2019, 2018, 2016, 2014, 2011, 2010, 2009, 2008, 2007, and 2006.

I personally hate paperwork. So one in every of my largest issues when selecting a product similar to a web based buying and selling platform or checking account is their long-term monitor file. I don’t wish to have to take a position hours into switching companies sooner or later.

Qtrade has persistently confirmed itself to be head and shoulders above different Canadian low cost brokerages on the subject of innovation and fixed upgrades.

As clients grow to be extra cost-conscious throughout this inflation-heavy time, the Qtrade vs Questrade rivalry in your DIY {dollars} has led to an more and more revolutionary closing product – delivered at lower cost factors – for each brokerages.