The 2025 Union Funds introduced reduction for a lot of taxpayers since incomes as much as Rs 12 lakh won’t be taxed, however many people are struggling to know the way it really works.

The first purpose for all of the confusion is the under assertion made by the union FM minister in her price range speech;

“Tax payers upto Rs 12 lakh of regular revenue (aside from particular fee revenue comparable to capital positive aspects) tax rebate is being supplied along with the profit as a consequence of slab fee discount in such a way that there isn’t any tax payable by them…”

So, what is supposed by Regular revenue? What’s the distinction between Regular revenue and Particular fee revenue?

Regular Revenue Vs Particular Fee Revenue

Regular Revenue refers to your common incomes like Wage, enterprise income, rental revenue or wages. These incomes are charged at under relevant (revised) slab charges.

As per the brand new proposal, revenue as much as Rs 12 lakh has no tax legal responsibility. What you probably have say Rs 7 lakh as wage revenue and Rs 5 lakh as Brief Time period Capital Beneficial properties arising out of your inventory buying and selling? Does this Rs 5 lakh can also be eligible for tax rebate?

The reply is NO!

The Capital Beneficial properties are thought-about as Particular fee incomes and are taxed at completely different charges. The Tax rebate just isn’t relevant on these incomes. So, the tax reduction is relevant solely in your Rs 7 lakh wage revenue and tax fee @ 15% is relevant on STCG of Rs 5 lakh. One other instance for particular fee revenue is ‘revenue from lotteries’.

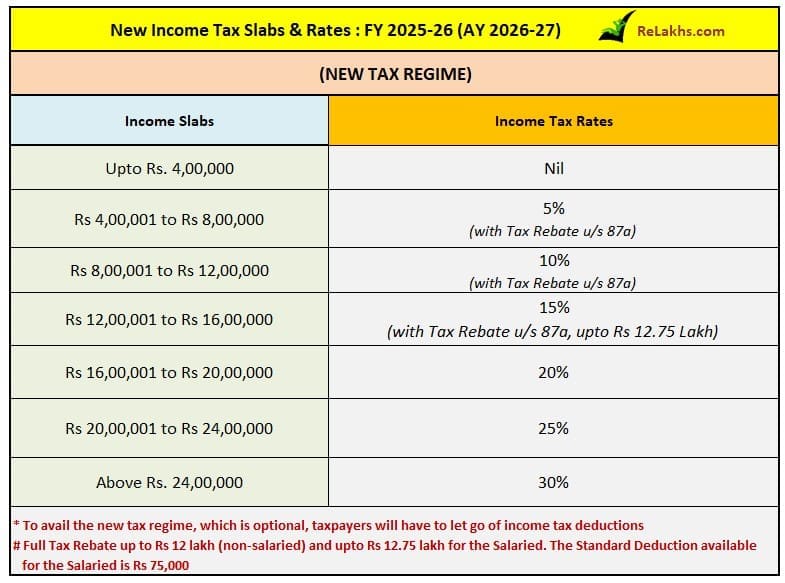

So, the Finance Minister has revised the fundamental exemption restrict to Rs 4 lakh and people incomes between Rs 4 lakh and Rs 12 lakh pays taxes at a decreased fee (5% & 10% relying on revenue), which, mixed with the tax rebate, results in zero tax. However, these earnings ought to be the usual incomes and never particular fee ones. The reduction measures strictly apply to plain revenue taxed underneath Part 115BAC. (Diminished fee can also be referred as slab fee discount.)

Revenue chargeable u/s 115BBE like unexplained money credit, investments, cash, bullion, jewellery, or different useful articles can also be thought-about as particular revenue.

Kindly word that this text shall be up to date/edited as and when extra info is accessible.

(Put up first printed on : 01-February-2025)