Claiming tax refunds on purchases made abroad is a method to economize whereas buying overseas. Nevertheless, I usually ignore it as a result of I don’t normally make massive purchases, and even after I do, filling out types generally is a trouble.

However throughout my latest journey to Dubai, I gave it a strive, and it was a particularly easy expertise. Right here’s the whole lot you could know:

The way it works?

“Planet” Tax Free is the service licensed by the UAE authorities to function the Vacationer Refund Scheme. There are principally two steps to it:

- At Service provider: Whereas buying, you’ll want to say that you simply’re searching for a VAT refund. The service provider will ask in your passport and provide you with a slip.

- At Airport: You possibly can declare the VAT by way of automated kiosks or manually on the Planet Fee counters positioned each airside and landside.

Phrases & situations:

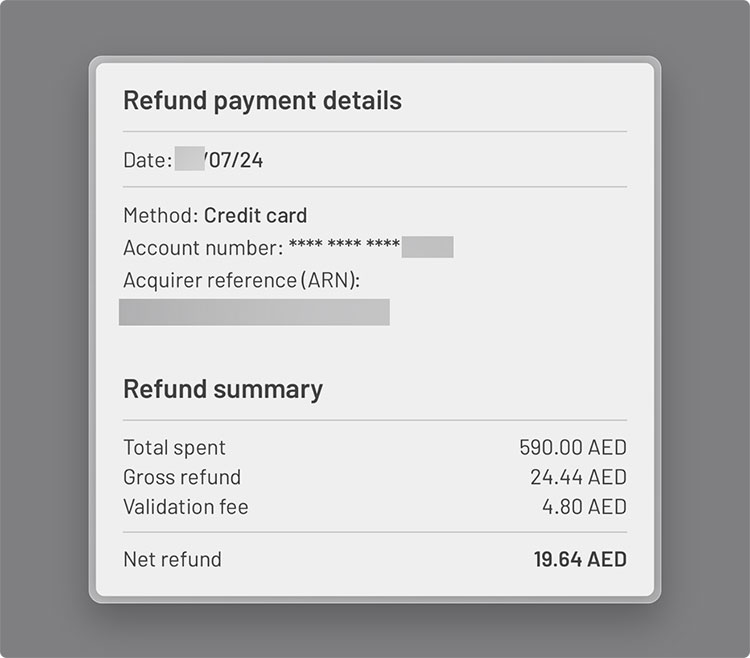

- A price of AED 4.80 per tag could be charged

- Minimal spend: 250 Dirhams

- Items which are consumed partially or totally are usually not eligible.

- Items not accompanied by vacationer whereas leaving UAE are ineligible.

Service provider Expertise

Whereas on the billing counter, the service provider requested for my passport and luckily accepted my digital copy. It took him a couple of minutes to undergo the method, after which he gave me a receipt that confirmed the VAT quantity that I can declare.

Airport Expertise

As quickly as I entered the DXB airport – Terminal 1, I seen the Planet Fee’s counter (landside) which was luckily empty at the moment.

The chief requested for my passport and flight particulars. He rapidly punched in my passport quantity on his handheld pill and stated it was already permitted. Then, he took my bank card quantity to provoke the refund and stated it was carried out.

The entire course of took hardly 5 minutes.

Nevertheless, another person I do know missed this counter and went to the airside counter. He had some 5 gadgets and was requested to indicate them, which, in fact, was not potential as they have been within the checked-in baggage. So he was not given the refund for one of many gadgets, which I believe is a good resolution.

In brief, I understood that when you may have fewer merchandise, the system auto-approves it, whereas it would set off a handbook verify when you may have a number of gadgets.

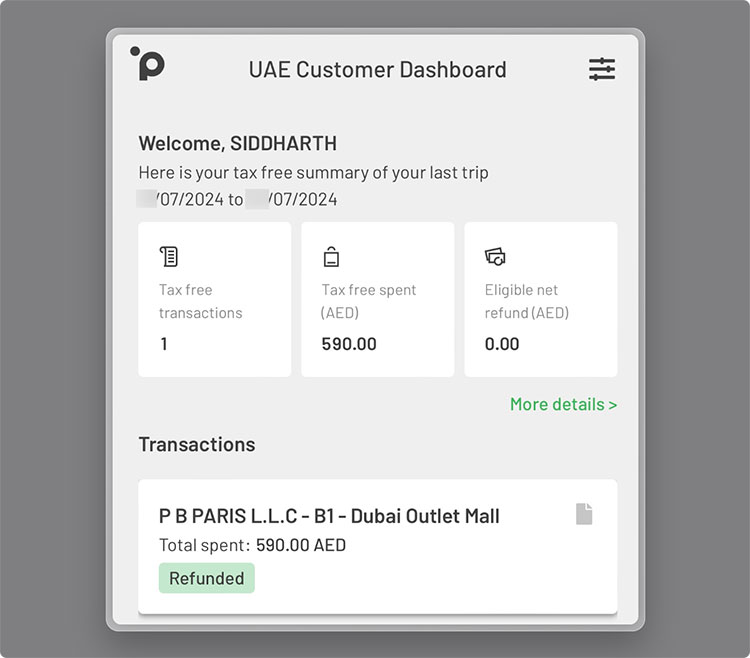

Refund

Refund kicked in about 3 days on to my bank card and their web site is helpful to know the price charged, and so on.

Whereas it’s a small quantity attributable to a minor buy and the truth that VAT is simply 5% within the UAE, it may quantity to few hundreds if it have been a European nation.

Bottomline

The tax (VAT) refund course of within the UAE is totally digital and really user-friendly in comparison with another international locations that also use paper processes.

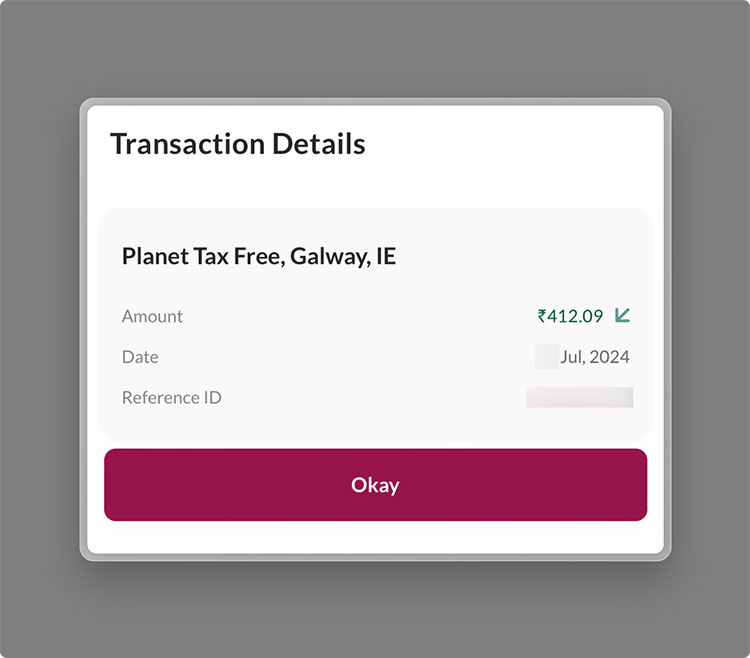

For instance, after I beforehand tried to go to the tax refund counter in Dublin, Eire, the queue and rush within the space made me not even hassle spending time on it.

Curiously, “Planet” is definitely primarily based out of Galway, Eire. It’s a bit bizarre that I didn’t discover them after I was in Eire. To not point out, they function in lots of extra international locations worldwide.

Do you may have the behavior of claiming Tax Refunds whereas buying items abroad? Be at liberty to share your experiences within the feedback beneath.