Microsoft founder Invoice Gates as soon as remarked, “If you’re born poor, it’s not your fault. Nonetheless, it’s totally your fault if you happen to die poor.” This assertion underscores the significance of planning to your monetary future, notably retirement. By planning early and systematically, you possibly can guarantee that you’re financially safe and unbiased throughout your retirement years. The sooner you begin, the higher your possibilities of reaching this objective.

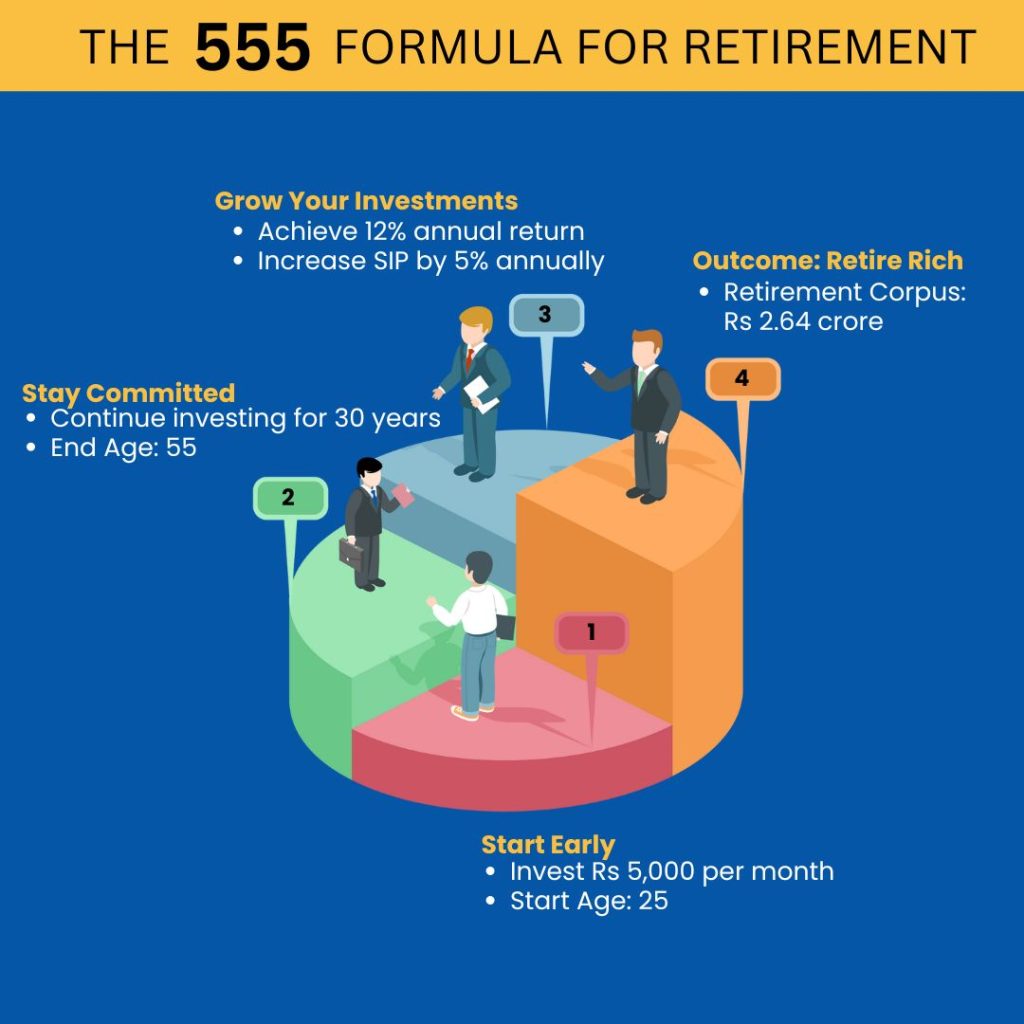

Understanding the 555 Rule for Retirement

Everybody goals of retiring with sufficient cash to stay comfortably for the remainder of their lives. Reaching this objective doesn’t require putting it wealthy in a single day or inheriting a fortune. As an alternative, it’s about persistently investing small quantities over time. The important thing to success lies in beginning early and sustaining self-discipline in your funding technique.

The 555 rule is a simple method to retirement planning. It means that if you happen to begin investing Rs 5,000 monthly at age 25, you can accumulate a corpus of Rs 2.64 crore by age 55. This calculation relies on a modest annual return of 12 %, compounded over time.

Nonetheless, if you happen to have been to make use of a web based SIP (Systematic Funding Plan) calculator to verify this declare, you would possibly discover that the ultimate quantity is just Rs 1.76 crore, not Rs 2.64 crore. The distinction comes from the third “5” within the 555 Method, which entails a 5 % annual enhance in your SIP contribution, also known as an annual “step-up.” By regularly growing your funding quantity every year, you possibly can attain the goal of Rs 2.64 crore.

How the 555 Method Works?

Let’s break it down additional. Suppose you begin an SIP of Rs 5,000 monthly at age 25 and proceed investing for 30 years till you flip 55. In the event you enhance your SIP contribution by 5 % every year, you’ll meet the Rs 2.64 crore goal with a 12 % compound annual progress price (CAGR).

On this state of affairs, your whole funding over the 30 years can be Rs 39.86 lakh, with the remaining Rs 2.23 crore coming from funding returns. This instance illustrates how small, constant contributions, mixed with annual will increase, can develop into a considerable retirement fund.

| Yr | Month-to-month SIP (Rs) | Annual SIP (Rs) | Cumulative Funding (Rs) | Corpus (Rs) |

| Yr 1 | 5,000 | 60,000 | 60,000 | 64,047 |

| Yr 2 | 5,250 | 63,000 | 1,23,000 | 1,39,418 |

| Yr 3 | 5,512 | 66,150 | 1,89,150 | 2,27,711 |

| … | … | … | … | … |

| Yr 30 | 20,581 | 2,46,968 | ₹39,86,331 | 2,63,67,030 |

Can You Retire Earlier Utilizing the 555 Method?

What if you wish to retire earlier, say at 50 as a substitute of 55? Is it nonetheless doable to build up Rs 2.64 crore? There are 3 ways you possibly can attempt to obtain this:

1. Enhance the Month-to-month SIP Contribution

2. Enhance the Annual Step-Up Share

3. Purpose for Increased Funding Returns by Taking up Extra Threat

Let’s discover the primary two choices.

State of affairs 1: In the event you persist with a 5 % annual step-up, how a lot greater would your returns must be to achieve Rs 2.64 crore by age 50? With solely 25 years to speculate, you would want to attain a CAGR of 15.95 %, which is very formidable and maybe unrealistic.

State of affairs 2: A extra achievable method can be to extend your beginning SIP quantity whereas retaining the returns at 12 % CAGR. To succeed in Rs 2.64 crore by age 50, you would want to start out with a SIP of Rs 9,700 monthly and proceed growing it by 5 % every year. Basically, you would want to double your preliminary SIP contribution.

Retiring early by enhancing your returns or dramatically growing your annual step-up might not be possible for most individuals. A extra sensible answer is to start out with the next preliminary SIP.

| State of affairs | Beginning SIP (Rs) | Annual SIP Step-up | CAGR (%) | Remaining Corpus (Rs) |

| Retire at 55 (Unique Plan) | 5,000 | 5% | 12% | 2.64 crore |

| Retire at 50 (Increased SIP) | 9,700 | 5% | 12% | 2.64 crore |

| Retire at 50 (Increased Return) | 5,000 | 5% | 15.95% | 2.64 crore |

Don’t Delay Your Retirement Planning

Essentially the most essential consider constructing your retirement corpus is time. The sooner you begin, the higher. Let’s contemplate an instance. In the event you begin investing Rs 10,000 monthly at age 25 and enhance it by 5 % yearly, with a 12 % CAGR, you can accumulate Rs 5.27 crore by age 55. Apparently, your corpus would double within the final 5 years (50-55), highlighting the significance of permitting your investments sufficient time to develop (the corpus can be Rs 2.73 crore if you happen to keep invested for under 25 years).

The takeaway is obvious: start your retirement planning as early as doable and keep dedicated to it for about 30 years. That’s how the 555 Method will help you safe a cushty and financially unbiased retirement.