Expenditures are excessive and projected to rise as a result of nationwide healthcare prices are uncontrolled.

The 2024 Medicare Trustees Report (launched this spring) bought nearly no consideration, contained no dangerous information. It’s true that, below present legislation, Medicare Half A – the Hospital Insurance coverage (HI) program – faces a long-term deficit, however that deficit is the smallest it has been for greater than a decade and the 12 months of depletion of belief fund reserves has been pushed out 5 years to 2036. Sure, the remainder of the Medicare program would require rising quantities of basic revenues, however they’re similar to these anticipated final 12 months. Regardless of the comparatively sanguine 2024 report, nevertheless, it’s essential to keep in mind that the Medicare program operates in a particularly expensive well being system.

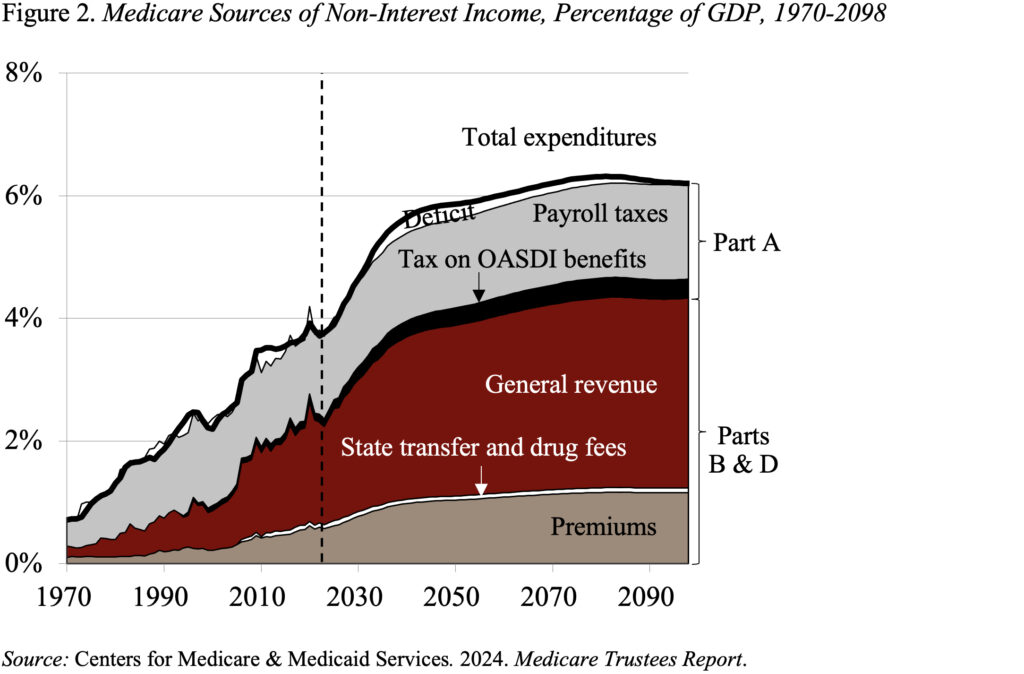

The Medicare Trustees undertaking this system’s funds below two units of assumptions – present legislation and an alternate situation that limits the cost-control provisions of earlier laws.

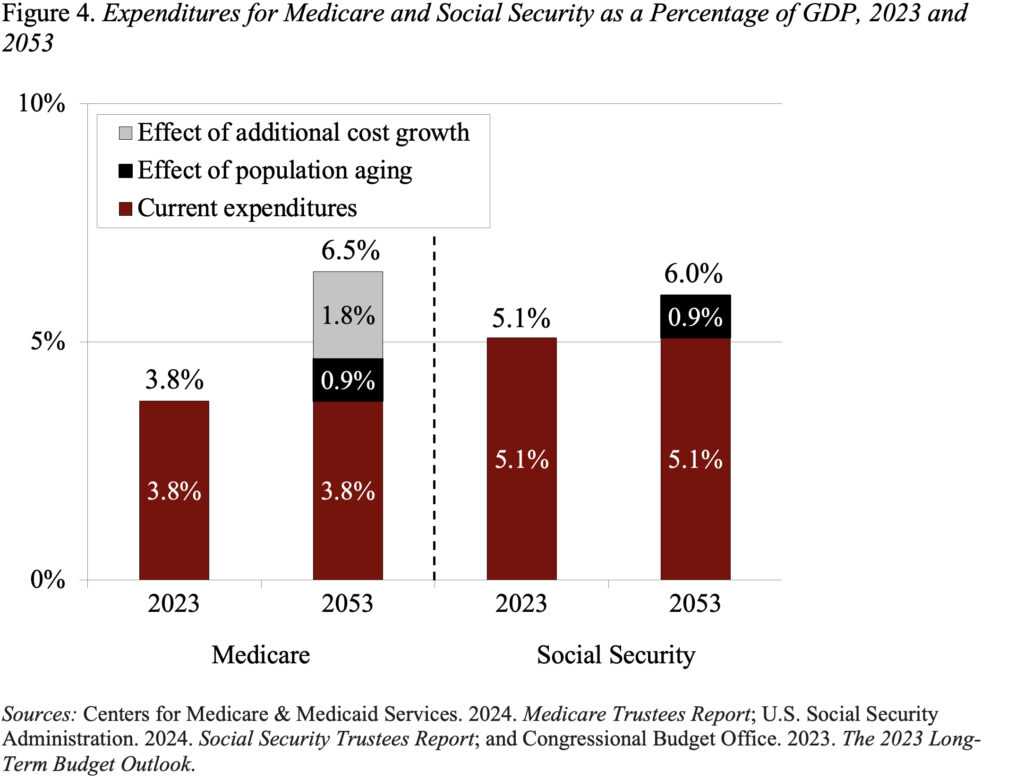

Assuming present legislation, the Trustees undertaking a 75-year HI deficit of 0.35 % of taxable payrolls. This deficit is on the low finish of the diminished deficits that emerged within the wake of the Inexpensive Care Act (see Determine 1). On account of the improved outlook, the HI belief fund now won’t deplete its reserves till 2036 – 5 years later than projected in final 12 months’s Trustees Report. As soon as the fund is depleted, persevering with program earnings might be ample to pay 89 % of scheduled advantages.

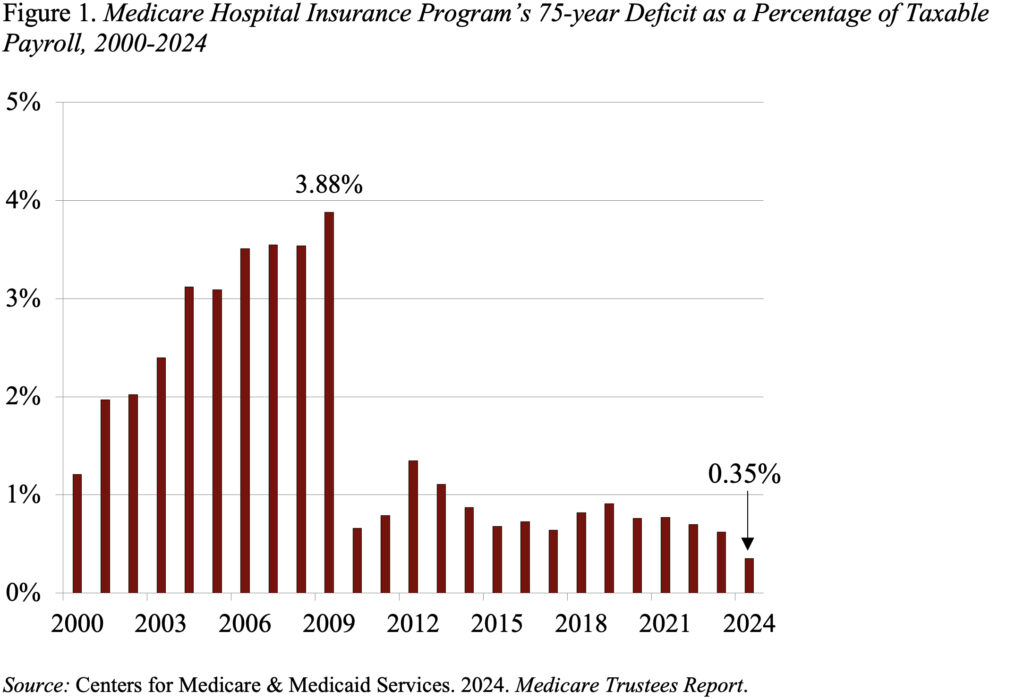

Half B, which covers doctor and outpatient hospital companies, and Half D, which covers prescribed drugs, are each adequately financed for the indefinite future as a result of the legislation supplies for basic revenues and participant premiums to fulfill the following 12 months’s anticipated prices. After all, an rising declare on basic revenues places strain on the federal price range and rising premiums place a rising burden on beneficiaries (see Determine 2).

Along with projections based mostly on present legislation, the actuaries additionally put together an alternate set of projections that loosen up the cost-saving provisions within the Inexpensive Care Act and subsequent laws. Below these different assumptions, by 2090, the full value of Medicare is about 2 % of GDP increased below the choice than below the current-law provisions. Be aware, nevertheless, that even these increased expenditures are approach under the pre-ACA projections (see Determine 3).

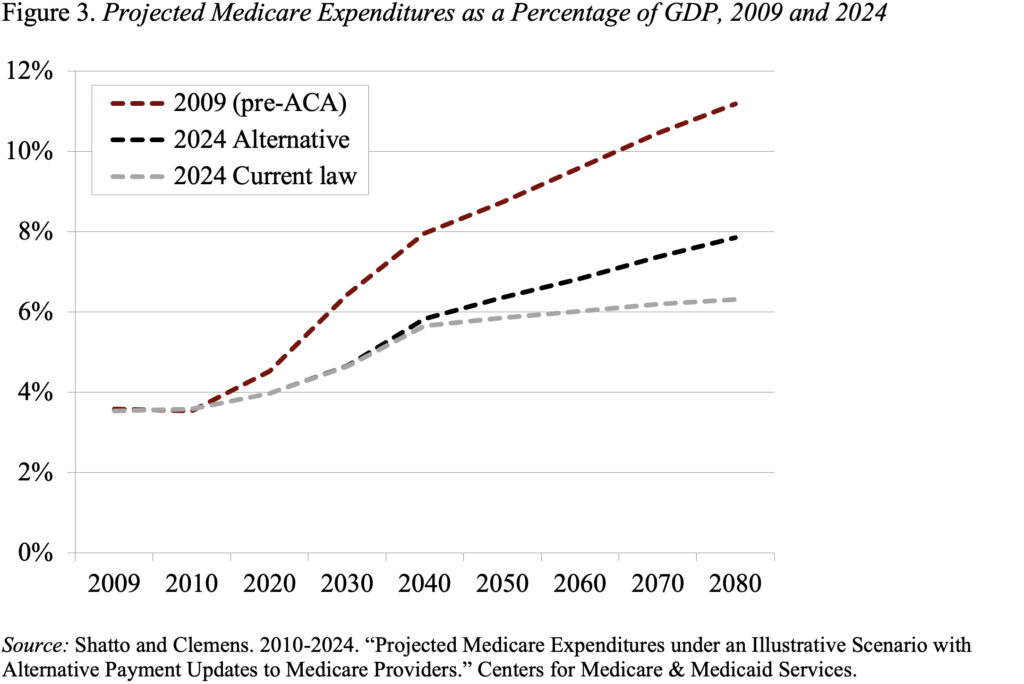

Whereas the 2024 Trustees Report produced comparatively excellent news on the Medicare entrance, this system’s prices are excessive and are projected to develop as a proportion of GDP. In distinction to Social Safety, the place inhabitants getting older can clarify all the expansion in expenditures over the following 30 years, an getting older inhabitants explains a lot lower than half of the projected future progress in Medicare (see Determine 4). The remainder comes from the prices for hospital and doctor companies rising sooner than GDP. The underside line is that the one option to management Medicare prices is to get nationwide healthcare spending below management.