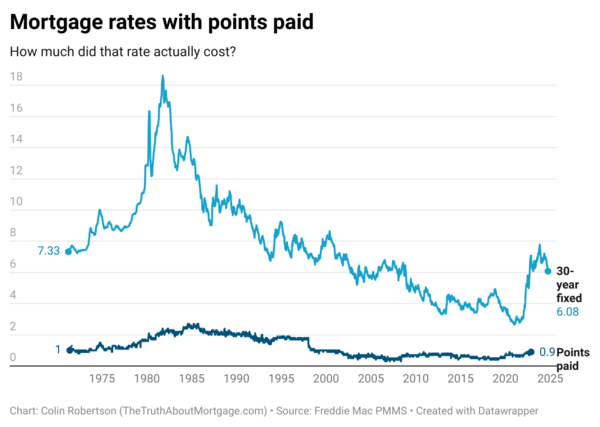

Though mortgage charges have fallen fairly a bit from their highs seen a yr in the past, they continue to be fairly elevated relative to a lot of the previous decade.

Certain, a 6% 30-year fastened is healthier than an 8% 30-year fastened, nevertheless it’s nonetheless a far cry from a 3 or 4% 30-year fastened.

This would possibly clarify why potential residence patrons haven’t precisely rushed again into the housing market in current months.

And now we’re being advised that is pretty much as good because it’s going to get for mortgage charges. That is still to be seen, however what’s fascinating is I’ve seen quotes down into the high-4s for mortgage charges lately too.

So how are lenders capable of promote charges that low if the Freddie Macs of the world are telling us charges are nonetheless above 6%?

Effectively, the key is slightly factor known as mortgage low cost factors.

Mortgage Charges Are Decrease When You Pay Factors

After mortgage charges surged since starting in early 2022, the secondary market the place traders purchase and promote mortgage-backed securities (MBS) obtained all out of whack.

Principally, uncertainty and volatility surged whereas quantity plummeted. Lengthy story brief, MBS traders wished extra assurances, which typically meant debtors needed to pay factors upfront.

This ensured a revenue even when the mortgage was short-lived and paid off in a brief time period.

It additionally allowed lenders to maintain mortgage charges from going even increased, utterly decimating lending quantity within the course of.

Situations have since improved, and it’s once more attainable to get a house mortgage at the moment with out paying factors.

However you’re nonetheless seeing lenders provide charges with factors connected. And the explanation why is as a result of you’ll be able to provide a decrease charge!

Clearly, it seems loads higher should you’re capable of promote a charge beginning with a 5 as a substitute of a 6, or a 4 as a substitute of a 5.

And that’s precisely what some lenders do, not less than those that lead on worth versus service or model title.

Apparently, I found over the weekend that this isn’t a brand new phenomenon. Again within the Eighties and Nineties this was additionally frequent.

Householders Paid Over Two Factors on Common from 1981 to 1991

Bear in mind these tremendous excessive mortgage charges within the Eighties? Effectively should you don’t, the 30-year fastened climbed as excessive as 18.45% in late 1981, per Freddie Mac.

Regardless of the speed being astronomically excessive, the typical quantity of low cost factors required at the moment was a whopping 2.3.

In different phrases, on a $250,000 mortgage quantity, you’d be speaking about $5,750 in charges simply to acquire that ridiculously excessive charge.

Did that imply a borrower who solely paid one level would have been topic to a 20% charge? Maybe, I don’t know, however that’s typically the way it works.

In the event you decide to pay much less or nothing upfront, your mortgage charge might be increased, all else equal.

This common quantity of factors paid by owners hit its peak in 1984 and 1985, when the typical quantity paid was 2.5 factors.

So for each $100,000 borrowed, a house purchaser must fork over $2,500. And once more, to wind up with a mortgage charge round 12 or 14% (they got here down a bit after peaking in 1981).

Are Mortgage Charges That Require Upfront Factors Legit?

Now that brings me to modern-day, the place lenders nonetheless cost a number of factors for the bottom charges.

Whereas optional, as I discussed, you do sometimes have the choice to pay factors at closing.

The tradeoff being a decrease rate of interest should you do. That is basically what residence builders have been doing to attract in enterprise with their everlasting and short-term charge buydowns.

They’re shopping for the charges right down to lure in residence patrons, which permits them to maintain their asking costs regular (and even rising).

Those that comparability store mortgage charges can also discover that some lenders are providing “below-market charges” versus what they see within the mortgage charge surveys.

The way in which lenders accomplish that is by asking you to pay factors upfront, that are a type of pay as you go curiosity.

So the speed supplied is likely to be 6% with no factors or for a no price refinance. However 5.25% should you’re prepared to pay some extent (or greater than some extent) at closing.

These are completely legit charges, they simply price cash to acquire them. And that price is actually an funding within the mortgage that you just’ll solely understand should you maintain it lengthy sufficient.

Paying Factors at Closing Would possibly Not Be the Greatest Transfer

Whereas the promise of a decrease mortgage charge, particularly one thing that begins with a 4 is attractive, it won’t be price it.

Let’s contemplate a fast instance the place you pay two factors to get a charge of 4.875% versus a charge of say 5.75% with no factors.

On a $500,000 mortgage quantity that will set you again $10,000 at closing.

The month-to-month fee can be $2,646.04 versus $2,917.86, or roughly $272 per 30 days.

Whereas that’s a good quantity of financial savings, it might take about three years to breakeven on the upfront price.

Now think about then 30-year fastened falls to the mid-4s and even decrease throughout that span. Or if you wish to promote your own home and transfer.

You’ve already paid for the decrease charge and won’t get the complete profit. This isn’t to say it’s a foul determination, because you, me, and everybody else doesn’t know what the long run holds.

However you’re making a acutely aware selection when paying factors and there are not any refunds.

If we glance again at these people who paid 2.5 factors again in 1984 for a 14% charge, solely to see charges fall to sub-10% by 1986, it makes you surprise.