If offering healthcare to extra People is the aim, the COVID-era tax credit for folks shopping for insurance coverage on the Reasonably priced Care Act (ACA) marketplaces have been a giant success.

Enrollment in ACA insurance policies has doubled to a file 24 million since 2021, when Congress permitted the credit, which decreased month-to-month premiums by lots of of {dollars} and ensured that medical insurance was reasonably priced through the pandemic. The Inflation Discount Act of 2022 prolonged the subsidies by the tip of this yr.

However the tax credit wouldn’t be renewed underneath some funds proposals being thought of within the Home.

With out them, the City Institute has estimated enrollment in ACA insurance policies would decline by greater than 7 million and that 4 million of those folks wouldn’t have the ability to discover an reasonably priced different. The toll over the long run might be even larger.

The federal authorities pays the tax credit on to insurers, which go them on to customers within the type of decrease premiums. Though the credit scale back premiums, deductibles are unaffected. Because of this, coverage holders usually are nonetheless paying excessive out-of-pocket prices for his or her doctor visits, exams, surgical procedures, and coverings.

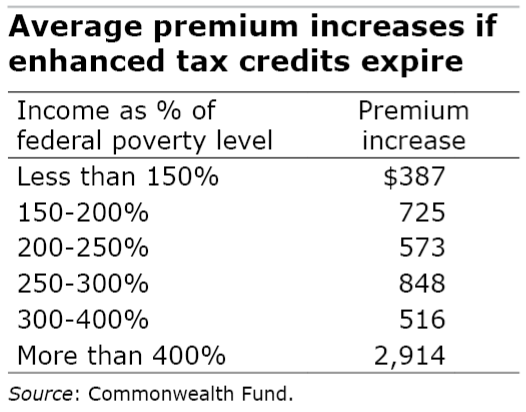

Who specifically can be damage if Congress doesn’t renew the beneficiant credit? Researchers on the Commonwealth Fund, KFF, and the City Institute have seemed intently at who can be most affected.

One apparent group can be the various lower-income staff at the moment paying underneath $10 a month for market plans. However the credit minimize the price of insurance coverage for working- and middle-class People too. The 2021 laws even prolonged tax credit to folks incomes greater than 400 p.c of the federal poverty degree – $62,600 for a person and $128,600 for a household of 4 in 2025 – and capped their premiums at 8.5 p.c of family earnings.

If the credit expire on the finish of 2025, nonetheless, premiums would improve $1,500 a month on common for a 60-year-old couple incomes $85,000, KFF estimates. A big share of the folks receiving credit are self-employed staff, small enterprise house owners, and people who find themselves over 50 however nonetheless too younger for Medicare.

Different weak teams are Blacks and Hispanics, who disproportionately depend on the tax credit that drove down their premiums – positive aspects that might be reversed if premiums rise. Younger adults may additionally drop their protection in the event that they deem the associated fee as too excessive, presumably destabilizing a market that advantages from larger enrollment by youthful, more healthy folks.

Residents in rural communities and within the 10 states that haven’t expanded Medicaid are additionally disproportionately depending on ACA insurance coverage – each for the protection itself and for the assist it gives to native healthcare economies.

If the tax credit expire, inflicting a surge in premiums, 2.5 million individuals are more likely to drop their insurance coverage within the 10 non-expansion states – Alabama, Florida, Georgia, Kansas, Mississippi, South Carolina, Tennessee, Texas, Wisconsin, and Wyoming – the City Institute says. This compares with 1.5 million individuals who would lose protection within the different 40 states that did broaden Medicaid.

In enlargement states, medical insurance is extra accessible to lower-income staff as a result of the ACA additionally elevated the earnings cap on Medicaid eligibility to 138 p.c of the poverty degree for states that agree to extend Medicaid enrollment. Within the non-expansion states, the cap has remained on the poverty degree, pushing extra folks into personal insurance policies on the ACA marketplaces.

However right here’s the rub concerning the tax credit: they’re a greater than $10 billion funds merchandise. The query dealing with Congress is whether or not they’re prepared to permit a pointy rise in hundreds of thousands of constituents’ month-to-month insurance coverage premiums.

Squared Away author Kim Blanton invitations you to comply with us @SquaredAwayBC on X. To remain present on our weblog, be part of our free e-mail record. You’ll obtain an e-mail every week – with a hyperlink to the week’s article – whenever you enroll right here. This weblog is supported by the Heart for Retirement Analysis at Boston School.