Buyers waited impatiently because the Federal Reserve thought-about reducing rates of interest. Will or not it’s 0.25% or 0.5%? They lastly lower charges by 0.5% on September 18th. The S&P 500 is up 20% yr up to now as traders contemplated whether or not we might have a recession or handle the elusive gentle touchdown. There have been three durations this yr the place the market fell 5% or extra. The S&P 500 has been comparatively flat for the previous three months however spiked over 1% after the Fed made the lower.

My survival intuition tells me to promote shares and purchase bonds, however my self-control tells me to stay to the plan labored out over the previous three years with the help of monetary advisors. The economic system is powerful, and I hope for a gentle touchdown. It’s 4 am within the morning so I’ll get one other cup of espresso and chill. I ready for the speed cuts by evaluating if I had sufficient in protected bonds, certificates of deposit, and cash markets to cowl three years of bills. I offered a small quantity of my extra unstable funds and acquired bond funds.

We’re at an inflection level with short-term rates of interest falling and the yield curve uninverting. I hope to achieve some perception into the following six to 12 months by taking a look at short-term tendencies on this article. I monitor over eight hundred mutual and exchange-traded funds from roughly 125 Lipper Classes obtainable at Constancy and/or Vanguard with out transaction charges or hundreds. For this text, I downloaded the most recent information as of September 21st utilizing the Mutual Fund Observer MultiScreen device. I created a momentum indicator based mostly on an equal weight of 1) August and September returns, 2) three-month exponential transferring averages, and three) fund flows.

This text is split into the next sections:

TRENDING LIPPER CATERGORIES

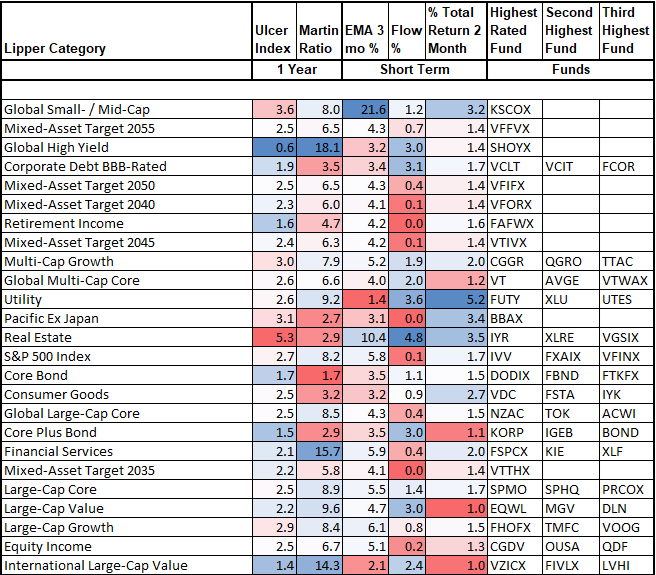

I calculated the trending Lipper Classes from the typical of the momentum indicator for particular person funds. As an informal commentary, there are six Blended Property, six International, six Fairness, 4 Bond Classes, and 4 Sector classes trending essentially the most now. A globally diversified inventory and bond portfolio is trending upwards very nicely. Bond funds have carried out nicely as a result of bond values rise as rates of interest fall. As bonds in my bond ladders mature, this desk comprises the Lipper classes and funds that I could also be focused on shopping for.

Desk #1: High Funds from Trending Lipper Classes (One-12 months Metrics)

DEFINITIONS:

- Ulcer Index measures each the magnitude and period of drawdowns in worth.

- Martin Ratio is a measure of extra return above a risk-free funding divided by the chance. It’s calculated as (Whole return – Threat-free return) / Ulcer Index.

- return, however relative to its typical drawdown.

- Nice Owl funds have “delivered high quintile risk-adjusted returns, based mostly on Martin Ratio, in its class for analysis durations of three, 5, 10, and 20 years as relevant”.

TRENDING GREAT OWL FUNDS

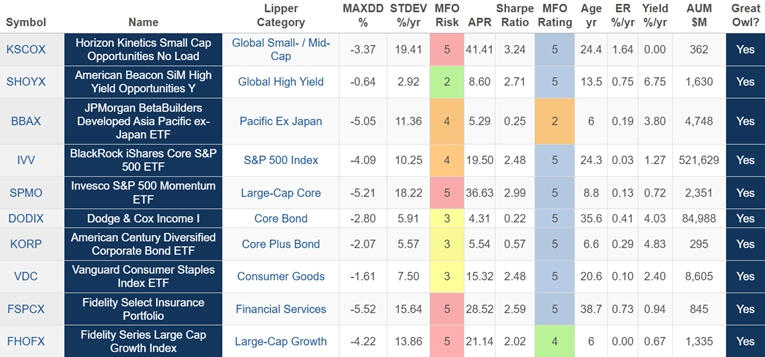

Desk #2 comprises Nice Owl Funds which can be trending strongly throughout the trending Lipper Classes in Desk #1. I personal a diversified world portfolio resembling a standard 60% inventory /40% bond balanced allocation. When the yield curve uninverts, a recession normally begins inside a couple of months, however the economic system at present appears resilient. I choose to underweight development funds which have carried out so nicely over the previous yr.

On the fairness facet, Vanguard Client Staples (VDC) has some enchantment as valuations of the S&P 500 stay excessive. With rates of interest more likely to fall over the twelve months or so, American Beacon SiM Excessive Yield Alternatives (SHOYX), Dodge & Cox Earnings (DODIX), and American Century Diversified Company Earnings (Korp) additionally curiosity me. I have a look at these additional in Part #4.

Desk #2: Trending Nice Owl Funds (One-12 months Metrics)

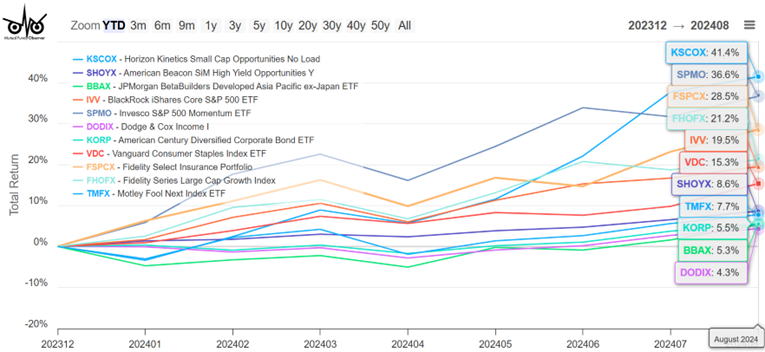

Determine #1 reveals that Vanguard Client Staples (VDC) and American Beacon SiM Excessive Yield Alternatives (SHOYX) have had comparatively regular returns over the previous a number of months. In a market downturn, they could carry out higher than diversified fairness funds.

Determine #1: Trending Nice Owl Funds

TOP FUNDS FROM THE TRENDING LIPPER CATEGORIES

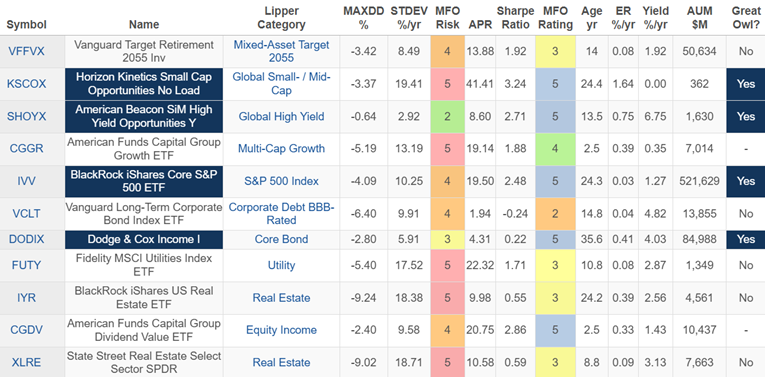

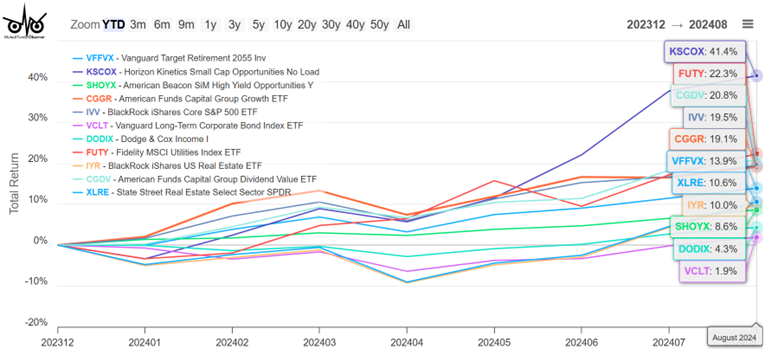

The funds in Desk #3 are trending in Lipper Classes the place nearly all of the funds are trending no matter whether or not they’re Nice Owl Funds. It consists of some Blended Property, utility, and sector funds.

Desk #3: High Mixed Funds from Trending Lipper Classes (One-12 months Metrics)

Amongst fairness, American Funds Capital Group Dividend Worth (CGDV) stands out for constant efficiency. For individuals who need a one-stop fund, the Vanguard Goal Retirement 2055 (VFFVX) fund has carried out nicely, however traders ought to have a look at the suitable goal date. Lastly, State Avenue Actual Property Choose Sector (XLRE) responded strongly to the speed lower.

Determine #2: High Mixed Funds from Trending Lipper Classes

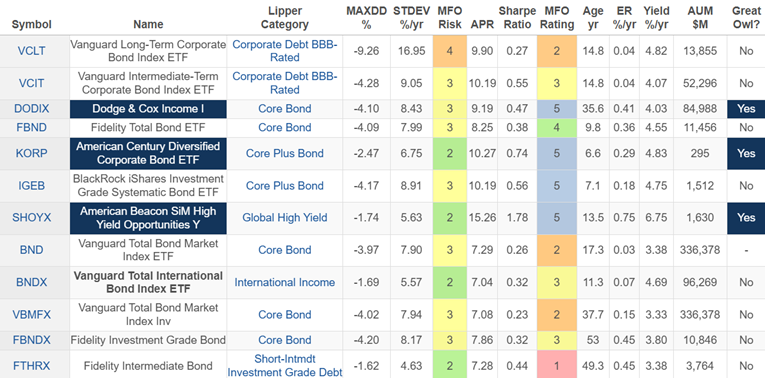

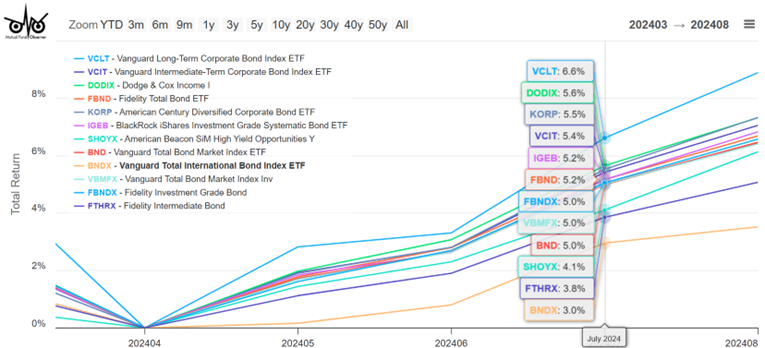

TRENDING BOND FUNDS

In a falling fee surroundings, I favor being chubby in bonds. The primary seven funds in Desk #4 have been recognized as top-performing funds within the trending Lipper Classes. The remaining 5 are included for comparability functions.

Desk #4: High Bond Funds from Trending Lipper Classes (One-12 months Metrics)

Determine #3 exhibits that long-term company bonds have elevated essentially the most in worth because the rates of interest fall. Constancy Intermediate Bond (FTHRX) comprises extra treasuries and has not climbed at a lot because the others. Dodge & Cox Earnings has been a high performer within the pack of different bond funds. One final commentary is that low-cost bond ETF funds are additionally on the high of the pack for efficiency.

Determine #3: High Bond Funds from Trending Lipper Classes

CLOSING THOUGHTS

I preserve an inventory of over a thousand funds that I’ve beforehand vetted. Which fund is greatest for an investor relies upon totally on their present and desired portfolio. I used to be not shocked that bond funds are trending favorably. I can be making small adjustments subsequent yr making an allowance for the affect of taxes and the economic system. Tax effectivity was not a consideration in figuring out these trending funds. Much less tax-efficient fairness funds needs to be held in Roth IRAs and fewer environment friendly bond funds like those on this article needs to be held in Conventional IRAs if attainable.