Over the past century, no asset class has trumped shares. Whereas Treasury bonds, housing, and numerous commodities like gold and oil have had their moments to shine, nothing comes remotely near matching the annualized-average return of shares over very lengthy durations.

However this does not imply shares transfer up in a straight line.

Though the mature stock-driven Dow Jones Industrial Common (DJINDICES: ^DJI), broad-based S&P 500 (SNPINDEX: ^GSPC), and innovation-inspired Nasdaq Composite (NASDAQINDEX: ^IXIC) are firmly in a bull market, the dramatic sell-off of equities in the course of the first-three buying and selling periods of August served as a reminder that sentiment can shift on the drop of a hat on Wall Avenue.

On one hand, there is not an ideal predictive indicator or metric that may forecast these short-term directional strikes within the Dow, S&P 500, and Nasdaq Composite with concrete accuracy. However, there are a selection of occasions and forecasting instruments which have strongly correlated with huge strikes in Wall Avenue’s three main inventory indexes all through historical past. It is these indicators and metrics that buyers typically flip to in an try to achieve a bonus.

Whereas there are a few metrics that recommend hassle could also be brewing for Wall Avenue, together with the S&P 500’s Shiller price-to-earnings ratio and the New York Federal Reserve’s recession likelihood device, the information level with the lengthiest good observe report of foreshadowing an enormous transfer in shares is U.S. cash provide.

U.S. M2 cash provide final did this in 1933

Although there are 5 completely different measures of cash provide, the 2 given essentially the most credence are M1 and M2. The previous is a measure of money and cash in circulation, in addition to demand deposits in a checking account. In essence, it is money you possibly can spend instantly.

In the meantime, M2 components in all the things in M1 and provides in cash market accounts, financial savings accounts, and certificates of deposit (CDs) under $100,000. That is nonetheless capital that may be spent, but it surely requires a bit extra work to get to. It is also the metric that is been making historical past of late.

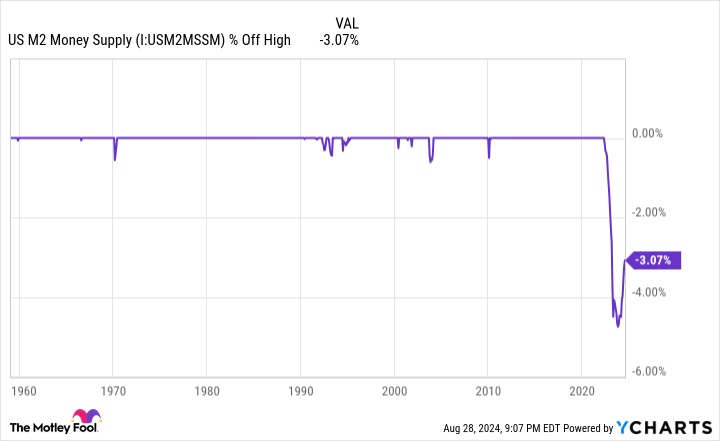

Sometimes, cash provide is not even one thing buyers could be compelled to concentrate to. For the final 9 a long time, cash provide has been steadily rising. An economic system that is rising over the long term goes to want extra capital to facilitate transactions, so this steadily incline in U.S. M2 cash provide is no surprise.

However within the extraordinarily outstanding cases the place M2 has declined, hassle has been a given for the U.S. economic system and inventory market.

Based mostly on information revealed month-to-month by the Board of Governors of the Federal Reserve, M2 peaked in April 2022 at $21.722 trillion. The most recent studying, as of July 2024, reveals U.S. M2 at $21.054 trillion, representing a decline of three.07% in a little bit over two years. Whereas that is nicely off the peak-to-trough drop of 4.74% from April 2022 by October 2023, it nonetheless marks the primary sizable decline in U.S. M2 cash provide because the Nice Despair.

There are, nevertheless, some caveats and asterisks to the above information that must be famous to offer a extra full image of what is going on on. As an example, M2 cash provide is definitely rising once more on a year-over-year foundation. Over the trailing-12-months, by July 2024, M2 has expanded by 1.4% — and enlargement is par for the course over the long term.

Moreover, M2 skyrocketed by greater than 26% on a year-over-year foundation in the course of the COVID-19 pandemic. Fiscal stimulus checks dumped cash into the laps of many shoppers and elevated M2 sooner than at any level relationship again to 1870.

Though the 4.74% peak-to-trough decline from April 2022 by October 2023 could signify a easy reversion to the imply, historical past has been fairly clear about what occurs when the M2 cash provide meaningfully retraces from an all-time excessive.

WARNING: the Cash Provide is formally contracting. 📉

This has solely occurred 4 earlier occasions in final 150 years.

Every time a Despair with double-digit unemployment charges adopted. 😬 pic.twitter.com/j3FE532oac

— Nick Gerli (@nickgerli1) March 8, 2023

Whereas the submit above on social media platform X from Reventure Consulting CEO Nick Gerli is greater than a 12 months outdated, it emphasizes a key level. Specifically, that year-over-year declines of two% or larger in M2 cash provide are scarce and traditionally related to financial turbulence.

There have been solely 5 events since 1870 when M2 dropped by no less than 2% from the prior-year interval: 1878, 1893, 1921, 1931 to 1933, and 2023. All 4 prior occurrences correlate with durations of financial melancholy and double-digit unemployment within the U.S.

The silver lining is that the Fed did not exist in 1878 and 1893, and there was restricted data of the right way to struggle again in opposition to fiscal and financial challenges within the Nineteen Twenties and Thirties. With the understanding of financial coverage that Fed officers have now, coupled with the fiscal coverage instruments on the disposal of the federal authorities, a melancholy is extraordinarily unlikely right now.

However, the primary notable drop in M2 because the Nice Despair factors to shoppers having to scale back their discretionary spending. This tends to be a recipe for a recession.

Though the inventory market does not mirror the efficiency of the U.S. economic system, a downturn in financial exercise would nearly definitely weaken company earnings and weigh on valuations. Traditionally talking, round two-thirds of the S&P 500’s peak-to-trough losses happen after, not previous to, a recession being declared.

Persistence and optimism produce the perfect funding outcomes

Based mostly on what historical past tells us about significant declines in M2 cash provide, an enormous transfer decrease within the Dow, S&P 500, and Nasdaq Composite, which can even end in a bear market, could await.

Although inventory market corrections, bear markets, and even crashes may be scary at occasions and play on the heartstrings of buyers — particularly newer buyers, who could not have skilled a fast pullback in equities earlier than — taking a step again, exercising endurance, and inspecting the larger image has been a profitable formulation for buyers because the inventory market’s inception.

There is no query that financial downturns and recessions may be difficult for many People. The unemployment price often rises, and wage-pricing energy shifts away from employees to companies throughout recessions. However these downturns are usually brief lived, which works in favor of long-term-minded buyers.

For the reason that finish of World Conflict II in 1945, there have been a complete of 12 U.S. recessions. Three-quarters of those downturns resolved in lower than 12 months, with not one of the remaining three surpassing 18 months.

Comparatively, there have been two financial expansions that went on to surpass the 10-year mark. Being an optimist and wagering on the U.S. economic system to develop over time has been a sensible transfer.

The factor is, what’s good for the U.S. economic system over the long term additionally tends to be good for Wall Avenue.

In June 2023, the analysts at Bespoke Funding Group posted a knowledge set on X that analyzed each bear and bull marketplace for the S&P 500 because the begin of the Nice Despair in September 1929. This meant including up the calendar size of every main transfer greater and decrease within the benchmark index over 94 years.

As you possibly can see, the typical S&P 500 bear market has solely caught round for 286 calendar days, or the equal of 9.5 months. Conversely, the everyday S&P 500 bull market has endured for about 3.5 occasions as lengthy (1,011 calendar days). As well, 13 out of 27 bull markets hung round longer than the lengthiest S&P 500 bear market.

In the end, we’re by no means going to have the ability to predict, with any assure, when inventory market corrections or bear markets will start, how lengthy they’re going to final, or the place the trough will likely be. It may be tough for buyers to just accept this realization.

However we do know that, over time, the Dow Jones, S&P 500, and Nasdaq Composite finally (key phrase!) put these downturns firmly within the rearview mirror. Having a long-term mindset and the right perspective could make it simpler to navigate no matter huge transfer in shares could also be forthcoming.

Don’t miss this second probability at a probably profitable alternative

Ever really feel such as you missed the boat in shopping for essentially the most profitable shares? Then you definately’ll need to hear this.

On uncommon events, our professional group of analysts points a “Double Down” inventory suggestion for corporations that they suppose are about to pop. When you’re fearful you’ve already missed your probability to take a position, now could be the perfect time to purchase earlier than it’s too late. And the numbers converse for themselves:

-

Amazon: in the event you invested $1,000 after we doubled down in 2010, you’d have $20,104!*

-

Apple: in the event you invested $1,000 after we doubled down in 2008, you’d have $43,321!*

-

Netflix: in the event you invested $1,000 after we doubled down in 2004, you’d have $378,232!*

Proper now, we’re issuing “Double Down” alerts for 3 unimaginable corporations, and there might not be one other probability like this anytime quickly.

*Inventory Advisor returns as of August 26, 2024

Sean Williams has no place in any of the shares talked about. The Motley Idiot has no place in any of the shares talked about. The Motley Idiot has a disclosure coverage.

U.S. Cash Provide Has Achieved One thing So Outstanding That It Hasn’t Occurred For the reason that Nice Despair — and a Huge Transfer in Shares Could Comply with was initially revealed by The Motley Idiot