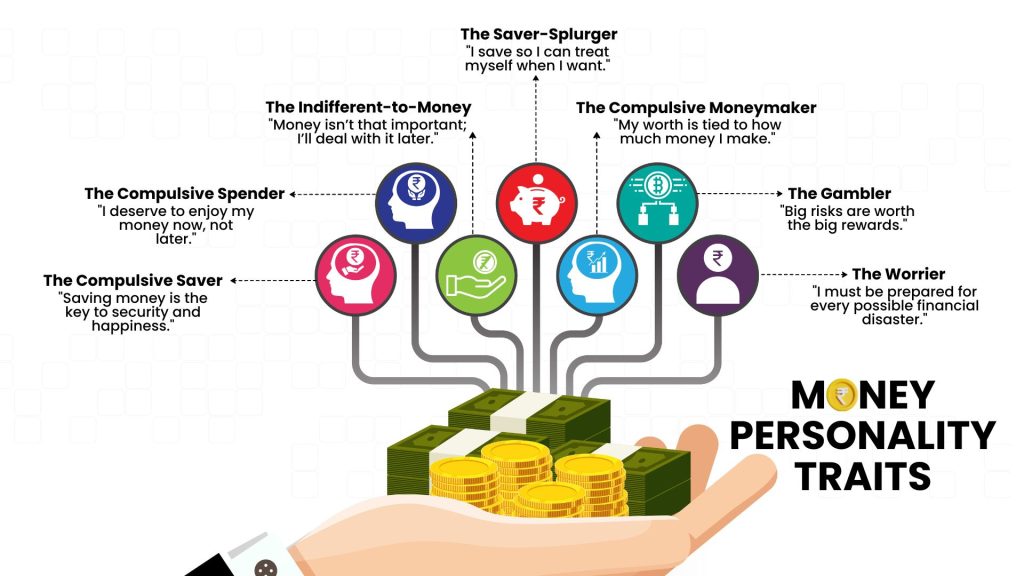

Everybody has a singular relationship with cash that influences how they save, spend, and make investments. Understanding your cash persona might help you make smarter monetary selections and keep away from widespread pitfalls. On this article, we’ll discover seven cash persona traits, how they have an effect on your monetary selections, and supply sensible recommendation to handle your cash higher.

1. The Compulsive Saver

Compulsive Savers are extraordinarily diligent about saving cash.

Indicators that you just is perhaps a “Compulsive Saver”:

- You lower your expenses obsessively, usually on the expense of having fun with life.

- You’re feeling a way of management and safety when your financial savings develop.

- You will have issue spending cash, even on stuff you want.

- You skip social occasions to keep away from spending cash.

- You hesitate to put money into alternatives that would yield larger returns.

Issues related:

- Lacking out on experiences, hobbies and actions that require spending.

- Potential pressure on relationships on account of frugality.

Cash recommendation:

Allocate a selected portion of your revenue for leisure actions and self-care.

Discover low-risk investments like bonds or balanced mutual funds to develop your financial savings whereas sustaining safety.

Outline clear objectives for each saving and spending, so you possibly can benefit from the current whereas planning for the longer term.

2. The Compulsive Spender

Compulsive Spenders have a love for purchasing and infrequently make impulsive purchases.

Indicators that you just is perhaps a “Compulsive Spender”:

- You’re keen on purchasing and infrequently make impulsive purchases.

- You battle to withstand gross sales, reductions, and promotions.

- You have a tendency to purchase issues to really feel good or deal with stress.

- You purchase gadgets you don’t want or not often use.

Issues related:

- Accumulating debt and monetary stress on account of frequent purchasing.

- Lack of financial savings for emergencies or future objectives.

Cash recommendation:

Wait 24 hours earlier than making any non-essential buy to cut back impulsive spending.

Set clear limits for discretionary spending and observe your bills.

Remind your self of your monetary objectives, like saving for a trip or shopping for a house, to remain motivated.

3. The Detached-to-Cash

People who find themselves detached to cash not often take into consideration cash.

Indicators that you just is perhaps “Detached-to-Cash”:

- You keep away from occupied with cash or managing your funds.

- You depend on others to make monetary selections for you.

- You usually really feel overwhelmed or detached in the direction of monetary issues.

- You’re feeling that cash doesn’t play an vital position in life.

Issues related:

- Whereas it’s wholesome to not be obsessive about cash, being too detached can result in monetary neglect.

- Monetary instability on account of lack of planning.

Cash recommendation:

Start by monitoring your bills and know the place your cash goes and the place you stand.

Be taught the fundamentals of budgeting, saving, and investing to realize confidence in managing your funds.

4. The Saver-Splurger

Saver-Splurgers save diligently however then take pleasure in occasional splurges, usually resulting in guilt or monetary pressure.

Indicators that you just is perhaps a “Saver-Splurger”:

- You save diligently however then splurge on big-ticket gadgets or luxurious experiences.

- You usually really feel responsible after making giant purchases.

- You undergo cycles of maximum saving adopted by extreme spending.

- You save for months after which splurge a big portion on a trip or costly gadget.

Issues related:

- Problem constructing long-term wealth on account of inconsistent saving habits.

- Monetary stress after splurging.

Cash recommendation:

Put aside a certain amount every month for splurging, so it’s inside your funds and doesn’t derail your financial savings objectives.

Take into account what actually brings you happiness and focus your spending on these areas.

5. The Compulsive Moneymaker

Compulsive Cash makers are pushed by a need to continually enhance their wealth.

Indicators that you just is perhaps a “Compulsive Moneymaker”:

- You’re continually searching for methods to earn more money, whether or not via facet hustles, investments, or new enterprise ventures.

- You equate your self-worth together with your monetary success.

- You battle to chill out or get pleasure from life since you’re at all times targeted on making a living.

Issues related:

- Burnout and stress from overworking.

- Neglecting relationships and private well-being within the pursuit of wealth.

Cash recommendation:

Guarantee you might have time for leisure, hobbies, and relationships, at the same time as you pursue monetary success.

Mirror on what success means to you past monetary achievements, comparable to private progress, relationships, and well being.

6. The Gambler

Gamblers are drawn to high-risk, high-reward monetary selections.

Indicators that you just is perhaps a “Gambler”:

- You get pleasure from taking dangers together with your cash, whether or not within the inventory market, playing, or speculative ventures.

- You thrive on the thrill of doubtless excessive returns.

- You put money into extremely risky shares or cryptocurrencies with out thorough analysis.

Issues related:

- Vital monetary losses on account of high-risk habits.

- Emotional stress and potential dependancy to the fun of playing.

Cash recommendation:

Solely allocate a small portion of your portfolio to high-risk investments and set clear boundaries.

Educate your self on the dangers concerned and make knowledgeable selections fairly than impulsive bets.

7. The Worrier

Worriers continually stress about their monetary state of affairs, usually fearing the worst even when their funds are secure.

Indicators that you just is perhaps a “Worrier”:

- You incessantly fear about cash, even once you’re financially secure.

- You continually take into consideration the longer term and potential monetary crises.

- You are likely to over analyze each monetary choice.

- You test your financial institution stability a number of occasions a day.

- You keep away from investments on account of worry of dropping cash.

Issues related:

- Lacking out on progress alternatives on account of extreme warning.

- Excessive stress ranges impacting your psychological and bodily well being

Cash recommendation:

Having a security web can alleviate a few of your worries. Goal for 6-12 months’ value of dwelling bills.

Unfold your cash throughout completely different asset lessons to cut back danger and develop your wealth steadily.

Take into account working with a monetary advisor to create a plan that gives each safety and progress.

| Cash Persona Trait | Monetary Behaviour | Pitfalls |

| Compulsive Saver | Prioritizes saving over spending. | Neglects vital spending, might not get pleasure from life. |

| Compulsive Spender | Regularly makes impulsive purchases. | Accumulates debt, monetary stress. |

| Detached-to-Cash | Neglects coping with funds. | Faces monetary instability or dependence on others. |

| Saver-Splurger | Alternates between saving and splurging. | Inconsistent financial savings, monetary pressure. |

| Compulsive Moneymaker | Obsessive about rising wealth. | Threat of burnout, neglects life satisfaction. |

| Worrier | Overly cautious, continually anxious about cash. | Misses out on alternatives, overly conservative. |

| Gambler | Interested in high-risk investments. | Potential for important monetary losses. |

Conclusion

Understanding your cash persona is essential to creating higher monetary selections. By recognizing your tendencies, whether or not you’re a Worrier, Spender, or Moneymaker, you possibly can take steps to handle your funds in a method that aligns together with your objectives and values. Bear in mind, the aim is to not change who you’re however to make use of your strengths to your benefit and mitigate any potential weaknesses.