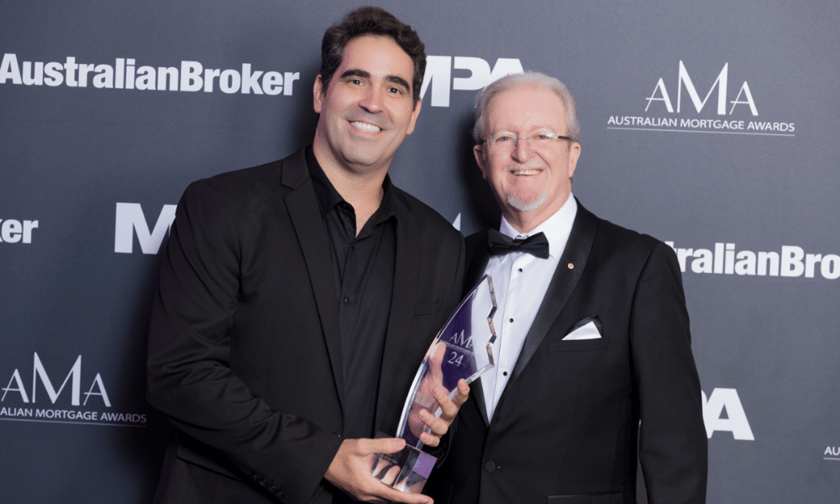

Group central to success at Australian Mortgage Awards

Capta Monetary founder Alvie Oliveira has put the success of his “strongly niched” residential brokerage enterprise right down to specializing in a consumer section the place “no one else wished to look”.

The enterprise additionally now helps its present consumer base when they’re shopping for their second, third and fourth properties, because of an Schooling Membership initiative supporting purchasers to improve their native property footprint.

Oliveira mentioned that, after arriving in Australia in 2016 and dealing at CANE Monetary, he discovered it arduous to interrupt into the well-established native market, regardless of robust finance expertise in America.

“Then I began educating these [new permanent residents and citizen] purchasers as to how this journey might happen, and attempting to make it just a little bit much less overseas to them,” Oliveira mentioned.

Launching in 2020, the only dealer enterprise is on monitor to write down between $130 million and $160 million throughout 2024, a year-on-year progress of between 15% and 20% in contrast with 2023.

Educating the consumer

Social media and digital advertising has been vital to Capta Monetary’s progress in Oliveira’s chosen area of interest, because the brokerage guides purchasers via the challenges of the native property market.

“There’s an extended journey for them, getting all of the PRs and citizenships prepared and whatnot,” Olveira mentioned. “We use social media channels to teach all of them till they’re prepared, in order that they really feel comfy as soon as they’re prepared to achieve out.”

The enterprise additionally manages a full calendar of webinars and seminars all year long.

“That is truly one thing I plan each December; we plan the whole yr by way of webinars and seminars. I’ve two extra seminars to do that month within the Gold Coast, as an example,” mentioned Oliveira.

“We cater for the whole Australia; with the ability to do a variety of these assembly on-line, it helps that, when purchasers unfold the phrase, we are able to help purchasers who’re primarily based just about in every single place.”

Capta Monetary has additionally made in search of and appearing on buyer suggestions a central a part of its enterprise, in an effort to repeatedly enhance the proposition it offers its purchasers over time.

“It’s about the place and the way we are able to do higher, what are the ache factors for the consumer?” Oliveira mentioned.

“Each single consumer will get surveyed, not solely as soon as the deal is over; we survey each single consumer that leaves, we survey each single pre-approval that doesn’t proceed. After each single rent we make or change in course of we do, we bear in mind the suggestions obtained.”

The suitable individuals

Oliveira, who has eight help employees, together with two primarily based within the Philippines, mentioned having a workforce behind him that “has a voice” was additionally a key side of the brokerage’s success.

“It’s widespread within the trade to be a one-man-band, however having a workforce behind you that may have their suggestions listened to and applied is one thing we’re actually pleased with.”

Oliveira mentioned two key senior roles within the enterprise – an operations supervisor and a buyer help supervisor – had “actually helped” the enterprise on its progress trajectory in recent times.

“I wasn’t anticipating to win [at the AMAs], we’d have been completely satisfied to be finalists. The fellows that there have been finalists have actually profitable companies, so this actually did humble us,” Oliveira mentioned.

Associated Tales

Sustain with the newest information and occasions

Be a part of our mailing listing, it’s free!