Wealthsimple was based again in 2014 by Michael Katchen, Brett Huneycutt and Rudy Adler. I gotta say that I actually preferred the corporate extra in its first few years than in its present iteration.

For the primary 5 years of its existence, Wealthsimple was solely centered on the product that’s now generally known as Wealthsimple Managed Investing. Some individuals referred to as this a “robo advisor,” others referred to as it a “automated wealth supervisor” – no matter you wished to name it, Wealthsimple’s first creation did the next:

- Took your cash and effectively invested in a portfolio of passively-managed index ETFs.

- Snagged little or no of your cash in comparison with Canada’s mutual fund business.

- Gave buyers an insanely-easy method of getting began in investing – and staying dedicated by means of an automatic contribution each month.

These three bullet factors sound easy – however they’re not.

And they’re massively consequential for the common investor!

You possibly can learn extra about what robo advisors are and what they do in our total have a look at Canada’s Finest Robo Advisors.

The issues began to come back as increasingly more of Wealthsimple’s shares had been bought to giant Canadian monetary firms. After which – shock, shock – these firms determined that they wished to make some huge cash on their funding.

That quest for extra revenue wasn’t going to come back from the low-fee world of robo advisors. So, they shuffled robo advising to the aspect (calling it “Wealthsimple Managed Investing”) after which they began specializing in flashier stuff like crypto buying and selling, non-public credit score, non-public fairness, and together with treasured steel investments of their portfolios. As they took their eye off the ball, they made some poor funding selections, and have always tinkered with the make-up of their portfolios (as outlined by Ben Felix within the Globe and Mail).

Of their quest for extra revenue they’ve strayed fairly removed from their unique give attention to their robo advising platform.

Oh – they usually additionally launched huge costly enlargement plans within the UK and USA… earlier than admitting failure and collapsing these operations.

Is Wealthsimple as Protected?

Sure – Wealthsimple is secure, and its safety towards fraud and cyber assaults are as strong as any financial institution, robo advisor, or brokerage in Canada.

Clearly, as an internet monetary service firm Wealthsimple takes security and safety extraordinarily critically.

Wealthsimple makes use of Transport Layer Safety (TLS) encryption. TLS is the successor to Safe Sockets Layer (SSL) encryption and is broadly considered the gold normal for securing knowledge transmitted over the web. TLS encryption works by establishing a safe, encrypted connection between the person’s machine and Wealthsimple’s servers. Because of this any info despatched out of your machine to Wealthsimple, equivalent to private particulars, login credentials, and monetary transactions, is encrypted throughout transit. Even when intercepted, this knowledge can be extraordinarily troublesome for unauthorized events to decrypt and perceive.

With options like two-factor authentication (2FA), the platform provides an additional layer of protection, making it exponentially tougher for undesirable friends to entry your account. It’s like having a double-locked door the place the second key modifications each time you wish to enter. Furthermore, Wealthsimple’s vigilance towards fraud extends to fixed monitoring and verification of transactions.

Along with these layers of Cybersecurity, Wealthsimple Make investments buyer accounts are additionally protected by the Canadian Investor Safety Fund as much as $1 million.

For those who’re anxious concerning the firm as an entire you’ll be able to relaxation simple figuring out:

- Wealthsimple is owned by Energy Company of Canada (one of many largest firms in Canada).

- Your property are saved separate from Wealthsimple’s financial institution sheet. In different phrases, even when one way or the other, a way, Wealthsimple wished to take your property for their very own use, that’s not potential.

- Lastly, Wealthsimple falls below the purview of the Funding Trade Regulatory Group of Canada (IIROC), making certain they play by the principles (even when these guidelines might in all probability be made a bit higher).

Wealthsimple Investing Efficiency

A robo advisor service is one which basically does the entire investing legwork give you the results you want utilizing the experience of its group. It’s a purely passive funding technique that you just received’t need to spend any time in any respect managing. Some discuss with this as “sofa potato” investing.

Lively investing, however, means that you’d be the one shopping for, promoting, rebalancing and managing all of it. Inventory choosing for instance would match below the definition of lively administration.

If you’d like a extra in-depth clarification of how robo advisors make investments try our important robo advisor article.

Now, whereas Wealthsimple has said that they comply with a passive funding technique, they’ve always tinkered with their portfolios through the years (which isn’t passive in any respect). They’ve made a number of huge errors, which has price their buyers, and led to them having by far the worst funding returns with regards to Canada’s robos. These errors had been detailed within the Globe and Mail. They embrace:

- Having an enormous publicity to long-duration bonds (which obtained crushed the final three years).

- Utilizing difficult ETFs specializing in unique issues like low-volatility and issue investing (versus primary index ETFs).

- Utilizing gold publicity in ETFs (gold isn’t a superb long-term funding).

All of those errors had been considerably preventable, as evidenced by the actual fact different robo advisors had a lot better (and extra easy) asset allocation methods. Right here’s a comparability of the Wealthsimple funding returns in comparison with our #1 robo advisor at Justwealth over a 5 12 months interval.

| Portfolio Kind | Justwealth | Wealthsimple |

| Average | 5.18% | 1.20% |

| Balanced | 6.95% | 3.60% |

| Aggressive | 7.66% | 5.70% |

Wealthsimple Monetary Advisors

Wealthsimple is a portfolio supervisor, and consequently has a authorized fiduciary responsibility to give you monetary recommendation that’s in your finest curiosity (even whether it is counter to their industrial curiosity). This reality places them one up on financial institution and credit score union advisors.

The Wealthsimple web site says which you can e-mail questions at any time, and I’ve heard various first hand accounts of how good that service is. Some persons are very proud of the recommendation they get on particular questions, whereas others felt it left rather a lot to be desired. The corporate’s 1.5/5 star ranking on TurstPilot.com exhibits that there’s a lot to be desired with regards to the corporate’s customer support.

When you attain $100,000 in property and will be moved to the “Wealthsimple Premium” class you get entry to “monetary check-ins with an advisor.” When you get to the $500,000 mark you turn into a “Wealthsimple Era” member, and at that time you get a devoted monetary advisor.

Notably, CI Direct and Justwealth give you devoted monetary advisors proper from the primary day you open an account with them.

Wealthsimple Make investments Accounts

Wealthsimple make investments affords Canadians the power to simply put cash into the next varieties of accounts:

- RRSP

- TFSA

- RESP

- RRIF

- LIRA

- Private

- Joint

- Company

- Money Financial savings

- Joint Financial savings

Regardless of the dimensions of your account, you’ll obtain a free portfolio overview of any non-Wealthsimple brokerage accounts, reap the advantages of automated tax-loss harvesting (which aids in minimizing your tax legal responsibility), entry to fractional share investing, choices for making Socially Accountable Investments (SRIs), protection of as much as $150 in switch charges for transfers over $5,000 to your Wealthsimple account from one other funding account, and free cash saving instruments.

Wealthsimple Core vs Premium vs Era

As you’ll be able to see under, Wealthsimple Make investments locations you into considered one of three tiers – Core, Premium, Era – primarily based on the amount of cash that you just make investments with them.

| Function/Service | Core | Premium | Era |

| Property Required | $1+ | $100,000+ | $500,000+ |

| Administration Charges | 0.5% | 0.4% | 0.4% |

| Money Account Curiosity | 4% | 4.5% | 5% |

| Choices Buying and selling Payment | $2 USD/contract | $0.75 USD/contract | $0.75 USD/contract |

| Crypto Buying and selling Payment | 2% | 1% | 0.5% |

| Monetary Recommendation | – | Monetary check-ins | Devoted monetary advisor |

| USD Accounts | – | Included | Included |

Wealthsimple Core

With Wealthsimple Core, you solely want $1 to begin, making it good for newbies. Your Core account will get you a customized portfolio primarily based in your responses to the preliminary evaluation you’ll participate in whenever you enroll. After you select your portfolio, you’ll be able to actually set it and neglect it with auto-investing. Wealthsimple will maintain the rebalancing, tax-loss harvesting, and dividend reinvestment too.

Don’t fear, they received’t go away you hanging when you have questions or need extra recommendation as you go alongside, as you should have entry to skilled monetary recommendation whenever you want it. You’ll get all of those options at a low 0.5% administration payment.

Wealthsimple Premium

When your account reaches $100,000, you’ll transfer up into Wealthsimple Premium, which provides you every part the Core tier has and extra. The nice factor is, you received’t need to pay extra to get the extras Premium affords, in reality, you’ll pay much less at 0.4% in administration charges.

At this degree, you’ll be able to actually begin to maximize your tax effectivity with tax-efficient funds along with tax-loss harvesting. You’ll additionally obtain a free session with an skilled monetary planner, serving to you to create the funding technique that’s best for you.

On high of that, you’ll get 15% off Property planning with Willful, so you’ll be able to relaxation assured that your cash will go the place you need it to, it doesn’t matter what occurs. For those who dwell in Ontario, you’ll additionally get a free 6 months of free well being and wellness companies with Medcan.

Wealthsimple Era

With the highest tier account, Wealthsimple Era, account holders which have $500,000 or extra of their account will get the gold normal when it comes to options supplied at a low 0.4% administration payment. Traders with over $10 million in property can entry an additional decreased payment of 0.2%

Era options embrace a devoted group of monetary advisors which are solely an e-mail away, a private monetary report that breaks down your funding technique and the potential rewards it might reap, personalised portfolios with bespoke asset allocations that maximize tax financial savings, and 15% off property planning with Willful. Ontario residents can even obtain 50% off Medcan’s Complete Care Plan.

Further Wealthsimple Options

Wealthsimple is a one cease monetary store. Along with low-cost robo advisor companies, Wealthsimple additionally affords free buying and selling on its platform Wealthsimple Commerce for DIY buyers, in addition to Wealthsimple Crypto for these eager on getting their foot into the cryptocurrency sport.

For these searching for extra conventional cash administration instruments, Wealthsimple additionally affords Wealthsimple Money account, a excessive curiosity financial savings account presently providing an eye-popping 4% rate of interest (greater for Premium and Era shoppers) in addition to 1% cashback on their related prepayment card.

Wealthsimple Charges

As talked about above, the account charges depend upon what degree of account you will have, in addition to the kind of portfolio you find yourself with. Take a look at the important thing information under.

- Core, holding as much as $99,999: 0.5%

- Premium, holding greater than $100,000: 0.4%

- Era, holding above $500,000: 0.4% (0.2% for buyers with over $10M in property)

For those who resolve to go the robo advisor route, which is certainly a clever alternative, there will likely be extra charges for every of the ETFs in your portfolio. The charges come within the type of MERs, or Administration Expense Ratios. These charges are once more simple and really low.

- Common ETF MERs: Roughly 0.12-0.15% yearly

- Socially Accountable Investing (SRI) MERs: 0.21-0.23% yearly

Wealthsimple Portfolio Choices

Wealthsimple Make investments has three portfolio choices. Inside these three portfolios – referred to as: Conservative, Balanced, and Progress – your cash will really be put into a number of ETFs. There are additionally Halal and SRI portfolios, which can focus on in only a second.

For now, we’ll have a look at the three important varieties of portfolios and the way they’ve carried out since inception.

Conservative Portfolio

With Wealthsimple’s Conservative Portfolio, your portfolio will likely be made up of roughly 35% equities and 62.50% bonds – with 2.50% gold allocation tossed in as nicely. This implies you’ll be considerably shielded from market volatility, however will probably expertise slower progress. It is a sensible choice when you have a really low danger tolerance.

This portfolio has grown at a median annualized return of 1.20% since its inception on January 1st, 2016.

Balanced Portfolio

Wealthsimple Make investments’s Balanced Portfolio is designed for each security towards volatility whereas offering a higher alternative for progress. This portfolio is made up of 60% equities, 37% bonds, and three% gold. That is appropriate for buyers with a medium danger tolerance.

This portfolio has grown at a median annualized return of three.60% since its inception on January 1st, 2016.

Progress Portfolio

With Wealthsimple’s progress portfolio, the asset allocation closely favors equities. The portfolio is made up of 80% equities, 17.5% bonds, and three% gold. As there’ll probably be extra market volatility skilled by buyers on this portfolio, that is finest suited to the investor with the next danger tolerance, in addition to an extended time horizon.

This portfolio has grown at a median annualized return of 5.70% since its inception on January 1st, 2016.

Wealthsimple Socially Accountable and Halal Investing

Traders can also have an interest to know that Wealthsimple affords Socially Accountable Investing (SRI) as nicely. Socially accountable investing is changing into increasingly more common lately, particularly amongst millennials.

To make clear, socially accountable investing is a kind of investing that means that you can put your cash in the direction of firms and companies that align together with your environmental and social values. A Wealthsimple SRI portfolio will embrace Wealthsimple’s personal socially accountable ETFs:

- WSRI (US and Canadian shares)

- WSRD (European, Asian, and Australian shares)

- WSGB (Inexperienced and social bonds that present mounted earnings whereas funding tasks that additional social and environmental causes)

In addition to BMO’s Lengthy Federal Bond Index ETF (ZFL) and the SPDR Gold Minishares Belief ETF (GLDM).

on high of socially accountable investing, Wealthsimple additionally affords Halal Investing. This portfolio is optimized for efficiency by utilizing firms that align with Islamic legislation. This implies no companies that revenue from playing, weapons, tobacco, or different restricted industries.

Moreover, the sort of investing won’t embrace any companies that acquire a major share of their earnings from curiosity on loans. All investments are screened by a gaggle of Shariah students to make sure that they’re as much as the anticipated requirements.

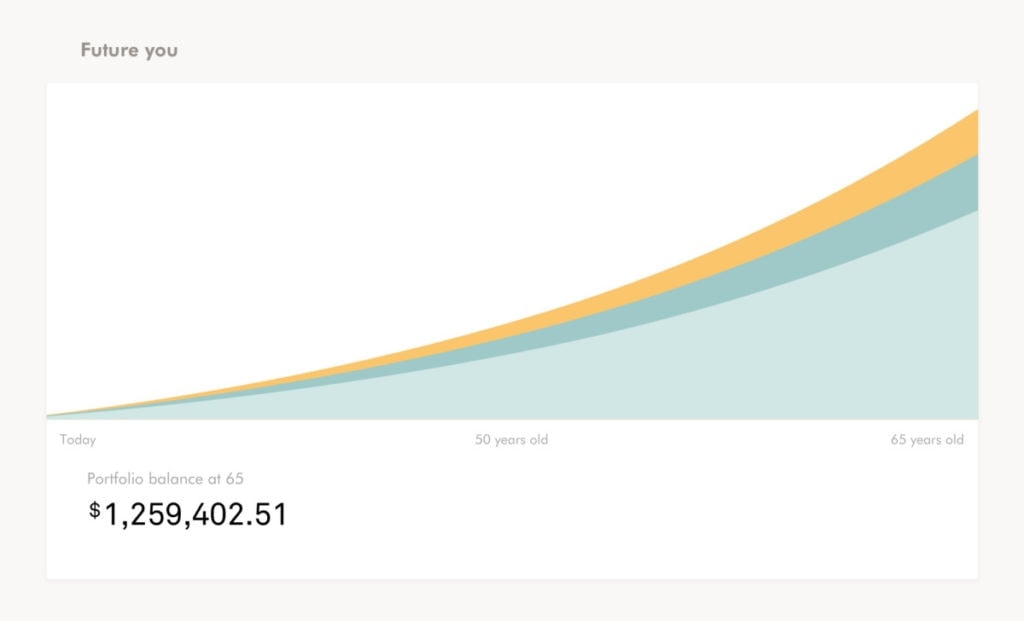

Wealthsimple RRSP Accounts and TFSA Accounts

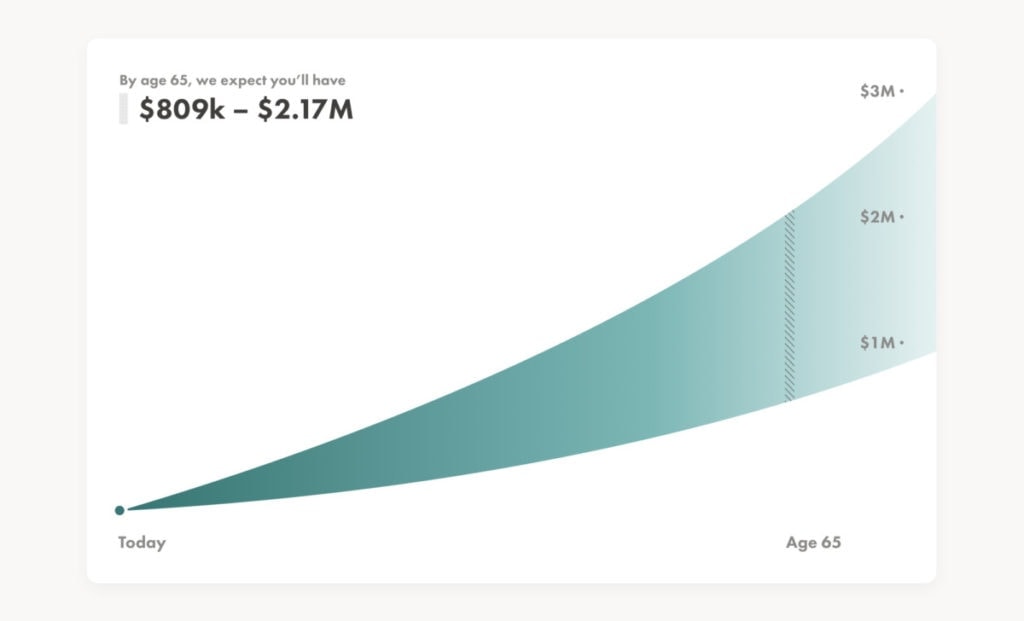

Most Canadians are simply searching for the best approach to make investments cash inside a registered account. It’s extremely easy to open a Wealthsimple RRSP, TFSA, or RESP account. It may be executed fully on-line, is sort of on the spot, and after hooking up your chequing or financial savings account, you’ll be able to conveniently arrange an automated contribution that places your financial savings on autopilot.

No extra worrying about RRSP season and final minute funding selections. Only a secure, easy, confirmed funding technique which you can set and neglect about till you’re able to make a large-scale change. Whereas Wealthsimple clearly affords all kinds of accounts, these three registered accounts characterize the overall investing exercise for a lot of Canadians, and are a important focus for Wealthsimple.

In case you have any questions on how the Wealthsimple RRSP or TFSA work, their on-line chat function (or their old-fashioned cellphone help) will be capable to effectively reply any questions you may need about the place to contribute or how you can use the platform.

About the one questions their first line of help may wrestle with is in-depth area of interest subject assist for one thing like funding trusts. (For those who don’t know what an funding belief is, don’t be alarmed – it’s most unlikely that you just’ll ever must.)

Wealthsimple Consumer Expertise

To get began with Wealthsimple you’ll be able to have an internet, e-mail, or cellphone dialogue with an advisor to debate what they suppose is the best choice for you bearing in mind your objectives and danger tolerance.

Don’t be afraid to ask questions, keep in mind that the Wealthsimple consultant you’re chatting with is an advisor and whereas they might not be capable to reply every part off their head (primarily when it comes right down to the extra detailed, advanced questions), they may reply your questions together with your finest pursuits at hand.

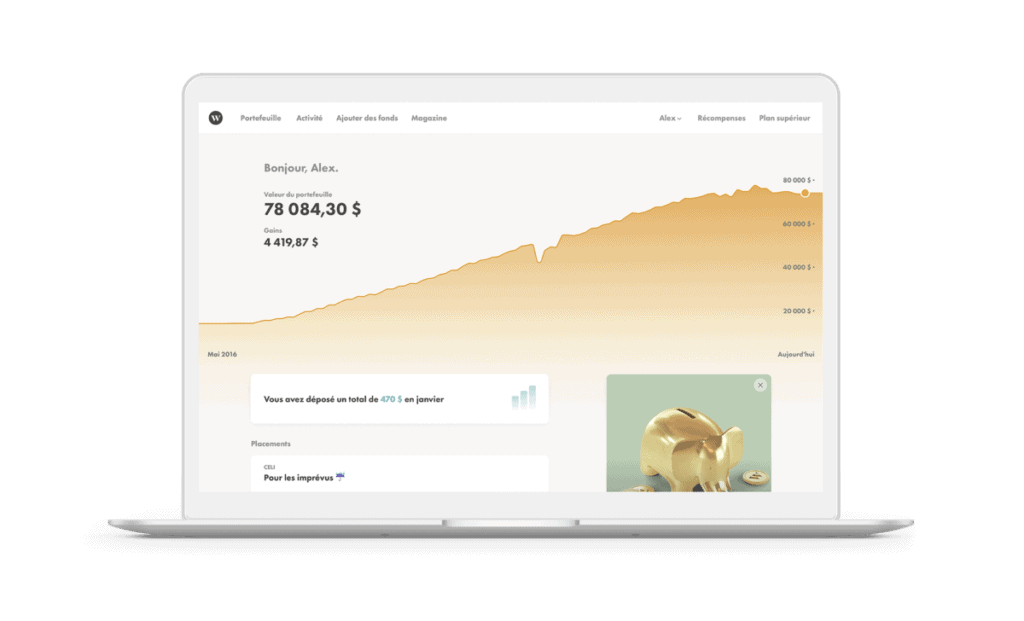

After getting began, you’ll be able to execute every part by means of their website or by means of the Wealthsimple cell app.

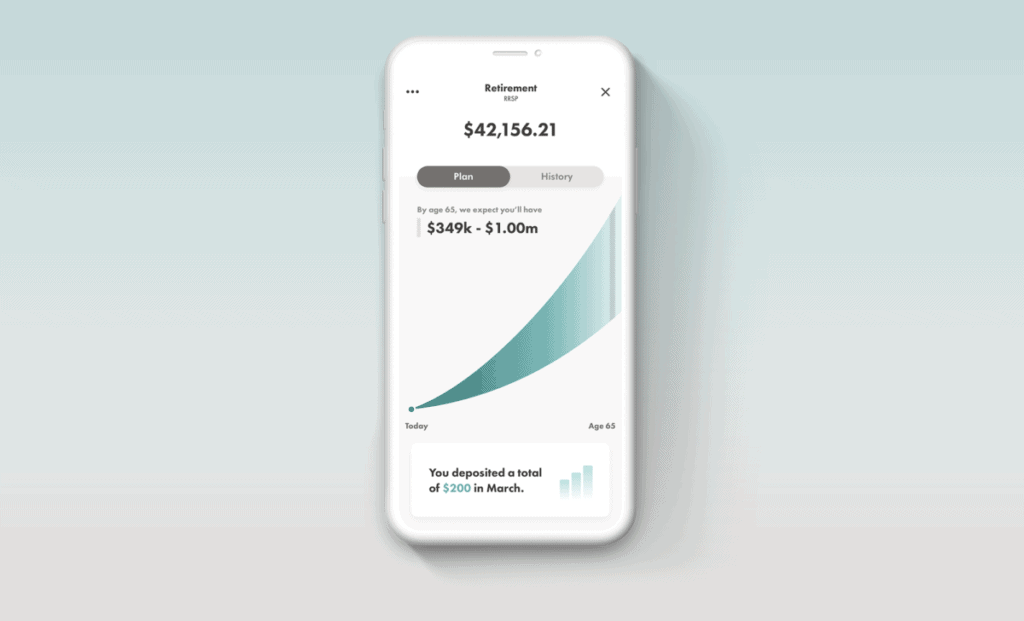

Wealthsimple Cell App

Talking of the Wealthsimple App, it’s really fairly superb. Launched in December of 2014, it was the primary app of its variety; an app designed with the precise purpose of constructing investing simpler.

In 2019, Wealthsimple launched a separate Commerce app for self-directed buying and selling, however in 2022 they mixed their Make investments and Commerce apps right into a single Wealthsimple app but once more. (Need to know the variations between Wealthsimple Commerce and Wealthsimple Make investments? we’ve obtained all the small print on our Wealthsimple Commerce Overview if you’re eager to study extra about how they evaluate.)

Wealthsimple describes their app as having a ‘monetary advisor in your pocket’. The app means that you can get in contact together with your wealth concierge on the faucet of a finger, plus you’ll be able to simply add funds, keep watch over your asset allocation, and look at your efficiency.

On high of making a simple and streamlined app, Wealthsimple additionally prioritizes privateness of their app. They go above the easy ‘create a password’ and permit customers to make use of both a biometric login like FaceID or TouchID or set a singular 4 digit passcode (for iPhone) or lock sample (for Android).

At present the Wealthsimple app is rated a 4.5 on the Google Play retailer and a 4.6 on the Apple App retailer. Wealthsimple is continually updating their app to attempt to enhance performance, which is nice, however as with most apps, it might typically get buggy in consequence.

How To Signal Up With Wealthsimple?

Similar to the identify signifies, signing up for an account on Wealthsimple is…easy. In only a few minutes, you’ll be arrange, logged in, and able to begin constructing your funding fund.

First, be sure to qualify for a Wealthsimple Make investments account (should be a Canadian citizen, Canadian resident, or have a Canadian visa, meet the age necessities of your province, and so on.). For those who meet the necessities, head over to the enroll web page and fill within the required info.

As soon as you’re logged in, you’ll present a couple of extra private particulars in addition to full a questionnaire so your robo advisors can perceive what portfolio allocation can be finest for you.

As soon as your plan of motion has been chosen, you’ll want to decide on the account sort, registered, non-registered, or switch from one other account.

Lastly, you’ll select whether or not or to not arrange automated contributions.

That’s it! You may make your first buy and begin seeing your wealth develop.

Is Wealthsimple the Finest Robo Advisor? Our Professional Comparability

We’re positively spoilt for alternative with regards to deciding on on-line brokerages, and even robo-advisor companies, so it’s actually necessary that we perceive what makes each distinctive. Listed here are a few of Wealthsimple’s distinct promoting factors which are positively price contemplating when making the selection that’s finest for you and your scenario.

- Wealthsimple’s enroll and portfolio creation course of is complete but fast. You possibly can set your danger tolerance proper off the bat, making certain the asset combine is simply best for you.

- You received’t pay buying and selling charges, solely low administration charges.

- There’s no account minimal.

- Wealthsimple affords a spread of socially accountable and Halal portfolios.

- Wealthsimple’s superior know-how mixed with its monetary specialists makes it one of the crucial respected robo advisor companies within the sport.

- Wealthsimple makes investing tremendous simple, so you’ll be able to principally set it and neglect it.

- Automated rebalancing is an enormous plus. You received’t have to fret about shopping for and promoting to ensure your portfolio has a wholesome stability of holdings. It’s all executed for you.

By now you’re nicely conscious of the numerous advantages of utilizing Wealthsimple as your robo advisor, however no nice overview can be full with out a comparability chart. Let’s see how Wealthsimple stands as much as the perfect Robo advisor in Canada – Justwealth:

|

|

|

|

Variety of Portfolios Accessible |

Over 80 totally different portfolios engineered to both develop your wealth, generate earnings, or protect wealth. |

3 normal portfolios, plus SRI and Halal choices. |

|

Customized Monetary Advisor |

||

|

5-year returns (balanced portfolio) |

||

|

$5,000 (With exceptions for RESP and FHSA accounts) |

||

|

$100-$500 On the spot Money Again |

||

You possibly can click on on the hyperlinks within the chart above to learn our detailed critiques of Wealthsimple’s important opponents, or go to our greatest Canadian robo advisors web page for a extra in-depth comparability and see why we rank Wealthsimple on the high.

Wealthsimple Overview – FAQ

Wealthsimple Overview: Abstract

First it was simply “Wealthsimple” – the entire firm was a robo advisor.

Then it was “Wealthsimple Make investments” – and the main target shifted.

Now it’s “Wealthsimple Managed Investing” – and it’s clearly changing into an afterthought for the corporate.

Gone are the times of straightforward, simple worth proposition centered round index investing. Now it’s all about cross-selling crypto, getting payment-for-order circulation by means of their low cost brokerage account, attempting to promote you a mortgage, and so on.

It’s fairly clear that chasing income has radically modified the corporate. Wealthsimple is susceptible to changing into a mediocre jack-of-all-trades, grasp of none.

If you’d like a greater robo advisor, I’d try our Justwealth Overview. If you’d like a greater DIY on-line brokerage, see our Qtrade Overview. Wealthsimple remains to be the perfect at creating lovely web sites, glorious advertising campaigns, and easy-to-navigate apps. I feel Wealthsimple Tax provides worth to the platform.

However the brand new give attention to including bizarre property like gold, non-public credit score, non-public fairness, and particularly cryptocurrency – have actually undercut the unique promise the corporate had. The asset allocation points of their managed portfolio are just too huge a difficulty to disregard, and consequently they’ve slid down our Canadian robo advisor listing.