The transient’s key findings are:

- Instructor pension prices have doubled as a share of payroll since 2001, elevating issues about managing this burden amid different training spending wants.

- Whereas faculty districts rely closely on state assist, comparatively little is thought about state funding for instructor pensions particularly.

- Strikingly, about two-thirds of states explicitly present funds for instructor pensions, with 15 of those states paying the complete price on behalf of colleges.

- The remaining third of states implicitly assist with pensions by means of primary state help to varsities, however this help appears to have fallen considerably behind rising prices.

Introduction

Many who’re aware of state and native authorities funds are involved that rising pension contributions may very well be crowding out vital authorities companies. And, some educational literature does discover that larger pension contributions are related to decreased employment in native governments and college districts. The difficulty is especially acute for college districts, which should preserve a comparatively massive workforce in comparison with different authorities items.

Importantly, faculty districts are completely different from different native authorities entities in that a good portion of their prices are lined by transfers from state authorities. So, because the employer portion of instructor pension prices has risen from about 8 p.c of payrolls in 2001 to nearly 20 p.c immediately, discussions in regards to the function of states in funding academics’ pensions have grown extra frequent. To assist inform the discourse, this brief primer investigates how, and the way a lot, states contribute to instructor pensions.

This primer has 4 sections. The primary part focuses on states that present specific assist for some portion of instructor retirement advantages – describing the assorted varieties of preparations, in addition to the dimensions and scope of the funding. The second part focuses on the remaining states – right here, the college districts are anticipated to pay for nearly all of instructor retirement prices, however the states implicitly assist some portion of those prices by means of common state-aid applications. The third part paperwork important modifications made by states since 2001. The ultimate part concludes that about two-thirds of states explicitly assist some portion of instructor pension prices, with 15 of those states paying the complete price of instructor pensions. The remaining third of states implicitly assist with pensions by means of the state-aid course of, however this assist appears to have fallen considerably behind precise prices.

Which States Explicitly Fund Instructor Pensions?

Only a few research have explored the function of states in funding instructor retirement prices. And, sadly, every of those research presents a considerably completely different pattern of states that explicitly fund instructor pensions and excludes some key particulars on every state’s funding association. So, to higher perceive the state of affairs, the CRR reviewed the present research, pored over present state statutes on pension funding and college finance, and skim the monetary reviews of all of the state and native retirement programs that present retirement advantages to academics. Under is a abstract of the findings.

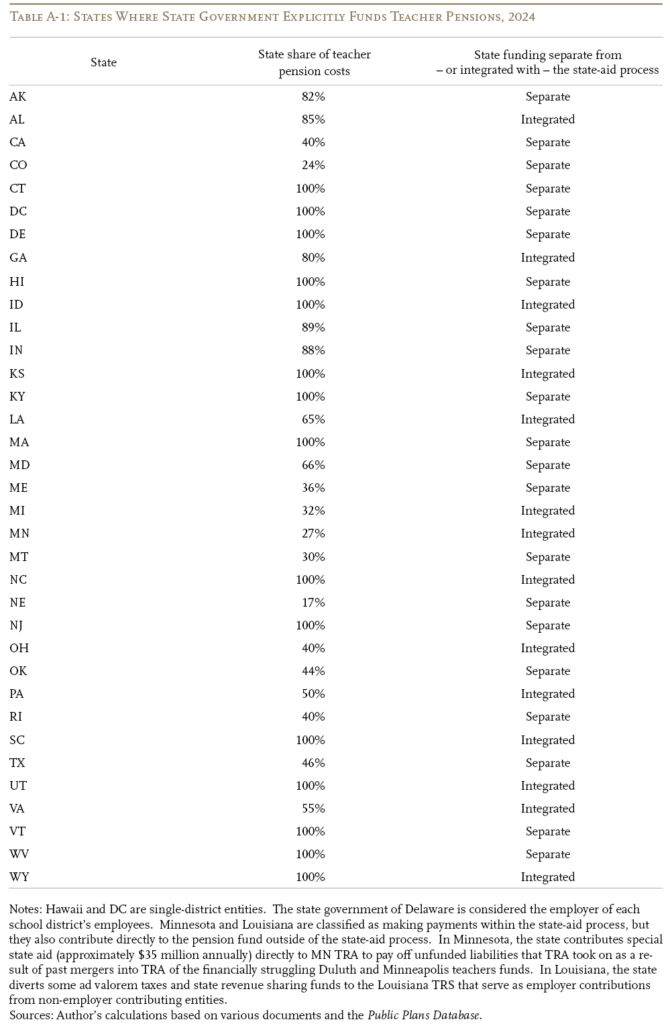

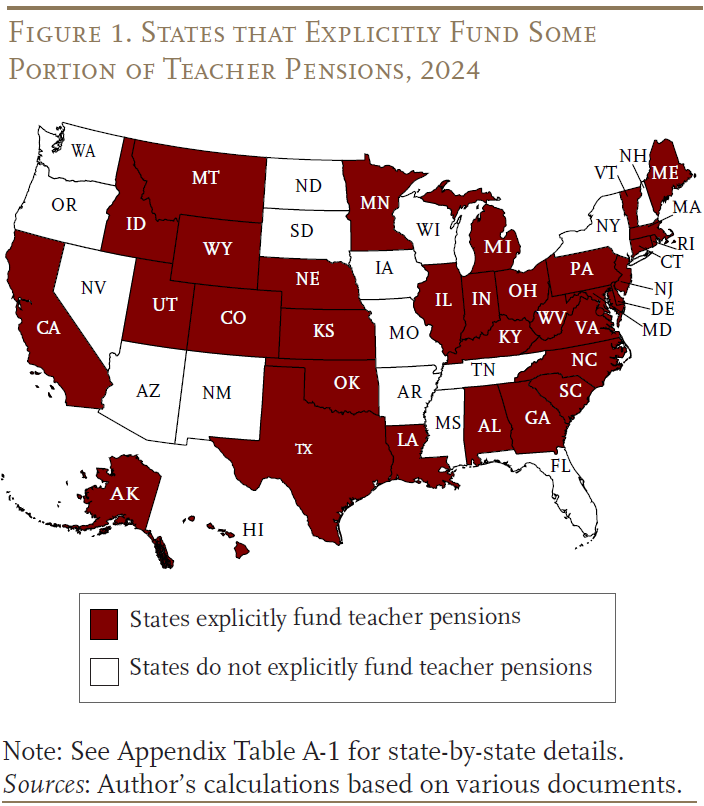

As of June 2024, 35 states (together with DC) explicitly present funds for some portion of the retirement advantages promised to high school district academics (see Determine 1). Whereas most states cowl academics by means of a state-run plan, a number of even have regionally run plans for academics. General, then, states explicitly present some extent of normal funding for 39 separate instructor pension plans.

To raised perceive the nuances of every state’s funding association and the way it may affect in-state discourse on instructor pension prices, it’s useful to take a look at two features of every state’s coverage. The primary is the quantity of funding that the state supplies for instructor pension prices – that’s, whether or not a state funds all the prices or reasonably contributes a selected portion, such because the funds to amortize the unfunded legal responsibility. The second facet is the pathway by means of which the state supplies the funds – that’s, whether or not it’s completely separate from the state-aid course of or considerably built-in.

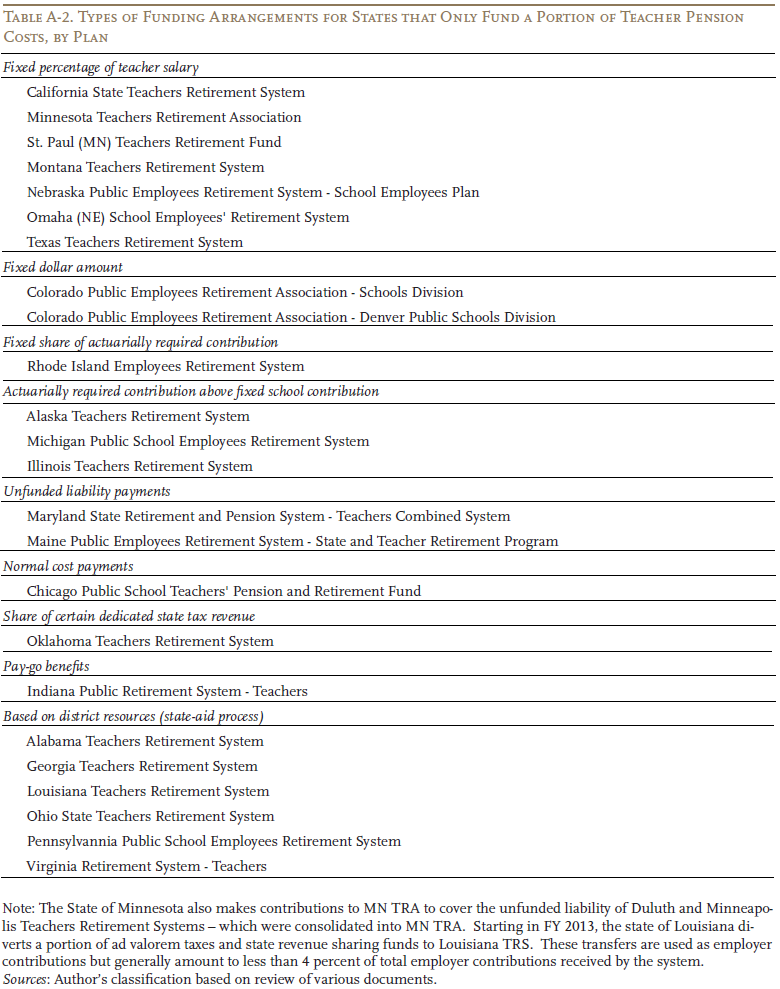

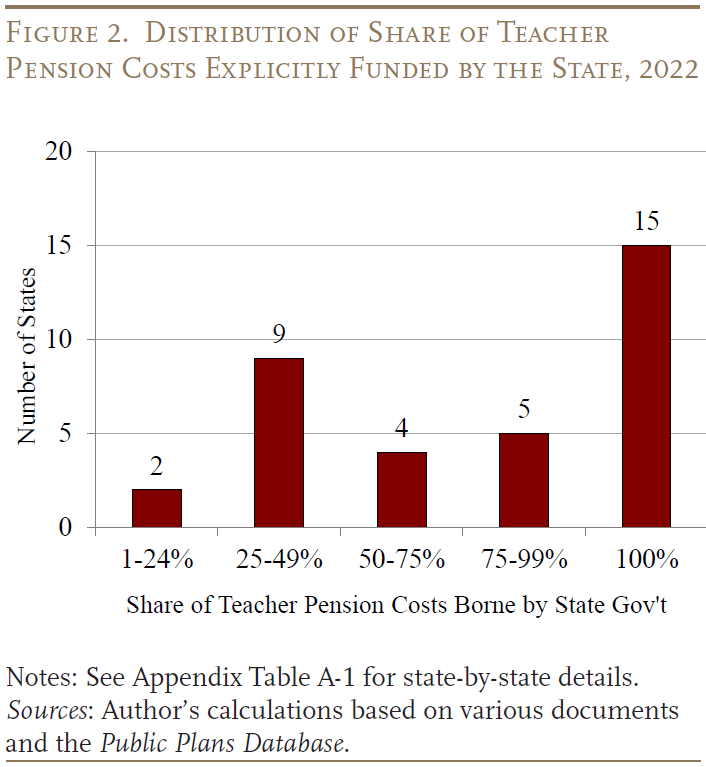

At present, 15 states (15 plans) explicitly fund nearly all instructor pension prices; and 20 states (24 plans) present funds for a portion of prices. Utilizing the main points from paperwork describing the funding preparations for every state and information from the Public Plans Database, Determine 2 reveals that – among the many states offering funds for a portion of the prices – 11 of 20 pay lower than half.

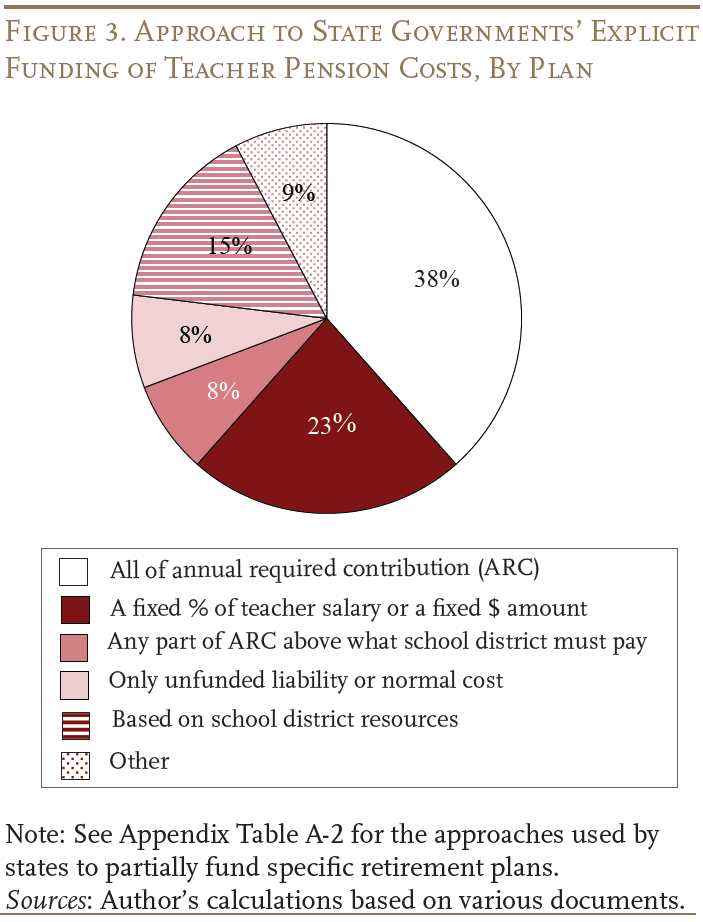

States use varied approaches to find out their funds. The most typical method – overlaying 38 p.c of instructor pension plans – is for states to pay the entire annual required contribution (ARC) (see Determine 3). In circumstances the place the state doesn’t pay the complete ARC, probably the most frequent coverage – overlaying 23 p.c of plans – is to pay a hard and fast proportion of wage or a hard and fast greenback quantity.

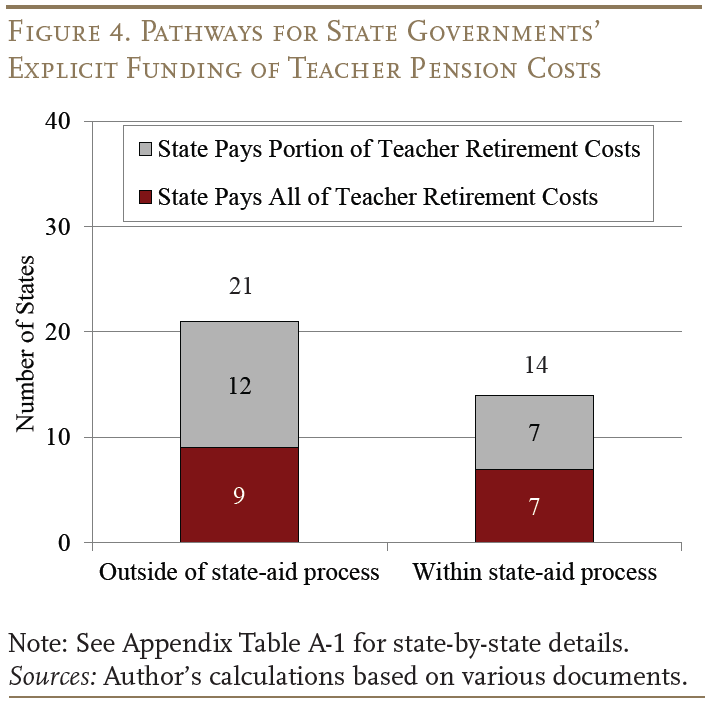

Lastly, Determine 4 reveals that 21 of the states that explicitly fund instructor retirement advantages select to switch cash on to the pension fund, absolutely separate from the state help course of, whereas 14 states combine their funding of instructor pensions with the state-aid course of. The method taken right here could matter due to its potential affect on faculty district decision-making. If states ship cash on to the pension fund, it bypasses the college district, making the funding much less seen to key stakeholders on the school-district stage. If states as an alternative combine funding for pensions by means of the state-aid course of, then faculty district decision-makers could also be extra acutely aware of pension prices.

States Implicitly Serving to Via Common State Assist

Importantly, even the college districts within the states with out specific funding implicitly obtain assist with their pension prices by means of the availability of common state training help. At a excessive stage, state help offered to high school districts is a operate of two elements. The primary element is the state’s estimate of the whole price to offer college students satisfactory primary training – sometimes called the “basis quantity.” The second element is the state’s estimate of every faculty district’s capability to pay for primary training from its personal fiscal sources. On the whole, state help to high school districts is supposed to assist districts that can’t assist the prices of satisfactory primary training by means of their very own sources. The important thing query for this primer is to what extent states’ estimates for the price of primary training incorporate the rise in pension prices over the previous 20 years.

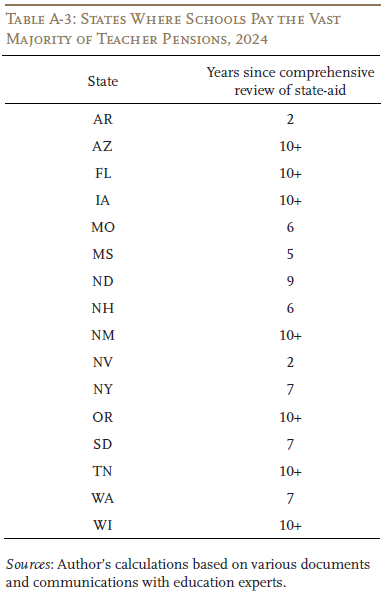

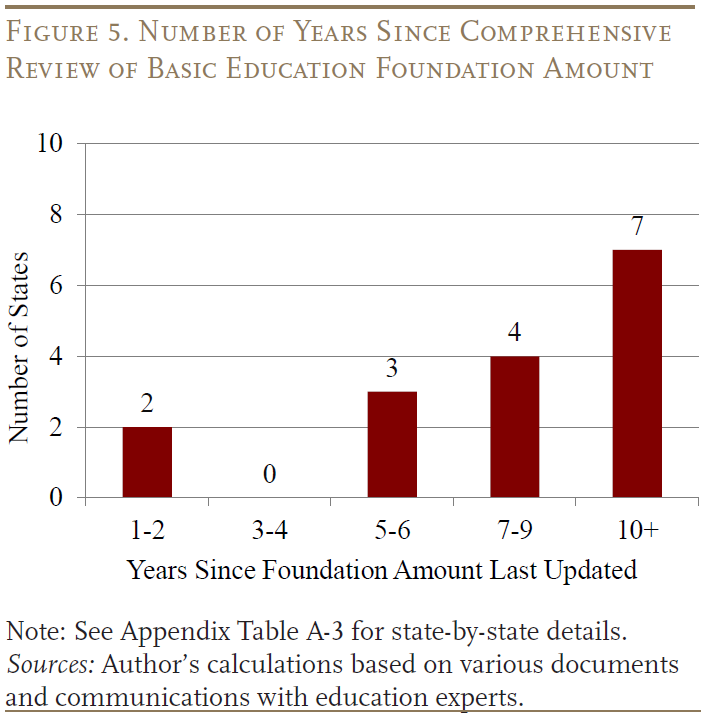

To raised perceive states’ processes for figuring out the price of primary training and the way which may affect faculty districts during times of rising pension prices, the CRR reviewed coverage briefs by training finance consultants, educational papers, and state laws on training funding. The evaluation revealed two vital info. The primary is that the price of primary training in lots of states is meant – in idea – to incorporate faculty district pension prices. The second is that states’ estimated prices of primary training are solely intermittently up to date to account for precise modifications in class district prices. As a substitute, fastidiously derived estimates of primary training prices are usually elevated by inflation for a number of years till it’s decided that one other complete evaluation is required. Certainly, as of June 2024, 7 of the 16 states the place faculties are chargeable for the lion’s share of instructor pension prices had not comprehensively reassessed the adequacy of their state help for over 10 years (see Determine 5).

For college districts chargeable for a big portion of instructor pension prices, the affect of a considerably delayed adjustment might be significant. For instance, instructor pension prices have risen from about 8 to twenty p.c of payroll from 2001 to 2024. If state help was designed to assist roughly 50 p.c of common faculty district prices (together with pension contributions) in 2001, a typical inflation adjustment of three p.c would have resulted in primary training prices that cowl solely about 40 p.c of college district pension prices in 2024.

How Has Coverage Modified Over Time?

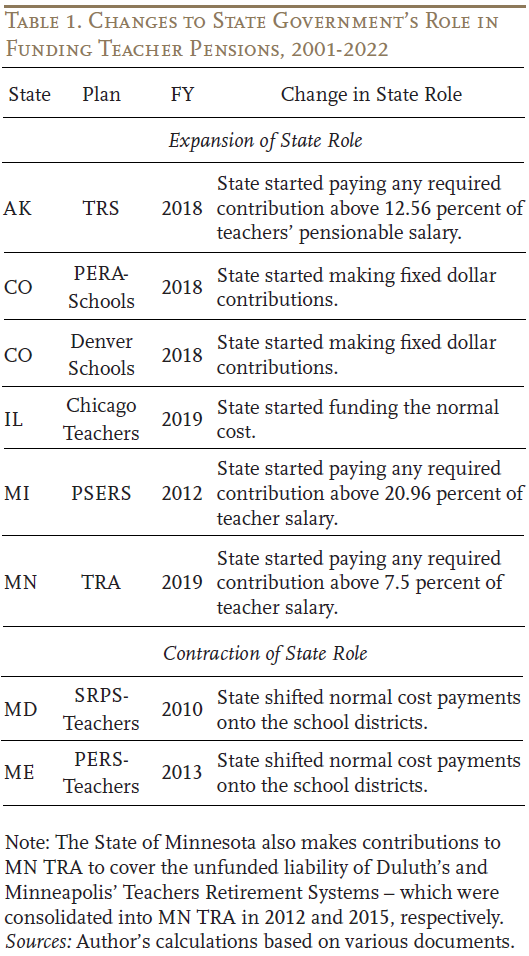

Normally, the state’s function in funding instructor pensions has modified comparatively little since pension prices have been at their lowest level previously 20 years. That mentioned, a number of notable shifts have occurred. Desk 1 particulars the significant modifications made in seven states since 2001. 5 of the states shifted from no state involvement to some type of specific state funding. However, curiously, two states decreased the state’s function by shifting a significant portion of prices onto faculty districts.

Conclusion

College districts are completely different from different native authorities entities in that a good portion of their general expenditures are associated to personnel prices; they usually rely closely on state authorities transfers for income. So, as instructor pension prices have risen from about 8 p.c of payrolls in 2001 to nearly 20 p.c immediately, discussions over tips on how to handle these prices – and the potential function of state authorities – have grown extra pressing. To assist inform the discourse, this brief primer investigated the present function of states within the funding of instructor retirement advantages. It discovered 35 states at present present some specific assist for instructor pensions, with 5 states starting to take action comparatively lately. Importantly, solely 15 of those states pay for all of the instructor pension prices on behalf of college districts. And, within the circumstances the place state governments don’t present specific assist for instructor retirement advantages, it looks like the training state help course of has fallen considerably behind the rise in pension prices.

References

Anzia, Sarah F. 2019. “Pensions within the Trenches: How Pension Spending is Affecting US Native Authorities.” City Affairs Evaluate.

Costrell, Robert M., Collin Hitt, and James V. Shuls. 2019. “A $19-Billion Blind Spot: State Pension Spending.” Instructional Researcher.

Eide, Stephen D. 2015. “California Crowd-out: How Rising Retirement Profit Prices Threaten Municipal Providers (Civic Report No.98).” New York, NY: Manhattan Institute.

Griffith, Michael. 2012. “Understanding State College Funding.” The Progress of Schooling Reform. Vol 13(3). Denver, CO: The Schooling Fee of the States.

Kim, Dongwoo, Cory Koedel., and P. Brett Xiang. 2021. “The Commerce-off between Pension Prices and Wage Expenditures within the Public Sector.” Journal of Pension Economics & Finance 20(1): 151–168.

Nation, Joe 2017. “Pension Math: Public Pension Spending and Service Crowd-Out in California, 2003-2030.” Coverage Report. Palo Alto, CA: Stanford Institute for Financial Coverage Analysis.

Public Plans Database. 2001-2024. Middle for Retirement Analysis at Boston School, MissionSquare Analysis Institute, Nationwide Affiliation of State Retirement Directors, and the Authorities Finance Officers Affiliation.

Randazzo, Anthony, Amy Dowell, and Nicki Golos. 2021. “Who Advantages? How Instructor Pension Financing Impacts Scholar Fairness in Connecticut.” Analysis Report. Lengthy Island Metropolis, NY: Equable Institute.

Randazzo, Anthony, Jonathan Moody, Max Marchitello, and Patrick Murphy. 2023. “Pension Debt Challenges for Fairness in Schooling: The Impact of Instructor Pension Debt Prices on Ok–12 Schooling Funding in California.” Analysis Report. Equable Institute.

Schuster, Adam. 2018. “Tax Hikes vs. Reform: Why Illinois Should Amend Its Structure to Repair the Pension Disaster.” Chicago, IL: Illinois Coverage Institute.

Appendix